A Special Alert Musing from Mickey the Mercenary Geologist

For Subscribers Only

Contact@MercenaryGeologist.com

May 13, 2015

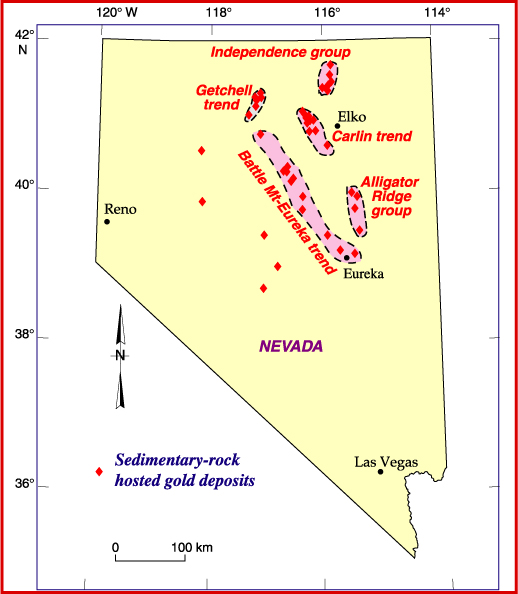

Nevada is one of the most prolific

gold provinces on Earth. In 2013, it was the world’s fifth largest gold miner,

behind only China, Russia, Australia, and Peru, with 169 tonnes of production

from well over 50 currently active gold mines.

Most of Nevada’s production comes from sediment-hosted,

disseminated gold deposits in the northern half of the state, i.e., the so-called

“Carlin-type deposits” that are located on a series of trends:

When considering all factors,

including geological potential, geopolitics, climate and infrastructure, and

mining costs, it is readily apparent that Nevada is the world’s most favorable

jurisdiction to explore for, discover, develop, and mine a giant gold deposit.

Given that caveat, what junior discovery has

the best chance to become Nevada’s next big gold mine?

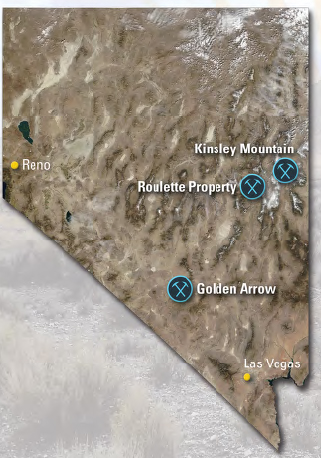

My opinion is unequivocal: The

Kinsley Mountain project, a joint-venture of Pilot Gold (PLG.T) and Nevada Sunrise Gold Corp (NEV.V), is the best candidate.

That said, Kinsley Mountain

is still an early-stage project without a tabled resource estimate. However, it

is often a sound strategy to roll the dice early in the speculative resource game.

And in this case, I have chosen to put my gambling money into the minority partner,

Nevada Sunrise, for direct exposure to this one project.

Let’s review NEV’s checkered

history for five years from Q3 2008 to Q3 2013:

Nevada Sunrise Gold Inc was a

privately-held junior explorer that had its initial public offering in mid-September

2008. This was during the global economic crisis and the company had to acquire

a bridge loan and reduce its IPO price by 40% to finally complete the

transaction. In February 2009, NEV optioned out the aforementioned Kinsley

Mountain project to a private company, which promptly defaulted in the early

summer.

Over the next three years,

the company did a number of dilutive financings at low prices, entered into a

loan to make option payments on a core asset, extended and amended the loan terms

twice before issuing shares for debt, joint-ventured its two best properties to

junior Animas Resources and got one of them back, and took an option on a

property privately held by its CEO and a large shareholder.

The company’s fortunes improved

in 2011 when Animas Resources sold its 51% joint venture interest in Kinsley

Mountain to Pilot Gold. PLG then twinned six holes around the old open pits and

encountered strong gold contents over significant widths.

In 2012, Pilot acquired a

9.9% interest in NEV via private placement. In the early fall, final drill

results of a 12,000 meter summertime program were announced and included strong

gold assays over wide zones in both in-fill and step-out drilling. A new zone

of gold mineralization had been discovered on the western flank of Kinsley

Mountain and a new claim block was staked to the north.

By early 2013, Pilot Gold had

earned its 65% interest in the Kinsley Mountain JV. NEV could not participate in

that season’s 20,000 meter drill program and was diluted to a 21% interest.

At that juncture, it appeared

Nevada Sunrise would be diluted out. However in August of 2013, the company underwent

major reorganization. The CEO and CFO resigned, the one remaining original

director was installed as CEO, and it announced at 10:1 rollback.

In January 2014 NEV closed a

$620,000 private placement at 10 cents with a new group of strategic investors

(including me). Since then, NEV has funded its interest in the Kinsley Mountain

exploration program.

Given its revamped management,

a tight share structure, and new investors, 2014 soon proved to be a pivotal

year for Nevada Sunrise. On the back of good drill results, two oversubscribed private

placements at 35 cents and 90 cents raised an additional $3.0 million by

mid-spring.

Drilling by Pilot Gold continues

to produce high-grade gold intercepts over wide zones at Kinsley Mountain.

Nevada Sunrise Gold is tightly

held with 22.5 million shares outstanding and 32.9 million fully-diluted. Included

are: 4.9 million in-the-money warrants at 15 cents that expire in January 2016;

1.5 million warrants at 50 cents expire in March 2017; and 1.1 million warrants

at 50 cents that expire in May 2017 but are subject to a call-in provision.

There are 2.0 million options

with strike prices from 19 to 50 cents and expiries from 2015 to 2019. Finder’s

fee warrants include 338,000 shares at 10 to 35 cents and expire in January and

May 2016 respectively.

Major shareholders include

management and insiders at 3.6%, Ernesto Echavarria at 7.6%, and Pacific

Opportunity Capital at 4.9%. All told, “family and friends” control over 25% of

the stock.

Its 52 week high is $1.50,

low is 25 cents, and it currently trades in the 30 cent range. With yesterday’s

closing price at 30.5 cents, Nevada Sunrise has a market cap of about $6.9

million. Cash position stands at $950,000, the monthly burn rate is $35,000,

and landholding costs in 2015 are $135,000.

The chart since the company

was rolled back in mid-December 2013 is posted below. Because much of the stock

is held by a group of strategic investors, NEV is generally illiquid. But it

had periodic high volume events from March to July of 2014 when drill

intercepts were announced at Kinsley Mountain and the first two private

placements became free-trading.

The stock went exponential from March to late June of

last year. As commonly happens with drill discoveries, initial euphoria subsided

and the stock price was in steady decline during Q3 and Q4 of 2014. NEV has

settled into the high 20 to high 30 cent range recently:

Nevada Sunrise Gold is led by original director Warren

Stanyer, an experienced junior company executive boasting successful stints with

both gold and uranium explorers. He was an officer of three juniors that have

been acquired by larger companies since 2006. Chairman of the Board is Michael

Sweatman, a Chartered Accountant with financial and director experience. The

company’s qualified person is geologist John Kerr, who has 50 years of exploration

experience with a significant portion of that in Nevada.

As mentioned above, the company’s

flagship project is a 21% contributing interest in Kinsley Mountain with partner Pilot Gold.

My first involvement at

Kinsley Mountain occurred in 1978 during a grass-roots exploration program for

Carlin-type gold deposits.

As a summer geologist for a large

Canadian mining company, my assignment was to pick reconnaissance targets for a

stream sediment program that employed an innovative sampling technique. The methodology

was to take a large sample and process it into a number of size and density

fractions for separate analyses. The well-conceived premise was that

“no-see-um” disseminated gold targets could be distinguished from coarser

vein-hosted occurrences. And it worked. Stream sediment anomalies were traced

to outcrop discoveries that were eventually developed into two small

Carlin-type gold mines.

One of my high-priority

targets was Kinsley Mountain. At the time, there was no quadrangle scale

topographic coverage so I plotted my samples on a regional 1:250,000 map. These

samples produced strongly anomalous gold in the desired fine fraction split, and

I recommended staking to the company. However, management apparently decided

the target was not in favorable host rocks or on a known trend and did not

acquire the ground.

By the mid-1980s, geologists with a successor company,

USMX, traced the sediment anomalies to a jasperoid outcrop discovery. Along

with Cominco, they developed a small resource in 1988. The deposits were

eventually mined by Alta Gold from 1995 to 1999 via seven shallow open-pits,

processing run-of-mine oxide ore via heap leach cyanide extraction and carbon

recovery. Production totaled 138,000 ounces of gold.

View Toward the Kinsley Mountain Mine:

37 years Later

A private company owned by

the original management of Nevada Sunrise staked claims over the mines and

surrounding area in 2000. In 2010, NEV optioned the property to Animas

Resources Ltd, a junior in which I was a pre-IPO shareholder.

Animas did basic exploration

work including mapping, sampling and geophysics and supported a Master’s thesis

by Bryan McFarlane at Arizona State University. Much to my chagrin, Animas

never drilled Kinsley and sold its 51% interest to Pilot Gold in 2011.

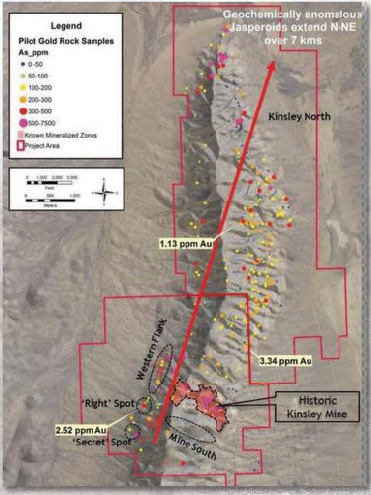

The property now consists of 475 unpatented and five

patented mining claims for a total of 3875 ha. In addition to targets extending

around and at depth below the old pits, it hosts many untested gold showings over

a seven km strike length:

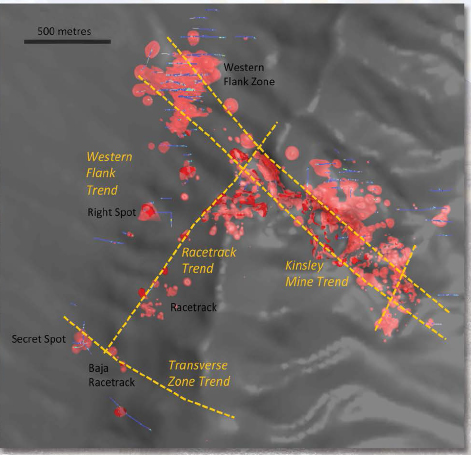

Kinsley Mountain Project

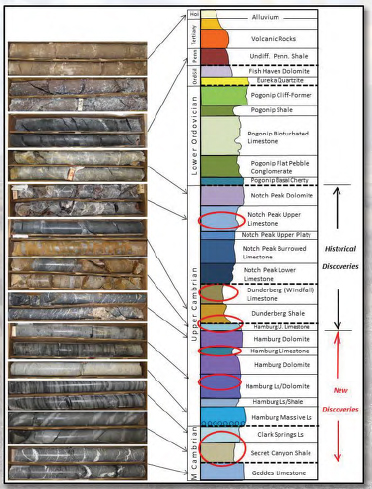

Gold at Kinsley Mountain is

associated with low-and high-angle fault intersections, decalcification and

silicification, a typical toxic metals suite, and especially with pyrite.

Ore-grade mineralization is hosted by six distinct rock formations, only three

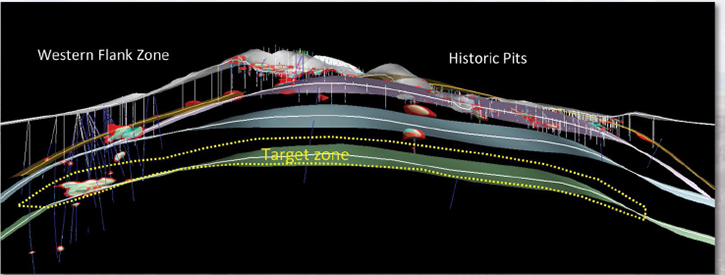

of which were mined in the historic open pits. Deeper gold-bearing zones in

stratigraphically lower host rocks were discovered during the 2013 drill

campaign and have greatly expanded the project’s potential:

Stratigraphic Column and Typical Core

Showing Multiple Hosts for Gold Mineralization

2014 was a landmark year at

Kinsley Mountain. The $6.0 million exploration program included 27,200 meters

in 81 drill holes, including a water well test, and resulted in discovery of the

high-grade zone at the Western Flank. Property-wide potential for significant gold

mineralization in both the Candland Shale and Secret Canyon formations was

recognized.

High-grade continuity was

established in the Western Flank zone. Sulfide intercepts include 8.5 g/t Au

over 36.6 m; 10.1 g/t Au over 39.6 m; 6.1 g/t Au over 30.5 m; 4.4 g/t Au over

29.6 m; and 6.9 g/t Au over 6.1 m. Significant gold was also detected in

widely-spaced step-out holes.

Other targets tested with

success include the Right Spot zone, where shallow, oxide gold mineralization

was intersected in multiple drill holes, and the Racetrack and Secret Spot zones,

where both shallow oxide and deep sulfide mineralization were encountered. Gold

was also found in three rock units between the Western Flank and the old mines.

Initial testing demonstrated that a simple

metallurgical process on sulfide mineralization from the Western Flank produces

high-grade gold flotation concentrates with excellent recoveries by

cyanidation.

Kinsley Mountain Gold Zones and Targets

The 2015 field program at

Kinsley Mountain is currently budgeted at US$2.0 million and will include up to

10,000 meters of reverse circulation and 1000 meters of core drilling. A number

of high-priority targets are primarily defined by intersections of NW- and NNE-trending

structures, similar to the high-grade zone at the Western Flank.

They include early-stage tests of gold-bearing

jasperoid outcrops in the Kinsley North area and fan drilling between and below

the historical pits and the Western Flank zone:

NE-Looking Long-Section along Kinsley

Mountain Trend

Now for the company’s other

two projects:

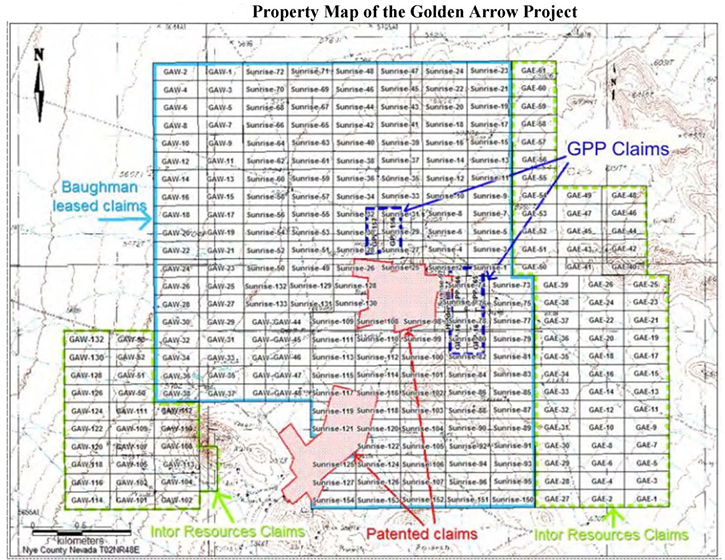

Golden Arrow

is a Walker Lane epithermal gold-silver deposit about 40 km east of Tonopah. It

consists of 17 wholly-owned patented claims and 357 claims under lease and

totals about 2300 ha:

The Golden Arrow district

produced gold and silver from 1905 until the 1930s as documented by shipments

to the McGill smelter near Ely. The geology is a caldera-margin volcanic

setting of older andesite flows and volcaniclastic sediments intruded by

rhyolite flow-domes and an alaskite stock overlain by rhyolite ash flow tuffs.

Epithermal gold and silver

mineralization at Golden Arrow consists of low-sulfidation quartz-adularia

veins hosted by andesite. High-grade ore shoots were mined in the past.

Modern-day exploration has focused on low-grade disseminated mineralization in

two areas, Gold Coin and Hidden Hill. Significant mineralization has been found

but is not of economic grade or size.

Old Mine Workings at Golden Arrow

Since 1988, the project has

been drilled by seven different companies for a total of 400 holes. Current

43-101 qualified resources are contained in two deposits, Gold Coin and Hidden

Hill:

·

Measured and

indicated oxide resources are 6.7 million tonnes grading 0.75 g/t Au and 7.2 g/t

Ag for a total of 129,000 ounces gold and 1.55 million ounces silver. Inferred

oxide resources are 2.0 million tonnes grading 0.28 g/t Au and 7.8 g/t Ag for a

total of 18,000 ounces gold and 510,000 oz silver. Oxidation extends to 80-100

meters depth. Limited metallurgical testing of oxide mineralization indicates

55-65% gold recovery depending on crush size.

·

Measured and

indicated sulfide resources are 5.4 million tonnes grading 0.96 g/t Au and 14.0

g/t Ag for a total of 167,000 ounces gold and 2.45 million ounces silver.

Inferred sulfide resources are 1.8 million tonnes grading 0.59 g/t Au and 13.1 g/t

Ag for a total of 33,000 ounces gold and 739,000 ounces silver.

Nevada Sunrise has a wealth

of archived drilling, mapping, geochemical, and geophysical data. Included are

all of the 10 core holes, drill cuttings from 281 reverse circulation holes,

and many duplicate samples and assay pulps. Company geologists have re-logged

all the core and cuttings and are compiling a 3D model for interpretation and

development of new drill targets.

About 90% of the drilling has

occurred in the two deposit areas, and there has been little exploration at

depth.

In the late fall, Nevada

Sunrise announced a letter of agreement to option Golden Arrow to private

company Atherton Resources on a 65% to 80% earn-in for a combination of cash

and shares. In early 2015, the agreement was extended to March 31 and included BLM

approval of a Plan of Operations for drilling of 240 holes. As of this writing,

no update has been posted.

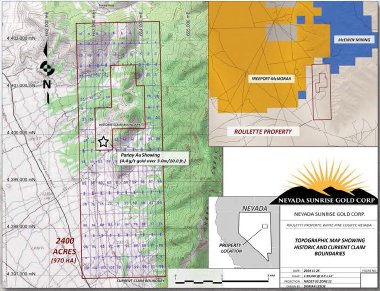

Roulette is an early-stage gold project in east-central Nevada

located about 25 km east of the sediment-hosted Alligator Ridge deposits that

produced 700,000 ounces of gold in the 1980s to1990s. NEV has an option to

acquire 100% on a core group of claims over five years subject to a buyable 2.5%

NSR and has staked the surrounding ground:

Three-five holes were drilled in the 1980s but

locations and results are not available. Jasperoid outcrops occur along 1500

meters of strike and one contains ore-grade gold:

Gold Mineralized Jasperoid Outcrop

The company recently

completed induced polarization, resistivity, and magnetic surveys at Roulette and

will initiate a comprehensive geochemical survey this summer.

At this juncture, Nevada

Sunrise Gold is my top pick in the junior resource gold sector. It has all the

characteristics that I seek in a junior explorer: a tightly-held share

structure; experienced and successful management; a flagship project with

potential to host a major gold deposit within a geopolitically-favorable

jurisdiction; and cash at hand. It is likely to have another $735,000 in the till

upon exercise of 15 cent warrants next January.

That said, NEV may go to the

market to top off its treasury within the next few months. The company is in an

enviable position in this bear market because it has the ability to raise money

when required from a strategic group of committed shareholders.

Note also that Nevada Sunrise

is trading only slightly above its 52-week low. There is a catalyst on the

horizon with initial 2015 drill results from Kinsley Mountain expected within a

month.

As always, my opinions are

colored by financial involvement with the company. Before you choose to

speculate, please do your own research and decide if Nevada Sunrise Gold merits

further attention.

Ciao for now,

Mickey Fulp

Mercenary Geologist

Acknowledgment:

Gwen Preston is the editor of MercenaryGeologist.com.

The Mercenary Geologist Michael

S. “Mickey” Fulp is a Certified

Professional Geologist with a B.Sc. Earth Sciences with honor from the

University of Tulsa, and M.Sc. Geology from the University of New Mexico.

Mickey has 35 years experience as an exploration geologist and analyst

searching for economic deposits of base and precious metals, industrial

minerals, uranium, coal, oil and gas, and water in North and South America,

Europe, and Asia.

Mickey worked for junior explorers, major

mining companies, private companies, and investors as a consulting economic

geologist for over 20 years, specializing in geological mapping, property

evaluation, and business development. In

addition to Mickey’s professional credentials and experience, he is

high-altitude proficient, and is bilingual in English and Spanish. From 2003 to

2006, he made four outcrop ore discoveries in Peru, Nevada, Chile, and British

Columbia.

Mickey is well-known and highly respected throughout

the mining and exploration community due to his ongoing work as an analyst, writer,

and speaker.

Contact: Contact@MercenaryGeologist.com

Disclaimer

and Notice: I am a

shareholder of Nevada Sunrise Gold Inc and it pays a fee of $4000 per month as

a sponsor of this website. I am not a certified financial analyst, broker, or

professional qualified to offer investment advice. Nothing in any report,

commentary, this website, interview, and other content constitutes or can be

construed as investment advice or an offer or solicitation or advice to buy or

sell stock or any asset or investment. All of my presentations should be

considered an opinion and my opinions may be based upon information obtained

from research of public documents and content available on the company’s

website, regulatory filings, various stock exchange websites, and stock

information services, through discussions with company representatives, agents,

other professionals and investors, and field visits. My opinions are based upon

information believed to be accurate and reliable, but my opinions are not

guaranteed or implied to be so. The opinions presented may not be complete or

correct; all information is provided without any legal responsibility or

obligation to provide future updates. I accept no responsibility and no

liability, whatsoever, for any direct, indirect, special, punitive, or

consequential damages or loss arising from the use of my opinions or

information . The information contained in a report, commentary, this website,

interview, and other content is subject to change without notice, may become

outdated, and may not be updated. A report, commentary, this website,

interview, and other content reflect my personal opinions and views and nothing

more. All content of this website is subject to international copyright

protection and no part or portion of this website, report, commentary,

interview, and other content may be altered, reproduced, copied, emailed,

faxed, or distributed in any form without the express written consent of

Michael S. (Mickey) Fulp, MercenaryGeologist.com LLC.

Copyright © 2015

Mercenary Geologist.com, LLC. All Rights Reserved.