Avrupa Minerals (TSX: NOX), Leverages Prospect Generator Model and Finds Important Deposits – Slivovo in Kosovo and Several More in Portugal

|

By Dr. Allen Alper

on 3/21/2015

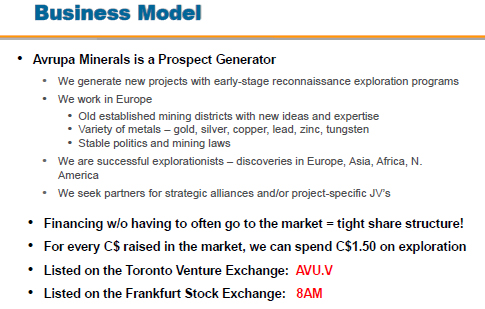

Avrupa Minerals (TSX: AVU) is currently using a prospect generator model that has identified discoveries in Kosovo and Portugal. Paul Kuhn and his excellent team have been making very important gold, silver, copper, zinc and tungsten discoveries that have attracted support from Joint Venture mining companies.

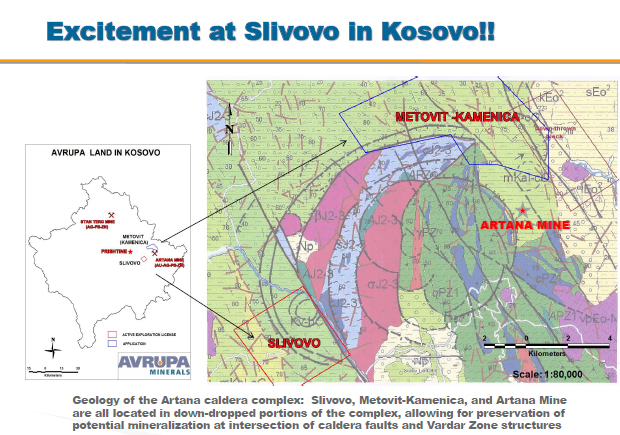

Paul Kuhn, CEO and Director of Avrupa Minerals (TSX: AVU), updated Metals News on the progress that they are making on their two discoveries and upcoming projects. Said Kuhn, “Recently we’ve put out news releases concerning the Slivovo Project in Kosovo, firstly covering results from our second and third drill holes at the Pester Gossan and then from two holes into the SW extension of the Gossan. We continue to follow on good gold results from the first drill hole, SLV004, and we are quite excited about how things have started. The results indicate continuity from the initial drilling in the Gossan and now we see that there are possibilities farther on in our program in the extension area. One thing to note is that this is just a total of eight holes into this prospective project, and we have a lot more room for more holes to work on this showing. It is exciting and being that it is very early, every hole has changed the story a little bit.”

Being a prospect generator means that the story on their properties changes regularly and creates positive news for the company. Said Kuhn, “The first drill hole into the Gossan, which we originally thought was drilled down plunge cut 125 meters of 6 plus grams of gold. We now know that the drill hole cut close to perpendicular across strongly folded stratigraphy (or bedding). The second and third holes cut obliquely across stratigraphy, yet still crossed mineralized beds. In the second Gossan hole (SLV005), we had a 12-meter intercept of over 12 grams of gold. That included a 7-meter interval of about 20g and within that 7 meters, a 3-meter interval of 38g. So, some of the things that we are seeing are very high grade. The third Gossan hole (SLV006) encountered more gold mineralization, but not as strong as SLV004 and SLV005. However, the oblique angle to bedding means that not too much stratigraphy was actually cut in SLV006. We had several intervals of 3g and a longer interval of about ten meters at 1.5g. That is the sort of thing that we saw. The market hit us on that because the results were not as high or continuous as in SLV004, and felt that the continuity of the mineralization has question marks. Again, the caveat is that we have only completed three holes in an area that needs at least ten or twenty more holes in the coming year. Further results from ALV007 and SLV008, in the SW extension of the Gossan zone also indicated presence of gold mineralization. In particular, we had a 13-meter intercept of 1.8 g/t gold in SLV007, within a zone of 53.6 meters of 0.9 g/t gold. Both holes were drilled more or less along strike of the bedding, but now we better understand the geology in the SW Extension area, and our 2015 drill plans will include much better positioned drill holes there.”

Avrupa’s focus is on finding new projects, which can take time to evaluate. Said Kuhn, “We are just in the early stages. It is a gold project, or a gold prospect, let’s say, and not every single hole is going to be a winner. We’ve got quite a bit more planned for this year, including 2,000 meters in the Pester Gossan zone, 1,000 meters in the SW Extension zone of the Pester Gossan, and 1,000 meters in the Dzemail target area (formerly called the “epithermal” zone). We hope to start drilling at Dzemail around the 20th of March, and once we get a second rig onto the property, start drilling the Gossan zones just after Easter. The project is still very much in its early stages, and we are looking forward to potentially good results this spring.”

The model that Avrupa is using allows a partner to assist them with their exploration work, which provides financial and operational support. Said Kuhn, “As you know, we are a prospect generator so we do our drilling through funding from our partners. In this case, our partner is Australian contract drilling company and mine builder, Byrnecut International. They have mines that they have built and operate all over the world. This is their first stab at exploration. Perhaps down the road they will have their own mine. We are excited about what we are doing.”

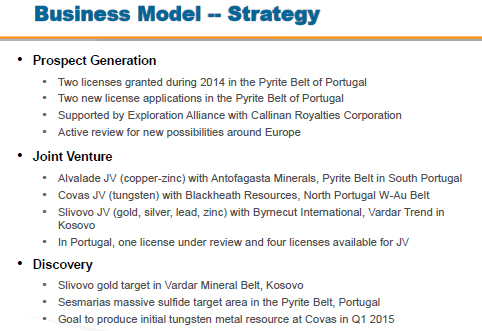

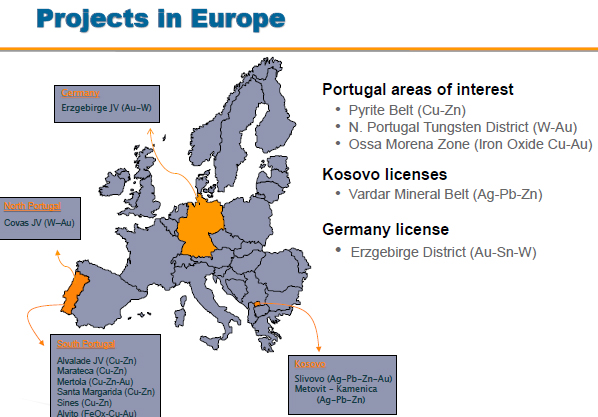

In addition to the work they are doing in Kosovo, there are also projects in Portugal that Avrupa is exploring. Said Kuhn, “As you know from previous conversations, our main area is in Portugal. In Portugal, we have three distinct project types. Up in northern Portgual, we have the Covas tungsten project, which is joint-ventured with a Canadian tungsten explorer. They are working on a resource calculation for at Covas, and should have it out by the end of Q1. Our main area is the Pyrite Belt of Portugal which was mined as early as pre-Roman times by the Phoenicians and the Celts. We have five licenses in the Pyrite Belt. We have that joint ventured one of them, the Alvalade license, with Antofagasta Minerals. We made a discovery that was the first one in twenty years.”

This discovery is a critical one to the area. Said Kuhn, “We have intercepts of copper and have defined a strike length of about 2000 meters. Our target there is a copper-rich sulfide system. We have done a lot of re-interpretation of the data. We have some fantastic mineralization which has helped us to propel our stock through 2014. We have more licenses in the Pyrite Belt, and we are showing other companies around those areas. We also have the Alvito IOCG prospect, where we have just completed first-pass and follow-up exploration on a large IOCG target. That license is now available for JV, as well. We have another prospect in Germany where we are just sending samples into the lab for gold and tin results. We are looking to see if we are onto something there. We are quite busy.”

Why should investors take a look at Avrupa? Said Kuhn, “We aren’t spread too thin, and we have used our geological smarts, gotten out into the field, and have made what looks to be two potential discoveries. More drilling is in the cards, and my main job is now to find some new joint ventures in 2015. So far the funding for drilling has been straightforward. As a prospect generator, we do the basic work and then have a partner company come in and do the drilling. All of the work that we have done for the last three years has been funded by our partners. This is how the prospect generator model works. If we aren’t drilling at all, then we don’t have any way to make a discovery. In this bad economy, it seems to work. Avrupa runs a prospect generator business model, which, when you have really good properties, works well in a bad market. We have very progressive geological skills and we get out and do the work. We have made two discoveries in the last year. We are tightly held at 45 million shares. Many of those are friends, family and other long-term investors. We are aggressively successful with great partners to fund the drilling.”

For more information:

http://www.avrupaminerals.com

|

|