Kaizen Discovery (TSXV: KZD) Offers Investment Dollars, with the Help of a Japanese Business Partnership, for Undervalued Mining Properties

|

By Dr. Allen Alper

on 3/2/2015

Matthew Hornor, President and CEO of Kaizen Discovery (TSX: KZD), spent some time with Metals News to discuss his company’s business model and the innovative way they have chosen to enter the mining industry.

Mr. Hornor said, “Our stated business purpose is to seek out high quality, undervalued opportunities in a troubled mining sector and partner with one or more Japanese trading houses. We came into this about a year and a half ago.” Matthew Hornor brings to the company a long background in business and law. He said, “My background is as a corporate finance lawyer. I spent a lot of time in Japan, speak the language and lived there. It has always been a passion of mine to be attached to that country in some way. I like their ethics and their approach.”

During his time in Japan, Mr. Hornor built relationships with a group of business owners that were looking for opportunities. He said, “I have been a part of a collective group of companies for about a decade. I have helped many of these companies obtain financing. In one financing I led, we raised approximately $300 million from a consortium of Japanese investors for Ivanhoe’s Plantreef project in South Africa.” This experience led him to his current business model. Mr. Hornor said, “The idea is to take advantage of the buyer’s market and be able to advance projects in a tough cycle when there aren’t a lot of investors. We can put up investment dollars – that’s the difference.”

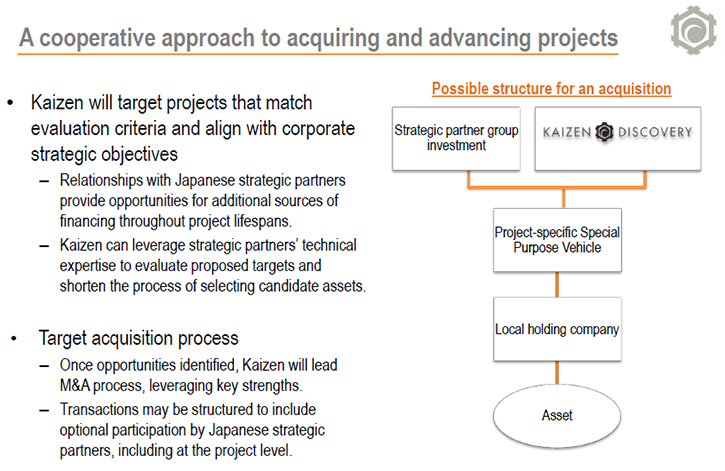

Matthew Hornor has used his experience in Japan to build Kaizen Discovery. He said, “The Japanese companies that we work with are primarily trading houses. They are looking for offtake to provide to their dealers, like Nissan and Toyota. In 2014, we entered into a strategic partnership with one of the trading houses, ITOCHU Corporation. ITOCHU invested $5 million for a 6% interest in the company. We also found Tundra Copper, an exploration company with a high-quality copper project and acquired it last year. We expect that our Japanese partners will provide funding to explore the Tundra ground. We also are taking a hard look at Tower Resources in BC. We are in an exclusive negotiation period with them right now.”

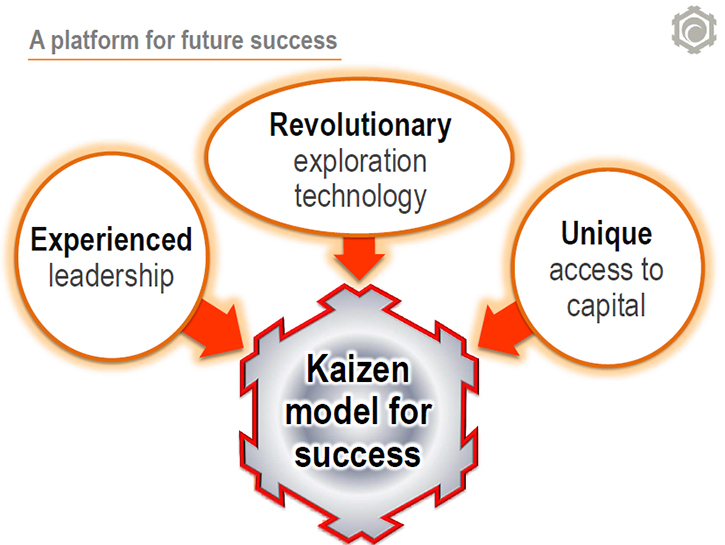

Using the leverage of the trading houses allows Kaizen Discovery to take on more projects in the mining sector. Mr. Hornor said, “You can look at us as a P/E fund. We have a decent treasury with access to additional funding from our Japanese partners. We think it is a winning model. No one has ever done it this way before. It requires a few key ingredients. You have to have a track record where you can raise money in Japan and a reputation that will allow you to get in front of them. You need M&A and mining experience, but most importantly, you need to have developed trust.”

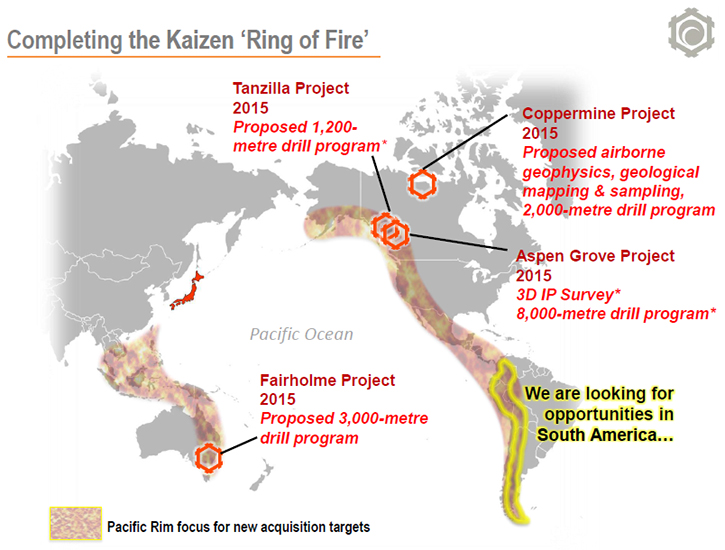

This level of trust has allowed Mr. Hornor to work quickly to build up Kaizen Discovery’s assets. He said, “We are finalizing a drilling program in New South Wales in Australia. We anticipate finalizing the Tower Resources deal and obtaining the support of our Japanese partners during the second quarter of this year. We are also looking at interesting projects in South America that are shovel-ready with defined resources. We have been looking at South America for a while. After Tower Resources, we will look closely at prospects in Chile and Brazil.”

*Projected work programs may change following meetings with financing partner

Geographically, Kaizen Discovery works as close to Japan as possible. Mr. Hornor said, “We are focused on the Pacific Rim because it is easier for the Japanese to be comfortable with in regions with less political risk. David Broughton is our Executive VP of Exploration. David will be receiving an award at PDAC for his work with Ivanhoe Mines in the discovery of the incredible Kamoa copper deposit in the Democratic Republic of Congo. We believe we have a project that looks a lot like Kamoa with similar geology and rock age. Because of David’s expertise, he was the ideal choice for running the exploration program on our Coppermine project.” In addition to Mr. Hornor, who travels to Japan about ten times per year, Kaizen Discovery also has managers in country. Mr. Hornor said, “We have a team in Tokyo that runs the Tokyo office. They stay in contact with our trading and industry partners.”

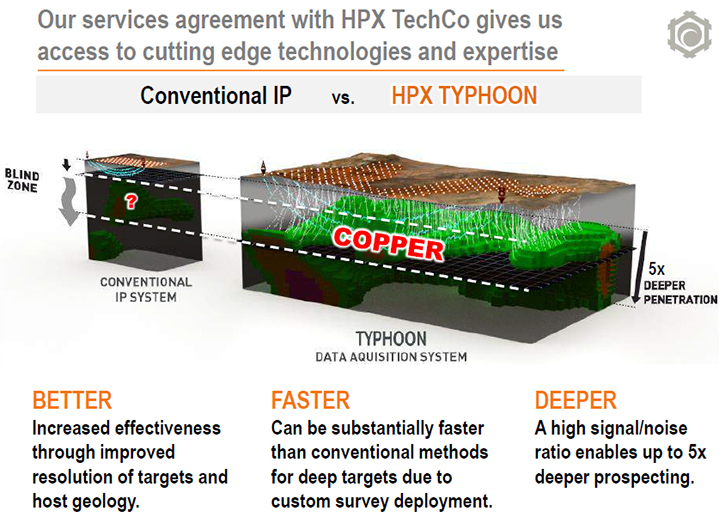

Investors who are looking for an innovative investment model may want to do some further research on Kaizen Discovery. Mr. Hornor said, “We acquired Concordia – 85% of that – and now we are sitting at about 160 million shares. Most of that is held by HPX Techco, which is a privately-held, Robert Friedland-backed investment company. Our share structure is not bad at all. About 50 million shares are publicly traded.” Who is an ideal candidate to invest in Kaizen Discovery in Mr. Hornor’s mind? He said, “If somebody wants to play the buy low, sell high market here and they want to back a group that has a proven track record of finding and building mines, that is exactly what we offer. We have a very strong team that has done this before. We have unique access to funding from Japan and we have large investors that protect the stock and prevent dilution. We have embedded strategic partners from day one. We also have geophysics tools that enable deeper prospecting than most. That gives us a decided advantage in areas such as Chile where it is hard to complete drilling or where you are drilling blind. In a tough market, we can find resources with our advanced technology. In my opinion, such a combination provides very little downside and an unlimited upside potential”.

http://www.kaizendiscovery.com

Office

Kaizen

Discovery

World Trade

Centre

654-999

Canada Place

Vancouver, BC

V6C 3E1

Canada

Phone: +1

604 669-6446

Email:

info@kaizendiscovery.com

|

|