Largo Resources (TSX: LGO) Produces Vanadium for Steel Manufacturers at the World’s Highest Grade Vanadium Project, Maracás Menchen Mine in Brazil

|

By Dr. Allen Alper

on 3/1/2015

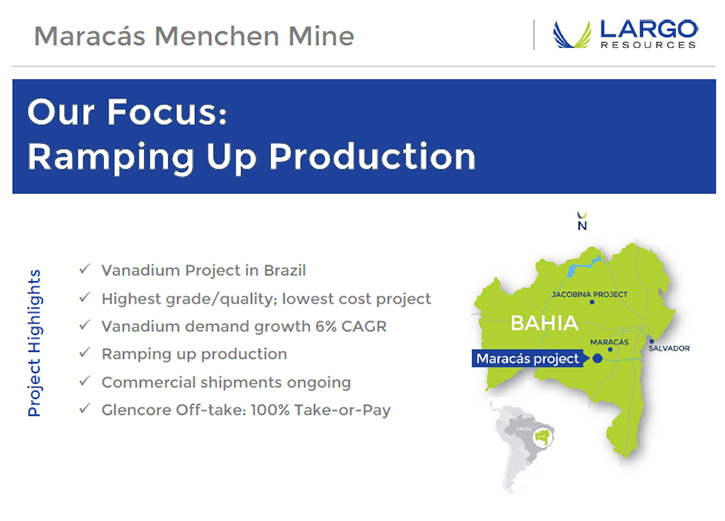

Largo Resources (TSX: LGO), flagship vanadium project in Brazil, is now producing vanadium that will benefit the steel and battery industries as they continue to expand the facility. It will become the highest grade, highest quality and lowest cost vanadium project in the world.

Mark Brennan, President CEO of Largo Resources (TSX: LGO), spent some time updating Metals News on the progress that his company has made in Brazil and the future of the vanadium markets. Said Mr. Brennan, “Largo is currently in the ramp-up phase of its production. We started producing our first material last August. We are targeted to be at our full capacity by the third quarter of 2015.”

This year is really about production for Largo Resources. Said Brennan, “So we are ramping up our production and moving forward. The project is going well. There have been the traditional sort of headaches, but nothing critical. When we prepared our production profile, we gave ourselves a year because we knew that there would be headaches. For the most part, it is going well. I think that the team is doing a great job.”

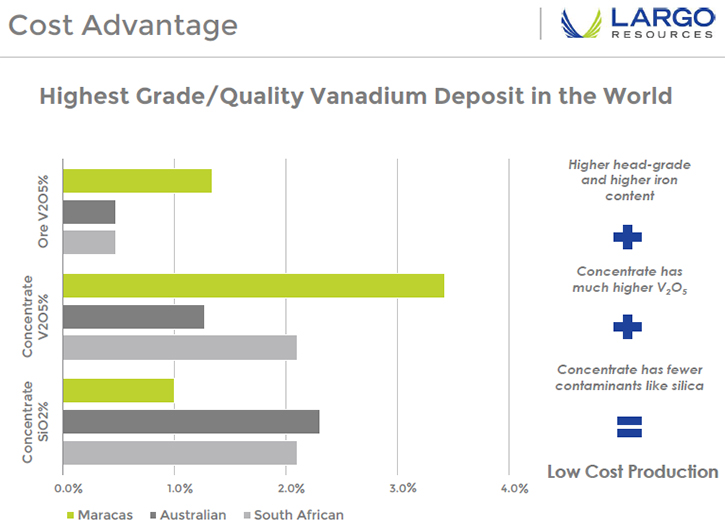

Mr. Brennan is optimistic because of the quality of the project and the need for vanadium in the market. He said, “This is a great project. It is the best vanadium project. As you know, there is only one best of breed project for every commodity. Vanadium is used to strengthen steel. Our project is the best of the breed. Once we get to our ramp up level and are working at our full capacity, our expectation is that we will see our project having the lowest cost of vanadium in the world. We expect that our project has a lot of scope to increase. Over time we will continue to expand the facility.”

In order to manage the growth of the project, Mr. Brennan has two groups of technical staff working to bring it to fruition. He said, “We have two separate groups of technical people working on the project. First and foremost, we have vanadium people. We have Les Ford who is the Technical Director in Brazil on the project. He is one of the foremost experts in processing vanadium in the world from South Africa. He has built, developed, operated and managed every vanadium project in the western world except for the U.S. He is recognized as a world expert. He is leading the charge. We have three or four other South Africans who have been working with companies such as Extrata and Glencore.” In addition to the vanadium experts, they also have another team of engineers working on the project. Brennan said, “We have a very strong core team of vanadium experts, but we also have another fifteen to twenty engineers. Many of them are very senior and have developed a lot of projects. Essentially, most of that team has come from Anglo. They have had a long history of work with Anglo.”

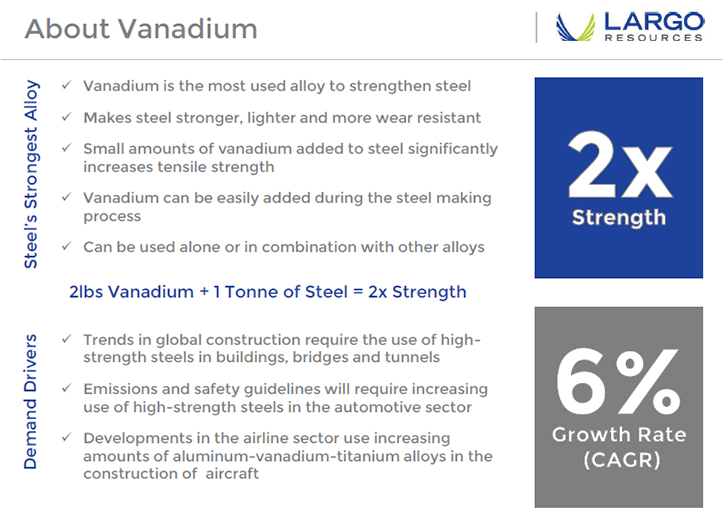

The focus on bringing vanadium to the market is that it is needed for steel production. Said Brennan, “The reason that vanadium is critical is that everything is looking to go lighter and stronger and tougher. When you add a kilo of vanadium to a ton of steel essentially you get the effect of it doubling the strength. That means you can either manufacture less steel to achieve the same goals or you can get materials that are much, much stronger. Vanadium is a significant player in the high strength steel markets. These composites are trying to take back market share from aluminum and composites. In order to provide their clients with state of the art technologies, they add vanadium to the process. In the last ten years, vanadium has only been used in very small segments of the market for steel production. Now it is moving away from being exclusive to construction and turbines for aircraft and engines for production. It is going into car manufacturing and airplanes, mines, bridges, tunnels – a wide array of projects. We are just at the beginning for this vanadium alloy.”

One reason that vanadium has not been mined extensive is the low price. Said Brennan, “Vanadium prices are at about $5 per pound. Over the last ten years vanadium has only traded under $5 for less than 200 days. There is a very rigid floor. The marginal production will shut down. People are not making money at that price. Demand is 4-6% year after year. That will be good for us because we are heavily leveraged to the price of vanadium.”

As a company, Largo does have to cope with a debt issue over the next few months. Brennan said, “There is a lot of concern in the market about Largo’s debt load. The amortization of our debt will become due in May. The lower vanadium prices have created a mismatch between the cash flow and the principal repayment. We have paid and remain current on all of our loans. We are talking to our banks and they have been very helpful. You will see that we are working on restructuring our debt. That should happen before May. Glencore has the offtake agreement. They get 100% of the product and pick it up from the mine site. They pay us 20 days later. They are great partners and we have enjoyed working with them. I think that the future for vanadium is very bright. We will see prices rebound at some point. We have the richest, highest grade in the world. This project will generate substantial cash flows once we get ramped up to our phase one capacity. From that perspective, we have a very bright future. Yes, we are being squeezed in the short term, but the market should be relieved and we should see an upside in the project. The renewable energy space is a very fast moving train right now. Renewable is what modern economies will be using in the future. We have been talking to battery producers about vanadium, but right now we are working in the steel market. That is our bread and butter. When batteries come, we will be prepared.”

http://www.largoresources.com/

Darcie Ladd, Manager, Corporate Development

info@largoresources.com

416-861-9406

Disclosure: The Alper family owns Largo Resources stock.

|

|