Abitibi Royalties (TSX: RZZ) Enjoys an Enviable Market Position in a Challenging Mining Investment Environment with Canadian Malartic Gold

|

By Dr. Allen Alper

on 3/1/2015

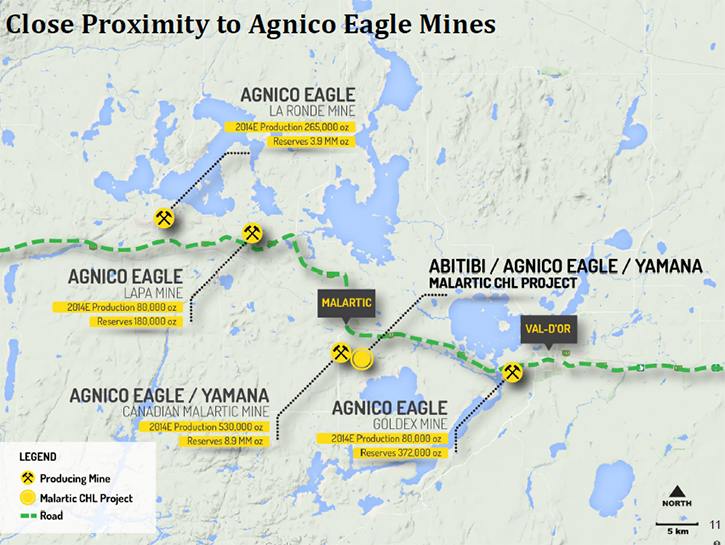

After outstanding accomplishments at Goldcorp and McEwen Mining, Ian Ball’s leadership has resulted in substantial financial success for Abitibi Royalties (TSX: RZZ). Abitibi is enjoying a very favorable position in the mining sector with their innovative royalties’ structure and very promising proximity to rich gold properties.

Ian Ball, the President of Abitibi Royalties (TSX: RZZ), took some time to update Metals News on Abitibi’s recent agreements, which could possibility lead to an extremely profitable royalty.

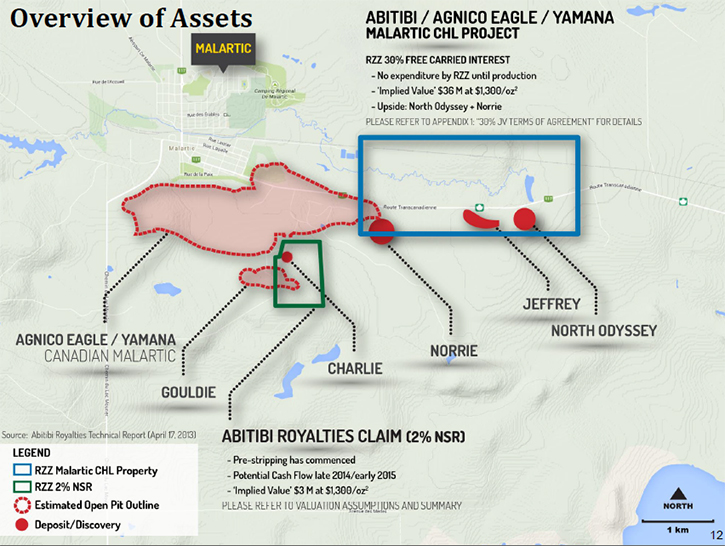

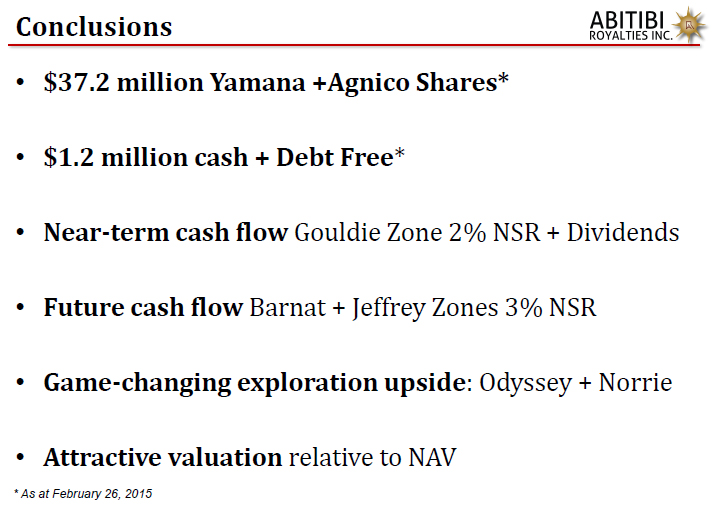

Mr. Ball said, “We came to an agreement with Yamana and Agnico Eagle to exchange our interest in the Malarctic CHL project, which is part of the Canadian Malartic Mine in exchange for two forms of consideration.” He said, “First, we received Yamana and Agnico Eagle shares that have a value of approximately C$35 million dollars. In addition to that, we have a three percent royalty on the property that has a value of approximately C$25 million dollars.” This solves more than simply the financial end of it. He said, “So, not only do we get that in exchange, but that settles all the outstanding legal claims that were surrounding the property and allows exploration and development to move forward. We are quite happy with it and think it positions the company quite well going into the future.”

How does this benefit the company for the short and long term? Mr. Ball said, “We have cash, shares and expected cash flow to be starting up in the very short term so we think it was a very good decision. Right now we are going to close the transaction which is expected to be done at the end of March.” Once the transaction is complete, the remaining companies will start additional exploration work on the property, which may increase the value of the holding over time. He said, “Agnico and Yamana have indicated that they are going to start drilling with two to three drills on the Odyssey discovery, which is on the CHL property.” Mr. Ball feels optimistic about the options for the project. He said, “We are quite eager to see what those drill results will outline with a C$3.5 million dollar budget for approximately 25,500 meters of drilling. Our expectations of the discovery are quite high.” Once the drill results are in, Mr. Ball expects that there may be a valuation change in the property that could raise their own value. He said, “We want to see what that means in terms of increasing the value of our royalty.”

Abitibi Royalties has a tight share structure that includes large shareholders. Mr. Ball said, “Right now there are just over 10 million shares outstanding. Of that, we have two significant shareholders. The first, Golden Valley Mines, holds about 56.5% of the outstanding shares. Abitibi was spun out from it in 2011. The second largest shareholder is Rob McEwen who owns 9.1% of the company.” Mr. Ball said, “We have a market cap today of approximately $38 million dollars. We will be receiving $35 million dollars in Agnico/Yamana shares. We have another $1.25 million in cash and then we have the new 3% royalty on top of that and another royalty which is on another area of the Canadian Malartic mine and that is expected to start generating revenue in the next month or so.”

Abitibi Royalties has a stake in a mine that has been seen as an opportunity by other majors royalty companies in the sector. Mr. Ball said, “With Canadian Malartic, the first thing you will notice is that we have a royalty perspective. The three largest gold royalty companies all own a royalty on the mine. Each of these companies has an interest in the mine already and that goes back to how desirable this property is. It is the largest gold mine in Canada.” Once the mine goes into full production, Mr. Ball and his team feel that they will see a good deal of gold coming out of the mine each year. He said, “After 2016, they are predicting that it is going to produce close to 600,000 ounces of gold. It also has a long mine life. They are predicting that it will run until 2029.” Even with that prediction, the company and its partners are moving forward with additional exploration to increase the overall size of the project. Mr. Ball said, “But now with the new discoveries where we have the royalty on Odyssey, there is clearly some potential to expand their current production from the 600,000 ounce mark and/or extend the mine life with that.”

Mr. Ball has the experience to move the company forward into royalty development. He said, “I joined Abitibi in the middle of last year. I worked for McEwen Mining for 9 years and was responsible for the production, mine building and exploration teams.”

Why should investors in the gold market take a close look at Abitibi Royalties? Mr. Ball believes there is a significant upside to his company. He said, “This is a big asset that will be running for a long time. We are the newest and the smallest company to have a royalty interest on this mine. I think it is a very unique value proposition. We have a market cap of $35 million plus $35 million in stock and cash flow starting from the royalties. You have a lot of value even without the mine. From a value proposition, you have a lot of value without the cost. Our business model has been to keep the cost down and the share count down. If you look at our share price, over the last 12 months we went from $0.50 cents a share. Now we are $3.75 a share. In a market where the gold price has gone sideways, our stock has gone up. That is due to our model. With future exploration success we hope to continue to outperform.”

http://www.abitibiroyalties.com/

Val-d’Or,

Québec

2864, chemin Sullivan

Val-d’Or, Québec

J9P 0B9

Telephone: 416.346.4680

E-mail: info@abitibiroyalties.com

|

|