Abitibi Royalties (TSX: RZZ) Uses New Business Model to Grow Share Price and Profits in Canadian Gold

|

By Dr. Allen Alper

on 11/19/2014

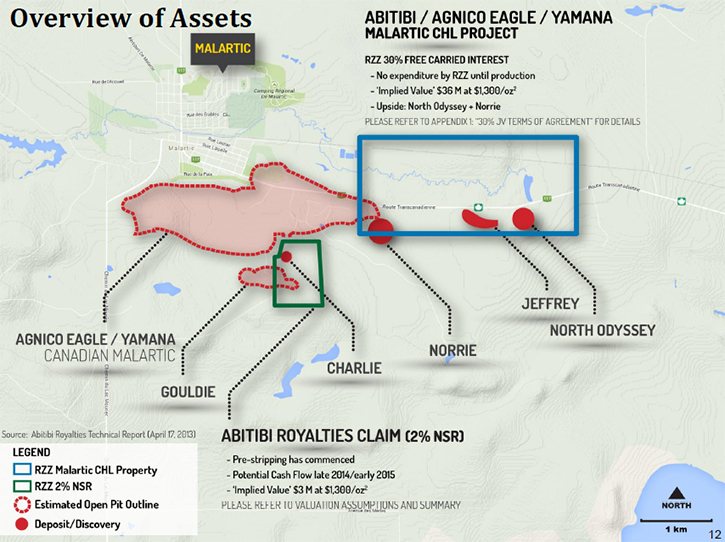

Ian Ball, the President of Abitibi Royalties (TSX: RZZ), took the time to speak to Metals News about the development of Abitibi Royalties and how his company is fundamentally different from so many other gold companies currently working in the mining sector. He said, “Abitibi Royalties is focused in Quebec. It has two assets. The first is our 2% royalty on a small portion of the Canadian Malartic mine which is the largest producing gold mine in Canada. We expect to see revenues from that royalty in Q1 2015. The second part of the company is that it has a 30% free carried interest to commercial production on the property right beside the Canadian Malartic and our partners are the operator of Canadian Malartic (Agnico Eagle and Yamana Gold) and what that means is that they have to put up the capital for the exploration and mine development.”

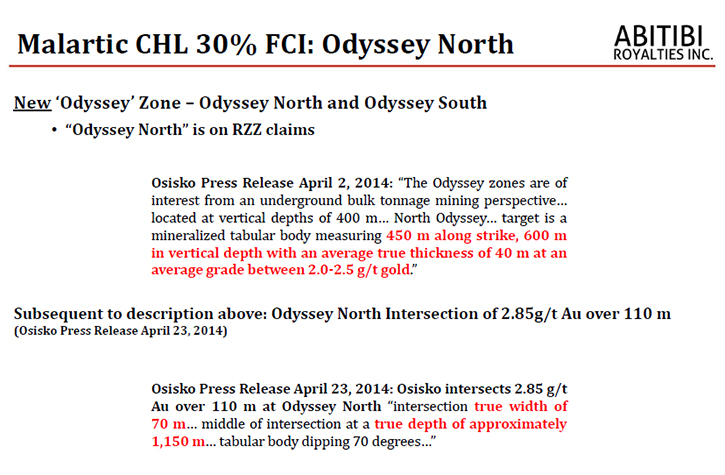

This business model of having other companies put up the working capital is one that has not been completed before. Said Ball, “They have to put up the capital for the mine development and Abitibi gets 30% of the eventual cash flows from the property.” In addition to the revenue stream, Ball is also excited about the new discoveries on the property. He said, “The biggest driver over the last six months has been a new discovery that has been known as North Odyssey. We put out some significant drill results in April and then in October. In addition, the results from October also found numerous high grade intercepts in and around the Odyssey discovery. It is too early to know what to make of that except to know that it is quite encouraging. We are waiting for additional assays from 5 outstanding holes.” Ball said that the benefit for the company is that they don’t have to invest in exploration. He said, “The key is that we aren’t paying for that exploration although we are receiving 30% of the benefit from that exploration.”

Financially, the company is in an enviable position. Said Ball, “Right now the company has approximately $1.25 million dollars in the bank. We are debt free and we expect our first cash flow to begin in Q1 2015, from a royalty interest. Right now we are waiting for potential cash flow coming from the joint venture property where there is a reserve already established on the property. It is not large, only about 170,000 ounces that we have established and that we get 30% of the cash flow.” Ball sees additional income on the long term horizon for the company as well. He said, “The bigger story is now the Odyssey discovery, which obviously doesn’t have any near term cash flow, but has good size potential.”

Their share structure is quite tight. Said Ball, “Right now there are just about 10 million shares outstanding. The largest shareholder is another company called Golden Valley Mines. They own 58% of Abitibi. The second largest shareholder is Rob McEwen. He owns over 9% of the company. That share position was purchased in the summer at $2.50 a share through a private placement. There were no warrants and no discounts attached to that. The rest of the shares are held by the public.”

Why should investors take a close look at Abitibi? Ball believes that there are some very good reasons that stock in Abitibi would be a smart investment decision. He said, “Obviously, everyone has their own risk profile, but if you are interested in being in a gold mining company then Abitibi might be of interest because it is not a company that is going to have to issue a lot of shares.” Ball believes that because of their unique business model that they have a lot to offer investors. He said, “The company has 10 million shares outstanding, it will have income and it doesn’t incur a lot of expenses or need to find a lot of capital for exploration, so you aren’t going to see the share dilution that will contribute to the share price pressure. There is nobody else in the mining sector that has this business model.”

While there are other companies that have the free carried interest, many of them still do have financial requirements. Ball said, “There are other companies that have free carried interests; however, they do have to be repay their partner out of future cash flows where we do not have that obligation.” Ball also believes that their new discovery makes them a desirable investment. He said, “The Odyssey discovery has potential size and it is located next to the largest producing gold mine in Canada.”

Ball is using his experience to build Abitibi Royalties. He said, “For the last ten and a half years, I have worked for Rob McEwen. I left in May because I wanted to do something on my own. The last position, I held there, was as president of the company, responsible for production and exploration. I wanted a business model that was different from everyone else’s. With Abitibi, I feel like I found that. The founder of the company also founded another company called Canadian Royalties, which is a nickel company. The Board has a lawyer by trade, who has his own law firm. There is another Board member who is very familiar with the property and the contracts. The thing for me is when you look at mining, you have to question the fundamental assumption of the business and you have to turn that over if you want to be perceived as different. With Abitibi, you don’t have the share dilution. The whole company has been structured around not building a large company, but one that has a higher share price.”

http://www.abitibiroyalties.com/

Corporate Head Office

152, chemin de la Mine École

Val-d’Or, Québec

J9P 7B6

Telephone: 819 824-2808

Facsimile: 819 824-3379

E-mail:

info@abitibiroyalties.com

|

|