Blackheath Resources (TSX: BHR) Focused on Restoring Tungsten Mining in Portugal to Fully Supply Europe

|

By Dr. Allen Alper

on 11/9/2014

Alexander Langer, President and James Robertson, CEO of Blackheath Resources (TSX: BHR) recently spent time with the Metals News team to update them on their progress with their tungsten properties in Portugal. Alexander Langer, President and James Robertson, CEO of Blackheath Resources (TSX: BHR) recently spent time with the Metals News team to update them on their progress with their tungsten properties in Portugal.

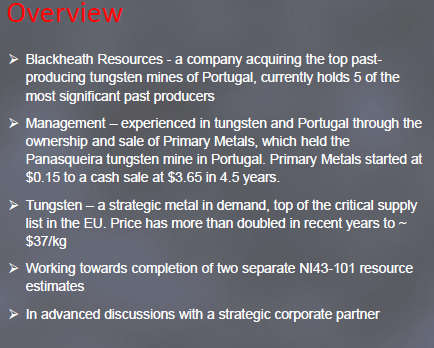

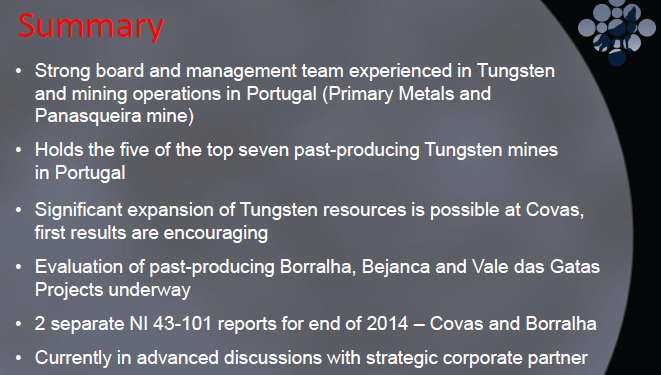

Said Langer, “We are completely focused on tungsten and Portugal. Why is that? We have had an operating mine previously that was sold to a Japanese company at a very good profit. After four and a half years, we got to know Portugal and tungsten very well. Since then we have added four tungsten mines. We have under control four of the top mines in tungsten in Portugal. We have been testing them with mapping and drilling with the goal of putting them back into production. My background is in the financial side. I joined Blackheath about 18 months ago.”

Robertson offered his take on the genesis of the business. He said, “I just wanted to add that I started this company. When we launched, I wanted a team of people who had experience in tungsten and in Portugal. Our Board is very small. I have been experienced in many companies that have been very successful. We have Jon Carter, who was President of Primary Metals, Kerry Spong from Primary

Metals, and other people who have been involved in fund management. We were delighted when Alex joined us to round out our abilities a little bit more. We have an advisement committee. We have Jonathan Henry on that team who is very knowledgeable about tungsten. George Cavey is also on that team. He was the geologist we used previously to do our 43-101 for Primary Metals. These people are very well regarded and very competent in dealing with the government and the community.”

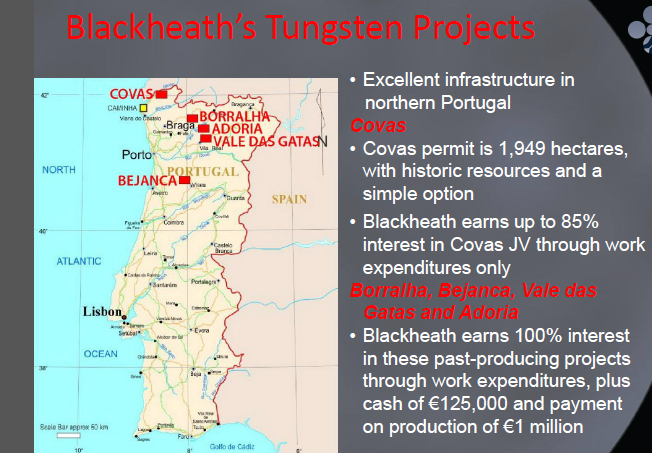

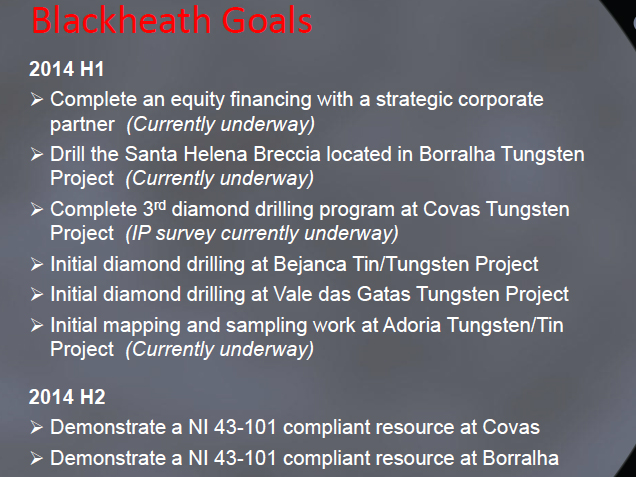

Langer spoke about the philosophy behind the company. He said, “As I mentioned earlier, we have 5 of the 7 best past producing mines in Portugal. There are two that we consider to be flagship. One is the Covas. Union Carbide spent a lot of time on this. They developed a historic resource of 923,000 tons at 0.78% WO3. That is not 43-101 compliant, but is it a starting place internally for us. We will drill fifty holes in addition to the more than 300 that are already on the property. We have been drilling this year and with that information we will get a 43-101.” The site benefits from strong infrastructure and support. Said Langer, “There is infrastructure on it including water, paved roads and a lot of support from the local community. They want the jobs. The government in Lisbon is very forward thinking. Mining will help them to get out of their recession.”

The Covas resource itself is still in development. Langer said, “The size of the resource is about one million tons at 0.78% WO3. That is about the highest I’ve seen for an open pit mine. We feel quite confident that we will be able to increase the deposit over time. Only 40% of it has been investigated. The Borralha is the other mine we are focused on. It was in production during the mid-1980’s when China’s production depressed the price of tungsten. Borralha has never seen a drill hole until now, but has produced 18,000 tons of tungsten. It had the largest tungsten smelter in Europe. Historically, they mined high grade vertical veins as well as three open pit areas.”

The company has begun some additional exploration on these sites. Langer said, “We have done some initial trenching work with a result of 100 meters of 0.13% WO3 at surface. If we are looking at open pit bulk tonnage, that could be quite attractive. We have started drilling there. We are about 75% there. We got 63 meters of 0.18% WO3. This could be a world class deposit in our opinion. We expect to release those results in the next month or so. The Covas deposit is primarily scheelite mineralization with some wolframite. The other four projects are all wolframite. Our third project is quite interesting as well. It is an alluvial sand material there with tungsten and tin values. The value of the area known so far is about half a billion dollars in today’s value. If there is a way to move it forward, we will do so. We also have the second largest past producer of tungsten in Portugal. This one has vertical vein structures and is an underground operation. We have found an area that has 128 veins at surface. We can add that to our projects as we move forward.”

The company is truly focused on moving their projects forward and creating opportunity. Said Langer, “We are advancing these projects at a pretty substantial pace. We have been smart with our money and will keep moving forward. It is always good to have a few extra things in the hopper just in case you need them. We have more than one million dollars in the bank right now. We have 28 million shares in the market. The last two financings were done at $0.25 cents. Our shareholders do believe in what we are doing. Currently, management insiders hold about 32% of the company. We do have two Asian investors. One of them is in the cell phone and tungsten recycling business. The other group is from Hong Kong.

It is a charity fund that helps to build schools and hospitals. They have also been very strong partners. Our market cap is about $8 million dollars.”

Langer said shareholders should look for news shortly, “There will be a good amount of news coming out because we are drilling on two projects. We will have a 43-101 report coming out which will revalue the company.” Robertson believes that their company is attractive to shareholders. He said, “The key thing is to remember that we have taken on a vision. Portugal used to be a significant tungsten supplier and only closed because of prices. We feel that we have some of the top tungsten projects in Portugal and we want to see them move forward and go into production fairly quickly.”

For further information contact Alexander Langer at 604-684-3800 or at info@blackheathresources.com

http://www.blackheathresources.com

|

|