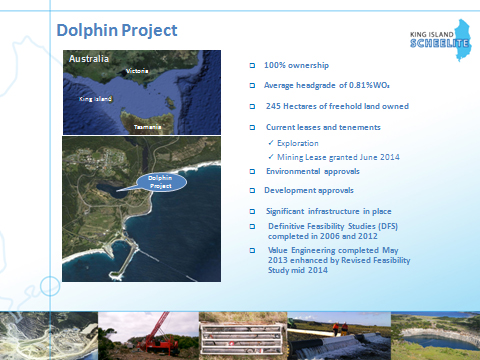

King Island Scheelite (ASX: KIS) Prepares to Reopen Dolphin Tungsten Project in Australia with Experienced Team

|

By Dr. Allen Alper

on 11/3/2014

Johann Jacobs, Chairman of King Island Scheelite (ASX: KIS), took a moment out of his busy schedule to sit down with Metals News at the recently held ITIA meeting to update interested parties on the progress in reopening the Dolphin tungsten project in Australia.

The Dolphin Project is a historic mine that was discovered nearly one hundred years ago. Said Jacobs, “The mine commenced production in the early 1900’s. It closed in 1992 due to very, poor tungsten prices. It had originally been an open cut mine however they then changed to underground mining”. Given the fact that the mine has not been used in more than twenty years, it is taking some work to get it up and operational again. Jacobs said, “We have commenced de-watering the void. Clearly, after 25 years the open cut void had filled up with primarily rain water.” Removing all of the water from the mine has been a laborious process, one that has taken months to complete. Jacobs said, “We commenced in July of this year, pumping at a rate of 400 liters a second, and we will finish doing that in mid October.”

Once the water has been removed from the mine, the company will move forward into a drilling programme. Said Jacobs, “We will then go into a limited drilling program and the intention is to make a final decision to reopen the mine in January, 2015.” If the company does decide to reopen the mine, the next stage will include rebuilding the processing facilities of the business. Jacobs said, “It will then take us about eighteen months to reconstruct, or construct, a processing plant and to be in production by June, 2016. ”

Though the mine has been in production on and off for nearly a century, there is still a great deal of tungsten left to mine. Said Jacobs, “The resource includes about 92,000 tons in situ and we will be producing at the rate of about 3,000 tons of WO3 per year.” Reopening a mine of this size does require funding. Jacobs said, “In terms of finances, we have just raised $2 million dollars from a rights issue to provide working capital through to early 2015. The total cost of the mine will be about sixty million Australian dollars and we will raise about fifty percent of that in the form of debt and warrants the balance in equity.” Said Jacobs, “Our market cap is twenty one million and we are trading at about fifteen cents per share, but we have very little liquidity. We will address that issue when we do the major capital raise in March.”

In order to deal with the financing issue, the company will look to additional investors who want to participate in a tungsten play. Said Jacobs, “We’ll be going out to retail investors to try to attract them. Our grade, the open cut part of it, is .55 percent and the underground is about one percent. Our total resource averages about .81 percent.” Jacobs has a great deal of experience in dealing with the financial end of a mining business. He said, “I’m a Chartered Accountant by profession. I have been in the mining business since 1980. I started in the coal industry in South Africa. I have been in Sydney since 1995 and I was involved originally in coal, then in mineral sands, iron ore, tungsten, uranium and graphite.” In addition to his financial background, there are other experts that work as part of the project. Jacobs said, “We have a three man board. My co-director is a geologist and the other one is a mining engineer. We have one project manager who is a metallurgist. He’s based in Hobart. The other three of us are based in Sydney. That is the sum total of the company at this stage. We rely a lot on contractors.”

In the short term, the company is considering offtake agreements to help them accomplish the work that needs to be done. Said Jacobs, “We are in very serious discussions with three parties. I am looking to do at least three offtake agreements within the next two to three months.” He believes that these will be an excellent option given the current state of the tungsten market. Said Jacobs, “Tungsten, in my opinion, is a steady market. Our risk profile is significantly reduced compared to any of the other tungsten players. We will certainly be in the lowest quartile for open cut costs. We anticipate them to be at A$110.”

As part of the project, Jacobs and his team will be looking for ways to decrease the costs of the project. He said, “Our most significant cost will be diesel. We are looking at options for that. We are looking at a net selling price of A$260 dollars. We will be selling a 65% WO3 concentrate”. Adding to the positive nature of the project is its location. Jacobs said, “In terms of our location, King Island is a very small island which has a total population of less than 1500 people. We would be seeking to employ the bulk of our workforce from the island. To date, our community has been very, very supportive of the mine reopening. It is the only industry outside of cattle and cheese on the island. We have a very supportive community for the mine.”

http://www.kingislandscheelite.com.au

REGISTERED OFFICE:

Level 26,

259 George Street

Sydney NSW 2000

Telephone: +61 (0)2 8622 1400

Facsimile: +61 (0)2 8622 1401

|

|