NioGold Adds Former Osisko Gold Mine Leaders and Begins an Aggressive Drilling Program for Gold in Quebec with $4.9 Million of New Funding from Osisko Gold Royalties Ltd

|

By Dr. Allen Alper

on 9/23/2014

NioGold (TSX: NOX), known for their gold projects in mining-friendly Quebec, has recently added Sean Roosen and John Burzynski to their Board and appointed Robert Wares as President and CEO. All are well-known mining industry leaders as NioGold moves forward on an aggressive drilling program. Metals News sat down to learn more about where the company is and what their near term plans are.

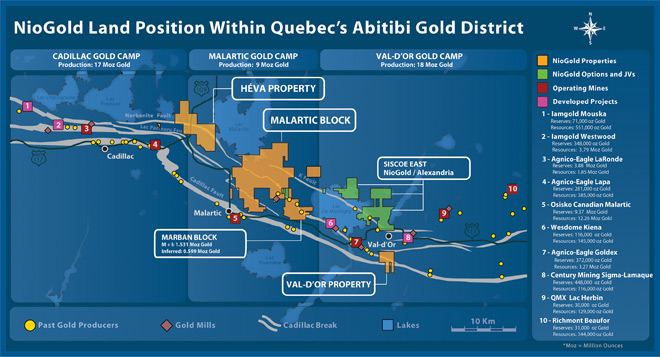

Dale Paruk, Vice President of Corporate Development, said, “As you know, NioGold has a very large land position in the Abitibi greenstone belt in Northern Quebec. We have a 130 square kilometer land package in the Malartic and Val-d’Or mine camps. A good chunk of that property is right across from what was Osisko Gold’s Canadian Malartic Mine. That was recently sold. Parts of those assets were spun out as Osisko Gold Royalties Ltd. I believe they have about 130 million in cash and are getting about $30 million dollars a year cash flow out of that mine.”

NioGold has just announced a financing with Osisko Royalties, where Osisko is investing $4.9 million into NioGold. NioGold is also benefitting by bringing on well-known mining industry leaders to their Board. Said Paruk, “The original Osisko gold mine was headed up by some very well regarded mining people, Sean Roosen and John Burzynski. Those gentlemen have now joined the Board of NioGold. Both of them are quite well known and legendary in the mining industry. They have won Mining Men of the Year awards and remain Directors of Osisko. Having them join the Board of NioGold is a real feather in our cap. It gives us some more senior people on the Board of Directors along with our current Chairman, Peter Hawley and current CEO, Mike Iverson.”

Paruk believes that this additional leadership is putting NioGold’s future on the fast track. He said, “NioGold is now building a very strong Board of Directors that is connected to our current land package in Quebec. We have three previous producing deposits that we have been developing into larger ore bodies. We have 2.1 million ounces of resources on those properties. Those continue to be developed and look like they have potential for new production. We are developing those, and now with Sean and John on the Board, that gives us extra clout in the province of Quebec and in mining circles as well.” The mining and investment community has reacted favorably to the news with the stock (TSX-V: NOX) jumping from $0.20 to $0.35.

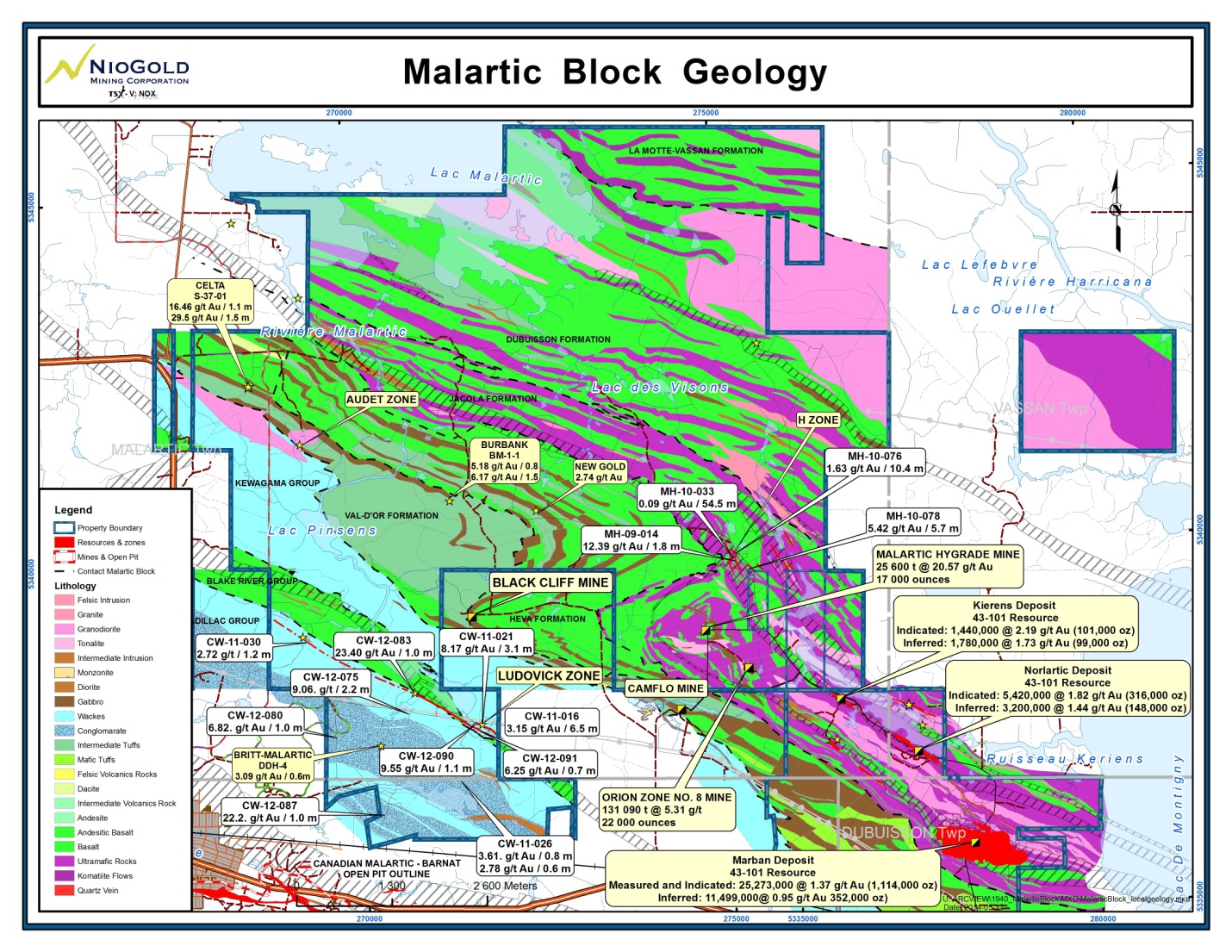

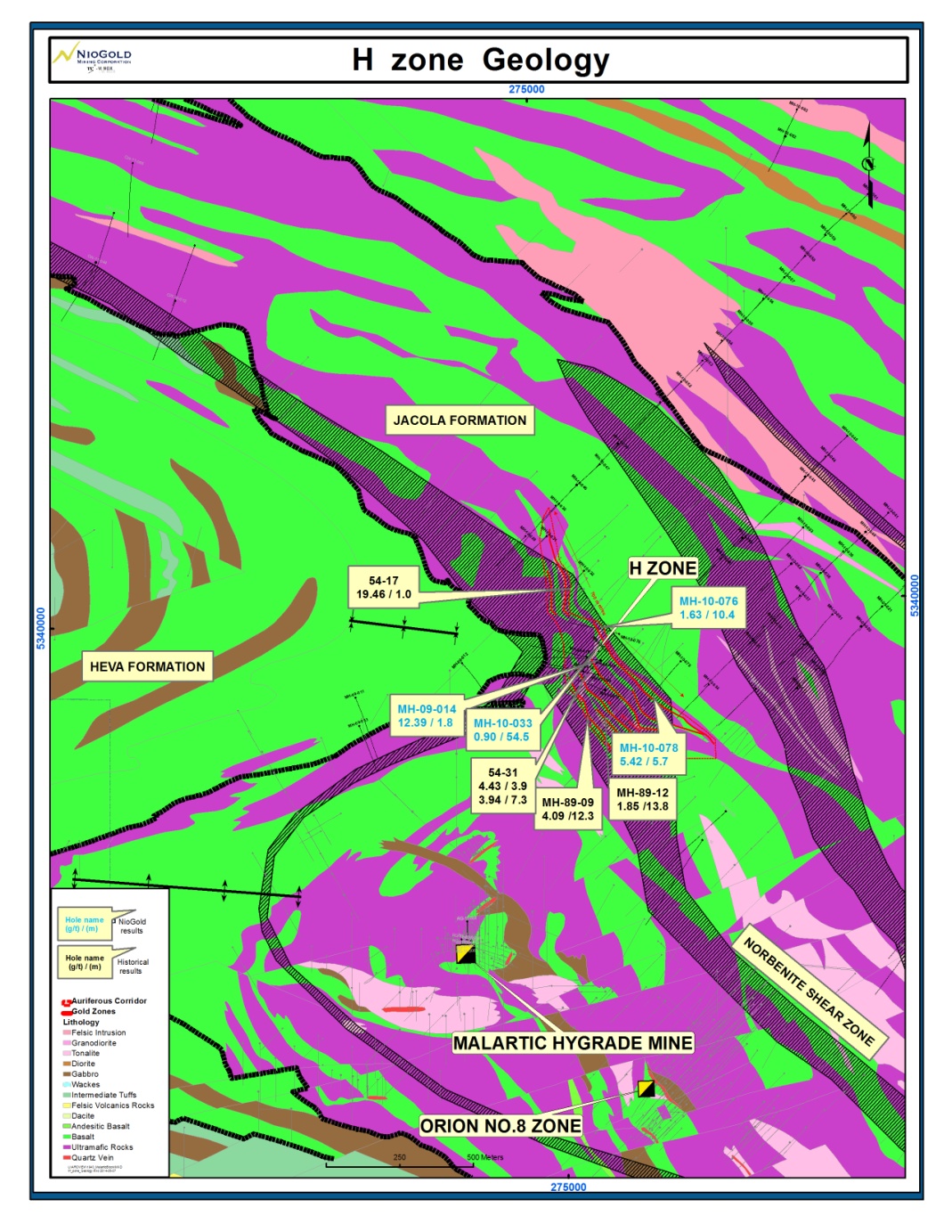

In addition to new Board members, the company is moving forward on an aggressive drilling program. Said Yan Ducharme, NioGold’s Vice President of Exploration, “We have announced a week ago that we have completed an exploration program that was outside the resource area. We were focusing on other targets on our Malartic Block property and some in areas we had never drilled before.” The drilling program has borne out positive results for the company. Said Ducharme, “We have identified two new gold bearing corridors that are so far 1.3 kilometers long, and those trends seems to be continuing inside our land package. With these two new trends, we now have three (including the previously discovered Ludovick zone) on this property. We are very excited about that.” Ducharme said, “As part of our exploration program we also drilled the ‘H’ zone on the Malartic H property, of which we just acquired the remaining 40% from Breakwater Resources. The nine holes that we drilled there helped us to understand the geometry of the zone. We had very good results confirming that we have a wide envelope containing some high grade shoots. We also drilled south of the Norlartic deposit on the Marban Block property and the holes are showing that there is gold everywhere. ”

Much of the next year’s drilling program will be funded by a recently closed financing deal with Osisko. Said Paruk, “We just closed a $4.9 million dollar financing with Osisko.” This has allowed the company to move forward quickly with drilling. Said Ducharme, “We started drilling this morning. We are following up on our 2013 results inside the inferred resource part of the Kierens deposit. We are also aiming to extend the resource between the Kierens and Norlartic deposits. We will also drill in the Marban deposit to test some of the zones near surface which have potential to add tonnes of resources. Our budget just went from $0.5 million to $5.4 million. We are going to be busy over the next year. We have to spend all the money by December, 2015. We will drill about 35,000 meters.”

Paruk believes that investors should take a close look at what NioGold has to offer. He said, “NioGold currently has 120 million shares with the investment from Osisko. We have a market cap of $40 million dollars. We are well capitalized with something over $6.5 million dollars in the bank. We have a strong Board. We are expecting to have an aggressive drilling package this year. We will have a lot of drilling results this year and have more exposure to the market with our new Board members. It looks like it will be a good year for NioGold.”

Disclosure:

The Alper family own shares of

NioGold Stock.

For more information:

NioGold Mining Corporation

24549-53 Avenue

Langley, BC

V2Z 1H6

T: +1.604.856.9887

F: +1.604.856.9479

|

|