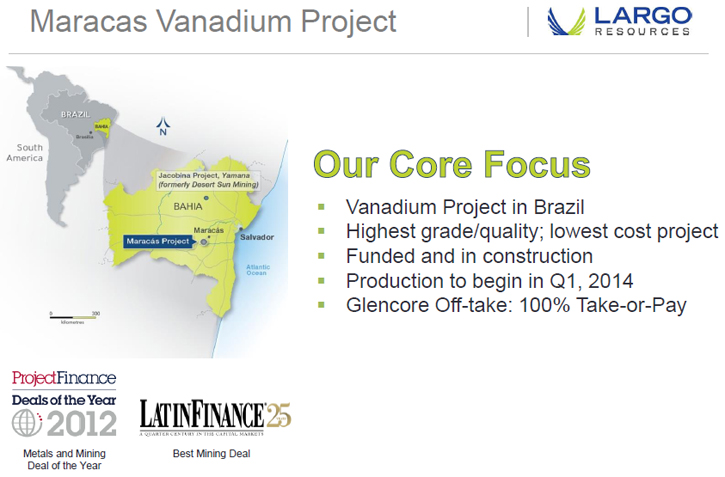

Largo Resources’(TSX: LGO) World’s Premier High-Grade Low-Cost Vanadium Project in Brazil will be in Production the Q1 2014

|

By Dr. Allen Alper

on 2/27/2014

Mark Brennan, President & CEO of Largo Resources (TSX: LGO)

Mark Brennan, President & CEO of Largo Resources (TSX: LGO), spoke to Metals News at the recently held Cambridge House Resource Investment Conference held in Vancouver, about the progress they are making toward production on their vanadium deposit.

Said Brennan, “The main focus of the company right now is our Brazilian vanadium deposit. It is the best vanadium deposit out there. As a result, we will be a low cost vanadium producer when we start production in a few months.” The company will begin a production process that will increase over time. Brennan said, “We will look to ramp up over the course of 12 months. We are looking for significant cash flows as a result of the project. We are targeting to start Cash Flow in April, but again, it will be a slow ramp up. We have used a very conservative ramp up schedule. For 2014, we are estimating about $30 million in cash flow. In 2015, we are looking for $70 million and 2016 north of $100 million. So, we will see a steady incline for cash flow.”

The company is very pleased with their vanadium deposit. Said Brennan, “We have a few new developments that we are looking at with respect of developing that cash flow even more. This is a fantastic little deposit that has given us a lot and keeps giving us a lot. We are very encoruaged by what is out there. The grade is 1.34% per ton, while every other deposit around the world is less than .5%. We are two and a half times richer than any other vanadium deposit. That is important, but the quality of the material is important. We have a 60% iron ore host and essentially very few contaminants, so actually when we look to move from a concentrate to our production process, what happens is because of the low contamination level, we are much, much cheaper than anyone else in terms of the production of the vanadium.”

While many people may not understand the applications for vanadium, nearly every person owns something with vanadium in it. Said Brennan, “Ninety five percent of vanadium is used for the enhancement of steel. It is a widely used alloy. It has the highest strength to weight ratio of any industrial material, so really what you are looking at is anything you want to be stronger or lighter, you use vanadium. It also does have an anti-corrosive element. What happens is if you add a kilogram of vanadium to a ton of steel it will double the strenth and reduce the weight by about 35%. It means you can use a lot less steel to get the same result for the same quality and strength you’d have previously.”

Having a low cost mine in Brazil is what makes Largo Resources a leader in the vanadium industry. Said Brennan, “What you see in the vanadium world is about 30% of the vanadium is produced out of primary mines. For the most part you have South Africa, China and Russia. What we are looking at in South Africa is that there have been issues with reivestment and issues with infrastructure, so the cost basis with South Africa, which was at one point about 35% of the vanadium market, has now dramatically increased.” Because of the changes in the market, some vanadium companies are finding it difficult to stay in business and competitive in the market. Brennan said, “You are now seeing companies that were leaders in the vanadium market losing money at current price levels. The interesting thing with vanadium is when you see $5 for vanadium pentoxide per pound, you tend to see marginal production shut down because people aren’t making money.” Largo’s low cost model gives them a significant advantage in the market. Brennan said, “Our production cost of $2.50 means that even when we see low commodity prices we still make a lot of money. Also, what is interesting is that because of the high grade deposit that we have we are even competitive with by-product and co-product producers. Traditionally, they are the cheapest price for vanaidum. We are the cheapest form of vanadium you can acquire.”

Financially, Largo is in an excellent position to continue to move toward production and achieve their own cash flow. Said Brennan, “We are funded to production and just raised $17 million dollars. We don’t expect any other equity raises for the foreseeable future.” The amout of shares they have in the market is currently quite extensive, though that may change over time. Brennan said, “We have 980 million shares outstanding. At some point we will consider consolodating those shares.” With cash in the bank, a newly completed equity raise, and nearing production, the company has a large market cap. Said Brennan, “We have a market cap of $250 million dollars.”

Vanadium is not the only project that Largo Resources is currently working on. Said Brennan, “We have tungsten projects as well. We are bullish on tungsten. We have a tailings operation in Brazil. Unfortunately there is a drought and a water shortage and we are hoping to get the facility up and working in May. We also have a very large tungsten deposit in Canada called Northern Dancer. We want to get the vanadium project working first and then put money into other projects.”

Why should investors consider Largo? Said Brennan, “The reason to invest is it is cheap, cheap, cheap. No matter how good the asset is, you want to buy it when it is low. You buy value for the items that you choose. We are very undervalued. As we move into production we anticipate that the valuation of the company will go a lot higher. The market believes there is risk to the construction, and there is, but as soon as we go to production, we expect that will be removed.”

Disclosure:

The Alper family

owns Largo’s stock and Dr. Alper is a Director of Largo Resources.

http://www.largoresources.com/

Largo Resources Inc. 55 University Ave. Suite 1101

Toronto, Ontario, Canada M5J 2H7

416-861-9797

|

|