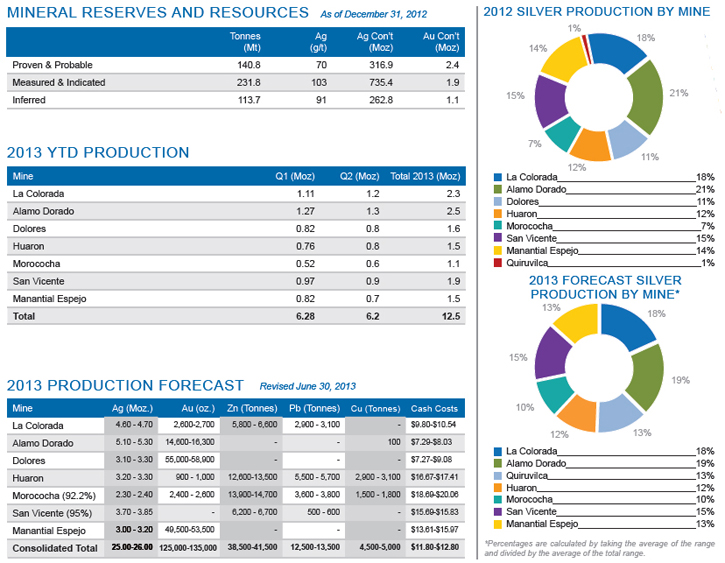

| Ross Beaty, the founder and current Chairman of the Board of Pan American Silver Corp. (PAAS: TSX; PAAS: NASDAQ) spoke with Metals News about the company, their current position and the status of the markets. With mines in multiple countries, Pan American Silver is one of the biggest silver producers in the world. Beaty said, “It is the second largest, primary silver mining company in the world. In 2012, we produced 25 million ounces of silver as well as copper, gold and zinc.”

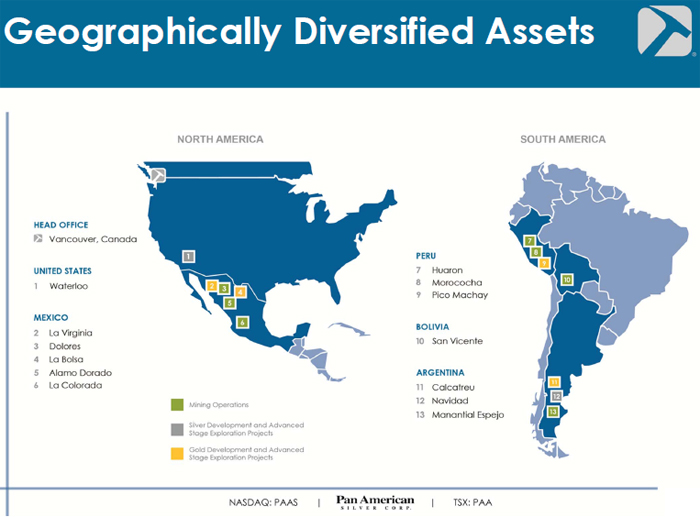

The company has diversified their holdings all over the world. Beaty said, “We have mines in Mexico, Bolivia, Peru and Argentina.” These holdings have created a large management project for the company. Said Beaty, “We employ 8000 people.”

|

In terms of value, Pan American has a very positive financial

situation. Beaty said, “We have a $2 billion

dollar market cap.” The company believes

that their financial strength is one of the reasons investors prefer their

stock over other investment options.

Beaty said, “We have the best balance sheet in the silver industry. We have $400 million in the bank. We are in good shape with strong cash flow.” In addition to the cash in the bank, Pan

American has projected that their production will continue to grow over

time. Said Beaty, “We expect our silver

production will continue to grow in 2014.

We will be working to increase production over the medium and long term,

too.” All of these efforts are designed

to move Pan American to the next level in the global silver market. Said Beaty, “We are aiming to be the largest

low-cost silver producer in the world.”

The company is

pursuing their growth by following their initial plans. Said Beaty, “The real goal is to stay close

to our mission. We’d like to do what we do well – build good mines, employ good

people.” One of their more recent

efforts was to buy back shares to support the value of their company. Beaty said, “We have spent $125 million

buying back our shares and we also pay a strong annual dividend of $0.50 per

share. We are returning value to our

shareholders.” This is just one of the reasons that the company is in a

financially enviable position.

Beaty believes that silver and gold will be

excellent investments for the future. He

said, “Silver and gold, being precious metals, are money. They have been driven by the same factors for

millennia. They are real assets, not

paper assets.” Beaty believes that

investors don’t always have confidence in the paper money they use on a daily

basis. He said, “People will seek out precious

metals as real assets with stable value.”

Though values for silver and gold have decreased in recent months, Beaty

doesn’t believe this will continue for long.

He said, “Silver and gold prices have come down because of

nervousness. The dollar is strong right

now. I don’t see that strength

staying. I could see gold over $2000 and

silver over $30 in the near future.”

Beaty doesn’t believe

the non-precious metals market is in as favorable a position. He said, “I’m not so favorable toward non-precious

metal prices. I think that growth will

be stressed in many places in the world.

On the supply side, gold supply is very stressed. We aren’t producing a lot of new gold. You are seeing static production rates.” These static production rates are now

impacting the price levels of gold and silver.

Said Beaty, “The mining industry has had ten years of exceptional pricing. When you have pricing doing so well, you end

up having supply catch up.” In addition

to more supply becoming available, there are also issues with the geopolitical

status of economies. Beaty said, “The

new metals supply is hitting today into a market that is nervous about world conditions,

which decreases demand. Mining equities

have been hit because of issues with capital allocations. Bad acquisitions and poor cost management have

caused investors to sell. It is quite

natural. It isn’t fair that shareholders

are blaming mining companies for all of this because some of this is currency

driven.”

Unlike many of the companies that are suffering

through a challenging market, Pan American Silver simply isn’t in that

position. Said Beaty, “Pan American

Silver is in a very strong financial position.

We pay a 4% yield. We think our

share price is dramatically undervalued.

We have $400 million in the bank and $700 million in working capital

with a great asset base.” Beaty believes that their share price isn’t

commensurate with their assets. He said,

“We have a diversified portfolio in

four countries and a very strong balance sheet with capital to do what we’d

like to do and the ability to protect ourselves in any downturn. We have portfolio development assets which

should increase our production. We have

a fabulous management team. We build and

operate all of our mines with a proven track record. The team is engaged and strong.”

Pan American Silver, the world’s second largest,

silver primary, silver producer boasts a strong balance sheet, $400 million

dollars in cash, $700 million dollars in working capital and a management team

that takes projects from the development stage to the production stage. Beaty believes the company is poised for future

growth and development, which will benefit shareholders.