Richard Spencer, the President and CEO of U3O8 Corp. (TSX: UWE) updated Metals News on the key milestones they’ve made on their uranium projects in Colombia and Argentina at the recently held Vancouver Resource conference.

Spencer brings a considerable amount of experience to the company. He said, “I’m an exploration geologist by training and have lived and worked in South America for 10 years.” Spencer’s past experience has prepared him well for leading U3O8 Corp. from exploration into development and towards production. He said, “I had a lot of success in copper and gold exploration in South America.” Spencer has been leading U3O8 Corp. for five years. He said, “When I looked at the exploration potential of U3O8 Corp’s initial deposit in Guyana, it became apparent that the rest of the continent would have similar uranium potential as the western part of Africa, which produces 17% of the world’s uranium. The contrast with Africa was that there was little competition from other explorers in South America – so outstanding projects could be acquired at very reasonable cost. And that’s exactly the way things have turned out. U3O8 Corp. acquired the two properties that are now its lead projects in mid 2010.

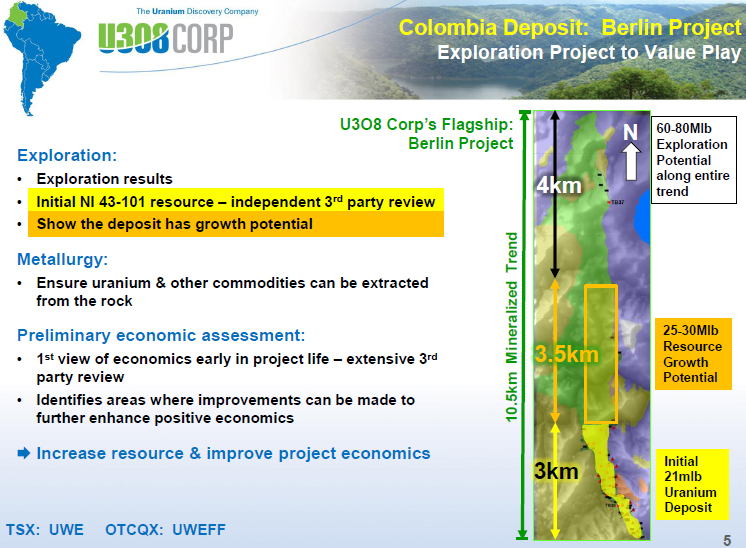

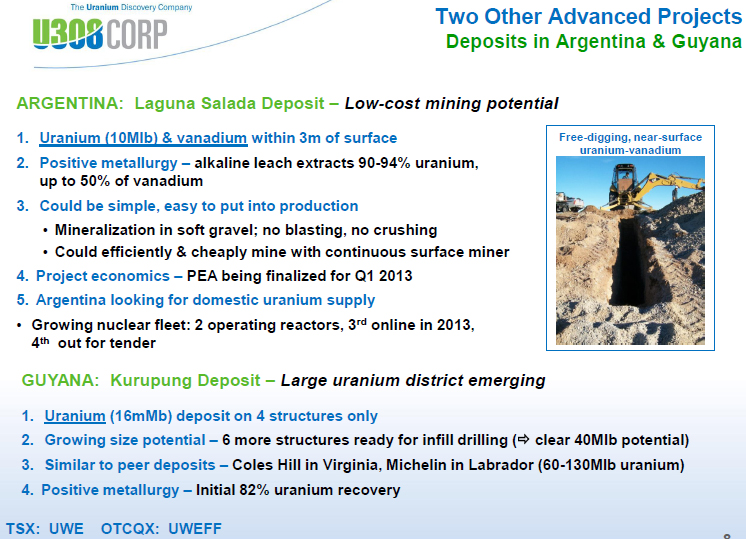

To date, Spencer and his team are happy with the progress of the three projects in Colombia, Argentina and Guyana. He said, “We’ve advanced these assets considerably – we have NI 43-101 resources on each of the projects, with a total resource of 48 million pounds of uranium.” With a resource portfolio of that size, U3O8 Corp. is emerging into a mid-tier uranium company – of which there is only a handful of peers in the space.” Said Spencer, “And with the recent PEA on part of the Berlin project in Colombia, we can demonstrate specific value to shareholders for the first time – and with a valuation of $1.88 per diluted U3O8 Corp. share or 9 times our share price, U3O8 Corp. is clearly undervalued relative to the Colombian deposit alone. The PEA only covers about one third of the mineralized trend, leading Spencer and his team to be optimistic about potential for tripling the currently 21 million pound uranium resource at Berlin. He said, “The take-away from the PEA is that the mining and extraction of the uranium is paid for by by-products such as phosphate, nickel, vanadium and two rare earth elements, yttrium and neodymium. With the uranium produced at zero cash cost, this could not only be a large deposit but would place Berlin in the lower quartile of potential uranium producers.”

Spencer also believes that the timing is good for investment in the uranium sector. He said, “The Japanese election last December, in which a pro-business and pro-economy government was elected, marks a turning point in the nuclear industry. This is a government that recognizes the importance of clean, reliable, cheap electricity as a driver of the economy – and that nuclear plays a key role in establishing that solid base from which the economy may prosper. He said, “Since the Japanese election, we have seen investor interest in the uranium sector increase. I really believe we are at the bottom of the current cycle. It is a good time to get in.”

Spencer and his team will have to do a financing in the near term to continue to push the projects forward. He pointed out that the use of proceeds from past financings has been very direct and clearly aimed at increasing resources and completing preliminary economic assessments to provide the first economic indicators of a project – and U3O8 Corp. is delivering on those milestones.

Spencer said, “Our development of both the Colombian and Argentinean projects has been methodical. First, we have defined an initial NI 43-101 resource, extensive metallurgy has been done to ensure that we can extract the uranium and other commodities from the rock, before moving to a PEA to ensure that the economics of the initial deposit are compelling and justify further expansion of the resource. This means that we have independent entities constantly checking our work and that we’re being absolutely transparent with the investment community in making our data available through comprehensive NI 43-101 reports – documents that are available for review by the public on our website as well as on SEDAR.”

Currently, the company has approximately 140 million shares outstanding. Spencer said, “About 30% of the shares are held by insiders and long-term shareholders, which provides a level of protection against a company making a low-ball, opportunistic offer for the company at the current low valuation. The company’s growth strategy is to joint venture each project with an operator, and for U3O8 Corp. to maintain a significant minority stake in each project. This would provide an income stream, part of which could be dividend out to shareholders and the other part used for focused exploration to bring the next discovery into the company to sustain constant growth.”

U3O8 Corp’s presence in Argentina has elicited questions due to the economic turbulence that the country is experiencing. Said Spencer, “Argentina has been through similar economic situations in the past – and after each crisis, the country has emerged and grown at a phenomenal rate. Given this history, I believe that it’s prudent to get our deposit ready during the crisis so that it enters production in the growth phase that will follow the crisis. So, we’re taking a classic contrarian approach in Argentina. Argentina has two reactors online now, a third that should be fully operational at the end of the year and a fourth reactor out to tender. It’s very keen to foster local uranium production because it’s currently importing all of its reactor fuel. We’re bullish on Argentina because it’s a growing nuclear country, committed to nuclear, and is calling for local uranium production.”

Why should investors take a look at U3O8 Corp? Said Spencer, “Firstly, although everyone says their company is undervalued, we can demonstrate the extent to which U3O8 Corp. is undervalued based on the results of the PEA on one part of one of three lead projects. Using an 8% discount rate, the net present value of only one-third of the resource potential of the Colombian property suggests that the company should be valued at about nine times the current share price. Secondly, U3O8 Corp. is emerging into one of the few mid-tier uranium companies with considerable NI 43-101 resources, positive metal recoveries, favourable economics, projects with low-cost uranium production profiles and a very clear path for further rapid growth. Thirdly, and importantly, insiders have been there on every single financing. We all have skin in the game.

http://www.u3o8corp.com/

Corporate Office

8 King Street East, Suite 710

Toronto, ON M5C 1B5

Canada

Phone: 416-868-1491

Fax: 416-868-1497

For information, please contact:

Richard Spencer, President & CEO richard@u3o8corp.com

Nancy Chan-Palmateer, Vice President, Investor Relations nancy@u3o8corp.com