Carl Kottmeier, the Project Manager on the Arctos Anthracite Project for Fortune Minerals

Fortune Minerals (TSX: FT, OTC QX: FTMDF) took the time to sit down with Metals News at the Vancouver Resource Conference to talk about the progress they have made in advancing the Arctos anthracite metallurgical coal project in Canada.

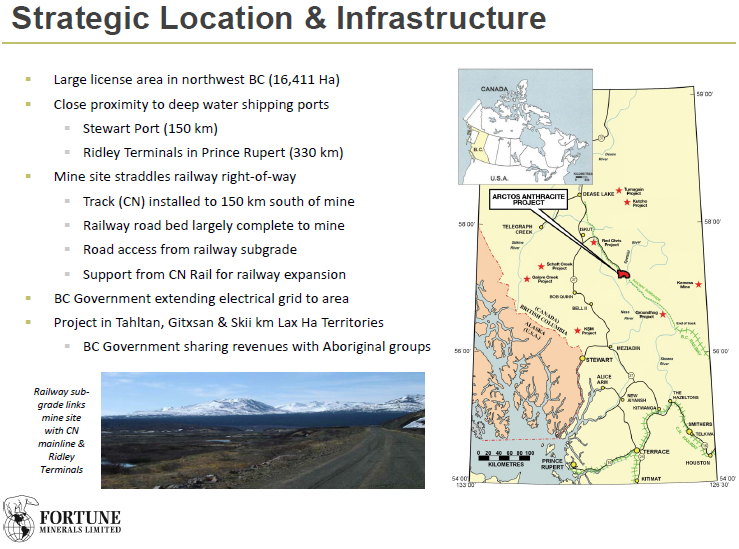

Carl Kottmeier, the Project Manager on the Arctos Anthracite Project for Fortune Minerals, has his sole focus on advancing the metallurgical coal project for the benefit of the company and its partners. He said, “Basically, I have been with the company since March, 2012.” A newer member of the team, Kottmeier has been charged with advancing the Arctos Anthracite Project to the next stage. He said, “One of the things we have been working on is the environmental studies and permitting.” In addition to the environmental permitting, Kottmeier and his team have been focused on moving the transportation side of the project to the next stage. He said, “We have been doing a lot of work on the railway as well. An unfinished rail bed, built by the BC Government in the 1970s, runs right through our project site and we are proposing to complete the job.” The company has an aggressive plan to extend the railway to the mine to make moving the coal to market more cost effective and efficient. Said Kottmeier, “We’ll extend the existing rail line 147 km to the mine site and use the rail to move clean coal to Ridley Terminals where it will be exported to the overseas steel industry. This transportation solution is efficient and scalable allowing for potential expansion of production to leverage the large resource base. ”

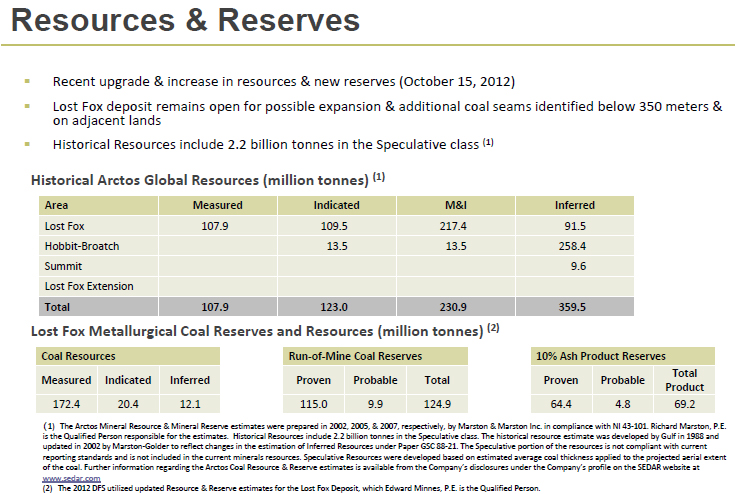

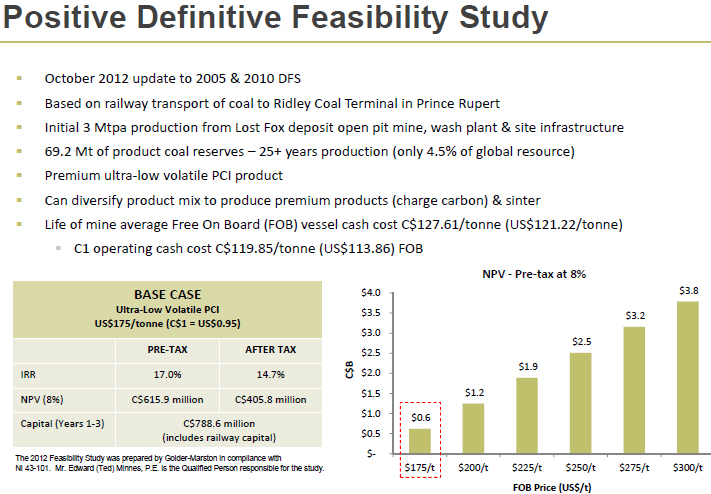

In addition to the work that the team has been doing on the environmental and transportation issues, Kottmeier has been working on the overall cost of the project. He said, “We recently updated our Feasibility Study and demonstrated robust economics. The mine life increased from 20 to 25 years, Product Reserves increased by 14%to 69 million tonnes. The NPV is $616 million dollars, based on an 8% discount rate, and the pre-tax IRR is 17%.” Another avenue for enhancing the project’s economics includes connecting the site to grid power. Said Kottmeier, “We are looking at other things we can do to improve the economics of this project such as electrification. We are looking at connecting our project to the Northern Transmission Line (“NTL”) currently being built by the BC Government. Connecting to the grid via the NTL would reduce operating costs significantly and would also serve to decrease the project’s environmental impact.”

Kottmeier’s focus on the railway includes several different avenues. Said Kottmeier, “Other activities we are engaged in include a more detailed cost assessment regarding the construction of the rail line.” The company has decided to seek outside assistance to enhance the estimate. Said Kottmeier, “We are working collaboratively with CN on this point, and we will be hiring an engineering company this year to complete a more comprehensive study on the work required to construct the railway. The current estimate of $330 million dollars is approximately 40% of our $788 million capital cost.” These numbers are consistent with information currently listed by the company, according to Kottmeier. He said, “That is following the updated feasibility report.” In addition, the Arctos project will benefit from a coal washing plant, which will feature environmentally friendly processes. Said Kottmeier, “We have updated the design of our coal wash plant and ninety-five percent of the water used in the plant will be recycled. This is important given the area’s significance to First Nations and is part of our commitment to protect the creeks and rivers. As mentioned, we are looking at electrification of the project. That means we won’t have to operate diesel burning generators 24 x 7, and we will therefore reduce our gas emissions which of course is good for the environment.”

Kottmeier is leveraging his experience in order to lead the project. In addition to being a graduate mining engineer from UBC in 1989, Mr. Kottmeier has an MBA from the same institution. Kottmeier has the support of the leaders of the company. He said, “The President of Fortune Minerals is an exploration geologist who discovered our NICO gold-cobalt-bismuth-copper project that is at the tail-end of the permitting process in the Northwest Territories. Mike Romaniuk, VP Operations, has a very strong background in turning exploration projects into successful producing mines having spent over 20 years with Xstrata Nickel and Falconbridge. For a development company, we have a very strong management team and experienced board of directors.”

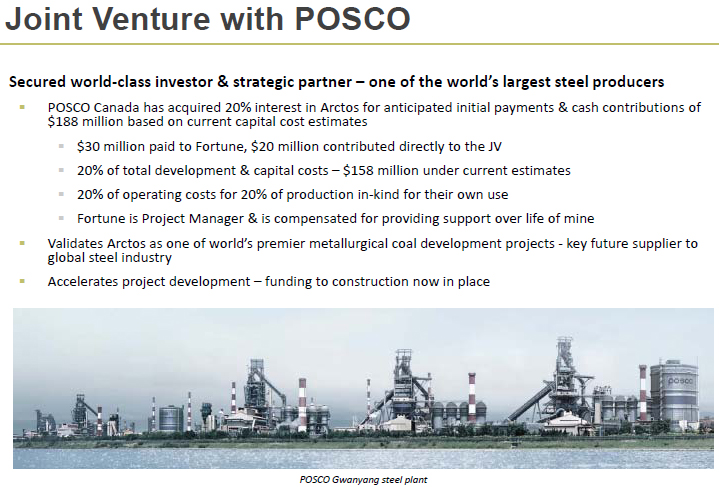

The timeline for the project is moving forward in the near term. Said Kottmeier, “For the Arcos Anthracite metallurgical coal project, we will be submitting our project description to the BC and Federal governments at the end of this January. Following this, in early 2014, we will be submitting our application for an environmental assessment certificate. That is part of the process to build a mine in British Columbia, Canada. If all goes to plan, we will kick off construction of our project in April 2015, and be producing coal in late 2016. POSCO Canada has a 20% share in our project. 20% of our coal will be going to their steel projects in Korea.”

Troy Nazarewicz, the Investor Relations Manager of Fortune Minerals said, “There is a $788 million initial CapEx on this project. Fortune Minerals has 121 million shares outstanding and a $61 million dollar market cap, the least dilutive way to finance Arctos is to match our need for capital to the need for metallurgical coal in Asia. We are working with Deloitte and Touche Corporate Finance Canada Inc. to secure a second stage strategic partner to complete project financing and hope to have that partner in place this year. POSCO provided capital to support the required permitting and community engagement up to the construction stage. The next partner will bring the money to build the project.”

Why should investors look at Fortune Minerals? Said Kottmeier, “Quality of the product and size of the resource. Anthracite metallurgical coal is the highest grade of coal you can have for steel making and it is very important to the Asian steel market. It is a relatively rare commodity and we have an abundance of it. We have almost 70 million tonnes of Product Reserves and we know we’ve only scratched the surface. The previous owners of the deposit demonstrated there is significantly more coal in the ground than what we have based our mine plan on. We also have the existing railway corridor. It runs right through our project. We only have to finish the construction of 147 kilometers of railway to get it to our mine. Having that rail transportation component decreases our cost to transport. We are proposing initial annual production of 3 million tonnes a year, but with the completed railway, we can easily scale up to a 4 or 5 million tonnes a year. We wouldn’t have to add to the rail line.” With an excellent metallurgical coal project and one of the world’s largest steel producers as a partner, Fortune Minerals is in a well positioned to advance their project.

http://www.fortuneminerals.com/

Fortune Minerals Ltd.

info@fortuneminerals.com

148 Fullarton St., Suite 1600

London, Ontario

N6A 5P3

TTF: (877) 552-7726

(519) 858-8188

(519) 858-8155