Tom Irwin Vice President, Alaska, Michelle Stachnik Manager of Investor Relations and Tom Yip CFO at the New Orleans Investment Conference

Alaska has long been considered the land of great resource potential, and International Tower Hill Mines is continuing to prove that idea true. At the recent New Orleans Investment Conference, we had a chance to sit down with Vice President, Alaska Tom Irwin, Michelle Stachnik Manager of Investor Relations and CFO Tom Yip to learn more about this exciting project as it moves toward fruition.

An Experienced Team

Often one of the key factors involved in getting a project off the ground is a management team with a solid level of experience in the industry, and you simply can’t find a man with more experience than Tom Irwin. A few years ago, Irwin was contemplating a well earned retirement when International Tower Hill Mines called him over to look at the project potential. He had worked for a variety of companies, including Amax Gold and Kinross. He assisted in a number of cold weather projects including the tungsten project in the Northwest territories of Canada and the Fort Knox project in Fairbanks. He also worked within the public sector, serving as the Commissioner of the Department of Natural Resources for three different governors. While there, he revamped the permitting system and even worked on permitting the Fort Knox area. If anyone understands what it takes to get a mining project off the ground, he certainly does.

Wondering what kept him out of retirement and within the mining industry? It’s the excitement of the Livengood project.

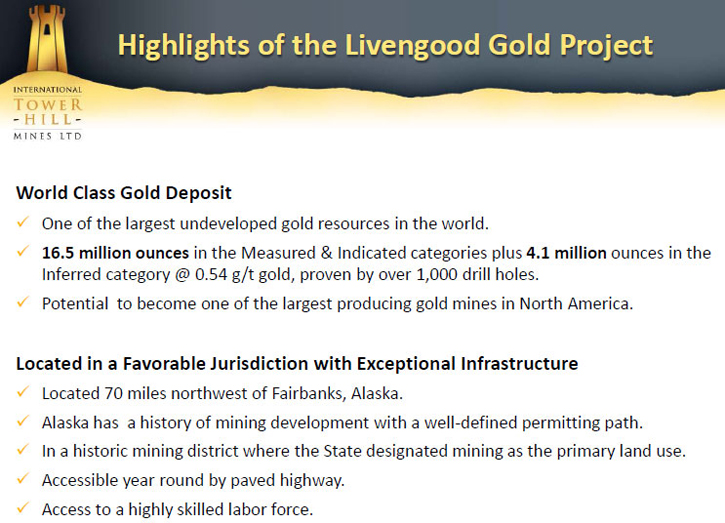

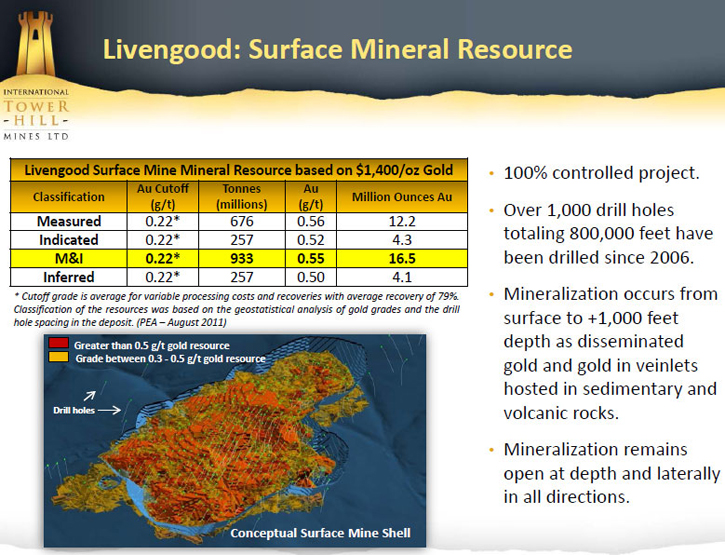

There’s much to be said for the thrill of building a mine, and this one certainly has a lot going for it. The ore body is open at depth and laterally, and it has 16 million ounces measured and indicated. What’s more, though, is that there’s another 4 million inferred. At 100,000 tonnes a day, this amazing ore body would last 23 years. For Irwin, both the size and level of access intrigued him. Unlike many other mining projects, theirs sits beside a paved highway that is state maintained. They’re just fifty miles from the Alaskan power grid. Sitting on 50,000 acres, the area all around them was previously mined, and Alaskan Mental Health Land Trust has chosen this area to call their own. Given that their job is to develop resources, the idea of a project here is fairly appealing.

An amazing ore body and great access aren’t enough to spell a solid project, though. In Alaska, environmental concerns are often the name of the game when it comes to permitting, and this project is nothing if not seriously permittable. International Tower Hill is in its fourth year of environmental studies to date. So far, they’ve found no endangered species, no fish issues, and no migratory animal or bird issues of any kind. It’s important to remember that this is an old mining district, so they’re not reinventing the wheel here.

While many companies would look at the ore body and try to find the potential for more, International Tower Hill is different. Sure, there’s exploration potential, but they’ve decided against looking into it for now.

“Something that happens 25 to 30 years out does nothing for today,” said Irwin, “so we have changed our whole focus.”

Instead of looking decades down the road, International Tower Hill is focusing on having their feasibility study done by 2013. Thanks to a close look at the metallurgical data, they feel this gives them more opportunity. The look they took at that data was certainly a comprehensive one. They statistically selected 11 tonnes of core samples, then did optimization studies to reconfirm. They went so far as to select samples individually so they could look for any issues, and they’re currently wrapping up a look at variability. They’ve done a lot of drilling, too – to the tune of 199 holes.

This is a company that knows operations in the cold, so between February and April, they drilled 47 holes. They didn’t just pull up those core samples and let them melt, either. They actually brought in a 30 ton air conditioner/chiller unit so they could recover the samples and look at the seams of ice in the rock so they could design for it.

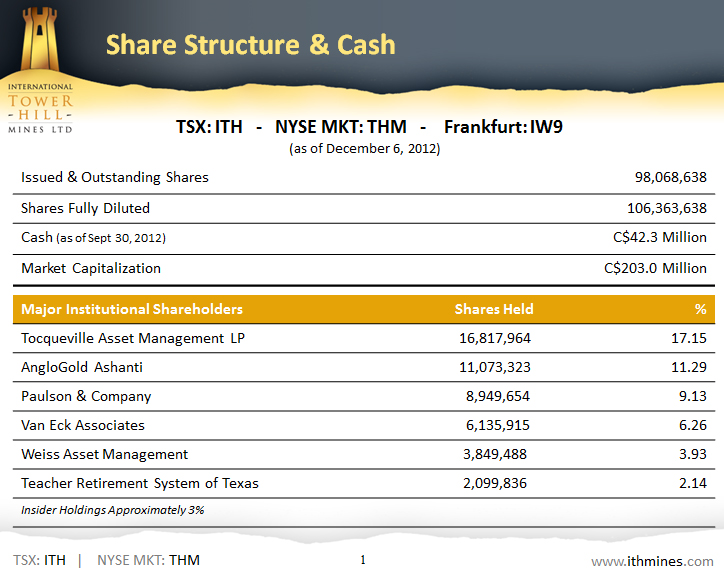

The economics look strong too. Tom Yip, the company’s CFO, took a moment to sit with us as well. Yip suggested the company was well financed through the end of their feasibility study. They currently have 100 million shares outstanding, and they have just shy of $30 million in cash on hand at the end of June. During their third quarter, they raised around $30 million through private placement. As they approach permitting time, they’ll take a closer look at how to finance this $1.6 billion mining project, but they have nearly four years to tackle that. They’ll continue to monitor the capital markets as well as other options to see what they can do.

Management (taken from website)

http://www.ithmines.com/

Tower Hill Mines (US) LLC is an indirect subsidiary of International Tower Hill Mines Ltd and manages exploration and project review activities.

|

OFFICERS |

|

|

|

|

Donald C. Ewigleben

Chief Executive Officer and President

Mr. Ewigleben has over 35 years of experience in the mining industry, having held senior positions at large international producers and smaller public companies with exploration and development projects. His career has included roles overseeing mergers & acquisitions, legal, regulatory, environmental and government affairs, including multiple projects in Alaska. Most recently he was President, Chief Executive Officer and Director of Uranium Resources Inc. (URI), a publicly traded uranium producer. Prior to joining URI in September 2009, he served as President and Chief Executive Officer of AngloGold Ashanti North America and held executive positions with AngloGold Ashanti Ltd. in North America and in Johannesburg, South Africa. Prior to joining AngloGold in 2000, he was the Vice President, Environmental and Public Affairs, for Echo Bay Mines Ltd. and was responsible for the management and permitting of the AJ and Kensington projects in Alaska. Mr. Ewigleben began his career with AMAX Coal in Washington, DC and later as Vice President Environmental & Governmental Affairs for AMAX Gold was intimately involved with the permitting and development of the Fort Knox deposit 60 miles to the southeast of the Livengood deposit. Mr. Ewigleben has over 35 years of experience in the mining industry, having held senior positions at large international producers and smaller public companies with exploration and development projects. His career has included roles overseeing mergers & acquisitions, legal, regulatory, environmental and government affairs, including multiple projects in Alaska. Most recently he was President, Chief Executive Officer and Director of Uranium Resources Inc. (URI), a publicly traded uranium producer. Prior to joining URI in September 2009, he served as President and Chief Executive Officer of AngloGold Ashanti North America and held executive positions with AngloGold Ashanti Ltd. in North America and in Johannesburg, South Africa. Prior to joining AngloGold in 2000, he was the Vice President, Environmental and Public Affairs, for Echo Bay Mines Ltd. and was responsible for the management and permitting of the AJ and Kensington projects in Alaska. Mr. Ewigleben began his career with AMAX Coal in Washington, DC and later as Vice President Environmental & Governmental Affairs for AMAX Gold was intimately involved with the permitting and development of the Fort Knox deposit 60 miles to the southeast of the Livengood deposit.

|

|

|

|

|

|

Tom S. Q. Yip

Chief Financial Officer

Mr. Yip has over 25 years of experience in all aspects of financial management including strategic planning, mergers and acquisitions, treasury and capital structure, reporting and risk management with both private and publicly traded resource companies.

Most recently, Mr. Yip served as the Chief Financial Officer for Silver Standard Resources Inc., a Canadian mining company with a substantial portfolio of silver properties in the Americas. Since 2007, he was a key member of the leadership team to transition from an exploration and development company to a producer. Prior to that, he served as the Chief Financial Officer for Asarco, LLC, a copper mining, smelting and refining company, from 2006 to 2007. He began his career in the mining industry with Echo Bay Mines Ltd., where he worked for 20 years holding various financial roles of increasing responsibility, including Principal Accounting Officer and then Chief Financial Officer, before the company merged with Kinross Gold Corporation in 2003. Mr. Yip is a Chartered Accountant and holds a Bachelor of Commerce degree in Business Administration from the University of Alberta. |

|

|

|

|

|

Tom Irwin

Vice President, Alaska |

|

|

Mr. Irwin has over 35 years' experience in the natural resource industry constructing, optimizing, operating and permitting major mining projects with companies such as Amax Gold and Kinross. Recent positions include Alaska General Manager for the Livengood Gold Project and the Commissioner of the Alaska Department of Natural Resources for six years.

Prior to his role with the Alaska Department of Natural Resources, Mr. Irwin held senior positions at Kinross Gold's Fort Knox mine located 60 miles southeast of the Livengood project. From 1992 to 1996, he was Vice-President of Fairbanks Gold Mining, Inc., responsible for engineering at Fort Knox during mine design. From 1996 to 1999, he was the Operations Manager responsible for mine start-up and operation at the Fort Knox mine and General Manager of the mine from 1999 to 2001. From 2001 to 2003, he became the Vice President, Business Development for Fairbanks Gold Mining Inc., a subsidiary of Kinross Gold, responsible for new project permitting, business development and governmental and public relations as related to Kinross activities in Alaska. Prior to his work at Fort Knox, Mr. Irwin was General Manager of Amax Gold's Sleeper Mine in Nevada and manager of the Climax mine in Colorado. Mr. Irwin has a degree in Mineral Engineering-Chemistry from the Colorado School of Mines. |

|

This seems to be one seriously undervalued company, though, and they want to make it more possible than ever for people to invest. Over the next year, they hope to de-risk the project thanks to their feasibility study, and move on to permitting.

Investors shopping for another project certainly have much to consider here. Thanks to the team behind this one, the size of the claim, the land position, and the fact that it’s very permittable, this is one interesting company.