Gold Fields (JSE: GFI) Focuses on South Deep Gold Project in South Africa as the country’s first underground mechanized mine

|

By Dr. Allen Alper

on 3/6/2016

Gold Fields (JSE: GFI), a very large producer of gold with sites around the world, is currently focused on bringing the South Deep project located in South Africa to a higher level of production with lower costs. Their profits are increasing with their focus on productivity and as gold prices strengthen .

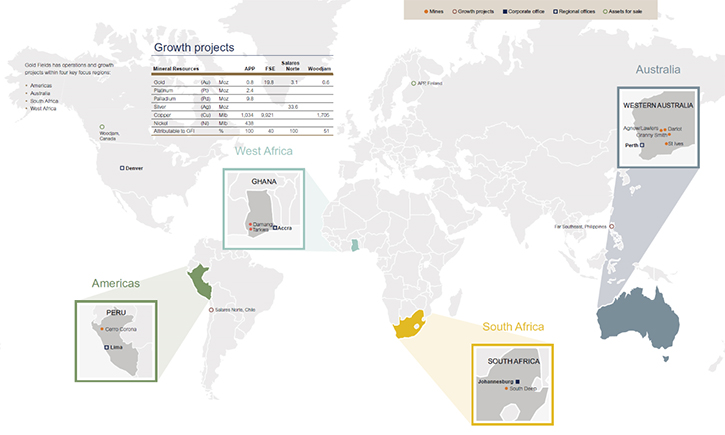

Sven Lunsche, VP of Corporate Affairs, said, “I think we are number eight in terms of global production in the gold producing ranks. Our head office is in Johannesburg, but we have operations in four countries around the world – South Africa, Ghana, Peru and Australia – and a number of development projects in other places around the world. We are listed on the JSE and we have a second listing on the New York Stock Exchange. We are fully compliant with SEC regulations and laws.”

The company has just released new numbers. Lunsche said, “Our fourth quarter results coincide with the full year 2015 results. Our results, as with the rest of the industry, are, to a great extent, determined by the gold price. Last year the gold price started at around $1,300 per ounce and it ended up at roughly $1,050/oz., so the average price we received in 2015 was about $1,140/oz., significantly lower than in previous years. That obviously impacted our results. We had a level of protection from the weaker Rand and the weaker Aussie dollar. Forty-five percent of our production is in Australia so they benefitted from a higher Aussie dollar gold price. And 10% of production is in Rand terms, with a strong rand gold price helping our South Deep mine here.”

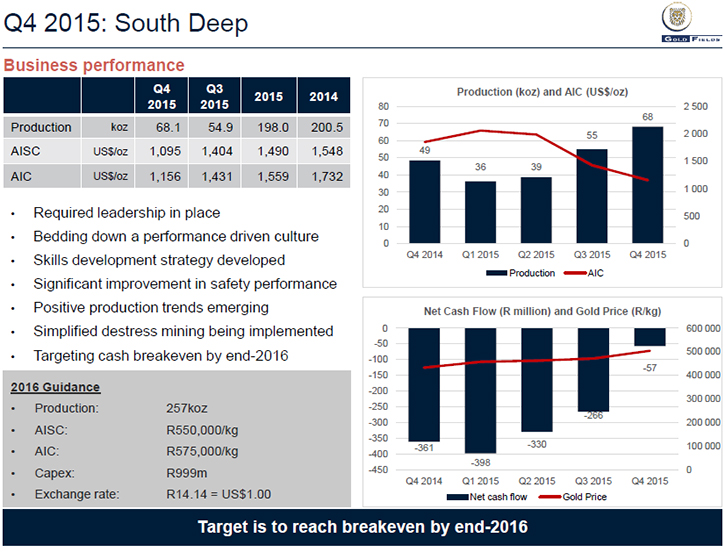

Currently, the company is spending a lot of resources and management time on their flagship project in South Africa, South Deep. Said Lunsche, “In South Africa we have one project, the South Deep project, which is still in ramp up, but is also producing. The production is paid in Rand so they received a higher Rand gold price.

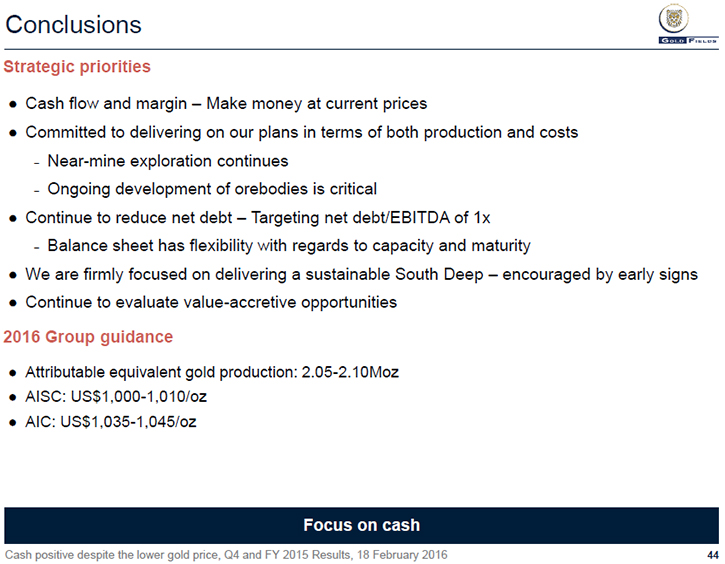

“For the Group as a whole, our production was about 2.16 million ounces last year, roughly three percent below the 2014 numbers. Our all-in costs were $1,026. US dollars per ounce, compared to $1,087. the previous year. Our normalized headline earnings were $45 million US dollars from $85 million the previous year, but we reported a headline loss of $0.28 per share from the profit of $0.27 previously. This is because we impaired several of our development projects, which altogether was $300 million dollars US impairment.”

Gold Fields had specific reasons for impairing some of their projects. Said Lunsche, “We impaired a number of projects. First of all, we have a project in the Philippines called Far South East. We control that project in coordination with a Filipino company called Lepanto. Lepanto holds 60% but we have a right to buy another 20% when the conditions are right. The project has been cut in our books by $100 million which reflects the holding price based on the ruling Lepanto share price. We have a platinum project in Finland that we have put up for sale and have impaired in our books by $49 million. Those were the two main impairments.”

The gold price does effect the company and their end numbers. Lunsche said, “Obviously, we have seen an uptick in the gold price of late which reflects some of the global economic and political uncertainty. We are still using a planning price of $1,100 for the year though. In our 2016 guidance we are predicting a slight decrease in our production for this year, but the costs will stay the same. Total All-in costs will be about $1,035. per ounce. The picture varies from operation to operation. Our Australian projects are doing well, but we are spending a lot of exploration. Our Tarkwa mine in Ghana is the largest in the group and we expect that it will maintain the production and cost level this year. We do have two small operators in our portfolio – Damang in Ghana and Darlot in Australia – which we are currently reviewing in terms of their long-term growth prospects. We expect to make decisions on these mines this year.”

With the changes in the gold price, the company is looking to increase the production at South Deep. Said Lunsche, “The South Deep mine in South Africa is the first large scale, underground, mechanized gold mine in South Africa. We are having some issues ramping it up, but with the addition of a new management team we are seeing improvements. The mine has the second largest gold ore body in the world, and has a 70 year mine life. We want to bring it up to full production in the next few years and we are on target to do that. Being in ramp up, the costs are a bit high. We were at $1,156. per ounce I the fourth quarter. That is a significant improvement on the first quarter of 2015 as higher production gives you decreased costs per ounce.

“We have invested a lot of money in that mine. We took over the mine in 2007 and have invested about 30 billion Rand (US$2.5 billion) to date. We are looking at the mining methodology to improve production there. At the levels we are at now we are looking to achieve cash breakeven by the end of this year. We are telling the market that we will give them production and cost guidance in 2017. We are working out those numbers now.”

Financially, the company is working on decreasing its debt. Lunsche said, “Our net debt is 1.38 billion US dollars. We are comfortable with that position, but we have a target to bring it down to 1 billion. That target is a bit ambitious, but we think we can bring it down to 1:1 over the next two years or so. We have debt in US dollars and Rand terms. We have unused debt facilities should we need them, but our goal is to bring down the debt further.”

Lunsche believes that the company is in a good position to maintain profitability in current market conditions. He said, “We certainly believe that gold has strong long term value, in terms of consumer demand from the East (India and China) and the fact that supply shortages are starting to emerge. We have a strong track record in terms of operating our international operations efficiently and are among lowest cost producers in the industry.”

https://www.goldfields.com/

|

|