African Gold Group (TSX: AGG) Advances Mali-Based Kobada Gold Project with Completed Economic Assessment

|

By Dr. Allen Alper

on 2/17/2016

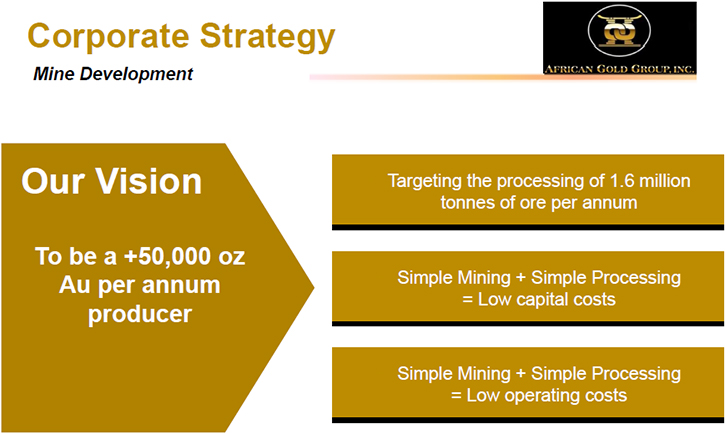

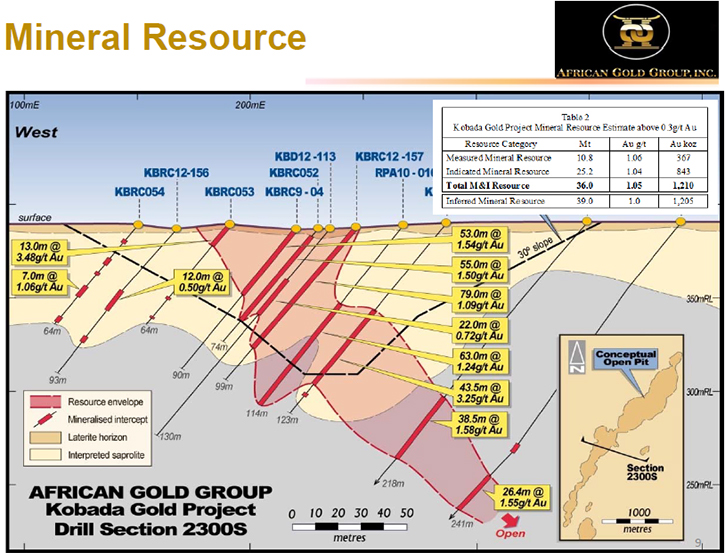

African Gold Group (TSX: AGG) is currently advancing the Kobada gold project located in Mali, with a completed economic assessment and plans to pursue equity and debt financing. Data indicates that the Kobada Gold project will have a low CAPEX and OPEX with a 511,000 ounce gold reserve.

Declan Franzmann, President and CEO of African Gold Group (TSX: AGG) is currently leading his company to advance the Kobada Gold Project in Mali as their flagship project.

Franzmann has a long history in mining. He said, “I’m a mining engineer. I have been in mining for the last 24 years. I have done a mixed bag of things; from working as a miner underground, to running an entire operation, to a managing director role. Most of my experience is in gold.”

With his experience, African Gold Group has been focused on their Kobada Gold Project in Mali. Franzmann said, “We have been doing quite a bit of work this last few years in quite difficult market conditions. We pushed the project through a preliminary economic assessment back in 2014 and now we have followed through with a feasibility study on the project, which really confirms the findings of the PEA. The feasibility study is mostly focused on our funding initiatives for the project. So in the last two years, we have managed to pull the mining license together, and have managed to get all of the environmental permits for the project. We have put together a 511,000 ounce reserve on the deposit as well. Really the focus now is to move forward with our funding initiatives and to get into a development stage.”

One of the highlights of the Kobada project is that it offers a comparatively low cost option for production. Said Franzmann, “The project lends itself to a low cost environment because it is a very simple project. What we are focused on is an oxide ore body, which lends itself to a non-traditional way of treating the ore. When I say non-traditional, most gold mines will go with grinding everything into bug dust right up front. There are a lot of costs, both in operating and project costs in actually doing that.”

The Kobada project is different from that. Franzmann said, “Because it is an oxide ore body it contains a lot of clay. So most of the gold in the saprolite ore body is bigger than 100 microns where most of the material that makes up the saprolite is finer than 100 microns. Kobada is clays and silty clays. Just by washing it and getting it into solution, we can separate the material and reject up to 70 percent with a loss of gold of only about four percent. So, we have a huge, mass rejection early on in the process which then focuses you down into the energy intensive part of the process with a much smaller material mass. That’s why our costs, from an operating point of view, are quite low and we are talking in the vicinity of $557 dollars US an ounce for cash costs.”

This processing concept also reduces the capital costs. Franzmann said, “It also lends itself quite well to keeping your capital costs to a modest level. In a traditional CIP or CIL plant there is a really significant amount of your capital tied up in the milling side of it. Typically you are talking about a mill with more than a megawatt of capacity and stored power. The plant we are talking about is a 100 kilowatt mill. The mill is very much smaller and therefore the capital cost of the plant is significantly lower than a traditional CIP plant.”

The company has capex already calculated for the project. Franzmann said, “Total capex for the project is around $45 million dollars. In that $45 million you basically have the entire processing plant. We are looking at building a modular plant. In fact, the plant will be pre-constructed in Australia and completely wet-commissioned in their factory and then sent to Africa where it is reassembled and recommissioned. The fact that you have a plant that is already assembled really brings your costs down.” This process is especially helpful in that the deposit isn’t in a well-developed area. Said Franzmann, “We are in a remote part of Mali near the Guinea border. There’s about $2 million dollars to spend on the access infrastructure. ”

Franzmann believes that their project is coming online at a time when the market is beginning to reassert itself. He said, “It has been a really tough couple of years for the mining industry. We are going to see a firming of gold. You see the sentiment coming back to the market. Our strategy is to continue in the market. With the feasibility study completed, we are going to go back to the banks and other financial institutions. They have been waiting for us to get the study done. The aim is to put together a debt and equity package over the next six months to get the project done.”

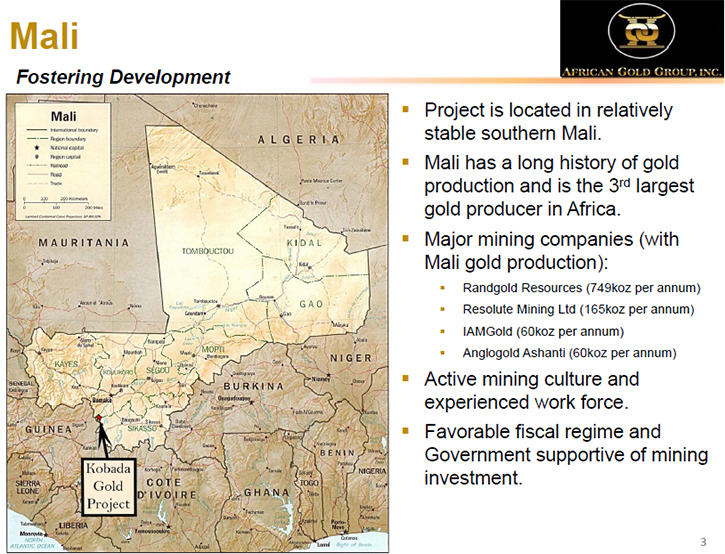

Franzmann and his team are confident in their ability to work in Mali. He said, “Mali has been interesting the last six months. Most of the people who have been involved with the project understand West Africa. Being in Mali from a financier’s standpoint probably reduces the gene pool of those who want to be involved. There is a smaller group of companies who want to make investments in Mali. Those are the ones we have focused on during the last two to four years. They know who we are and what we plan to do. They have been following along as we bring this up to the feasibility process.”

To further prioritize their Mali project, the company has recently sold other interests elsewhere. Franzmann said, “We have been going through a sale process with our Ghana projects. We just sold all of our interests in Ghana, so our sole focus is now on Mali. That will give us the focus to sort out our finance strategy.”

http://www.africangoldgroup.com/

Yonge &

Richmond Center

151 Yonge

Street, 11th Floor

Toronto,

Canada M5C 2W7

Phone:

647-775-8538 647-775-8538 647-775-8538

Fax: 647-775-8301

|

|