Discussion with Mark Selby, President and CEO of Royal Nickel Corporation (TSX: RNX): a Low-Cost Nickel-Copper-Gold Producer

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC

on 6/11/2016

Mark Selby, President and CEO of Royal Nickel Corporation (TSX: RNX) focuses on free cash flow and generating good return for

capital on the shareholders. They are planning on ramping up the Beta Hunt nickel gold property by the end of 2016. RNC has a pretty

deep pool of technical resources willing to take on technical challenges, and anything that they do will be in relatively stable

jurisdictions. RNC has run up recently but still has room as metal prices rebound.

Dr. Allen Alper: This is Dr. Allen Alper, Editor in Chief of Metals News interviewing Mark Selby, President and CEO of Royal

Nickel Corporation.

I can see a lot of exciting things are going on at Royal Nickel. You completed your acquisition of VMS Ventures and increased

your stake in the Beta Hunt Mine to 100%. I find your company to be very interesting in that it's both base metal and precious metal.

It's diversified; it's not just pure nickel. You have a nickel gold property and now you have a nickel copper property. Could you tell

me a bit on your strategy, your focus, and what your plans are?

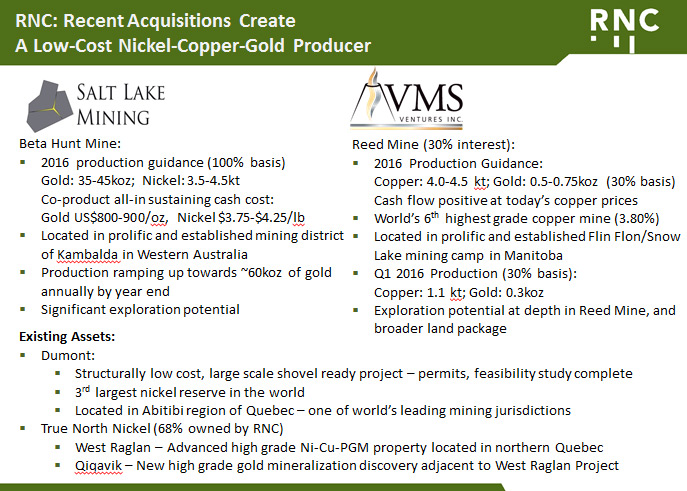

Mr. Mark Selby: Yeah, RNC was founded with a focus on becoming a multi-asset mining company. I think the key thing for us is

not necessarily commodity or geography, but being focused on free cash flow. So, in both acquisitions that we made, the acquisition of

Salt Lake Mining, which owns the Beta Hunt Gold- Nickel Mine and then the acquisition of VMS Ventures, which has the Reed Copper-Gold

Mine, we saw outstanding opportunities to deploy shareholder capital.

In the case of Salt Lake Mining, with its Beta Hunt Mine, we acquired a two-thirds interest in it for C$2.5 million in cash and C$5

million in paper, RNC paper. At the time we announced the deal for an asset that should generate, based on a technical report we did,

over $20 million dollars in cash flow annually.

We exercised our option to acquire the remaining third of the asset, so at the end of May, we increased our stake to 100

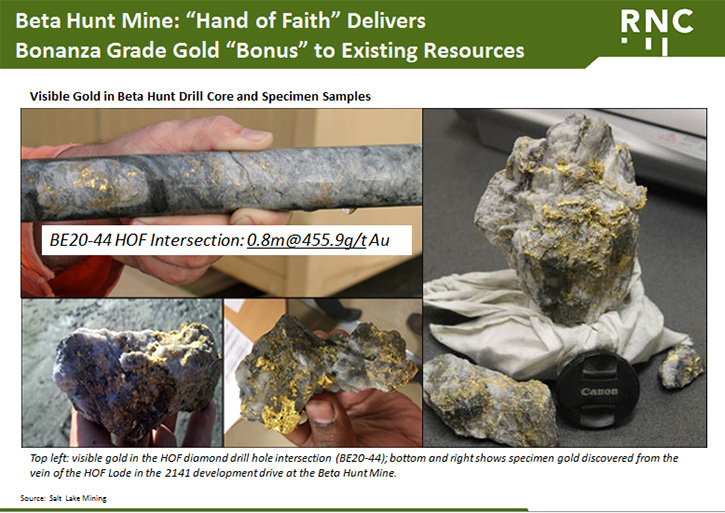

percent of that particular asset. We think there's a massive amount of exploration potential there. It's been a nickel producer on and

off for fifty years. It was one of the few nickel mines that was still mining nickel profitably in the Kambalda area. The potential is

the gold that's there. We have 5 kilometers worth of a very large ramp sitting 20 meters above very prolific gold ground. We have

400,000 ounces in resource. We have another half million ounces targeted that will get us to approximately one million ounces. We feel

pretty confident that we'll be able to get there. Because the other big thing, when we acquired that asset, was 650,000 meters of

historical drilling targeted to the nickel. The nice thing is, as they were targeting the nickel, they drove another 10 to 30 meters

into the host rock of the gold. So there are literally thousands of gold intersections to follow up on.

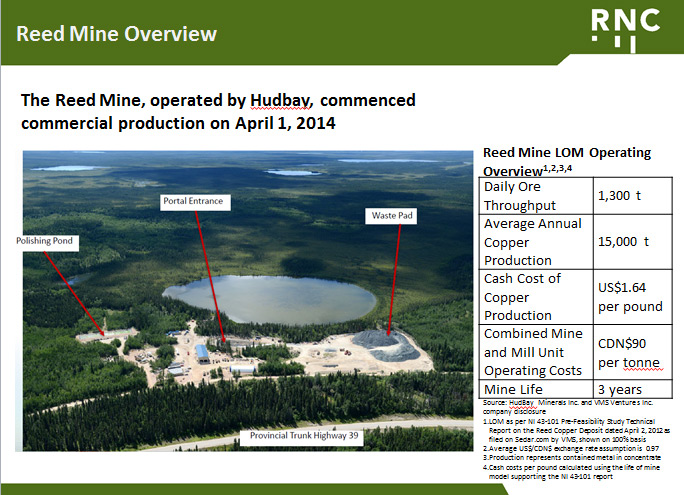

We think that's a very exciting asset. The VMS Ventures acquisition was to get exposure to the Reed Mine, which is a producing copper-

gold mine in the Flin Flon Snow Lake camp. We now have production exposure to ten million pounds of copper a year and 600 ounces of

gold. Again, one of the few copper assets that could generate meaningful cash flow even with prices down below two dollars, which is

where prices were when we announced the transaction.

Dr. Allen Alper: I'm very impressed with the amazing job you're doing in acquiring key assets that are multiple minerals or

metals; and that you've done it in a time when the markets were suppressed. Now it seems like the market is firming up. Seems like your

timing is fantastic.

Mr. Mark Selby: You're never sure exactly what you're timing is going to be, so it's good to be lucky. At the end of the day

the thing that always amazes me about the mining industry is time and time again we seem to forget that it's a cyclical business.

Companies go off and do a bunch of crazy deals at the top of the market. The bottom of the market, when it is the time we should be

pulling assets, people sort of put their head in the sand. So my view has always been you can never time the bottom exactly but if you

can buy stuff closer to the bottom and return capital to shareholders closer to the top of the market then you should come out a winner

eventually.

Dr. Allen Alper: That sounds great. Sounds like, with your background and your board and your management team, you fellows

understand the market very well. That's excellent.

Mr. Mark Selby: Thank you.

Dr. Allen Alper: Sounds like your philosophy is to look for assets that can produce cash flow and give profits to your

shareholders. Is that correct? Could you elaborate on that?

Mr. Mark Selby: Yeah. I think one thing mining companies fail to do is return adequate amounts of capital back to shareholders.

When these mines ramp up and we're in a place with respect to financing and performance of the assets where it makes sense, we'll

return capital to shareholders in a way that makes sense for the company and the shareholders. We were able to recognize producing

assets that were highly, highly undervalued. We'll also look at near-term production opportunities where, for the right amount of

capital, we can generate a significant amount of cash flow. We still see some opportunities. The producers have moved a little bit now,

since January. Some of the companies, with late development stage assets, really haven't moved yet. We've seen several opportunities in

that space.

Dr. Allen Alper: Could you elaborate on what your plans are for 2016 and going into 2017?

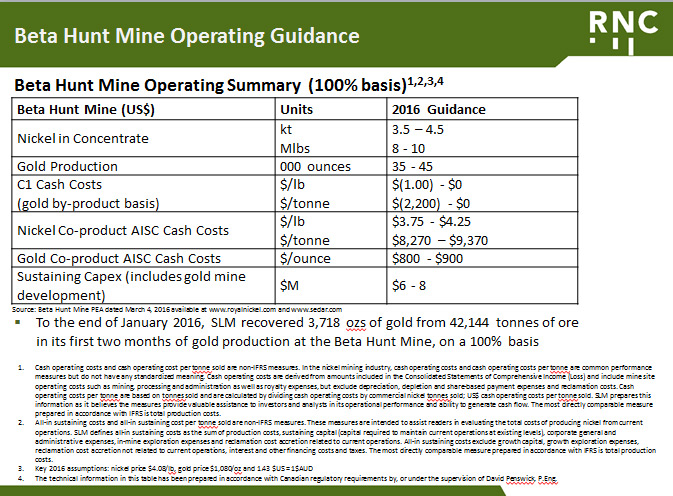

Mr. Mark Selby: Sure. The key focus is ramping up that gold production at the Beta Hunt mine. We started gold production this

year at around 20,000 ounces annual run rate. We have two stopes on line. We hope to bring a third stope on line shortly. That will

give us a capacity to ramp up to a nearly 60,000 ounce annual run rate by the end of the year. That's obviously the key success factor

for us in terms of generating free cash flow. We have another half dozen or so opportunities in the pipeline that we're reviewing today

of various sizes and various stages. I hope to be able to pick up another couple assets in a way that people are equally excited about

as they've been about Beta Hunt and about Reed.

Dr. Allen Alper: That's great! That sounds like an excellent plan. I see you focus on stable areas. Could you tell me a bit

about that?

Mr. Mark Selby: Yeah. We're comfortable with the wide range of technical and operating risks, given our experience at Inco and

Quadra and other companies. We feel we have pretty good access to a pretty deep pool of technical resources. We're willing to take a

little bit of risk in that area. But we avoid areas with high political risk. Anything we do will be in relatively stable

jurisdictions. At the end of the day, the issue with political risk is that you've always got a chance of a zero if the government

changes the rules on you or ends up forcing you to sell all or part of an asset to one of their local friends. That's something we will

definitely stay away from as we continue to build the company.

Dr. Allen Alper: That sounds like a very sound philosophy and approach. Could you tell me what differentiates your company from

other companies?

Mr. Mark Selby: We focus on free cash flow and returning capital. That's something that's very, very important to us. We

could have easily acquired assets earlier, but we just thought it would be too dilutive to our current shareholders to do so. Again, we

didn't want to become a producer just to become a producer. I think, in a year or so people will see these assets as very smart

transactions. We have a great development asset in Dumont, which is the 5th largest nickel sulphide deposit ever discovered. Our focus

is to generate the highest return for our shareholders from that asset. We'll bring it to market for financing when the nickel market

comes back. We expect that to happen over the next 12 to 24 months. But, we'll only use our shareholder's capital to get it into

production, if it generates a high enough return for our shareholders. I'm not going to take a lot of dilution on to get it done. I

don't need to tick a box to say I've got a large project financed or a large project into production. It's about focusing on free cash

flow and generating a return on capital for shareholders.

Dr. Allen Alper: That sounds very sound. Could you tell me a little bit about your background and your team's background?

Mr. Mark Selby: Yeah. Our board is anchored by the ex-Inco Senior Management Team. We have Scott Hand, Peter Jones, and Peter

Goudie who are the former CEO, COO and EVP Marketing for Inco, respectively. We also have Don McInnes, who along with his partner Mark

O'Dea have been involved in a number of successful companies like Frontier Gold and True Gold. So it was a great addition when we

acquired True North Nickel to have Donald become part of the board. In terms of the management team, generally we're all ex-Inco, and

ex-Falconbridge in one way, shape, or form. I think one thing that differentiates us from a lot of junior mining teams is that we have

experience in not just exploration or in mining but also in mineral processing, in smelting and refining, and all the way through to

marketing. That gives us a broader view in terms of the range of potential opportunities that are out there.

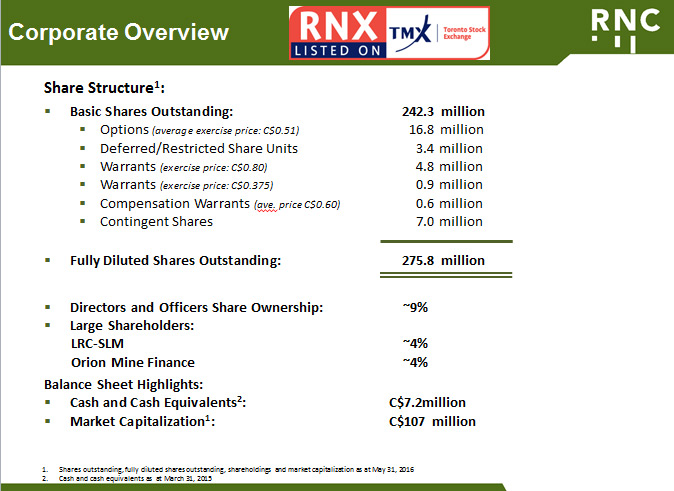

Dr. Allen Alper: That sounds great. Could you tell me a bit about your capital structure?

Mr. Mark Selby: We have 243 million shares outstanding. The board and officers own about 9 percent of the overall total. Then

in terms of cash, we have over 10 million dollars in cash on the balance sheet.

Dr. Allen Alper: That's very good. It's a very tough time for the mining industry and it sounds like your company is doing very

well in a very difficult time. It looks like things are firming up and improving. What are your thoughts on the market conditions?

Mr. Mark Selby: I think the mood has definitely changed from the fourth quarter of last year. I think you can see a lot of the

metal prices are back off the bottom and some of them are now breaking through their 200 day moving averages. I think you're seeing the

beginning of industrial recovery in China to some extent as well. Again, I don't think prices are going to come roaring back anytime

soon like we saw in 2009. I think we'll just have a typical economic cycle recovery and should see prices continue to move at least

another ten to twenty percent from here.

Dr. Allen Alper: That's very good. Could you tell me the primary reasons our readers/investors should invest in your company?

Mr. Mark Selby: I think number one is our focus on free cash flow and generating good return for capital for our shareholders.

I think the acquisitions we've done will emphasize that to them. I think number two, the gold-nickel property that we've picked up at

Beta Hunt, if we're able to successfully ramp up by the end of the year, which we're expecting. If you look at the comps for 60,000

ounce gold producers with 7 to 800 $U.S. all in sustaining cash costs. You can see the value of those assets in the range of 200 to 300

million dollars, which is almost a dollar per share just for that one mine alone and never mind the value of Dumont, Reed and our

exploration properties. Our share prices had a good run so far, but I think there's a substantial amount of upside from here. I hope

your readers get involved in our story and we'll have a long and profitable relationship together.

Dr. Allen Alper: Well it sounds like you have a very promising company. It sounds like it's very well managed and you have

excellent properties and excellent places. I think our readers should like your attitude toward shareholders, I know I do. Is there

anything else you'd like to add?

Mr. Mark Selby: No, I think we covered everything. Thank you for taking the time to hear more about our story.

http://www.royalnickel.com/

Royal Nickel Corporation

220 Bay Street, Suite 1200

Toronto, ON

Canada M5J 2W4

|

|