Dr. Alper Interviews Craig Lindsay, President of Otis Gold Corp. (TSX-V:OOO, OTC:OLGDF) about 100% owned Flagship Kilgore Gold Project in Idaho

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC

on 5/19/2016

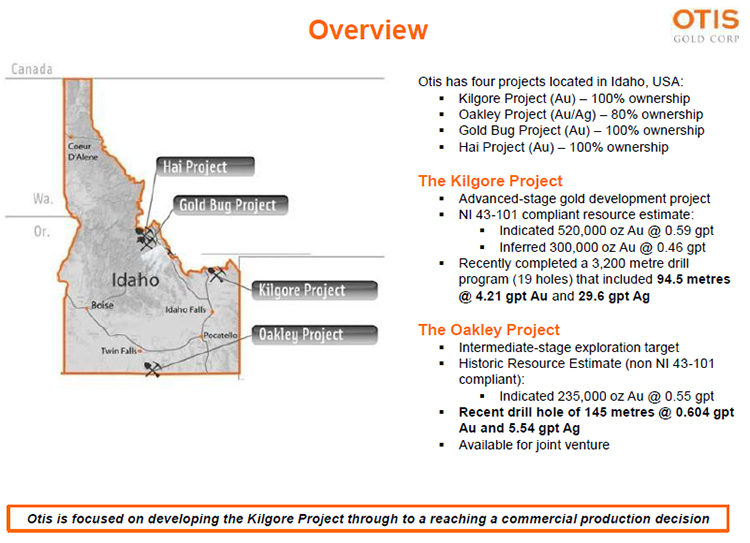

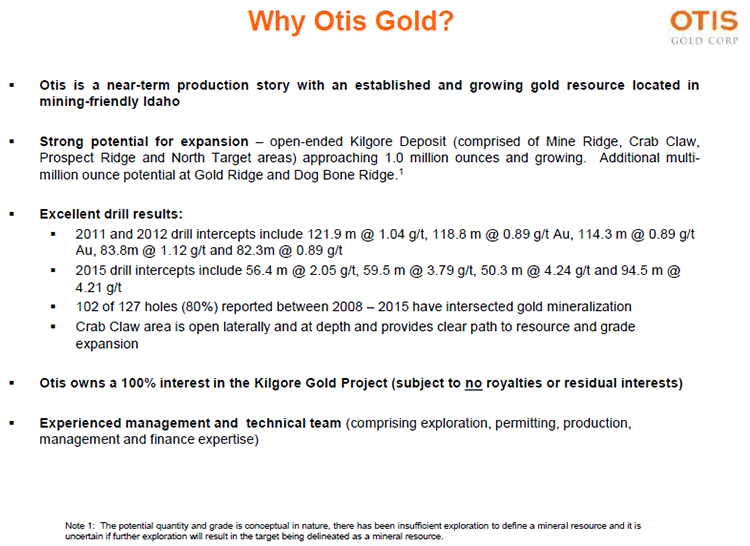

Otis Gold Corp. (TSX.V: OOO, OTC: OGLDF) is a Canadian-based mineral exploration company with a portfolio of quality precious metal deposits in the

Western USA. Otis is currently developing its flagship property, the 100% own Kilgore Gold Project, located in Clark County, Idaho. Craig Lindsay,

President of Otis Gold, is excited about some really strong results from their 2015 fall drilling program at the Kilgore deposit that gives the company

a strong potential to expand both the size and grade of the existing gold resource at Kilgore.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Craig Lindsay of Otis Gold Corp. I hear some exciting news

about you buying gold properties in Idaho. Could you tell me more about that?

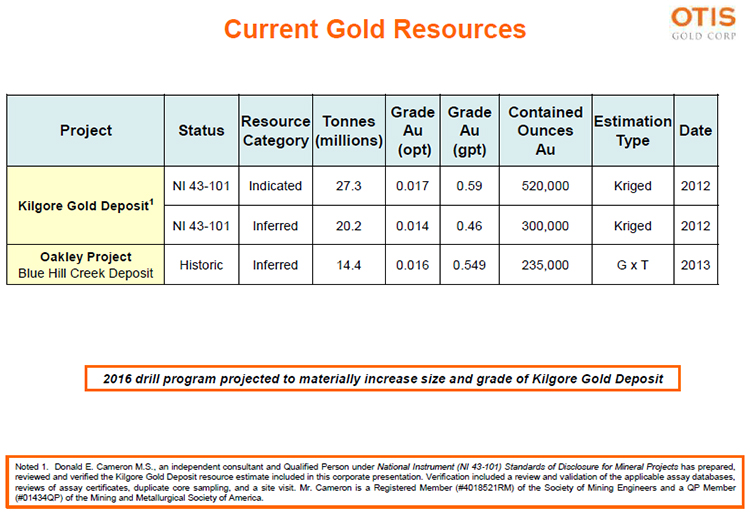

Mr. Craig Lindsay: Sure. The focus of the company is developing gold projects in the State of Idaho. We have 4 projects in Idaho, 2 of

which host existing gold resources. The most advanced being the Kilgore Project which hosts a 520,000-ounce resource indicated at 0.59 grams per ton and

an inferred gold resource of 300,000 ounces at 0.46 grams per ton. What's exciting, Al, is that in the fall of 2015, we completed a 3,200-meter, 19-hole

drill program that stepped out from the north end of the existing Kilgore resource and started to intersect some really strong drill results that are

both thicker than the average size of the existing deposit and also have significantly higher grades than the existing deposit.

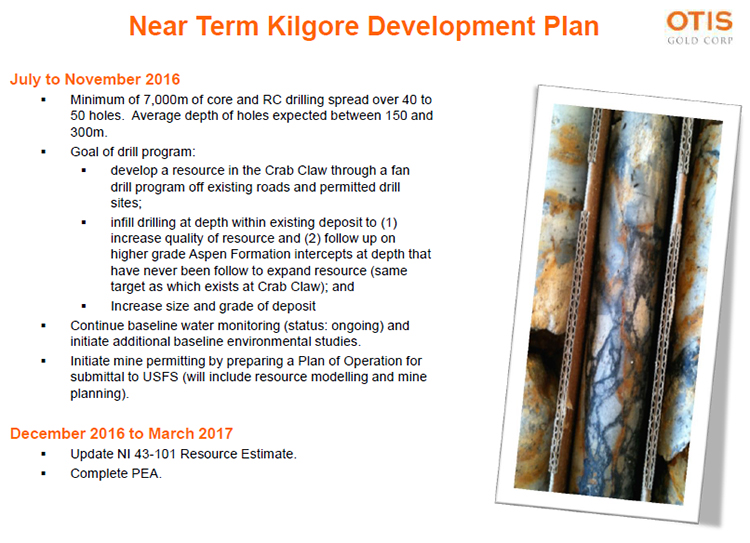

We think we're moving into a situation where we have a very strong potential to both expand the size of the existing gold resource at Kilgore,

as well as increase the overall grade of the resource. Specifically, some of the most exciting drill holes would be drill hole OKR-309 which intercepted

94.5 meters, grading 4.21 grams per ton, and that drill hole was open-ended. We also had 50.3 meters of 4.24 grams per ton, we had 59.5 meters of 3.79

grams per ton, 56.4 meters of 2.05 grams per ton. These were, again, open-ended intercepts. These holes ended in mineralization, so not only are we

having the potential to expand the deposit with step-outs, there's also potential to expand the resource at depth.

The other thing to point out is that the main host of this mineralization that we've intercepted in 2015 has been a sedimentary unit underlying the main

host of the existing deposit. Most of this ore is hosted in a sandstone and siltstone unit called the Aspen Formation. What's interesting is that there

are quite a few additional hits in the sandstone unit underneath the existing Kilgore deposit that were never drilled out or followed up on

historically. So not only do we see the potential to grow the size of the deposit into the north end, but we're also going to go back and follow up on

some of the open-ended Aspen Formation mineralization underneath the existing deposit. We're going to be doing that this year with this planned 7,000

metre drill program totaling up to about 35 holes that we hope to get started in July of 2016.

Dr. Allen Alper: Well, that is excellent. It sounds like you have an exciting program planned for this year.

Mr. Craig Lindsay: Yeah, it really is! One of the challenges that we have always faced with Kilgore has been the lower grade nature of the

deposit. The fact that we are able to see some real potential to increase the grade of the deposit is excellent. The size potential is also exciting.

Our land package is about 4,300 acres, and we own 100% interest in it. Importantly, there are no royalties on the project. In addition to the size

potential that we see out there, one of the critical elements of the Kilgore deposit is that we have really extremely strong metallurgy. In the main

host rock, we get about 85% gold recoveries in Lithic Tuff, and we see no crush size sensitivity in column leach work. We've done crush sizes of 0.5”

and 1.5” and you get the same recoveries at 1.5” that you get at 0.5”. That's really a critical piece of the whole Kilgore story and has always offset

the lower grade nature of the deposit. But now that we've seen a real path to increase the grade of the deposit later on and the already really strong

metallurgy and the projected strip ratio of about 1.5 to 1, it's creating a situation at the existing Kilgore deposit that is really quite compelling.

When you take a step back, and I think you and I have probably talked about the Kilgore deposit in the past, this is a volcanic hosted

epithermal gold system on the northeast margin of something called the Kilgore Caldera. It produced historically as an underground mine in the 1930s,

and then in the late '80s and early '90s. A number of majors came along, including Bear Creek, Placer Dome, Pegasus Gold, and Echo Bay Mines. They

started to drill out a near-surface, open-pit heap leach target that exists out there today.

In the mid-'90s, Kilgore was actually going to be Echo Bay's next production story. In 1995, they had identified a starter pit with a size of

about half the resource that we've got out there right now at a grade of a little over a gram per ton. It was actually going to be their next production

story in a $350 gold environment, then the price of gold dropped well beneath $300 and Echo Bay was forced to step away from their development projects.

Fast forward to 2008 when I picked up the project. It gave us the opportunity to go and pick this project up that had quite a bit of historic drilling

on it from the 4 companies that I just mentioned. There's been about 46,000 meters of historic drilling on the project. Otis itself, since 2008, has put

down 24,000 meters of that 46,000, but we stepped onto a project where there was already an established resource.

We've just been stepping out on it and slowly expanding this resource. In terms of blue sky, there're a number of other targets out at Kilgore

that we think have the potential to be lookalikes of the existing deposit. They have the exact same geologic signatures that we see at the Kilgore

deposit itself. These are targets that are right along the main controlling structure which is called the Northwest Fault. There's cross-faulting

associated with these targets, the same kind of thing that you have at the existing deposit. There's the same stratigraphy that we have at the existing

deposit. There's an IP resistivity low on top of these targets, which is the same feature that you have at the existing deposit.

Also, and it's well-documented in our NI 43-101 Technical Report, there are arsenic anomalies at these other target areas out at the Kilgore

Project that are exactly the same as arsenic anomalies that stick out like a sore thumb on the downhill side of the existing 820,000-ounce resource at

Kilgore. Lots of room exists to find additional deposits out there, in addition to the existing deposit. It's getting exciting! The price of gold has

started to turn around a little bit. There's a bit more life in the market. These results that we put out in January have generated a lot of interest,

so my life has become much more interesting than it was a year ago. We've been very, very fortunate.

Dr. Allen Alper: It's good to see things firming up and looking better for your life and the life of many other miners, who've been hanging in

there. It sounds like you have an excellent property there and you have excellent prospects, so you must be feeling quite good right now.

Mr. Craig Lindsay: Yeah, it's been a tough slog for all the guys like me out there. The companies that have managed to make it through this

downturn in the market, we really had to tighten our belts, but the ones that have made it through are the ones that have good assets. We've been

blessed in that we own 100% of Kilgore and we have very low holding costs. We haven't been mixed up in any expensive earn-ins where we’ve had to try and

renegotiate property deals or decrease our land positions. In fact, during this downturn we’ve actually increased our land position. We also should

point out, Al, that we raised $2.6 million in three private placement financings last year.

Dr. Allen Alper: That's great to be able to do that in a very tough time. It shows that people had confidence in you and your project.

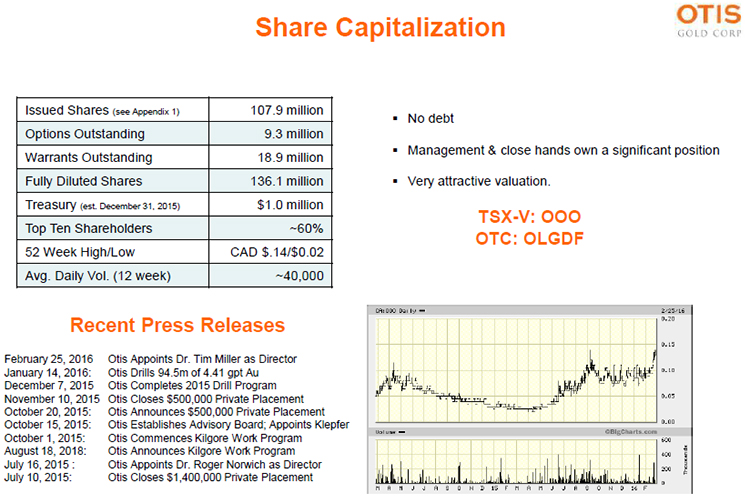

Mr. Craig Lindsay: Yeah, that's exactly right. All 3 of those financings were done at above market prices, and 80% of that $2.6 million was

raised without any dilutive warrants. We haven't blown up our share structure like a lot of companies have in funding themselves through this downturn.

We now have 10 shareholders approximately, who own about 60% of the company, and this core group is made up of long term investors, or what I would call

“sticky money”.

Dr. Allen Alper: That's excellent. Could you tell me about yourself and your team?

Mr. Craig Lindsay: My background is in corporate finance and investment banking. I've been involved in a number of different mining deals

where I've taken projects public, built them up, and sold them. For instance, I used my shell Malaspina Capital to take Miranda Mining Development

Corporation public. I don't know if you recall Miranda Mining Development Corp, but it was the early developer of the Guerrero Gold Belt down in

Mexico. It was a small scale gold producer, but it controlled, among other assets, the Los Filos Project, which is now a big producer for Goldcorp. We

took this asset public through an RTO, and then we sold that company to Wheaton River, which was then purchased by Goldcorp. I was also founder and CEO

of Magnum Uranium Corp which I built up and sold to Energy Fuels, which is the largest producer of uranium in the United States. Then I moved on to

establish Otis Gold Corp.

I'm the guy, who raises the capital, puts the deals together, builds the team and does the public company stuff. But really, the critical guys,

I feel, are my technical team consisting of Dr. John Carden, and Mr. Mitch Bernardi, who are geologists that I worked with for over 12 years. They're

former Echo Bay Mines guys. They were actually the ones that drilled out the Kilgore deposit for Echo Bay Mines in the period from 1993 to 1995. Really

good track records at developing gold deposits and other metals projects in the Western US. John Carden was the discoverer of the Lamefoot deposit,

which was Echo Bay's highest grade, lowest cost producer. He's also discovered the Easy Junior deposit. Both of them are extremely capable guys. We

have a really strong working relationship. They run our Exploration office at Spokane, Washington.

Then I've been fortunate to put a good board together that's being led, right now, by Dr. Roger Norwich. Roger was a founder of Mexican Silver

Mines which went out and acquired a company called Rio Alto Mining. They've built that company up to be a 200,000-ounce-a-year gold producer, which was

sold last year to Tahoe Resources for just over a billion dollars. Roger has a good track record in the mining space. Recently, I also brought Dr. Tim

Miller onto our board. He's had a long career in the area of corporate governance and risk management, which is an emerging issue for junior companies.

All the big companies are very strong with corporate governance. We just decided, because we have plans to grow the company that we wanted to

have some good, strong corporate expertise on our board. We've got that with Tim. He had a long career with several large companies, including Standard

Chartered Bank where he was the chairman of Standard Chartered Bank Korea. We also have a name that you would probably know, Don Ranta. Don was also

formally with Echo Bay Mines. He was also a former chairman and CEO of Rare Element Resources. When he was at Echo Bay, he was Vice President of

Exploration for Echo Bay.

Dr. Allen Alper: Yeah, I've known him for many years. He's a great fellow.

Mr. Craig Lindsay: He really is. He's always had a soft spot for the Kilgore deposit, and has always been keen on the potential there. He's

been on our board from day one and has always been very supportive. We're very fortunate to have Don with us.

Dr. Allen Alper: Well, you have an excellent background and you have a great team and a wonderful board. You're really well set to keep moving

the company forward. That's excellent. It sounds like you have a great property. You have a lot of things going for you.

Mr. Craig Lindsay: Well, thank you. Thank you. I appreciate that.

Dr. Allen Alper: Could you tell me a about your capital structure?

Mr. Craig Lindsay: 108 million shares issued and outstanding and 136.1 million shares fully diluted. We have about a million dollars in the

bank as of December 31st, trading at about 15 cents a share or a $15 million Canadian market cap.

Dr. Allen Alper: It sounds like there's a lot of value for shareholders left.

Mr. Craig Lindsay: Yes, you're getting exposure to a million ounces of gold and a good location in the Western US at a $15 million price

tag right now. It's very compelling, particularly when you look at some of our competitors down to the south in Nevada.

Dr. Allen Alper: Looks like your company has room to increase value.

Mr. Craig Lindsay: We think there is a bit of an Idaho discount out there because there are no operating gold mines in Idaho today. There

is a long history of gold mining in Idaho, but there's no active goldmining today. I think that has always created a bit of what I do refer to as an

Idaho discount, but you may know that Midas Gold, which also operates in Idaho, recently received about a $55-million financing from Paulson and Company

out of New York, which has been good for us because it puts a stamp of approval on Idaho and the permitting regime that we have there by virtue of

making a significant investment to fund all of the permitting work that Midas is going through to permit their gold and metals project, so that's been

positive.

Your readers may also be aware that very large open pit phosphate mines exist in Idaho, and Thompson Creek has a very large open pit molybdenum

mine in Idaho. Further, Idaho is well-known, of course, for the Silver Valley out by Wallace, Idaho. So, Idaho is certainly supportive of mining.

We really want to play a role with companies such as Midas to help get Idaho back to being a gold producer in the United States, so we're excited about

it.

Dr. Allen Alper: Well, that sounds very exciting. Could you tell me several reasons to invest in your company?

Mr. Craig Lindsay: I think probably the most critically is, you have a gold project that's got an established resource with a very clear

path to a larger resource potentially at a higher grade. You have a very attractive valuation relative to some of our peers. We've got very compelling

metallurgy at the project which is absolutely critical when it comes to putting a mine into production. I think we also have one of the strongest

technical teams out there, an extremely strong board of directors that's very active and focused on helping build the company out. Those would be some

of the high points, I think, in terms of why people should be having a look at Otis as an investment opportunity if they're looking for exposure to gold

in the US.

Dr. Allen Alper: I would say your company sounds very, very promising. It's in a great area, a safe area, and it's in a state that is supportive.

It sounds like you have not only a project where you've shown a lot of gold, but you have more potential and you're getting funding to do more drilling,

so it sounds like you're a company worth watching as a potential investment.

Mr. Craig Lindsay: Thank you, Al. I appreciate the interest.

http://www.otisgold.com/

580 - 625 Howe Street

Vancouver, B.C., V6C 2T6

Tel: 604.683.2507

Fax: 604.608.9002

E-mail: info@otisgold.com

Mr. Craig Lindsay, President

E-mail: craig@otisgold.com

|

|