Monument Mining LTD (TSX: MMY) Looks to Variety as a Way to Grow Gold Company and Create Profits

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC

on 5/2/2016

Monument Mining (TSX: MMY) is focused on investing in gold and other mineral properties around the world as a way to develop value for shareholders. It is a success story. Monument specializes in investigating distressed assets, looks at them carefully with “mining eyes” and evaluates their potential. Mr. Baldock said, “I think it is a good time for us to grow. The company is currently adding more properties to their portfolio. “Corporately, we leverage the company by being in different political jurisdictions, different properties and minerals so that we don’t have all of our eggs in one basket. That should insulate us from the shocks and hits that this industry sees in the world. We are cautious. We do a lot of due diligence and investigation with people. We tend to look at things, decide we are going to do it, and then tell people about it. Mistakes cost the shareholders. We try not to do that. We have been successful in our approach.”

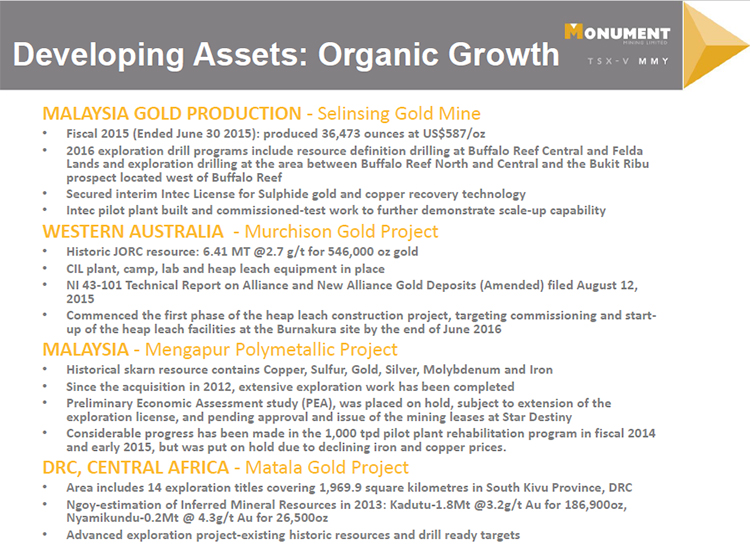

Robert F. Baldock, CA(M), FCPA, FCMC, Chairman, Chief Executive Officer and President of Monument Mining LTD (TSX: MMY) spent time updating investors in the progress of his gold company at the recently held PDAC conference. Mr. Baldock said, “Our Company is Monument Mining Limited. We are a gold producer. We have a producing asset in Malaysia that has been producing gold for about eight years now. We have a good five years of mine life ahead of us still on that project. It was a project that was distressed and we bought it out of liquidation and put it into production and it has produced over three hundred million dollars of cash since.”

Mr. Baldock believes that Monument has struck upon a way to find success. He said, “It is a success story. We specialize in investigating distressed assets. We can look at them carefully with mining eyes and see if we think they can be fixed. If so, for how much and what is the sort of prospect for the turnaround. We have been doing that for the whole time. That is how Monument started. We started by buying assets that were distressed and putting them into production. Our big stock of projects have been distressed projects because generally they are being liquidated and the people have the need to get rid of the project for a reasonable price. That is an advantage of course, if we can put it into production.”

The company is currently adding more properties to their portfolio. Said Baldock, “I think it is a good time for us to grow. We have a gold project with a good life. We have another project that we acquired in Australia called the Murchison project. We are putting that into production as we speak and we are moving forward with it. We hope to be able to produce on that this year. We recently announced a gold project in DIC in Africa and have been working on closing the agreement.”

Having projects in a wide variety of areas is a deliberate move on the part of the company. Said Mr. Baldock, “Corporately, what we are trying to do is leverage the company by being in different jurisdictions, political jurisdictions. We are also in different properties and minerals so that we don’t have all of our eggs in one basket. That should insulate us from the shocks and hits that this industry sees in the world. That is our high level corporate objective for the moment.”

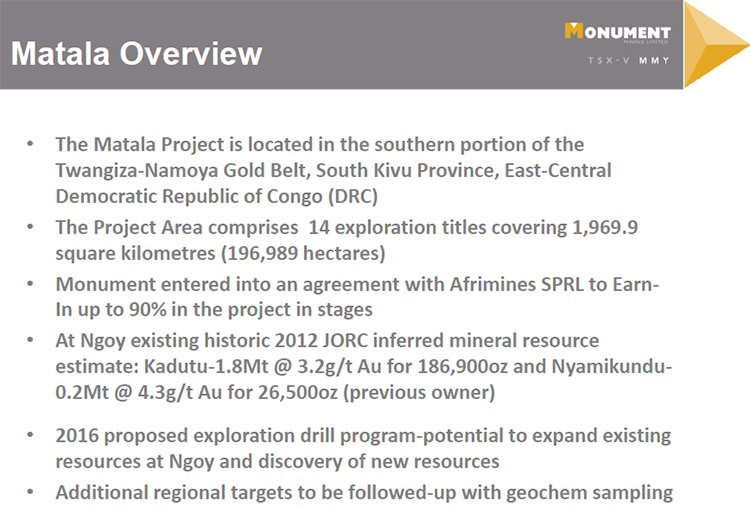

The company is just beginning work in Africa. Mr. Baldock said, “The reason for choosing Africa is because there have been a lot of big resources in the area that we have gone into. The DRC there is one of the most prospective places. Very large resources have been proven up in that zone. Companies have gone from nothing to more than 20 million ounces, nothing to 15 million ounces, and we are seeking to emulate that sort of performance. If successful, we can pay a dividend to our shareholders because the resource base we have is sufficient for us to keep paying that dividend. So it isn’t a flash in the pan. We are operators and we own everything we have. We have no debt with $20 million in the bank and cash flow and that is what you need in order to survive in this market.”

The company hopes to be active in Africa soon. Said Baldock, “We aren’t operating in Africa yet. We have entered into one agreement and will intelligently move ahead with that. We are going to move into production with other projects. We spent about a year and a half researching the DRC and there are some good working people there. There is a will to work and some good skillsets there. We have been on the ground looking at that. We think we can work with the politics there. The politics are risky everywhere.”

Mr. Baldock credits his team with being able to advance the company and their projects. He said, “I have been in this business for my whole life. I have a team of people behind me. I can’t do all of this myself. I have a team of operating people. We have a CFO who is pretty frugal and we own all of our assets 100% with no debt. That is what you need to survive. We think we are doing okay compared to the industry.”

What makes Monument Mining different from so many other companies on the market? Mr. Baldock said, “I think maybe we are cautious. We do a lot of due diligence and investigation with people before we launch into any new projects. That isn’t common in the industry. We aren’t into arm waving. We tend to look at things, decide we are going to do it, and then tell people about it. You can get it wrong and then you have egg on your face and it costs the shareholders. We try not to do that. We have been successful in our approach.”

The company believes, like many other junior mining and exploration companies, they have assets that haven’t been recognized by the overall market. Mr. Baldock said, “We have 324 million shares out with a share price of $0.15 at the moment. Like most companies, we think we are undervalued. We have a market cap of $35 million. We have nearly that in cash. That says to the average analysts that we are undervalued. When we go out to grow the business, it is hard. But the whole industry is seeing that. We can’t change the gold price. We don’t have any debt and we do have cash. I think our gold assets are the right type of assets for the mineral space at the moment.”

http://www.monumentmining.com/

Monument Mining Limited (Head Office)

Suite 1580 - 1100 Melville Street

Vancouver, BC, V6E 4A6 Canada

Investor Relations

Richard Cushing

Tel: +1 604 638 1661 (ext. 102)

Fax: +1 604 638 1663

Email: rcushing@monumentmining.com

Website: www.monumentmining.com

|

|