Aeris Resources Limited (TSX: AIS) completes Debt Restructures and Sales of Non-Core Assets to Focus on Copper Production in Australia

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC

on 4/15/2016

Aeris Resources Limited (TSX: AIS) is an established Australian mining and exploration company that recently completed a three year corporate turnaround which included restructuring its debt, closing or selling non-core assets and changing their name (previously Straits Resources Limited). Their flagship asset is the Tritton Copper operations in New South Wales. It includes multiple mines and a processing plant and is aiming to produce at least 29.5 thousand tons of copper this year. Robert Brainsbury, CFO of Aeris Resources Limited (TSX: AIS) believes that the longer term fundamentals for copper remain attractive and with the turnaround completed, Aeris is now looking for opportunities to expand its business, through development of new mines at its current operation and through M&A, to position itself to take advantage of improvements in the copper price.

Robert Brainsbury, CFO of Aeris Resources Limited (Aeris), took a moment to update readers on the restructuring of his company over the last three years and how it has improved their market position, production and opportunities for the future.

Mr. Brainsbury said, “Aeris Resources Limited was a roll through from a previous company called Straits Resources Limited (Straits). About three years ago the current management team joined Straits and embarked on a turnaround of the company, which included closing a gold mine in Indonesia, selling non-core assets and restructuring the company’s considerable debt. This culminated in December 2015 when shareholders voted to approved the debt restructure (from around US$110 million to a US$50 million Senior Debt payable in 7 years). At the same time we took the opportunity to undertake a 1 for 10 share consolidation and to rename the company Aeris Resources Limited.

The name change was deliberate as the company needed to refocus and move forward after the difficulties of the last few years. Mr. Brainsbury said “We are now focused on growing the company, both organically and through M&A. There are a lot of interesting mines coming on the market, as majors are getting rid of non-core assets. We think this will present some interesting opportunities. Our aim is to become a mid-sized, multi-mine company, delivering shareholder value through an unwavering focus on operational excellence.”

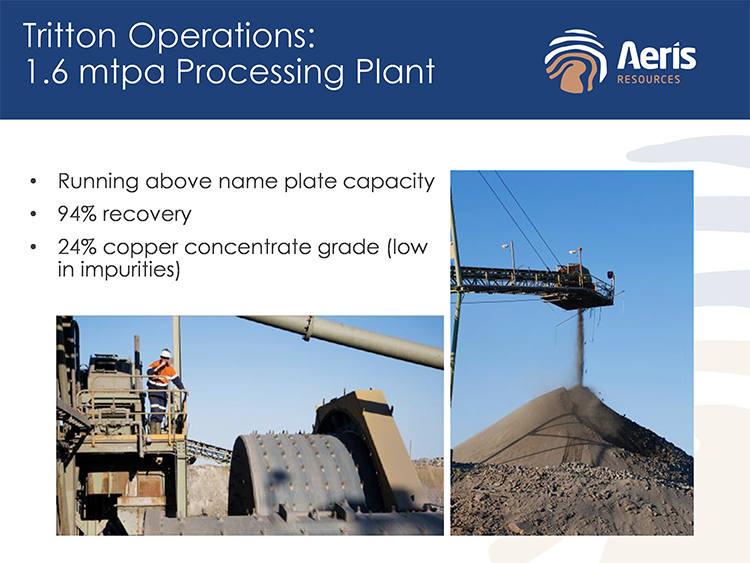

Mr. Brainsbury said “Our core asset is the Tritton Copper operation (Tritton) in central New South Wales in Australia. This year we are targeting to produce at least 29.5 thousand tons of copper contained in concentrate. We mine from two underground mines (Tritton and North East/Larsens) and transport the ore to a central processing plant. We have recently announced the development of a new mine, Murrawombie Underground, to replace North East/Larsens, which is almost depleted. We are also fortunate to have a land package of approximately 185,000 hectares around our mining operations. This tenement package hosts a pipeline of next mine projects that are ready to be advanced and is also highly prospective for further exploration success, all of which indicates there are good opportunities to extend the life of Tritton. With a C1 unit cash cost of around US$1.70 a pound, in the current low copper price environment our focus is on managing the Tritton Copper operations to optimize cash-flows and be positioned to take advantage when the copper price improves.”

The process of changing the company took several years to complete and was very much a team effort, including everyone at the Tritton Operations. Said Mr. Brainsbury, “Three years ago when we first embarked on this turnaround we had debt somewhere in the region of AUD $150 million. Today, we have been through a process where we have restructured loans with two financiers and introduced a third financier. Now we have a US$50 million dollars in senior debt and a US$25 million working capital facility to fund growth projects at Tritton, for example the recently announced Murrawombie Underground mine.”

The management of the company has a long history of working together. Mr. Brainsbury said, “The core executive team is Andre Labuschagne as Managing Director, Ian Sheppard as Chief Operating Office and myself as CFO. The three of us were also the executive team at Norton Goldfields Limited (Norton) whose primary asset was the Paddington Gold Mine in Kalgoorlie in Western Australia. At Norton we undertook a similar turnaround at both an operational and financial level before the company was taken over by Zijin Mining in 2012. We have all spent our careers in mining and combined have over 80 years of experience in the industry. We see our core skills as being in turning around and optimizing performance of operations and financial restructuring, rather than true greenfields exploration. We have been working together as a team for more than five years.”

To accomplish the changes needed to turnaround the company, Mr. Brainsbury said it was important to have engagement and buy-in from all levels within the company, effectively everyone from mine workers on up, as well as key external stakeholders. He said, “We have a very supportive workforce and we all pulled together to build what we have today. These things don’t happen through one or two people, they happen through a lot of people working together. We have also had supportive financiers, service providers and shareholders.”

Mr. Brainsbury believes that copper will continue to be a needed resource in the future. He said, “We have a view that copper is one of the more attractive commodities to be involved in. As we move more into alternative energy sources like solar power and electric cars, these all require a lot of copper. Market forecasts are also indicating that the supply/demand balance is heading into deficit by the end of the decade, which augurs well for the copper price. At Aeris Resources we have a copper producing mine that also has excellent exploration upside. Now that the turnaround of the company has been completed we are focused on growing the business.”

http://www.aerisresources.com.au/

Level 2, HQ South Tower,

520 Wickham Street,

Fortitude Valley, Brisbane QLD 4006

t +61 7 3034 6200 +61 7 3034 6200 +61 7 3034 6200

e info@aerisresources.com.au

|

|