Dr. Alper Interviews Jack Stoch President and CEO of GLOBEX with a Huge Highly Diversified North American Portfolio

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC

on 4/14/2016

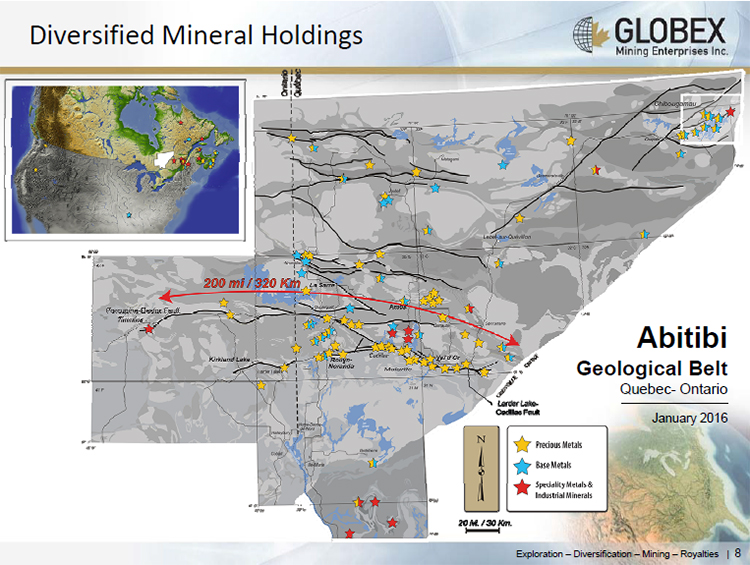

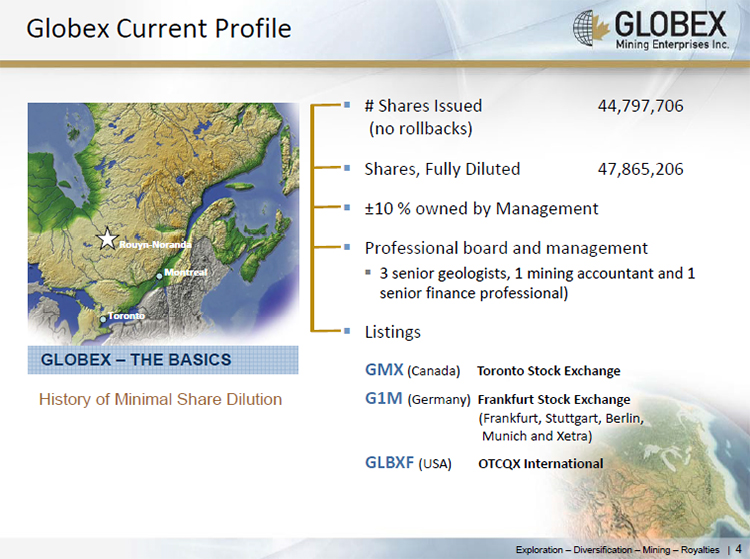

GLOBEX Mining Enterprises Inc. is a TSX, Frankfurt and OTCQX-listed Corporation with a huge highly diversified North American portfolio of over 130 mid-stage exploration, development and royalty properties containing precious, base and specialty metals and minerals. According to Jack Stoch, director, president, and CEO of GLOBEX, they are basically a mineral bank that owns all these properties and has no debt. GLOBEX seeks to create shareholder value by acquiring mineral properties, enhancing them and either exploring, optioning or joint venturing them, developing them to production, or in some cases selling projects outright.

Dr. Allen Alper: This is Al Alper, editor-in-chief of Metals News, talking with Jack Stoch who's director, president, and CEO of Globex. I know a lot of things are going on right now. So could you fill us in on what's happening and tell our readers about your company’s background? I know it's highly diversified, you have many properties, and it looks like you're taking this downturn to buy more properties. So fill us in on what's happening.

Jack Stoch: Sure, it will be a pleasure. Basically, Globex is, a Toronto Stock Exchange listed company. We are also listed on the OTCQX and five exchanges in Germany, including Frankfurt. We're basically a mineral bank.

What we do is acquire mineral assets that we think have value, unrecognized value, and we work them a bit to make the value evident and then option them off. Other companies pay us for the right to try to earn an interest in our projects.

At the moment, we have over 130 projects. About 70 gold projects, 43 base metals, 18 industrial minerals and specialty metals such as talc, iron, lithium, magnesium, manganese, silica, vanadium, antimony, feldspar, and so on.

We have about 40 royalties in our package. We don't do grassroots projects, we concentrate on projects that have defined value. It could be either drill holes with intersections of economic interest, previous production, NI 43-101 resources, or historical resources. To the point where, of the 130 projects that we have, 49 of them have historical or NI 43-101 resources.

Dr. Allen Alper: That's excellent.

Jack Stoch: Yes, we have our own skilled staff; we work on the projects to shine a light on their value. The only thing that is good in the current downturn, which has been truly horrible and has hurt our stock price incredibly, is that if you have the staying power and if you understand markets when it turns Globex will reap the benefit from our acquisitions.

This particular downturn has given us a chance to pick up assets for basically nominal value or almost no cost at all. It's really been quite amazing. For example, we just announced that we picked up a property called the Cameron gold property up north of Lebel-sur-Quevillon in Quebec. There are three gold deposits starting at our western boundary and going westward away from our property. On our property, we have over six kilometers of what's called the Cameron Lake Gold Shear, 119 drill holes have been completed so far of which 57 are within what's called the 'Principle Gold Zone'. Wide zones of low grade gold values were intersected with individual, I'd say sometimes multi-ounce, individual sections, you know like 1.5 meters of 21.8 grams, that kind of thing. Very, very nice project. We picked it up for almost nothing. Really, quite amazing!

A couple weeks ago we did a deal to acquire what are called the Francoeur and the Arntfield gold mines just west of Rouyn-Noranda. The mineral resource on the Francoeur is about 320,000 tonnes grading 6.47 grams per tonne (measured and indicated) with another inferred resource of 18,000 tons of 7.17. Then beside it, there is a historical resource on the Arntfield Gold Mine property of 633,000 tons of 4.84 grams per tonne gold. Included in the purchase was the head frame, the hoist, the transformer, the office building, the machine shop, the metal shop, the core facilities, the power lines, the security systems, electronics, the whole thing! We picked it up by taking on $157,000 in bonding obligations and then we immediately vended off the sterile rock pile for use in construction to a third party for their assuming the $157,000 bonding requirement so we actually ended up getting the property for nearly nothing!

Jack Stoch: There are all kinds of deals that can be done out there.

Dr. Allen Alper: Well it sounds like not only do you have a geological background but you have a very strong business background and understanding how to acquire properties and negotiate.

Jack Stoch: Yes we are said to be pretty tough negotiators. Importantly we recognize value, and we also recognize distress. If we see an opportunity, we jump on it. You know, my father taught me "buy low, sell high" and we work by that old methodology. There's no special place in heaven for people who pay full price. You have to negotiate. You have to recognize what are the negatives but also what are the hidden positives that create value and, like I said previously, this terrible market has put people in distress and this is the time to acquire. Is it going to be recognized? Not yet. The prices of the metals have to rise, particularly precious metals, but when they do I don't think anybody is going to be as well placed as Globex will be.

49 of our projects have historical or NI 43-101 resources! Amazingly 30 of our projects are former producers, which brings to mind the old adage “ the best place to find a mine is beside a mine”.

Dr. Allen Alper: Wow that's great. How do you find these? Do you have a team working?

Jack Stoch: Yes in our office, we have 8 geologists that are full-time staff, as well as technical support personnel. These people live up in the Noranda mining camp. We are in the Abitibi where mines have been and continue to be found. In a couple hours we can be anywhere, to visit a property or to do work, so our costs are lower than our competitors.

We own, not only all these properties, we have no debt. We own our office buildings, we own all our equipment, our trucks, our physical equipment, everything.

Dr. Allen Alper: That's a great position to be in, to own everything. A lot of people got into debt over their heads.

Jack Stoch: Correct. Basically, when you go to accountants they keep saying that you should do debt so you can write off the costs. "You shouldn't own property", for example, "You shouldn't own an office building, shouldn't own a core facility. You should be renting so you can write it all off."

I mean that, excuse me, but that's just a bunch of bull.

One should own assets because as you know this business it's cyclic, and because it's cyclic you're going to fall on hard times. If you have to pay rent and you can't pay it, they're going to want you out! We own our office buildings. We own our core facilities. We have an office building that's around 3,000 square feet. We have a core facility with a ground footprint of about 5,000 square feet, if you put in the balconies used for storage it's probably about 7,500 square feet. We have our own apartment for geologists that work for us and that come from out of town. No costly hotel bills for us.

We keep our costs as low as possible and that, I think, is just prudent business.

Dr. Allen Alper: That sounds like a very good approach. Could you tell me a little bit about your capital structure?

Jack Stoch: The capital structure? We have just under 45 million shares issued. Like I said, we're listed on the senior Toronto Stock Exchange, we're not on the TSXV. To get onto and stay on the Toronto Stock Exchange you have to jump through many more hoops than you do to be on the TSXV. We're also on the Frankfurt and four other exchanges in Germany, plus the OTCQX in the United States. Matter of fact, we are the first Canadian company and the first mining company to list on the OTCQX. In fact we were invited to list on the OTCQX when it was formed.

Dr. Allen Alper: That's very good.

Jack Stoch: Yes it is.

We're a different company. Most companies that you're going to look at and you've probably interviewed have one principle property and a couple backup ones in case the first one doesn't work out.

We have a whole bunch of principle properties. We have things that people only wished they had. We have one on which a group is working on a pre-feasibility study right now as well as permitting for possible production.

We have a number of options. We have one in Nevada called Bell Mountain with Eros Resources, where they're looking at the potential of putting it into production. The gold/silver deposit is an open pit heap leachable deposit.

We have a number of other things that we'll be announcing in the next little while, some deals that we are doing in industrial minerals. We have an interest in a silica project with Rogue, on which they've been drilling and announcing purity assays.

We just picked up a feldspar deposit, an example of thinking outside the box. Feldspar is used in glass making and ceramics. If you want to make tempered glass, potassic feldspar is what you want. Roughly 40% of the cost of feldspar is transport cost so if you can come up with good clean feldspar with cheap efficient transport, you're laughing.

Well, we picked up a reported historical resource of somewhere between 20 maybe 30 million tonnes of potassic and sodic feldspar. Open pit-able, on the north shore of the St. Lawrence River, with a loading dock on the property so you can actually load the feldspar directly from the property onto the ships. The deposit was sitting open, we picked it up by staking, cost us a couple hundred dollars. It was just crazy! If you keep your ear to the ground and if you're willing to be diversified and look for opportunities and not class yourself as a particular brand of company, for example, a "gold company" or "a base metal company" there is a lot of value you can add to your company.

When you go to buy a coffee, they don't care where the money comes from - Whether it comes from a gold property, from a base metal property, from an industrial mineral property. The idea is to create the end product, and the end product is the money that you get from selling the production from the property. It's not the actual feldspar or manganese or copper or gold that is the end product. So many people lose sight of that.

We're in this business to try to make money!

Dr. Allen Alper: That sounds like a great approach, particularly in this environment. By the way, one time I used a lot of feldspar, I worked for Corning Glass.

Jack Stoch: Oh, really? So then you know exactly what I'm talking about!

Dr. Allen Alper: Right. I was a senior research associate there. In those days I was using my geology background to make all sorts of ceramics and glasses. I got 22 patents for Corning Glass.

Jack Stoch: I'm going to have to tap you for some background information.

Dr. Allen Alper: Sure! I'd be glad to.

Now, what are your thoughts on what's going to happen to this market? It's been about a five year downturn, with a recent upturn in a few areas.

Jack Stoch: Well, I'm definitely not a guru, I've been wrong more often than right. I've been thinking that the market had to turn, and that's why we've been taking advantage of the bad market and as long as it doesn't turn to the better we will continue to take advantage of it by acquiring more and more assets.

I still take that position. It has to turn, I just don't know when. It just doesn't make any sense, where the precious metal prices are, where the base metals prices are. Certain things, yes, maybe make sense, but in the totality, and particularly in the precious metals, which is the one that is going to set the tone of the market, it just makes absolute no sense at all.

In Canada, if you're a producer you're laughing, not only has the gold price gone up a bit, but because of the devaluation of the Canadian dollar versus the U.S. dollar. Costs if one is in production are in Canadian dollars and you're selling in U.S. dollars, so it's a hell of a bump up. All the Canadian producers are making money.

I think that things are going to improve. They have been improving in fits and starts. If you look at the charts, the precious metals went down and then they started to go back up again. They retreat, then they go up farther, they retreat again but they don't come back down to where they were before. Over the long term I don't think we're going to get a two-day jump of 150 dollars. I think we're going to get these bumps up and down. It's going to go up 30 bucks, come back 20, but it's going to be consistently upward.

Globex is going to be able to take advantage of that once the price of minerals goes up, so that our projects increase in value. We just picked up, for 350,000 shares, what's called 'The Devil's Pike Property' in New Brunswick, 100,000 ounces of gold near surface with a chance to expand, plus a whole bunch of drill-ready targets. Actually we're putting together an exploration program on that right now. One couldn't have bought that property even two or three years ago for that price. We ended acquiring it as the company that had it is not a gold oriented company and they decided that they were going to pull out of Canada. They called me up and said, "Do you want to do a deal?" We did a great deal.

Dr. Allen Alper: Fantastic. That's really great.

Jack Stoch: At the same time we have other people coming despite the poor market to look at our projects. We had somebody in our office today, a geologist and a company president, looking at one of our open-pit gold projects that has the potential to be put into production They are studying it, doing an evaluation.

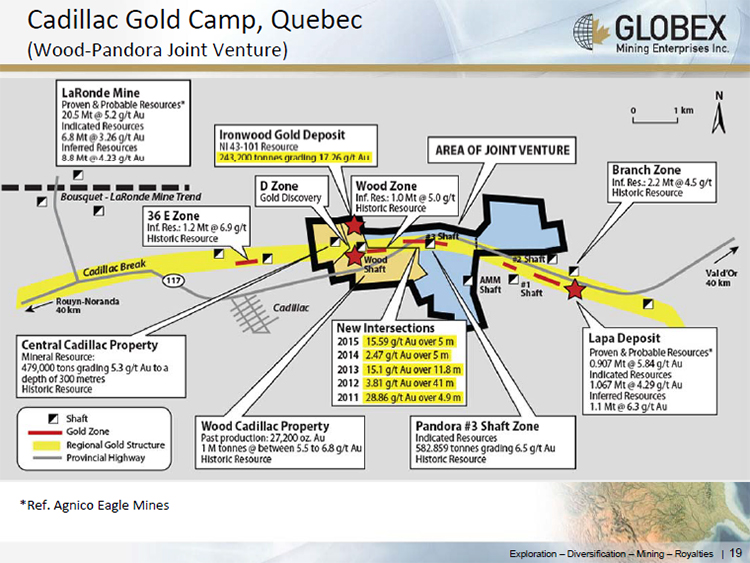

We continue on with joint ventures. We have a gold project on the prolific Cadillac Break where we're the manager with partners Agnico Eagle and Yamana.

We've discovered a small, very high-grade gold deposit running 17 grams gold. We are studying to see what we can do with that. We've got several kilometers of the 'Cadillac Break' and we've done a fair bit of drilling. We have done four or five different drill programs. Every single one of them has hit.

Dr. Allen Alper: Very good.

Jack Stoch: Quite spectacular intersections.

I don't know if you saw the property we picked up called the Montalembert project up in Northern Quebec near the town of Waswanipi just off the main highway to Chibougamau. It's a historical project, hasn't been worked for over 40 years. You can go and we did, and take some surface samples. Historically there's a zone 405 feet long that runs in 0.97 ounces per tonne gold. We went in and sampled a parallel structure getting up to two and a half ounces in our surface assays.

We're going back in there this spring as soon as the snow's gone and we are going to do more significant work. We're going to be washing the stripping that we did last fall and we're going to be doing a mini-bulk sample.

There is a lot going on. We have a manganese project in New Brunswick which we have upgraded and we hopefully will be announcing a deal on very shortly. Significant expenditures, principally on drilling are planned to be undertaken this summer.

Manganese, I don't know if you know, but there's no manganese production in North America. It's 100% imported for use in the steel industry. A lot of people don't recognize that it has potential use in lithium batteries. Manganese is one of the components. It's something that is going to create, I think, a little bit of a stir if we get our deal going because our client is looking at it as a high-tech mineral.

Dr. Allen Alper: That sounds excellent.

Jack Stoch: Like I said, lots and lots of stuff going on, I mean we're very, very, very busy. Lots of acquiring and a lot of exploration.

We have our talc-magnesia project. We're trying to get it going, with the talc for the plastics industry and the magnesia for wallboard. I don't know if you're familiar, most wallboard is made up of gypsum, but gypsum absorbs water and allows black mold to grow on it. If you make it out of magnesium oxide not only is it more fireproof, but it won't absorb water and it won't allow black mold to grow on it. There has been no production of magnesium oxide wallboard in North America, so there are a couple firms setting up to produce wallboard and they're going to need supply. One particular company has tried our material for wallboard and is willing to purchase it, so we're working on trying to get financing to get into production.

Dr. Allen Alper: Sounds very promising.

Jack Stoch: Yes it is. As you know, we have lots of gold projects. For example the 50% owned Duquesne West Property that has a NI 43-101 gold resource of 853,000 ounces and lots of exploration potential. A visit to our website will display many more.

We have royalties. One of the frustrations has been that we have a zinc royalty on a zinc mine in Tennessee and they put it on 'care and maintenance'. If they get back into production, and there is large resource, I mean a minimum 25 to 30 years resource, that will generate at over 90 cents over a million dollars a year for Globex, which it did before, until the zinc prices fell out of bed and they decided that they were going to shut it down and put it on 'care and maintenance'.

Lots of potential, incredible potential in Globex compared to a lot of other companies.

Dr. Allen Alper: That sounds very good, really a good opportunity to be so diversified and to be getting so many projects and properties at excellent prices.

Jack Stoch: Yes indeed.

You know, the thing about us is that we're very respectful. I'm the largest shareholder, and we're very respectful of our shareholders and our money. One of the ways that we show our respect is by limiting shareholder dilution. We only have, what is it, 44.8 million shares out. We have never done a rollback.

We've been around for a fair number of years, and we manage our company like it's a business, which it is. That is important to us, and it's important to do the minimum amount of dilution possible.

Dr. Allen Alper: That's very good. That's a mistake that many, many companies make - issuing stock and diluting their stock. I'm glad to see that you've been very prudent not doing that.

Jack Stoch: Yeah, I know, we're very, very careful. I'm not sure it's recognized or appreciated by those who are not shareholders, but those who are shareholders, and we know a lot of them individually because they call us and I take the calls personally, most people are very pleased. Nobody's happy about the share price, but hell, I don't think anybody's happy about the share price with most junior companies.

With us, the difference between share price and real value in the company is so big, the gap is so wide, it's just crazy. There are companies that have less than any one of our projects and are trading at maybe 50% of the value of us, and we've got 130 of them!

Dr. Allen Alper: Yeah, that's amazing.

Jack Stoch: Yes but we're a difficult story to understand because we are so diversified and have so many assets.

Dr. Allen Alper: Could you tell our investors several reasons why they should invest in your company?

Jack Stoch: Well there are a lot of reasons, most of which I've touched on before. Number one is the huge bank of assets that we have. We own them all and we have no debt. We are diversified, so if one particular element is out of favor, well, we have the other elements that we can work on.

The deals that we're going to be announcing, in the next little while, are industrial mineral deals. It's hard to do gold deals, it's hard to do base metal deals but it is much easier than it was to acquire them and hold them until markets improve. The diversification is important. The long-term view is important.

We're respectful of our shareholders in that we try to limit dilution.

We're prudent with shareholders money. We own our assets. We're not subject to the option agreements like many others where we would have to pay someone else in order to maintain our assets. It's quite the opposite. Other people are doing deals with us where we get cash and shares and a royalty interest, and if they don't hold up their end of the bargain we take back the property.

In these arrangements, we're in the superior position. Not on one property, of the massive number of properties that we have, do we owe a penny to anyone. They're ours! As long as we do the required assessment work and pay the taxes that the governments require, they're secure. They belong to us. We continue to maintain and improve the assets while create value.

Dr. Allen Alper: That's excellent! That's an excellent position to be in. Is there anything else you'd like to add that I didn't ask about?

Jack Stoch: Not really. I just would ask people to go and take a look at our website, Globexmining.com, and take the time. It requires time for people to appreciate the value and understand it. One of the problems with the brokerage community and a lot of investors is they want a five minute story that is simple to understand and can be easily communicated. Globex is not that.

You have to spend the time, look at the assets, recognize the value in them, and look at the management model and understand it. If you take the time to understand it, the value is so evident. If you get discouraged by the fact that Globex owns so many assets and that they are so diversified you may walk away, but you're walking away from probably the best junior mining stock around, in my humble opinion.

Dr. Allen Alper: That sounds great!

http://www.globexmining.com/

Globex Mining Enterprises Inc.

86-14th Street

Rouyn-Noranda, Quebec, J9X 2J1

Canada

Telephone: 819.797.5242

Fax: 819.797.1470

info@globexmining.com

|

|