S2 Resources Ltd (ASX: S2R) Enjoys Solid Financial Status and Explores for Gold and base metals in Australia and Scandinavia

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC

on 3/27/2016

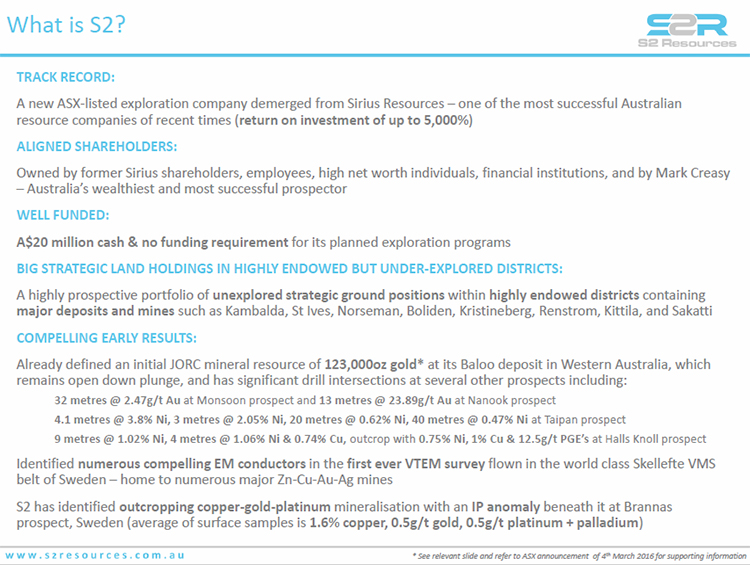

S2 Resources Ltd (ASX: S2R) team sold Sirius Resources last year for $1.5 billion dollars, which they started with $7 million dollars and retained and formed S2 Resources. S2 Resources Ltd is currently enjoying a solid financial status, which is allowing them to explore gold and base metal properties in both Australia and Scandinavia. S2 Resources’ team lead by Mark Bennett has an amazingly successful track record of discovering valuable deposits, developing them and then selling them to other mining companies. Individuals that are interested in investing in gold should look closely at S2 Resources as an investment opportunity.

Bennett, Managing Director and CEO of S2 Resources (ASX: S2R) updated readers on the progress that S2 Resources has been making on their Scandinavian and Australian gold exploration since their spin off from Sirius.

Bennett said, “S2 was spun out of Sirius Resources late last year, which was taken over for $1.5 billion dollars. We started off as a five million dollar company, made a big nickel discovery and ended up getting taking over for $1.5 billion dollars, so it was a good return for everybody. Part of the deal was that we would simultaneously spin out a new company, which is S2 Resources, together with $22 million funding from Sirius.”

When the spin off occurred, Bennett had the opportunity to form his new company. He said, “I had my pick of people to take from Sirius and $22 million dollars of funding as well. In these times, it was good to start life as a junior explorer with some money in the bank. It is important as well because Sirius shareholders got an entitlement to S2, so we have former Sirius shareholders who are already really happy and are well aligned with what we are trying to do.”

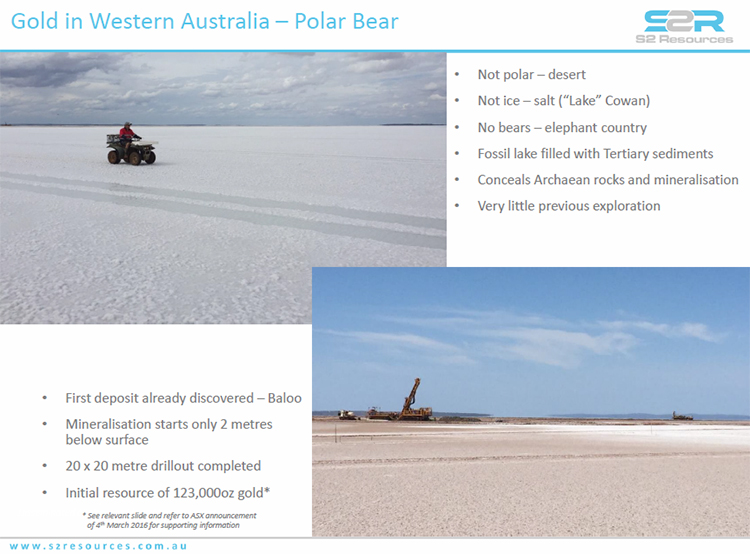

The company is currently focused on exploring gold properties in two different areas of the world. Said Bennett, “We have properties in Western Australia and Scandinavia. We have predominantly gold ground in Australia, in a good gold endowed district. We just started drilling and within three months of listing we published our first resource, which is only modest. It has about 120,000 ounces, but it is at surface, right next to a hungry mill. It is a good position. We see this not as an end in itself, but as a means to an end. We can potentially create cash flow from it in addition to the $20 million dollars that we already have, to fund us for the hunt for the big one. It is our mission to find the big one without having to go back to market again.”

The process in Scandinavia started as Bennett and his team met explorers who have had a great deal of success with other projects in that area. He said, “We supplemented the Australian projects with another project in Scandinavia and teamed up with a couple of guys that are pretty accomplished explorers in their own right. I met these guys from Anglo American, including the ex-head of exploration. They have been in those countries for twenty years looking for deposits. So now, between the old Sirius crew and the new guys from Scandinavia, we have a team that has probably found six or seven tier-one deposits. We have the exploration expertise and the corporate expertise to go with it to find and fund the next one, which could be in Australia or it could be in Scandinavia.”

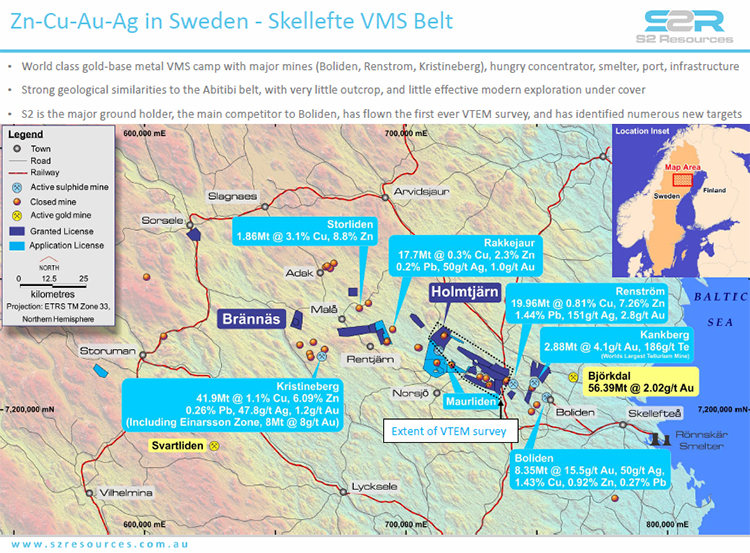

With several projects to choose from, Bennett and his team are looking closely at what is available for gold exploration in Europe. He said, “Right now, our view is that Sweden is the most likely place that we will make a discovery. We went into the Skellefte belt in northern Sweden, which is the home of Boliden. They had not picked a lot of ground around their operating mines. We went in and basically stitched the belt up, which surprised them somewhat. We then flew airborne VTEM geophysics, which was the first time it had ever been flown. This identified a lot of good anomalies in unexplored ground along strike from already producing mines. These are under about five meters of cover (transported overburden that conceals the bedrock), so they are hidden, but not too deep. Any one of those anomalies could turn into another mine. The nearby mines range in size from ten to forty million tons, containing good grades of copper, gold, silver and zinc.”

Bennett and his team have a business focus that he feels is rare in the mining industry. He said, “Most of us have started lives in geology. Lots of people know geology, but you need to be able to sense an opportunity and then act on it. I was from the UK originally and did a geology degree there. I went to Australia when the market took a dive. I went back to the UK and then did a PhD and ended up working on oil in the North Sea. Eventually I ended up back in Australia and discovered gold and nickel deposits there. That company was taken over for $7 billion dollars. After that we set up Sirius. At the start, Sirius was one of maybe 300 small Australian exploration companies with a share price of $0.05. After we discovered the Nova-Bollinger nickel-copper deposit our share price peaked at $5.00. We don’t just discover things, we finance them and put them into production. In the case of Nova-Bollinger, we did that in exactly two and a half years after discovery. Western Australia is a pretty friendly place in terms of permitting, but even for there this was a record. After Sirius was taken over by IGO, I was able to bring my people with me. I brought 16 people with me and they all took pay cuts of between 20% and 60%. They have all bought stock on the open market. They believe in our future. We realize that doing exploration is high risk but it is also high reward, and given the track record of the people in the company, we feel that we can do it again.”

Financially, the company is in solid shape to continue with exploration. Bennett said, “We have roughly 200 million shares on issue at about $0.15 per share with a market capitalization of $30 million dollars. When you take the cash off, we have an enterprise value of about $10 million dollars. We have about five institutions in our top twenty shareholders which is unusual for a junior explorer.”

http://www.s2resources.com.au

North Wing, Level 2

1 Manning Street

Scarborough WA 6019

Telephone: +61 8 6166 0240

Facsimile: +61 8 6270 5410

Email: admin@s2resources.com.au

|

|