Flinders Resources LTD (TSXV:FDR) Manufacturing Refractory Grade Graphite and Developing a Graphite Product to Provide New Source for Battery Needs in Europe and North America

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC

on 3/21/2016

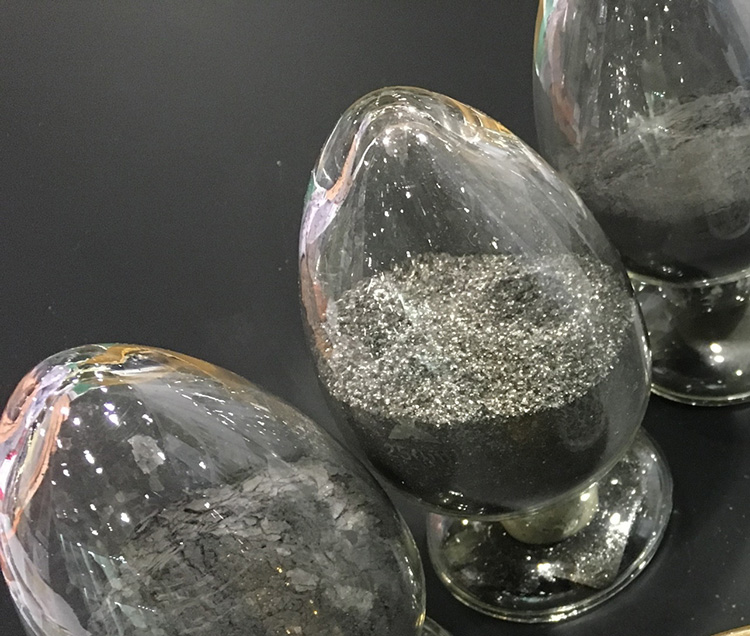

Flinders Resources (TSX:FDR) is in a great position being one of only two graphite producers in the EU supplying the graphite market in Europe. The company has a large high grade and quality graphite resource, fully operational mine and processing facility, and a proven and experienced management team. They have been producing refractory grade graphite (94% purity) at their 100% owned Woxna mine and processing facility in Sweden. Currently they are working on growing their business model to produce high purity graphite to the automotive battery sector. Blair Way, CEO of Flinders Resources and his team have achieved 99.9% purity and are working with battery and automotive manufactures to develop and qualify their product.

Blair Way, CEO of Flinders Resources (TSX: FDR), spoke with Dr. Alper at PDAC to update our readers on the progress of Flinders Resources. He said, “So, for Flinders Resources, we have transitioned from a start up to a running operation.”

Mr. Way said, “We are producing a refractory grade material which is 94% flake material for the traditional market. With the downturn of the steel industry, unfortunately we are victims of the lack of demand and subsequent drop in graphite concentrate prices. We shut down the plant in a controlled manner last July to preserve treasury and explore ways to improve the business case. We have identified value adding our refractory concentrate as the best way to move the business forward.”

The company has decided to focus on producing value adding graphite products to grow the business. Mr. Way said, “We are taking our concentrate from 94% up to 99%. The most recent news we put out, just last week, was that we have achieved the 99.9% purity and we will be able to generate this spherical high purity graphite product needed for the battery market. Currently, we are going through the process of meeting with all the end users such as automobile manufacturers and battery manufacturers to gauge interest in this EU sourced product. If so, the next step would be to add a high purity processing plant to our existing processing facility.”

Mr. Way and his team have established the size of their deposit. He said, “On our deposit, we issued a NI 43-101 twelve months ago. We have eight million tons averaging 9.3% C, which means we easily have more than thirty years of mine life. So mine life is not an issue in regards to our business. The first stage of processing, flotation is really quite straight forward. There are some tricks to it that you need to know in order to process graphite efficiently, but it is basically taking it from the ground, milling it and then sending it through a series of flotation and regrind in order to produce a 94% C product. We cover a full spectrum of flake size, but to take that product from a refractory grade of 94% concentrate to be purified means that the flake size really isn’t so critical. A lot of other people discuss flake size as king, but the reality is that it is carbon content, purity is king. The purification process and the requirements of battery manufacturers is for a sub 50 micron product. So having a 500 micron flake is going to get ground down to nothing.”

The company has discovered they can purify their graphite with traditional processing reagents. Mr. Way said, “So, for us the next step after floatation is a high purity, which is what we have found from our testing using passive leaching processes. We are currently fine tuning the flow sheet to define our capex and opex.”

With the changes in the market, the Flinders team has been streamlined. Said Mr. Way, “My team at this time is a lot smaller than it was last year. In order to preserve treasury we maintain a small team in Sweden so we can maintain our commitments to the regulator while keeping costs to a minimum. We are maintaining our license with our monitoring program and other compliance requirements. ”

Mr. Way feels fortunate that Flinders is still operating and has a direction. He said, “For us compared to many of our peers, we are in a good place. We still have $2 million in the bank and we are maintaining our fully operational site for less than many other public graphite companies maintain an exploration project. If we can find a way to economize, we are doing so. We have 46 million shares outstanding with a share price hovering in the low twenties. It is a far cry from the glory days of a few years ago, but we feel like we have a strong story and the market will eventually figure that out as some of the more showy projects start to drop away.”

Mr. Way isn’t sure of how the graphite space will develop in the future. He said, “For the graphite space, on the refractory side of things, crystal balling is a tough one. I’m not seeing iron ore prices changing in a big rush. Steel ovens need to be running continuously and there is a lag before we see refractory grade graphite demand increase. As far as the high purity space, currently all battery grade natural flake graphite is produced in China and consumed by China, Korea and Japan battery manufacturers. For us to break into that, we need partnerships with an end user who dictates supply chain expectations. We believe end users will be seeking out a sustainable source of natural flake graphite, which for the present time only Flinders Resources can produce.”

The new strategic direction for Flinders is one, in which, Mr. Way is confident. He said, “We believe that focusing our efforts on high purity value added products is a good one. We have a permit to feed 100,000 tons into our plant per annum so it makes more sense to value-add our product line to maximize profit. It will take time to build relationships, but that is the nature of working in the industrial mineral sector. Since we are the only graphite producers in the space we believe that is a significant differentiator. Being in production in Europe is unique and with the large German Automakers heading down the Electric Vehicle path we expect increased demand for an EU sourced raw material supply chain.”

http://www.flindersresources.com/

Head Office

Flinders Resources Ltd

1305 - 1090 West Georgia Street

Vancouver, BC Canada V6E 3V7

Investor Relations

Phone: +1 604 685 9316

info@flindersresources.com

|

|