Cordoba Minerals (TSX: CDB) Advances San Matias Copper Gold Project in a World Class Mining-Friendly Area of Colombia

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC

on 3/6/2016

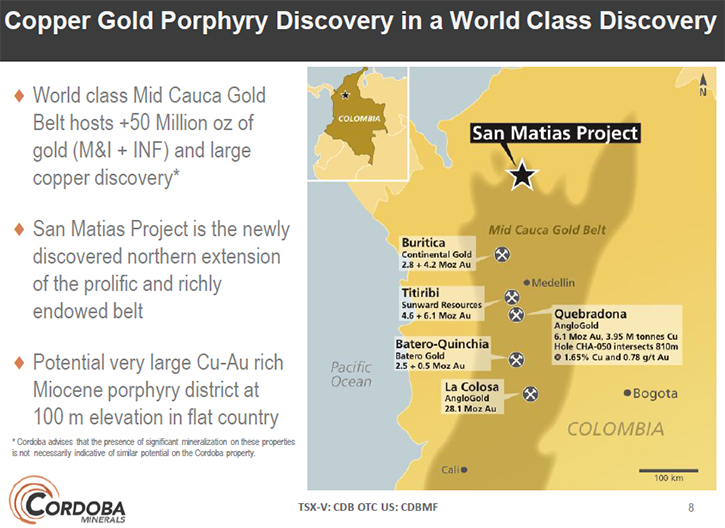

Cordoba Minerals (TSX-V: CDB) is currently drilling on their San Matias copper gold project located in Colombia, with the goal of discovering a world class copper gold deposit. This newly discovered copper gold district is the northern extension of the world class Mid Cauca Gold Belt which hosts over 50 million ounces of gold. Cordoba is uniquely positioned as a junior explorer with financial and technical support of Robert Friedland’s High Power Exploration (“HPX”). The company is led by the very capable and experienced hands of Mario Stifano.

Mario Stifano, President and CEO of Cordoba Minerals (TSX: CDB), took some time to update readers on the progress the company is seeing in their Colombia-based copper gold project, called San Matias. “Cordoba Minerals is a copper and gold exploration company in Colombia. We think we have one of the best copper and gold exploration projects out there,” commented Mr. Stifano.

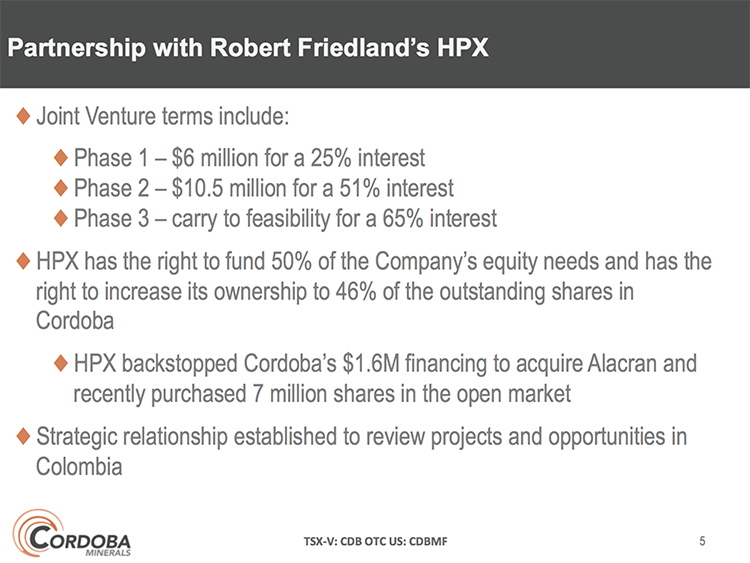

“The company has benefitted from a relationship with investor Robert Friedland, We are really looking for an elephant, and we have one of the best investors for elephants in Robert Friedland,” said Mr. Stifano. HPX has a right to earn up to a 65% interest in the San Matias project in Colombia by taking the project to feasibility. However, Mr. Friedland and HPX has also been a big investor in Cordoba Minerals. In less than a year, HPX has increased its ownership in Cordoba from zero, before the joint venture, to 37% currently. HPX recently purchased 7 million shares of Cordoba in the market and exercised early their 7.3 million warrants contributing approximately $1.5 in cash to the company. Cordoba, even though it is a junior explorer, has the capital to explore the copper gold district aggressively as their partner HPX recently completed a $100 million financing.

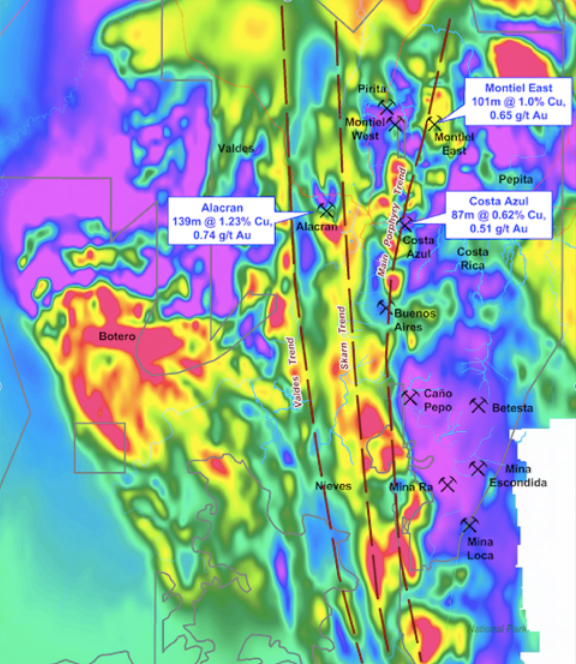

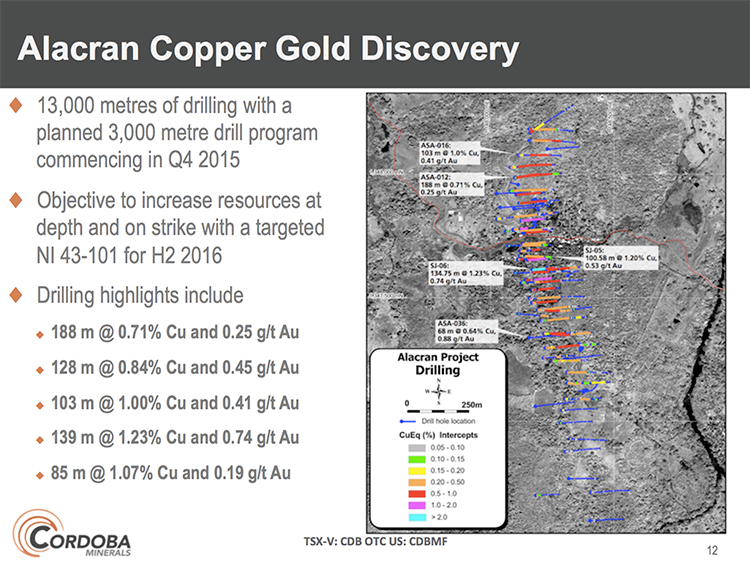

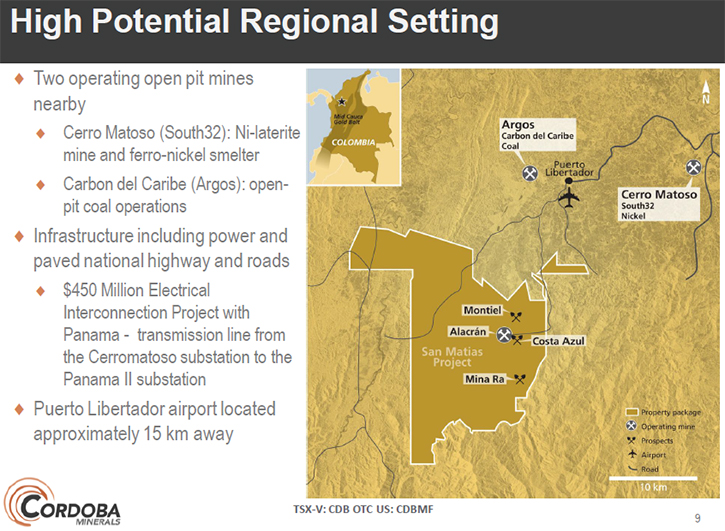

“The San Matias project encompasses a large and newly discovered copper gold district in Colombia,” said Mr. Stifano, “The San Matias project is a 20,000 hectare land package with multiple copper gold targets over a highly magnetic 13km trend. In addition to our core holding, when we recognized that the geology in the Department of Cordoba was prospective for copper gold, we locked up over 200,000 hectares of ground so no other company can enter into our district. We have identified and drilled two porphyries to date and we are currently drilling a 3,000 metre program at Alacran on the skarn trend. At the Montiel East porphyry, we drilled 101 meters at 1% copper and 0.65 g/t gold, starting from surface. Approximately two kilometers to the south of Montiel, we drilled another porphyry called Costa Azul where we drilled 87 meters at 0.62% copper and 0.51 g/t gold. Approximately two kilometres east of Costa Azul is the Alacran skarn with 13,000 metres of drilling including 123 metres at 1.23% copper and 0.74 g/t gold. The high grades and widths we are seeing are exceptional,” said Mr. Stifano.

“We believe we have a prolific copper gold district and what we have discovered to date is just the beginning of what may be the most exciting exploration project in some time,” commented Mr. Stifano. The recently acquired Alacran project has a historical resource of 37 million tonnes at 0.6% copper and 0.4 g/t gold. With the current 3,000 metre drill program, Cordoba is targeting to increase the tonnage and grade of the historical resource and is expecting to release a NI 43-101 compliant resource during the second half of 2016. “The Alacran deposit is currently over 1.3 km of strike and open in all directions and to depth. Whenever you have these large skarns like Alacran there is a high likelihood that a very large porphyry will be nearby and we have already discovered two porphyries. We are just scratching the surface,” said Mr. Stifano.

Mr. Stifano believes Colombia is the place to be exploring in Latin American and the location of the San Matias project is ideal for open pit mining as it is only 100 metres above sea level and near operating open pit mines. “We are right next to Cerro Matoso, the world’s third largest nickel mine and two open pit coal mines. There is a significant amount of infrastructure and a favorable social situation as the communities work at the operating mines,” commented Mr. Stifano.

Mr. Stifano brings substantial mining experience to the company and has raised over $750 million to explore and develop assets. “I am a CPA but I have been in mining since 1999. I started out at Noranda until I became the CFO of Ivernia where we discovered and developed the world’s largest lead mine. I was also the CFO of Lake Shore Gold from 2008 to 2012 and during that time we discovered and put two mines into commercial production. I left Lake Shore for Cordoba in late 2012 when I saw the copper gold potential at San Matias. I was looking for something new and something big and our project has that potential,” said Mr. Stifano.

There are some good reasons that Mr. Stifano believes investors should look at Cordoba. He said, “We have a tight capital structure with only 86.7 million shares outstanding. When we move into the joint venture phase with HPX, they will be spending the capital to explore San Matias. There are not many juniors out there that are financed to allow them to drill and aggressively explore. Keep in mind, I don’t care how good of a capital structure you have or even how good management is, the real value comes down to your asset. We had almost every major mining company have a look at our project and we received multiple joint venture offers. But, from day one, I wanted to partner with Robert Friedland. I met Robert in an elevator and told him about the project. That was the most important elevator ride of my life as we are now joint venture partners. Now that I have spent personal time with Robert, he is probably the most brilliant and forward thinking individual I have ever met and understands how to explore for world class assets like no one else in our industry. Somehow he has this sixth sense for finding world class assets. We are now in an enviable position where he is our biggest backer and we are moving the project forward,” said Mr. Stifano. Cordoba will have numerous catalysts in 2016 including the release of drill results from the Alacran drilling, the results from HPX’s Typhoon a proprietary deep IP technology, commencement of drilling at the porphyry targets and an initial NI 43-101 resource at Alacran.

http://www.cordobaminerals.com

Cordoba Minerals

181 University Ave, Suite 1413

Toronto, ON

Canada M5H 3M7

(+1) 416-862-5253 (+1) 416-862-5253 (+1) 416-862-5253

E: info@cordobamineralscorp.com

|

|