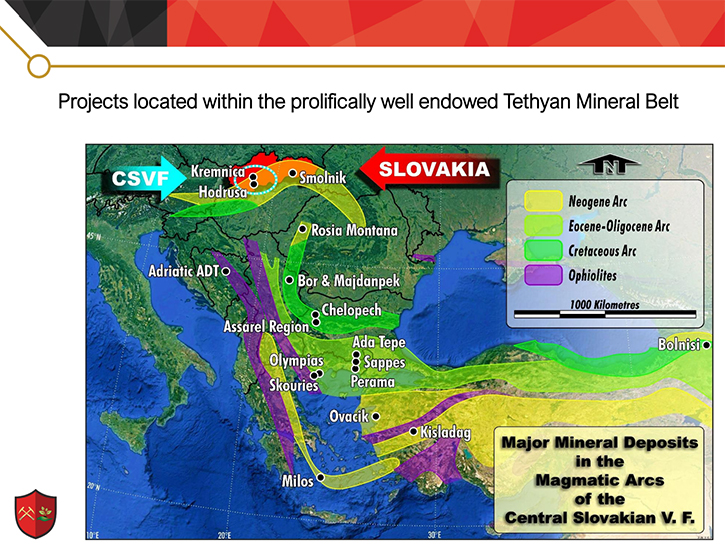

Jason Beckton, Managing Director, Prospech, Ltd. (ASX: PRS), discusses their Under Explored, Gold and Silver Exploration Licenses, in the Tethyan Magmatic Arc, in Slovakia, One of the Most Prolific Global Metal Belts

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 11/29/2022

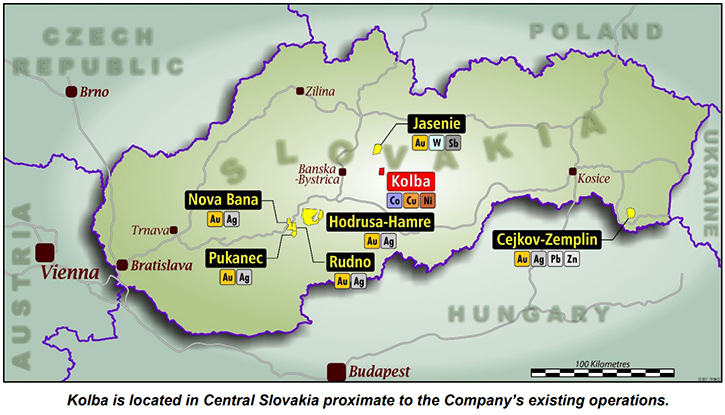

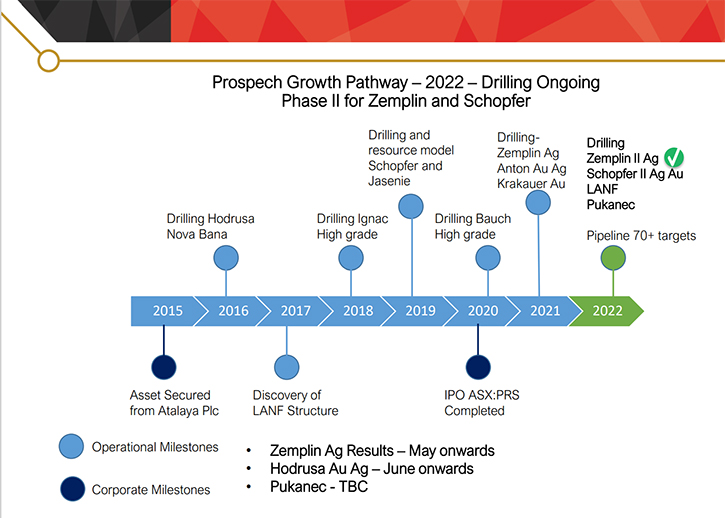

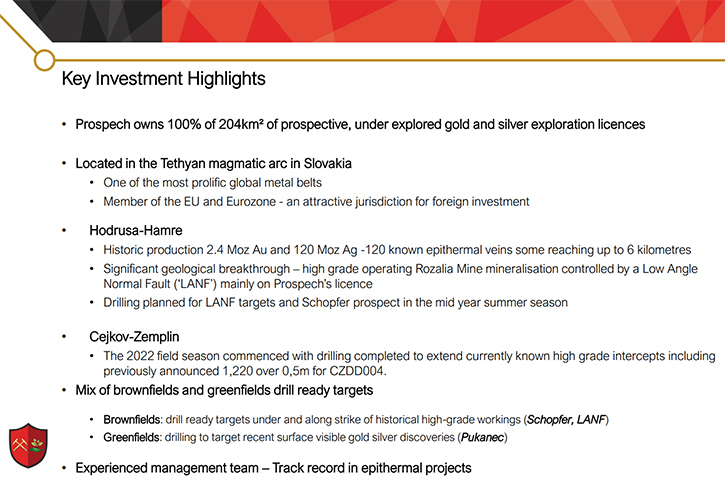

We spoke with Jason Beckton, who is Managing Director of Prospech, Ltd. (ASX: PRS). Prospech owns 100% of 204km² of prospective, under explored, gold and silver exploration licenses, in the Tethyan magmatic arc, in Slovakia, which is one of the most prolific global metal belts. The Company has recently made a new discovery, at the Low Angle Normal Fault (LANF) prospect, at their historic Hodrusa-Hamre project. Drilling was conducted at the LANF targets and Schopfer prospect this summer, and Prospech is currently receiving the results. In addition, in September, the new exploration licence has been applied for and granted at the Kolba cobalt-copper-nickel property, located in Central Slovakia, proximate to the Company’s existing operations. Slovakia is an advanced economy, with producing mines and is a member of the European Union and Eurozone.

Prospech, Ltd.

Dr. Allen Alper:

This is Dr. Allen Alper, Editor-in-Chief of Metals News, talking with, Jason Beckton, Managing Director of Prospech, Ltd. Jason, could you give our readers/investors an overview of your Company and what differentiates it from others?

Jason Beckton:

We are an exploration Company on the ASX traditional precious metals, initially. However, since 2018 we've had a tungsten property and more recently a cobalt property, which we'll talk about. What differentiates us is we operate in a low-cost environment, in Central Europe, which is pro-investment. Slovakia is rated, by the World Bank, as one of the best foreign direct investment destinations in Europe.

But as importantly, the scale of the gold field that we control, particularly the Hodrusa and Nova Bana Project means that we're not just looking for the small systems, we're looking for the large metals, precious and strategic ore, as they're known, as raw materials, critical elements in Europe. I guess we are in some ways a standard exploration Company. However, what we do is focus on very high-quality properties. We know of a lot of open ground of mineralized properties that are lower quality. We were very selective. Without going on, our business model is exploration.

Dr. Allen Alper:

That sounds great. Could you tell us a little bit more about your project in Slovakia and what distinguishes it and what you found? From my understanding, it's a high-grade project.

Jason Beckton:

Yes. We're referring to the announcement on the 16th of September, where we announced a cobalt-nickel property and also copper in Kolba. We've been watching this property for five years, so it wasn't an overnight thing. We've been waiting for the previous group to depart, who didn't drill the property. The reason we like this style of asset is these are very high-grade systems up to and including 2% cobalt, 1% nickel and up to 2% copper.

The challenge has always been not the grade, but the tonnage and continuity. We seek to fill out something that hasn't been done before, which is a mineralized dike that runs through the property connecting the Svatodusna through to the cobalt property, which is effectively a cobalt rich node, on what is a copper-silver system. In many ways, like many cobalt prospects, it is, in fact, polymetallic.

It's quite conventional, we don't need to do any significant geophysics because of the high-quality government mapping that we've inherited. There was a minor amount of work done by the previous operators, but no drilling. We're excited about the fact that the mineralization is concentrated, within a host dike that is up to and including 20 meters thick, which is a key criterion, investors use when they filter these opportunities. They look for, not just grade, but width, which of course goes to resource outcomes.

Effectively, what we're doing right now is collating the old information in three dimensions. We obviously had to wait until we got government grants, or we spent significant private money on that. Now we move to the all-important phase of preparing drills and metals, which I think builds planning, which I think will be in 1 to 2 months’ time.

Dr. Allen Alper:

Well, that's excellent. Could you tell us what your plans are for the remainder of the year going into 2023?

Jason Beckton:

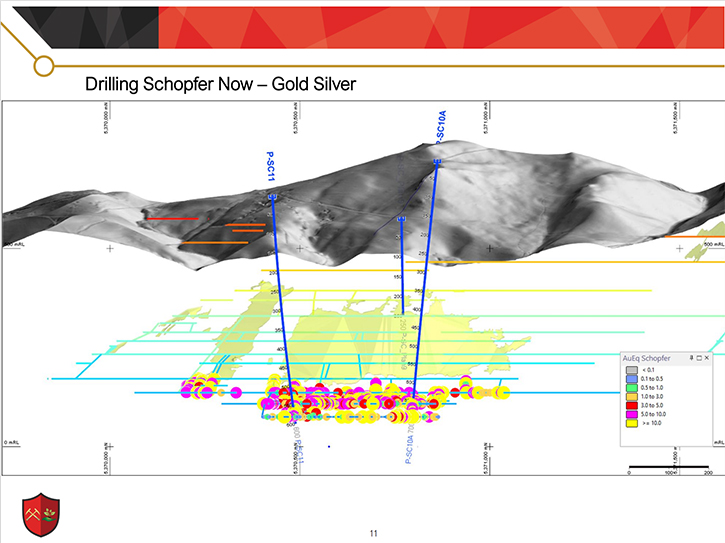

On the corporate side of things, we do maintain a cash balance. We like to see at least annual budgets, reasonably modest, at one to two billion euros per annum. So, there might be corporate fund raising, later in the year, as is evident in our quarterly reports. From the technical or operational standpoint, we're in receipt of some results, from two of our gold-silver properties, within the Hodrusa-Hamre Project. One of them, called Schopfer, is an old Austrian run mine. Another one, called the Low Angle Normal Fault, is the new discovery of our Team of a large detachment fault, as you see in some of the gold systems in Fiji or Bulgaria.

Without getting too technical, we need to see some drill results from those two programs. The samples are all at the lab and probably starting to come in now, so we should be reporting on those in late September, within 10 days’ time and then that'll also determine operations. We do have a bit of a long list of prospects, though. They must compete for the drill meters. Obviously, Kolba, the cobalt-copper-nickel property, will compete to drill meters immediately, but the precious metals target is over 80. Within that, we like to see robust thicknesses and growth before we commit to drilling.

To answer your question, we should re-commence drilling next year, in October. There's a bit of a hiatus right now, while we do some corporate activity, to replenish the cash balance. But after that. we should be drilling through to Christmas. Then normally, we have a winter hiatus, unless we're drilling underground, of course, which we can do all year round.

Jason Beckton:

Then we have a winter hiatus of about eight weeks. We get back into it in early March. Sometimes we drill underground things if we can do that safely. But that'll be drilling out precious metal targets. The Kolba area, we need to permit, I would expect the Kolba area we're drilling early in the new year, because of low snowfalls there and we look forward to ongoing drill results, being reported to current and future shareholders, from next week onwards.

Dr. Allen Alper:

That sounds great. Could you tell us a little bit about your tungsten property?

Jason Beckton:

That property, Jasenie, we drilled in 2017 and 2019. There were some delays, due to COVID. However, we're back into a resource evaluation. The project is called Jasenie, which is gold tungsten, but also importantly antimony SB, which is another critical raw element for the EU. One of the prospects, within the Jasenie project, is called Kysla, where we do have a JORC tungsten gold resource. We would like to drill two more holes there, particularly focused on a high-grade gold skin, on the edge of the tungsten resource. There’s a very high-grade and there's a very high grade 2% antimony target, called Lomnista, in the southeast of the project, where we are trying to figure out the geometry of drilling it, because the drill road, at the moment, is in the footwall. We're just trying to work out the best angle of attack there. There's a very small lead-silver resource, which is pre-JORC, called Soviansko, we're evaluating that as well.

The reason we're not acquiring a lot more properties, and Kolba is our first new property, in three years, is because we are fairly spoiled for choice as it is. Other properties such as Rudno and Nova Bana are subject to rationalization, as we try to keep the target list under 80. However, Jasenie would be drilled, for example, in terms of competitive fuel targets, it would be subsequent to more drilling at Hodrusa-Hamre, Pukanec, Kolba and then Jasenie. So, you can see, we’re not short on drill targets, with the friendly investment environment.

Normally, when we plan a drill hole, within seven to eight weeks, we're drilling it. So, the permitting process is quite commercial. We find the Slovak government very easy to work with. Most of our Team is Slovak, I'm the only full-time foreigner and we have one part time geologist, who does the risk work, and a Board, based in Sydney.

Dr. Allen Alper:

Sounds very good. Could you tell our readers/investors, a little bit about your background, your Team and your Board?

Jason Beckton:

I'm an Economic Geologist, I first started work 30 years ago, in Western Australia, in production environments, underground, open pit as well. After completing a master's in 99, I worked in Mexico for Palmarejo Gold Corp., which was listed on the Toronto Exchange, working on the Palmarejo Project, a junior called Bolnisi Gold NL, and after that again working for a Toronto listed Company, called Exeter Resource Corporation in Chile, where we made the Caspiche discovery. Then started Public Company Directorship in 2007, with Chinalco Yunnan, before stints, with a private equity in Chile, CMR Capital and Redhill, and now finally commenced this role in 2015.

The Board I have worked with, since 2004, in various compositions, out of Sydney. They were in fact principals on the Board, including Peter Nightingale and Tom Mann, who were involved in the Palmarejo discovery as well, so we have a supportive technical Board. On the corporate side, they’re able to ensure the Company’s ongoing operations, with continued investment. We are obviously looking to diversify the Company's share register both in the Americas and in Europe. First things first, we have been preoccupied, with trying to generate better results, which we’re just turning the corner on now.

Dr. Allen Alper:

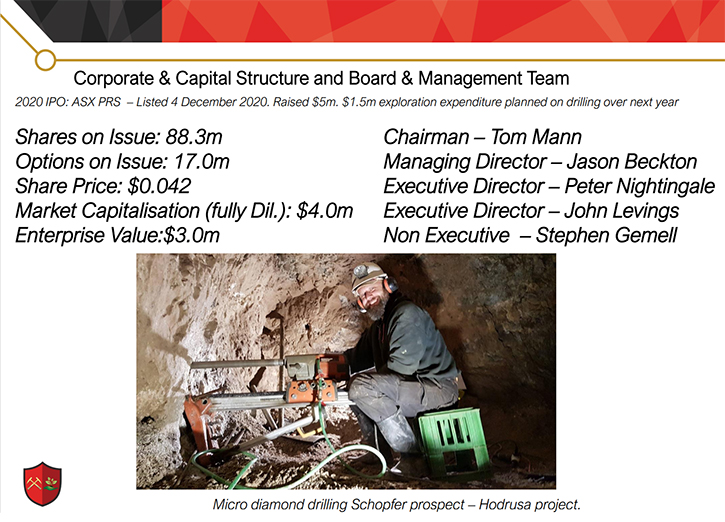

It sounds like you have a very experienced, diversified Team and Board, so that's very good. Jason, could you tell our readers/investors a little bit about share and capital structure?

Jason Beckton:

We have approximately 88 million shares on issue, with a share price currently three cents, so a market cap of about $3 million. We're what's called a Nano-Cap, I guess, at the moment. That's been a function of selling a European asset, on the Australian market. But also, we've had a few years of fair to middle true results. Basically, the share register is not one shareholder, it is more than 10%. We have significant Board ownership, including up to 7% to 9%, for most Board Members, and no direct selling in seven years. We obviously seek to diversify the register, with future issues, but there's no impediment to significant corporate investment, in the Company.

Dr. Allen Alper:

Well, that's very good. Could you tell our reader/investors the primary reasons they should consider investing in your Company?

Jason Beckton:

I guess the primary reason is that they've been doing this since 2004. In particular, we picked a style of deposit, which some of your readers and investors are aware of, epidermal gold. In Nevada, for example, we focus on that style of deposit, because they're very commercial, in terms of you don't need to build a complicated processing plant. Generally, they're shallow to underground systems.

But importantly, and this is a key point, if I remember one thing from a talk, which is what I'd normally do, the one thing to remember from our presentations is that we surround a producing mine, so we're not in an area where we hope one day there'll be mining and processing. Our main project surrounds an existing production facility, this modern processing plant. It's not ours, sadly, but we have surrounded it, and we work, with those people, in terms of their producers.

We're explorers. So that, I think, is a key future point, regarding our Company. Yes, we're developing resources and discoveries, but we also are applying modern exploration techniques, in a belt of epithermal rocks, where there's been minimal work completed, on a very large asset, of scale. And importantly, as in current modern production, with the taxpaying mine at the core of our main project, in Hodrusa.

Dr. Allen Alper:

Well, it sounds very good. It's great to be in, and have an interest in, an area where there's infrastructure and where there are people who know and appreciate mining. And to be close to operating facilities that may be used, at some point, for us to work with.

Jason Beckton:

Yeah, that's right. There's nothing signed at the moment. But obviously that is one of the attractions of why we got into the act, to start within 2015, when we farmed into the asset, was the fact that it is a producing belt and there's nothing new about people putting together mining permits and environmental permits and development. When I look at investment opportunity, you want to make sure, particularly with a small Company like ours, that things can’t go away. Also, it's not just exploration, in a remote area, that doesn't know what production is. That's one of the key filters for me on the asset and Prospech Limited.

Dr. Allen Alper:

That sounds excellent. By the way, I was a General Manager and a Vice President, and ran the largest tungsten powder plant in the Western world, making tungsten chemicals, APT and also tungsten powders and tungsten carbide. At some point, maybe my background would be of use to you in getting you connected to other tungsten people and also getting funds from tungsten people.

Jason Beckton:

Maybe, to start with, I'll send you our resource estimate of the tungsten deposit that we hold. Obviously, if you visit Europe, you're most welcome to visit the site. We're about a two-hour drive from Vienna, and it is quite simple to visit the project.

Dr. Allen Alper:

That's a beautiful area.

Jason Beckton:

Yeah. I do stress to people it's not tourism. We're there because of the endowment and the commercial support. However, yes, as you've probably detected, it's not a hardship assignment.

Dr. Allen Alper:

That's right. Well, I've been in that area. In fact, the company I worked for also has a powder plant in Czech Republic and I've been to Slovakia and Vienna. It's a wonderful area. The people are wonderful.

Jason Beckton:

Yeah. Unfortunately for me, even though I speak Spanish, I don't speak Slovak. Well, I'm learning it now. It's been 28 years now, since the end of the socialist regimes, though they're quite commercial and there's a lot of foreign investment. Recently, Volvo announced a multi-billion-dollar investment, in the east of the country and there are other foreign investment initiatives that have been completed recently, including Renault and Range Rover.

There's a lot of industrial investment, but less on the mining side. However, there are foreign entities such as U.S. Steel, up until recently aluminum smelter, they've turned off their kilns because of energy prices. But it's not a jurisdiction that foreigners have any difficulties with, you just follow the law. We’re protected by being in the EU. There's one point people may not be aware of, Slovakia is a fully integrated member of the EU, including EEC. And currently, in terms of geopolitical, they’re also a member of NATO, so you might as well be in France or Germany, it’s a fully integrated member.

Dr. Allen Alper:

That's great! Yes, that makes a big difference and I think that’s a great area to be in.

https://prospech.com.au/

Jason Beckton

Managing Director

Prospech Limited

+61 (0)438 888 612

info@prospech.com.au

|

|