Interview with Rob McEwen, Chief Owner and Chairman, McEwen Mining Inc. (NYSE: MUX, TSX: MUX): Discusses Outlook for Gold, Silver and Copper and his Goals for McEwen Mining

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 11/23/2022

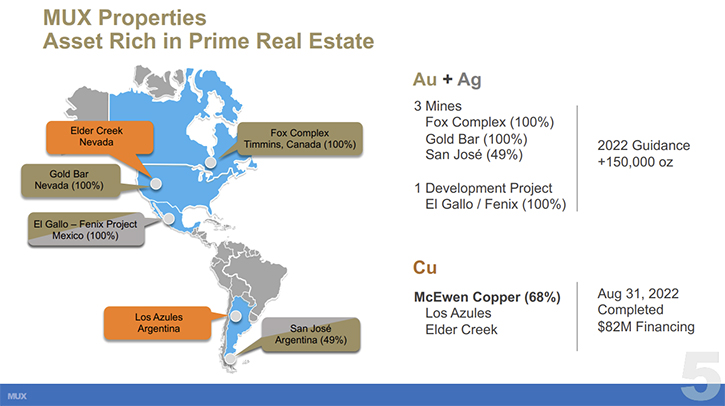

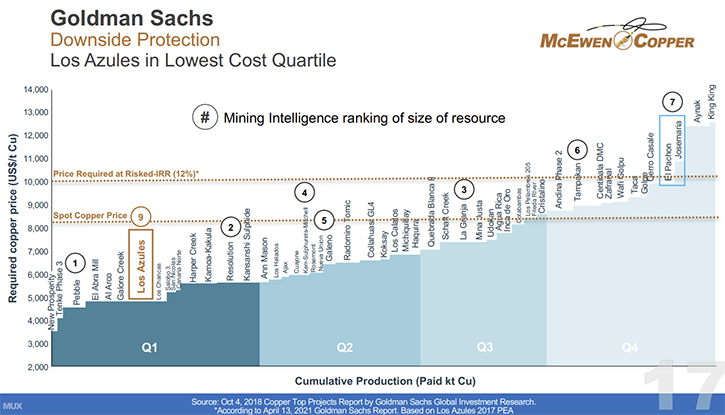

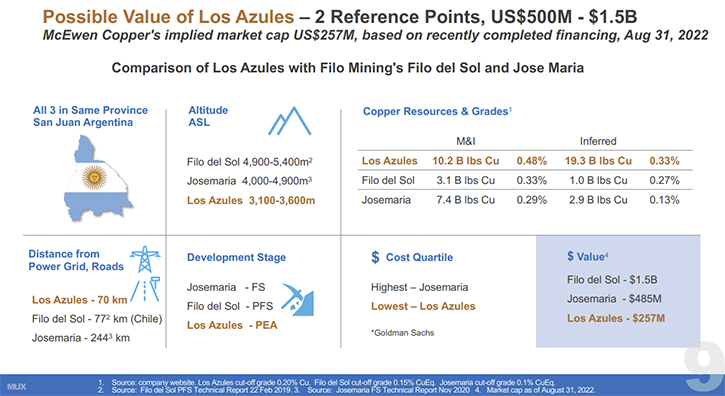

We spoke with Rob McEwen, Chief Owner and Chairman of McEwen Mining Inc. (NYSE: MUX, TSX: MUX), a diversified gold, silver producer and explorer, focused on the Americas, with operating mines in Nevada, Canada and Argentina. In addition, owning 68% of McEwen Copper, which owns a 100% of the Los Azules copper project, in San Juan Province, Argentina and it owns 100% of the Elder Creek project, in Nevada, USA. Los Azules is located in one of the most significant copper districts globally and is considered to be the 9th largest, undeveloped copper project, in the world. According to the project’s Preliminary Economic Assessment (PEA), completed in 2017, during the first 10 years of the 36 years of operations, the project is anticipated to be one of the world's larger copper producers, with costs in the lowest quartile. Near-term plans include further metallurgical, geotechnical & hydrology programs and drilling to support an updated PEA, to be released in Q1, 2023, in preparation for an IPO in Q2, 2023.

Picture of site – Los Azules

Dr. Allen Alper:

This is Dr. Allen Alper, Editor-in-Chief of Metals News, talking with Rob McEwen, Chairman and Chief Owner of McEwen Mining. Rob, I wonder if you could tell our readers/investors what you think about the outlook of gold, silver and copper?

Rob McEwen:

The recent strengthening of the dollar has led to a weakening of prices for gold, silver, copper and many other commodities. The strength of the dollar is due primarily to the combination of the Federal Reserve interest rate increases and the dollar’s status as the world’s reserve currency. How long will this dollar strength persist, is an important question for precious metal investors. I believe the weakness in the price of gold and silver will be short term in nature. Why, because we are midst an enormous global speculative bubble. This has been created by governments around the world, who have recklessly promoted massive monetary simulation that has released an unprecedented and huge tsunami of liquidity and they compounded this extremely dangerous situation by keeping interest rates abnormally low and even negative! When this bubble collapses, and it will, there will be an urgent scramble into precious metals. Now is a most opportune time to start buying or adding to existing positions in the precious metal equities and bullion, as the sector has been hard hit and prices are attractive.

Dr. Allen Alper:

Well, that sounds like good insight for our readers/investors. Could you tell our readers/investors, what is the vision for McEwen Mining? I know a lot of things have been going on and you've been entering into a lot of investments and co-operations, with other companies, so maybe you could kind of highlight what your vision is.

Rob McEwen:

My vision is to build a company that extracts precious and essential minerals, in an environmentally responsible manner, that ultimately generates positive free cash flow and pays a healthy dividend. Over the past 3 years our share price was slammed hard as our operations failed to deliver on guidance. The market essentially told us to get off the field and go sit on the bench. Today, we have resolved many of our challenges, but not all of them. Our treasury is thin, but we have been making progress improving our operating margins, most notably at our Fox Complex in Q3. Progress at our other operations will become evident next year. Our assets are in some of the most prolific mineralized areas in the world.

Dr. Allen Alper:

Could you tell our readers/investors some of the highlights of 2022 and some of your plans for the remainder of 2022 and 2023?

Rob McEwen:

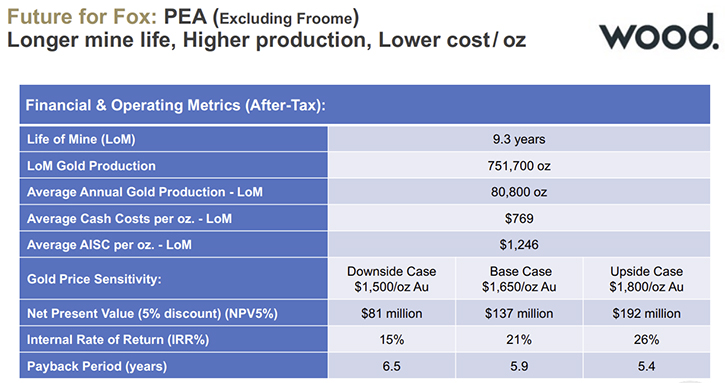

This year has been much better than the previous three! While we still have issues to resolve, such as increasing our treasury by producing more ounces at a lower cost, we can clearly see a brighter future. At the Fox Complex, where we have had a history of high operating cost/oz we are making good progress reducing our cost. I am pleased to say that in Q3 our cash cost/oz at Fox fell to $774, our lowest since mid-2018. This is well below the industry average. So, our mining operation is running well. Our attention is now focused on our next important area to improve at Fox, which is the process plant (mill). Specifically, we see considerable opportunity to boost our cash flow, by increasing the ore recovery rate and increasing the mill throughput, because our mine is now producing more ore than our mill can process. As a result, we have a large surface stockpile of ore equivalent to more than two months of production. The value of this stockpile is greater than $11million, which is far too much money tied up in inventory. The improvements to the mill will allow us to capture this value.

In Q1, 2022, we issued a Preliminary Economic Assessment (PEA), for extending the life of the Fox Complex, for at least another 9 years, of low cost /oz gold production. Our exploration focus has been to increase our estimated gold resources, to cut the payback period in half. The report was prepared by Wood Consulting.

At Gold Bar, we are looking forward to starting to mine our Gold Bar South (GBS) deposit this quarter. We are expecting to have a much lower cost/oz than our YTD cost, because we will be mining higher grade ore at GBS, with half the strip ratio and none of the problematic carbonaceous material that plagued us in H1, 2022.

In Mexico, we recently acquired a complete process plant on very advantageous terms that will help to reduce, significantly the projected capital requirements for our Fenix project. This acquisition has made Fenix more attractive to build and construction is expected to take 12 months to complete.

The San José mine, where we have a 49% interest, put in a strong quarter and its exploration is continuing to extend its high-grade silver and gold veins.

In July our shares outstanding underwent a 10 for 1 consolidation. This was an unfortunate, but necessary action done to protect our listing on the NYSE, which is our principal exchange and where our trading volume is the highest.

Production guidance for 2023 is 150,000 to 170,000 gold equivalent ounces (GEO).

Dr. Allen Alper:

That sounds very good. Could you give us more details about your recent agreement, with Kennecott Exploration, which is a subsidiary of Rio Tinto?

Rob McEwen:

Not only did we do one deal, with a subsidiary of Rio Tinto, but we recently completed two deals. Rio Tinto is the second largest mining company in the world. On August 31st we announced that we completed an $82 million financing, in a very tough equity market, and that Rio Tinto’s technology arm, Nuton Technology, was part of that financing and invested $25 million to owns 9.7% of McEwen Copper. Then on September 6th, we signed a deal with Kennecott Copper, the exploration arm of Rio Tinto. They have committed to spend $18 million on McEwen Copper’s Elder Creek project to earn a 60% interest in the property. The Elder Creek property is located at the north end of the Battle Mountain Cortez Trend in Nevada and situated amongst several large gold and copper mines, Marigold mine owned SSR Mining. The Phoenix and Lone Tree mines are owned by the Nevada Gold partnership of Barrick Gold and Newmont Mining.

In addition, Nuton Technology is testing McEwen Copper’s Los Azules’ ore, to see if their technology will both accelerate and increase the recovery rate of copper, above the typical rates in a heap leach operation. Los Azules is being designed as a heap leach operation rather than using a conventional processing plant. This way Los Azules will use far less water, eliminate the potential environment risk of a failed tailings facility, and require considerably less capital, power and have less carbon emissions.

Dr. Allen Alper:

That's excellent! So how do you look to that relationship proceeding with Rio Tinto?

Rob McEwen:

Rio Tinto has a very deep pool of mining expertise and technology. I am optimistic that we can learn much from them. I believe they were attracted to Los Azules because of its potential size and cost of production.

According to a 2022 Mining Intelligence study, Los Azules is one of the world’s largest undeveloped copper projects. And in a 2017 report by Goldman Sachs, Los Azules was shown to have projected operating costs/lb, based on the 2017 PEA, that places Los Azules in the lowest cost quartile, of the undeveloped copper projects globally.

Dr. Allen Alper:

Well, that's really great! It seems like you're very well positioned, and you have a great strategic partner. I think the outlook, for that project, looks very promising. Rob, could you tell our readers/investors why copper is so important?

Rob McEwen:

Absolutely. Copper appears destined to be the strategic metal of the future, for the energy transition from fossil fuels to electric vehicles. All the major automakers have been announcing their plans to dramatically shift a good portion of their production to making electric vehicles. As a result, there are many demand projections for copper, suggesting there will be a large deficit in the supply, which will drive the price of copper much higher. McEwen Copper’s Los Azules property has the potential to become an important producer of copper, providing a product that will help the world electrify transportation and combat climate change.

Dr. Allen Alper:

That sounds excellent. It sounds like Los Azules is in a great position, for development and supplying copper to the world. So that's excellent. Rob, could you summarize why our readers/investors should invest in McEwen Mining?

Rob McEwen:

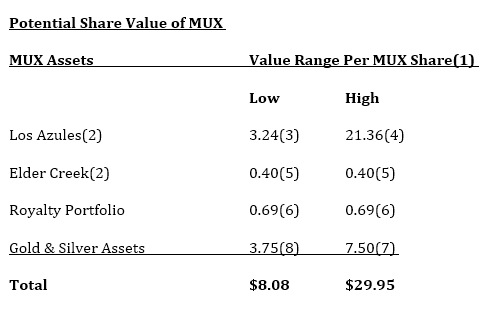

Yes. I think McEwen Mining is significantly undervalued. Based on current gold, silver, and copper prices, I believe our share value ranges from a low of $8 to a high of $30 per share. Value, like beauty, is frequently in the eye of the beholder. I am often asked what I think MUX is worth and I want to share my answer with you.

I have arrived at a high/low range of value for MUX, by adding up the sum of its parts. Here are the parts: MUX has a 68% interest in McEwen Copper, it owns 100% of three gold mines: Fox Complex, Gold Bar and El Gallo/Fenix, a 49% interest in the San José gold/silver mine, a portfolio of five royalties (NSRs) and a collection of exploration properties.

The operating challenges we have faced, in recent years, have severely damaged our credibility, with our shareholders and the market. As a result, few investors have taken a close look, recently, at our assets. If they did, I believe some would see the potential value that I see today. Yes, our cash is tight, our costs/oz are high, and our mine lives are currently short, but that has been changing for the better. So let me show you my math and how I had arrived at a possible value for MUX of $8 to $30/share.

In this valuation estimate I have compared Los Azules to two copper projects, Josemaria and Filo, that are in the same province, in Argentina, as Los Azules. Compared to Los Azules these projects are located at substantially higher elevations, are at a greater distance from critical infrastructure (highways and power grid), have a smaller published copper resource base and copper grade, and they have public market values. Josemaria was purchased for $485M in April and Filo Mining has a market capitalization of $1.6B. The low end of the range is based on 50% of Jose maria’s purchase price and high end on Filo’s market capitalization.

For the valuation estimate of MUX’s gold and silver mining interests, we compared the average Enterprise Value (EV) per GEO production, of five smaller producers. The low end of the range is based on 50% of their multiple and the high end at par, with their multiple. Please refer to the footnotes.

As you can see, I believe there is considerable potential value in MUX. It’s current share price of $3.66 reflects the low end of potential value of McEwen Copper and you get all the other assets for free.

Dr. Allen Alper:

That would be very good for them to look that over and understand and appreciate the possibility of investing in McEwen Mining. Rob, is there anything else you'd like to add?

Rob McEwen:

Yes, McEwen Mining is in a very fortunate position. Not only are we producing gold and silver, which I believe is heading much higher, due to the issues, of which I have already spoken, and we have a very large deposit of copper, a metal critical for the energy transition. Both of those elements are going to be very important in our future, to protect one’s wealth, and to continue to power our economy.

Dr. Allen Alper:

All those sound like very compelling reasons why readers/investors should invest in McEwen Mining. Is there anything else you'd like to say?

Rob McEwen:

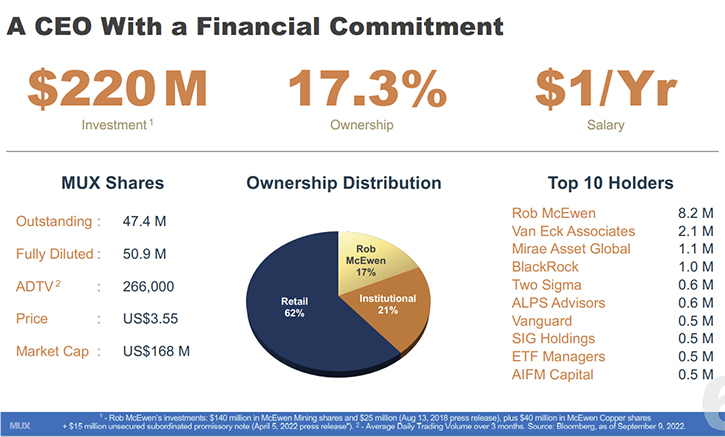

I'll close by saying I'm a big believer in MUX’s future, as illustrated by my large personal financial commitment of $220 million, invested in McEwen Mining and McEwen Copper.

Dr. Allen Alper:

Well, it's great to see someone so aligned with investors and someone who believes in their Company and are willing to have skin in the game and be totally committed to it. So that's great! Also, I'll remind our readers that you don't get paid at all for being the Chairman and Chief Owner of McEwen mine, I think it's a $1 or something like that.

Rob McEwen:

Yes, it’s $1/year. I have strived to align my financial interests with that of all my shareholders.

Dr. Allen Alper:

That's fantastic! Is there anything else, Rob?

Rob McEwen:

Just thank you for your continuing interest in our story.

https://mcewenmining.com/

Investor Relations:

(866)-441-0690 Toll-Free

(647)-258-0395

Mihaela Iancu ext. 320

info@mcewenmining.com

|

|