Interview with Gary Thompson, Chairman, CEO, President and P.Geo., Brixton Metals Corporation (TSX-V: BBB, OTCQB: BBBXF): A Huge District Scale Copper-Gold-Silver-Molybdenum Project in British Columbia

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 11/23/2022

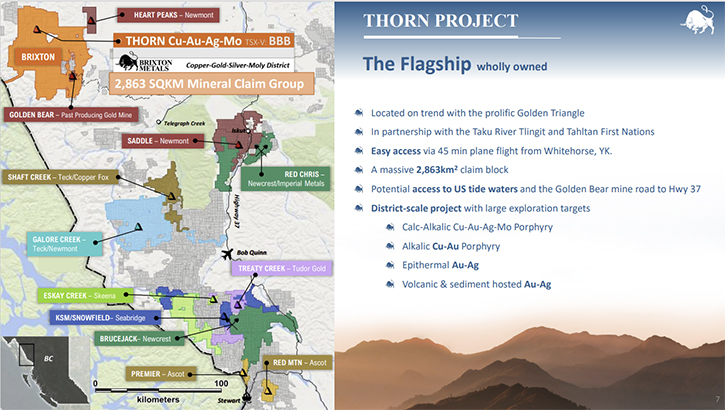

We spoke with Gary Thompson, Chairman, CEO and President, and Professional Geologist of Brixton Metals Corporation (TSX-V: BBB, OTCQB: BBBXF) a Canadian exploration Company, focused on their flagship, Thorn Copper-Gold-Silver-Molybdenum Project (a major porphyry district). The Company’s other project, which includes the Hog Heaven Silver-Gold-Copper Project, in NW Montana, USA (under option to Ivanhoe Electric Inc., NYSE: IE), the Atlin Goldfields Projects, located in NW BC, (under option to Pacific Bay Minerals Ltd., TSXV: PBM) and the Langis-HudBay Silver-Cobalt-Nickel Projects, in Ontario.

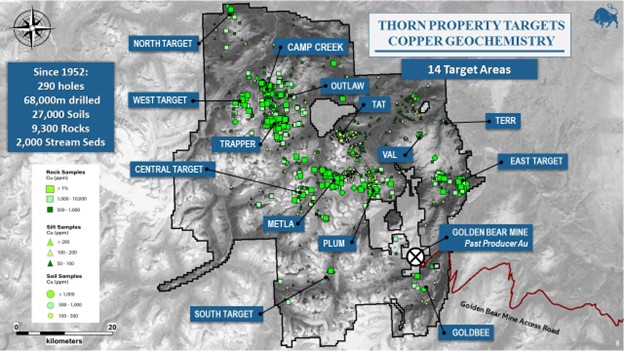

Brixton has recently secured a strategic investment from BHP Group Limited, with the goal of advancing the Thorn Project. The wholly owned, 2,863 square kilometer Thorn Project is located in Northwestern British Columbia, at the northern extension of the prolific Golden Triangle, Canada, approximately 90 km northeast of Juneau, AK, and about 50 km from tide water. Fourteen large-scale copper-gold targets have been identified on the project, to date, that warrant further exploration work.

Dr. Allen Alper:

This is Dr. Allen Alper, Editor-in-Chief of Metals News, talking with Gary Thompson, Chairman, CEO and President and Professional Geologist, of Brixton Metals. Gary, you had great news the other day, of BHP investing in your Company, a strategic investment. Could you give us an overview of your Company, what differentiates your Company and tell us a little bit more about the investment that BHP just made in your Company.

Gary Thompson: Brixton Metals is a junior exploration company, focused on copper, gold and silver. Our flagship project is called Thorn. It's, on a northwestern trend of the prolific, metal rich Golden Triangle of British Columbia. We've been working on this project since 2011. The last few years have been quite exciting because we've been having great success at the drill bit, and we have made several discoveries.

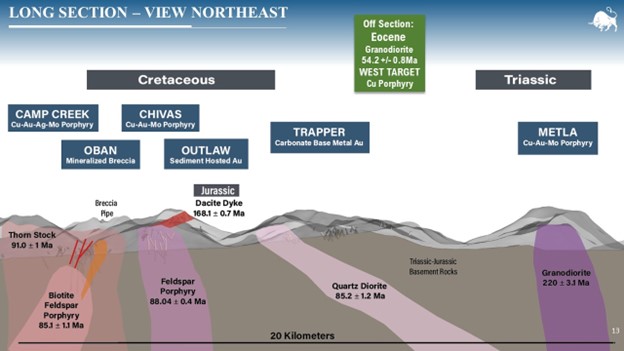

Since about 2018, The Thorn Project has grown dramatically into one of the largest mineral claim holdings, in the province of British Columbia, for any company. We've learned that the project is in an emerging porphyry district, with ages ranging from Eocene-Cretaceous-Jurassic-Triassic. We recognize that we have multiple porphyry centers. It is known that porphyries tend to form in clusters. What we've found are multiple mineralized events, over a long period of geologic time. We've identified 14 large target areas for copper and gold.

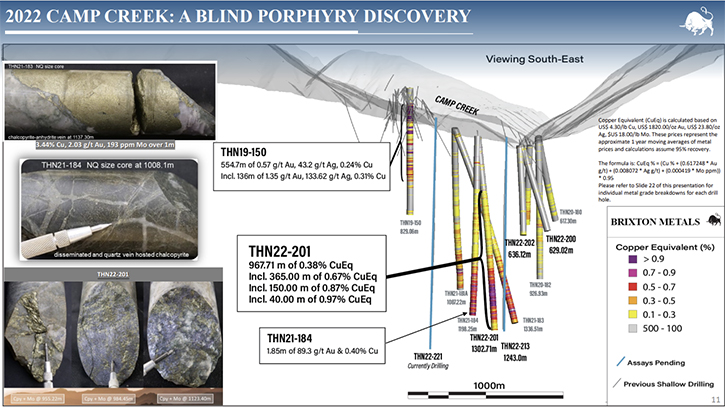

Some are more gold rich, like our Trapper Target, where we discovered visible gold. This year we drilled 64 meters of 5.7 grams of gold, within that, some higher-grade sub intervals of 29m of 10.5 g/t gold. We drilled about 18,000 meters, largely between the two targets. One is called the Camp Creek Porphyry, and it's a very large copper-gold-silver-moly porphyry target. It was actually a blind discovery, in that it doesn't crop out at surface, and it was only found through continuing to drill deeper.

Now we're into this large porphyry system that we have about a half a dozen holes in it now, with some of the holes, almost a kilometer of porphyry type mineralization. And so, we're quite excited about that and we're looking to advance on that, some more, next year.

Then the other target is the Trapper target, which is more of a gold dominant target. There are some base metals associated with the Trapper Gold, but it seems to be more a dominant gold, with a significant amount of visible gold, associated with these base metal veins.

This area, of Thorn, lit up as one of the highest ranking, largest porphyry anomalies, in the province of British Columbia. It was largely open ground in 2018, so we staked it through online staking, in addition to the ground that we had, originally. So, we expanded our claim holdings significantly and then acquired a couple of deals. Most recently the Trapper Gold Target, from Kodiak Copper, in 2020 and then the Metla Target, from Stuhini Exploration, in 2020, as well. So now we have this very large target area, with 14 target areas, that we've been working on.

This year is a pretty big year for Brixton, because we also had Crescat Capital take a significant ownership of the Company. Now there have about 14% of Brixton and recently we announced that BHP will be taking 19.9% of Brixton Metals, which equates to about $13-$14 million. Canadian.

Dr. Allen Alper:

That's fantastic. That's really great support, it shows you have a potential, a great project and a district scale project.

Gary Thompson:

Yeah, we're pretty excited. Lots of people have been asking us why BHP invested in Brixton? And I really think it goes to the copper potential of this area that we're on. It's really underexplored, so we continue to find new showings and on a regular basis we're really starting to expand on the data that we have so far.

Dr. Allen Alper:

Well, that sounds excellent. What are your plans going forward?

Gary Thompson:

Well, this year we can say we drilled about 18,000 meters. We ended with three drills on site. The goal is to continue to build momentum. Ideally, we have three, maybe four drills turning in 2023 and just continue to advance on these targets. We're still finding new showings. So, I'm sure we'll have some other large targets to talk about, in the future.

We had some really good success this year, on a relatively new target, called Metla, that we acquired in 2020. We were able to sample some high-grade copper and gold at surface that was never sampled before, because we were basically sampling it around the retreating glaciers, we're sampling material that was literally under ice a few years ago. So, we're excited about this target, from what we're seeing at surface, so that's going to get some attention in 2023, for sure.

Dr. Allen Alper:

Well, that's great. Gary, could you tell our readers/investors a little bit about your background, your Team and your Board?

Gary Thompson:

Sure. I'm a geologist by training. I guess I'm probably north of about 25 years in the resource space, mostly mineral exploration. But I also spent about five years in the oil patch, in unconventional gas. Prior to Brixton, I founded and built up a renewable power company, focused on geothermal development projects, in the US, which was acquired by one of our competitors in 2010 and then I Co-founded Brixton in 2010 with Cale Moodie.

Cale Moodie is a Chartered Accountant, he was the CFO of Underworld Resources that was acquired by Kinross in 2010, and we've been working together on this, since then. Rita Adiani is a Board Member, who brings a lot of M&A finance and has a legal background. Randall Thompson is a mine builder. He has lots of experience in building mines and operating them. Ian Ball is a Director, he recently sold his Company, Abitibi Royalties, Prior to that, he was working with Rob McEwen at McEwen Mining.

We have a solid Board of Directors. In Management, we’ve had some changes over the years. Most recently we brought in Christina Anstey, as a VP Exploration, and she spent five years working with Pretivm, running their exploration, on their Brucejack Mine. I give a lot of credit to Christina for building the geological team. We have a relatively young, hungry, discovery-driven team of geologists.

Dr. Allen Alper:

It sounds like you have a great Team and a great Board, and you yourself have an excellent background. Gary, could you tell our readers/investors a little bit about your share and capital structure?

Gary Thompson:

Sure. Currently, Pre-financing, we have about 300 million shares outstanding, recently trading around $0.19 Canadian. So, a pretty low market cap, I think, relative to our peers and for the potential of the project. We believe we're undervalued. This transaction, with BHP and Crescat, would put us at about 380 million shares outstanding and we are fully funded for 2023.

Dr. Allen Alper:

That sounds excellent. It's great to have such strong support, by such great companies. Gary, could you tell our readers/investors, what are the primary reasons they should consider investing in Brixton Metals?

Gary Thompson:

Yeah, I'd say the primary reason is that we are undervalued, and the Thorn Project is a new emerging copper-gold porphyry district. Now that it has been endorsed by the investment with BHP, I think investors can get in at a relatively low-cost entry point, on a project that we believe has major potential for multiple, large-scale, long-life mines, in a stable mining friendly jurisdiction, like Canada. With the push to a low carbon economy, the fundamentals for copper look strong, and I believe that Brixton can benefit from this.

Dr. Allen Alper:

Those sound-like excellent reasons for our readers/investors to consider investing in Brixton Metals. You have a great project, great support and financial support, great strategic partners and in our wonderful jurisdiction.

Gary Thompson:

Yeah, I would agree. We're very excited. I think we have a lot of opportunities in front of us. We have a lot of discoveries yet to make. We've already demonstrated that with some of the work we've done to date. I think we'll continue to surprise the market with the results that are yet to come from this project.

Dr. Allen Alper:

That sounds excellent! We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://brixtonmetals.com/

Mr. Gary R. Thompson, P.Geo., Chairman and CEO

Tel: 604-630-9707 or email: info@brixtonmetals.com

|

|