Interview with Kyle Floyd, CEO, Vox Royalty Corp. (NASDAQ: VOXR, TSXV: VOX): A data driven, returns focused, Royalty Company

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 10/30/2022

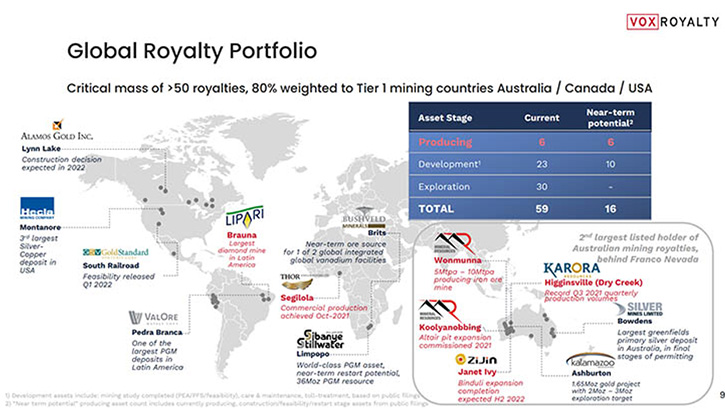

We spoke with Kyle Floyd, CEO of Vox Royalty Corp. (NASDAQ: VOXR, TSXV: VOX), a returns focused, mining royalty company established in 2014, with a portfolio of over 50 royalties and streams, spanning eight jurisdictions. Vox’s portfolio is predominantly weighted towards precious metals royalties, which make up over 70% of its portfolio weighting by NAV. In addition to the precious metals’ royalties, the Company has underlying exposure to a more diverse array of commodities, including base and battery metals and certain bulk commodities. Vox's portfolio spans four continents, but is heavily weighted to Australia and North America, where >80% of their assets are located. Vox has both immediate cash-flowing royalties, generating recurring revenue and royalties, over several long-life, economically robust development-stage assets, with great operating counterparties. Since the beginning of 2020, Vox has announced over 20 separate transactions, to acquire over 50 royalties.

Dr. Allen Alper:

This is Dr. Allen Alper, Editor-in-Chief of Metals News, talking with Kyle Floyd, CEO of Vox Royalty Corp. Kyle, could you give our readers/investors an overview of your Company and what differentiates it from others? Also, could you highlight what has taken place since we talked last September?

Kyle Floyd:

Absolutely. As a refresher, Vox is a specialist buyer of third-party royalties, all around the globe. We are underpinned by the most significant intellectual property in the industry, a technical deal-sourcing Team at the front lines of our business, and a transaction validation cycle that really hasn't been seen in the industry for decades, in terms of our ability to secure value for our investors in what's become an incredibly competitive industry for our peers.

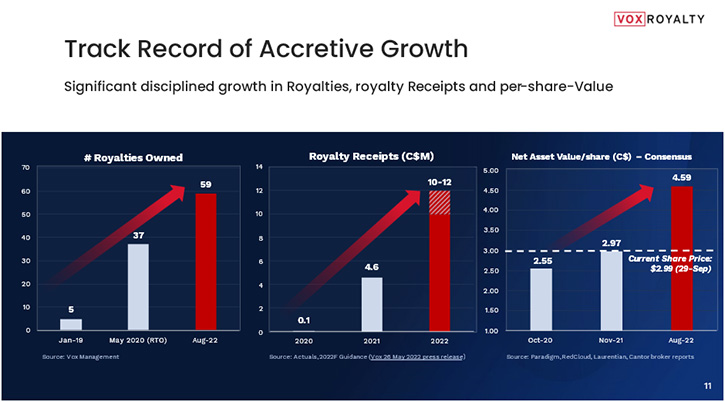

Vox was founded back in 2014. That has allowed us to both develop the intellectual property that I've spoken about, and the expertise, in terms of sourcing and securing royalties, at a very good value for our investors. Since we talked last September, it has been a tremendous period of growth for Vox. We had raised our 2021 revenue guidance from C$1.7 to C$2.5 million to approximately C$4 to C$5 million in July 2021. In 2022, we've more than doubled our upgraded 2021 revenue guidance, expecting between C$10 and C$12 million top line from royalty revenue receipts.

It has been a very successful growth cycle for Vox, most of that driven by organic productivity of our assets. That's from royalties that we've acquired pre-production, then transitioned into production – significantly growing our revenue and resources under royalty.

Dr. Allen Alper:

That's excellent. Could you tell our readers/investors a little bit more about your portfolio?

Kyle Floyd:

We are a value focused Company, in terms of the royalties that we secure, primarily driven by expected returns, over the near and medium term, while maintaining long term upside and positive optionality. From a NAV perspective, we remain weighted towards precious metals. That being said, we've developed an interesting and very robust portfolio, across the hard rock commodity spectrum, from iron ore to silver to copper and vanadium. We've developed tremendous diversification in our portfolio, which is certainly benefiting investors, in this period of time, and it's highlighted by a few key assets. One of our assets that I'm really excited about right now, is the Janet Ivy gold royalty that we acquired in March 2021. We acquired that royalty because it had the prospects of becoming part of the largest heap leach project in all of Australia.

Since we last spoke, the operator, Zijin Mining, has invested $283 million, to date, into the Binduli North heap leach expansion project, which covers our Janey Ivy gold royalty. They are starting to stack ore and that's a significant milestone for Vox and our shareholders. It's an incredibly significant project, and a huge milestone for us. It's one of the exciting royalties, from which we expect to drive value for our shareholders, for approximately a decade, maybe more.

We also acquired the Wonmunna iron ore royalty that is over the producing Wonmunna iron ore mine, operated by Mineral Resources, with an $11 billion market cap, which was a tremendous acquisition for Vox. It's added a significant amount of cash flow for the Company, and it was acquired at a great value. We also have another five producing royalties that are continuing to drive value for our shareholders. I'll tell you our new asset acquisition pipeline is something that I'm very excited about, as well.

Dr. Allen Alper:

Well, that's great. Could you tell me some more about the royalties you have?

Kyle Floyd:

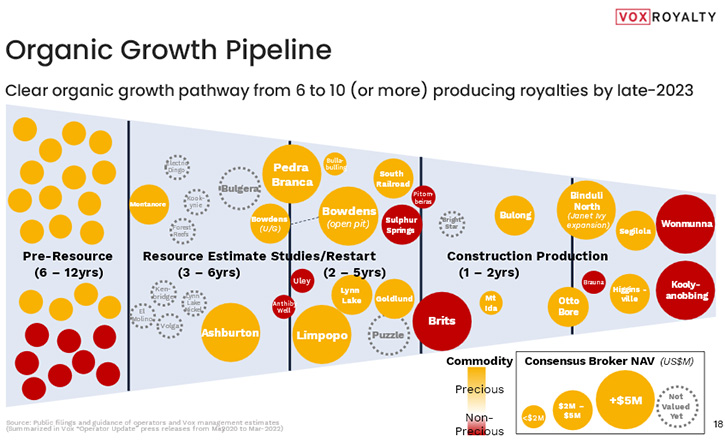

We're closing in now on 60 royalties, so in a little over two years we've almost doubled the size of our portfolio. We've gone from what was one producing asset that we sold a year ago, to now having seven producing assets, and we expect the producing asset count to increase to double digits, as we exit 2023. We have a couple of assets that we expect to come online, over the remainder of this year and into early next year: i) the Otto Bore Gold Project, operated by Northern Star Resources, and ii) the Bulong Gold Project, operated by Black Cat Syndicate. Both of these projects are located in Western Australia. And we’re expecting a handful of additional royalties to come into production, towards the back half of 2023.

We've just recently received notification that Otto Bore is in production, so we're excited about the profile of the business and the growth cycle that we're in right now. Ultimately, in a royalty model, the most tangible form of success is when the royalties go from pre-production to production. There's a re-rating that occurs, in terms of the value of those royalties. We have the ability to secure royalties two to three years out from production and our mining engineers and technical Team really understand the risks, the returns, and the technical details of those deposits. Being able to accurately project the development of these assets has really allowed us to find deep value for our shareholders.

Moving from seven producing royalty assets to a double-digit producing royalty asset count is incredibly significant. Investors are seeing that in the royalty revenue numbers that we've put forth, in terms of our expectations, for the rest of this year, from where they were in 2021, as mentioned, we more than doubled our revenue guidance in 2021, and are expecting more than double 2021 revenue guidance for 2022.

Dr. Allen Alper:

That sounds fantastic. You’ve made amazing progress in a rather short time. Could you explain to our readers/investors the difference between a royalty company versus a mining company, as far as an investment?

Kyle Floyd:

Absolutely Al. The way to look at a mining company, from the Vox perspective, is that they're our best friend. The mining companies are out there doing the hard, capital-intensive work in a lot of instances. They are the operator of the mine, they're in charge of all of the tasks and duties to both develop and maintain production from operations.

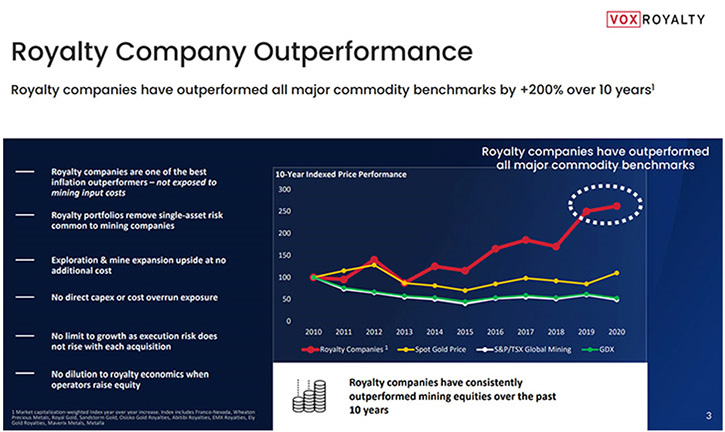

What we do is we look for third parties that own royalties over these projects. So, these royalty holders are entitled to a percentage of the revenue, typically in the range of 1% to 3%. We take a percentage of the revenue that's generated. It's especially important for your readers to understand, in this heavy inflationary backdrop, that we find royalty companies, especially a company like Vox, extremely well positioned because that top line revenue interest is not affected by the inflationary cost input pressures that miners are realizing.

The revenue and the operating profit that we're generating is not afflicted by the higher mining costs that most mining companies are realizing. In most inflationary cycles, not only have royalty companies done very well, but commodities have also done very well. And so, if you can leverage the increase in commodity prices, without the potential negative inflationary cost input pressures, like Vox does, I believe that positions investors very well, in the current economic backdrop.

Dr. Allen Alper:

Well, that's excellent! Could you tell our readers/investors about your share and capital structure?

Kyle Floyd: Vox represents a simple, streamlined capital structure. We have approximately 44.5 million shares outstanding, approximately 8.7 million warrants that strike at C$4.50 per share, no debt, and approximately C$7 million of current assets on hand, primarily consisting of cash and accounts receivable, as per our most recently completed June 30, 2022, quarter. We continue to build cash in this business. So, it’s a very simple capital structure and one that we believe is very well positioned.

Dr. Allen Alper:

From what I understand, Management has a stake in the game and is in line with investors. Can you tell us about that?

Kyle Floyd: Vox’s Management owns approximately 15% of the shares outstanding. This is hugely differentiated, versus many of our peers in the royalty space, which own proportionately much smaller stakes in their businesses. This allows us to be very well aligned with our shareholders. It has us motivated to seek value and to make sure that the return on investment and return on invested capital that we're generating truly delivers value in excess of what our cost of capital is.

Dr. Allen Alper:

It's excellent to see that Management has skin in the game. Kyle, could you tell our readers/investors a little bit about yourself and your Team?

Kyle Floyd:

I think it's been pretty well documented, in previous interviews, but I founded the Company, back in 2014, however, I actually started building it in late 2012. We, as a Team, have overseen more than $1.5 billion of royalty transactions, making us one of the most experienced Teams in the entire industry. It's a very technical Team in terms of composition.

Spencer Cole, our Chief Investment Officer, is a mining engineer and certainly one of the more influential people in the royalty industry. Simon Cooper, our VP Corporate Development, has been with us for a very long time. He’s both a mining engineer and a geologist. He has worked on a plethora of projects, all around the world, in diverse jurisdictions and with various diverse mine types. So, he's a wealth of technical capabilities and experience for us.

Riaan Esterhuizen is our Executive VP of Australia, a renowned geologist that's worked with the Who's Who of majors, in Greenfields exploration campaigns. He heads up our Australian efforts. Then we have a very deep Team, from a structural transaction diligence and processing standpoint. Our CFO, Pascal Attard, is terrific. And also, Adrian Cochrane, our General Counsel, all help to support the deal engine and the value engine, that Vox is.

Dr. Allen Alper:

Well, that is excellent! You and your Team are very experienced and very accomplished. That's excellent! Kyle, could you tell our readers/investors, the primary reasons that they should consider investing in Vox Royalty?

Kyle Floyd: Vox Royalty Corp. continues to create value in a very competitive industry. While many companies in the royalty space are investing capital, realizing a negative return, Vox continues to validate and demonstrate its ability, in terms of generating a return on invested capital. We have a tremendous number of catalysts in front of us. This is probably one of the more catalyst rich periods of time that we're entering, for Vox and our shareholders.

We've been very disciplined about building the portfolio, with assets that we believe will come into production in the near term. We now have seven in production, right now, and in the current portfolio, potentially an additional ten that can come into production, over the next few years. We're expecting double digit royalties, in production, as we exit 2023. So, it's a very exciting growth cycle, at the moment, for Vox. We have a very deep pipeline of opportunities as well, that we believe will eventually be secured at very good valuations for our shareholders.

We are also building cash now. The business has transformed, in terms of what we're generating, and what that means for potential returns of capital to investors. We have been active on our buyback, which is one form of capital return to investors, as well as recently announcing the initiation of an inaugural quarterly dividend policy. A dividend of US$0.01 per common share will be paid in the fourth quarter of 2022 and represents an approximate 1.8% yield on an annualized basis. The launch of a quarterly dividend is a major milestone for Vox shareholders.

And lastly, we have recently commenced trading on the NASDAQ. With that, we expect enhanced trading liquidity in the US market, along with the investor market exposure that goes alongside that. We're extremely excited about the upcoming quarters for Vox. It's a very catalyst-rich period of time for us and we believe there's a lot of value that's going to be surfacing throughout the portfolio.

Dr. Allen Alper:

Those are very compelling reasons why we, as investors, should consider investing in Vox. Kyle, is there anything else you'd like to add?

Kyle Floyd:

No, I think we covered it all. Greatly appreciate the opportunity to be with your readership and we're excited about what's in front of Vox, for our investors. As always, you can email us at ir@voxroyalty.com to get in touch with us and ask any additional questions that develop.

Dr. Allen Alper:

That sounds excellent! We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://voxroyalty.com/

Kyle Floyd

Chief Executive Officer

ir@voxroyalty.com

This article was sponsored by Vox Royalty Corp. and written by the metalsnews.com. This article is provided for general information purposes only and does not constitute investment advice or an offer to buy any securities within the United States (as defined in Regulation S under the United States Securities Act of 1933, as amended). In making any investment decision, investors must rely on their own examination of a company, including the merits and risks involved. Graphics and the source material referenced therein are sourced from the Vox Royalty Corp. investor presentation available at https://voxroyalty.com/investors/presentation/ (the “Presentation”). This article contains management estimates and forward-looking information, including but not limited to statements related to future revenues of Vox and the timing and number of producing royalties held and to be held by Vox – readers should review the disclaimer contained at the beginning of the Presentation to review the risk factors related to such forward-looking information.

|

|