Dr. Dave R. Webb, President and CEO, Sixty North Gold Mining, Ltd. Discusses High-Grade Gold Mining: Restarting a Past Producing Gold Mine within the Prolific Yellowknife Gold Camp, NWT

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 10/30/2022

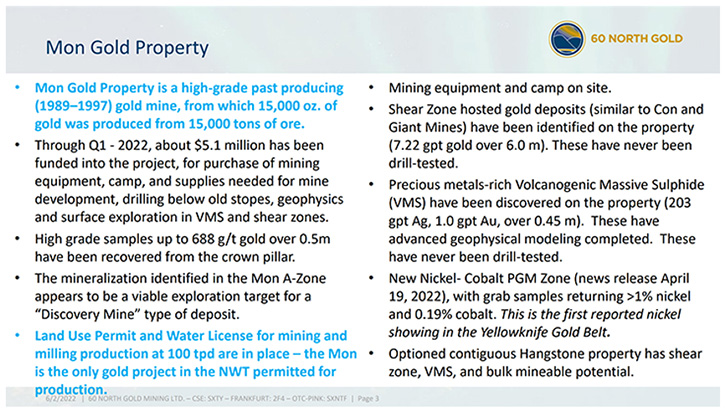

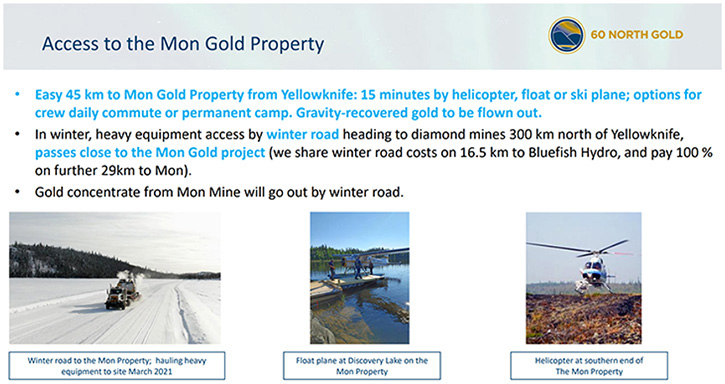

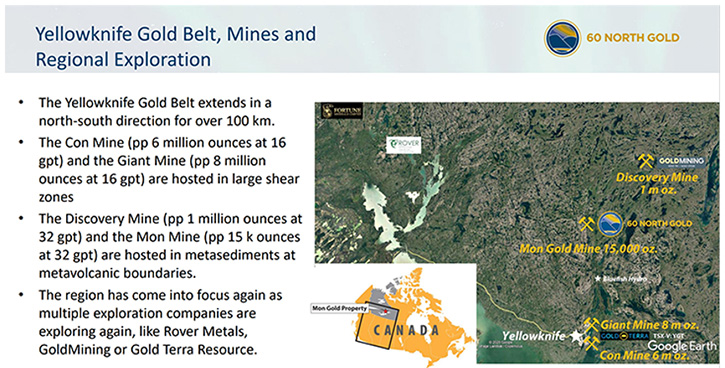

We spoke with Dr. Dave R. Webb, President and CEO of Sixty North Gold Mining, Ltd. (CSE: SXTY, FKT: 2F4, OTC-Pink: SXNTF), who are focused on restarting the high-grade, past producing, Mon Mine, 40 km north of Yellowknife, NWT, within the prolific Yellowknife Gold Camp. The Mon Mine produced 15,000 ounces of gold, from 15,000 tonnes of ore, between 1989 and 1997. Permits to explore, mine and mill, at 100 tpd, are in place, and the Mon Mine is the only gold project permitted for production, in the NWT. Sixty North Gold is expecting to commence its mill and mine operations in Q2 2023. It expects the first cash receipts, from gravity gold sales, to come in Q3 2023. Other targets on the property include recently discovered silver-and gold-rich VMS targets, as well as the giant shear zone-hosted gold mineralization. Recently, the Company made an unexpected, brand-new, high-grade, Nickel-Cobalt-PGM discovery, on the property, which is the first reported nickel showing in the Yellowknife Gold Belt.

Sixty North Gold Mining: Supplies delivered to site in 2022, with A-Zone in background

Dr. Allen Alper:

This is Dr. Allen Alper, Editor-in-Chief of Metals News, talking with Dr. Dave R. Webb, President and CEO of Sixty North Gold Mining, Ltd. Dave is also a professional geologist and a very accomplished, well-known exploration geologist. Dave, could you give our readers/investors an overview of your Company and what differentiates it from others? Also, could you give us an update on what's happening at Yellowknife.

Dr. Dave Webb:

It is an interesting time in the markets and Sixty North Gold Mining Ltd. was created to move forward the Mon Gold Project, in the Northwest Territories. The Mon Project is a past producing gold mine. In the 1990s, it produced 15,000 tons, through a small mill on site, and recovered one ounce per ton of material. It's a very high grade, which is not unusual for the Yellowknife greenstone belt.

To the north of us is the Discovery Mine. It produced from 1949 to 1969, 1 million tons, of one ounce per ton material. The Con and Giant Mines, to the south of us, cumulatively produced 14 million ounces of gold, at a grade of half an ounce per ton. It is better to look for a high-grade gold mine, in a belt that's produced, at an average, over half an ounce of gold per ton.

The first thing we did is a little unusual. We acquired all of our permits to operate, to put in a mine, to put in a mill. It's a little unusual in that we had no ore. Because that's a sticking point for many operations, I felt it was worthwhile to talk to the local first nations and the regulators to make sure that we could put a mine and mill in there. After investing many millions of dollars, in finding out that you can't, seemed counterintuitive.

We had the permits for the mine and mill, basically the way we had in the 1990s and we moved forward on that. Getting a good crew together that can actually extend the ramp, below the old stopes. And to put it in perspective, the Discovery Mine mined from surface down to 1,200 meters below surface. The Con Mine started from surface outcropping mineralization down to 1.9 kilometers depth.

On the Mon Property, our mine here started from surface and went down 15 meters. That's all. It shut down in the ‘90s because gold went very low in price; it actually hit $256 an ounce. I would say that virtually no mine in Canada was making a profit at that time. This mine, being a small one, the financial group wanted out. They felt that clearly the price of gold is going down and it's never going to go up again. A bad time to leave a mine, but here we are today, substantially better positioned. We know what our mining costs are, and we have the same crews together that can do this.

Dr. Allen Alper:

That sounds great. Could you tell us a little bit more about the mine and the project? Also, what you have achieved to date and what your plans are?

Dr. Dave Webb:

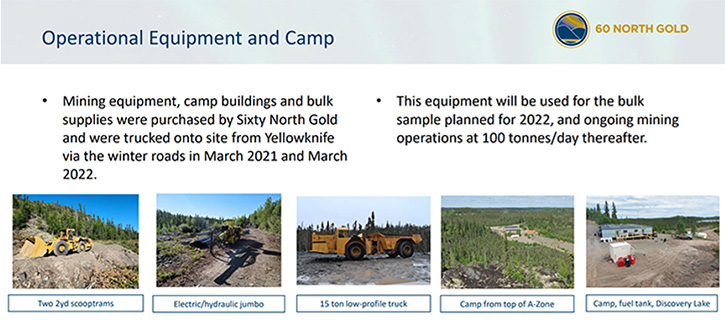

We spent much of the last while getting all the equipment assembled. In 2021, we brought everything up onto the property, including fuel and explosives. Unfortunately, we got COVIDed, so it was a difficult time. It took forever for the assays to come back. But we did manage to extend our ramp, slash it out and get it down to 17 meters below the old stopes. We have more rock above us than they ever had in the past, in their mining operations.

We also managed to develop the infrastructure on site, so the camp is fully operational, the compressors, pumps, water systems, everything is set. The plan is, next year, to bring the crew in. We intend to drive the ramp another 70 meters, to get below drill holes of 61 grams of gold per ton, over 1.7 meters, 15 grams over 1.7 meters, 45 grams over three meters.

These are all wonderful drill holes to have above you, knowing that you're going to be stoping through these areas. That's our plan, start the mining operation, develop the stopes, bring tonnage up to surface to demonstrate to our shareholders that this is a real project, and the rock is there. Even if we only had 2000 tons, of one ounce gold per ton material, up on surface, that represents $4 million worth of recoverable gold to us.

Dr. Allen Alper:

Well, it sounds like it's a great opportunity! It sounds like it's a huge opportunity for exploration and development.

Dr. Dave Webb:

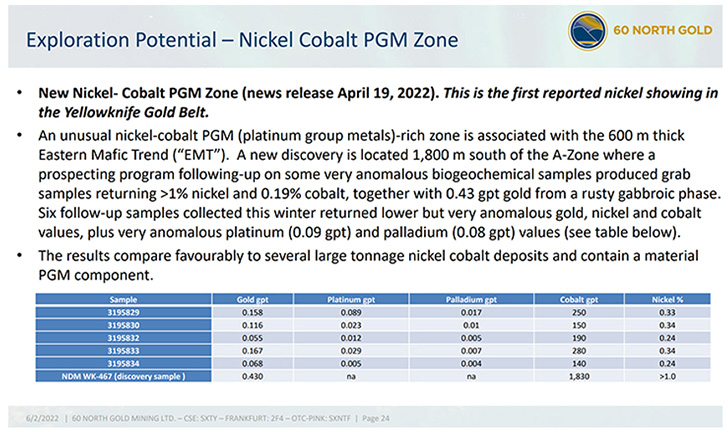

Yeah, we're not leaving the exploration side away, it's just not our focus. We have crews there. We don't need a geologist in the mine 24 hours a day, it's really just an hour a day to make sure that we're on track and focused. Last month, we announced that we had done a geochemical survey and one of the Trends that we had sampled came up with a very high cobalt value. We use cobalt as a pathfinder element, looking for the gold deposit. We thought we would probably have a really nice gold showing, in the area.

We sent the prospectors out to sample in the area, and they came back with one sample, and they said, “Oh, very rusty gabbro, looks like it has some potential.” We ran that and unfortunately it only came back half a gram gold. Fortunately, we ran a full ICP analysis on it, which came back, over limits, on nickel, so it was greater than 1% nickel and almost 0.2% cobalt, which is a remarkable discovery, the first ever, of this type, in the Yellowknife belt.

When we look at the airborne geophysics and the size of the anomaly, we're very excited about the potential of this, just as an adjunct, something we can add to our mining venture.

Dr. Allen Alper:

Sounds excellent! Cobalt and nickel are crucial in electric vehicles, and there's great demand for that.

Dr. Dave Webb:

Further work, including consultations with experts in the field, has identified this deposit as an IOCG, or Iron Oxide Copper Gold deposit. This is a class of deposit that includes the 9 billion tonne Olympic Dam deposit, as well as the 200 million tonne Prominent Hill deposit and the nearby 33 million tonne Nico Deposit. We have a very sharp prospector, who managed to chisel out the sample, initiating this discovery, but our airborne survey shows the target zone to be over 3.2 km long and over 500 m wide. Follow-up work confirms very elevated Rare Earth Elements and Phosphorus helped confirm the target type.

Dr. Allen Alper:

That sounds very good. Maybe you could share a little bit about the geology in that area, for our readers/investors, to give them a better understanding of the geology and the potential.

Dr. Dave Webb:

Yellowknife is centered in an Archean terrain, so it's the same kind of rock as you'd find in Red Lake or Timmins or Val d'Or or Kirkland Lake. It's very old rock. It's really home for most of the vein, high grade, gold deposits in Canada. Because we have the Giant and the Con and the Discovery mines, as analogies, this too has these kinds of deposits. It's a mixture of mafic volcanic rocks, so rocks that you might find spewing out, in the middle of an ocean, and the similar sedimentary rocks that go with them.

Sandstones, greywacke, archerite, things like that. The big mines in Yellowknife are all hosted in shear zones. There are large structures, where there's a break in the earth, and all sorts of hydrothermal fluids come bubbling up there, depositing all kinds of things, including gold. The Discovery Mine, at the north end, is a more discrete, single quartz vein system that's in a folded series of rocks. It's not like the Acadian or the Nova Scotian gold deposits, because it doesn't follow the bedding of the rocks, it is in structures that crosscut the rocks. The Mon Property is the same.

Dr. Allen Alper:

That sounds very good. Could you tell our readers/investors a little bit about yourself and your Team?

Dr. Dave Webb:

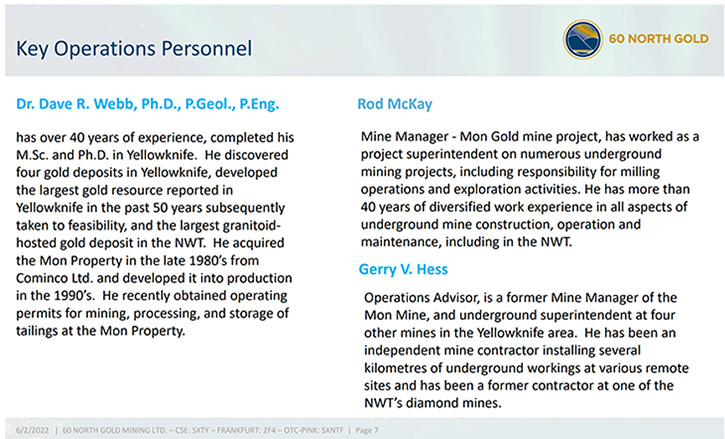

I do have a Master's Degree and a Ph.D. in these topics that were centered in Yellowknife. My Ph.D., when I finished my Master's, I thought, man, this is a really rich gold belt. My Ph.D. was focusing on how you can figure out where these things occur. So, I completed that back in the ‘90s, but I've managed to go on to stake and develop other properties. We brought up over 2 million ounces of gold. These other projects, in the Yellowknife Belt, include the largest granite-hosted gold deposit, in the Northwest Territories. I discovered that back in the ‘80s, while I was still at school.

We developed the Yellowknife Gold Project, under Tyhee Gold. That was over 2 million ounces, in three different deposits. I did some work for Fortune Minerals, and we discovered this project, called NICO, had been staked, by a Director of the Company, so they needed an independent review, as all 43-101 deposits are treated. I was the independent geologist, to come in and co-author a report, recommending that Fortune Minerals acquire the NICO project. It was an exceptionally large cobalt-bismuth-gold deposit of the IOCG-clan and is today, permitted for development.

The balance of my crew are miners. Gerry Hess, who is a partner of mine, in New Discovery Mines, which had co-owned the property. He put the mine into production, with me, back in the 1990s, and he was the Mine Manager then. Rod McKay was the assistant Mine Manager of the Tyhee development, the Ormsby Project in Yellowknife, and a very capable and experienced miner. With the crews that he attracts, through his other projects, he has brought a very experienced crew. We don't have miners, with one or five or 10 years of experience. They come in with 20 or 30 years of experience, very safety conscious, they just know how to do things right.

Dr. Allen Alper:

That sounds excellent. Sounds like you have a great, experienced Team and very knowledgeable. That's very good! Could you tell our readers/investors a little bit about the share and capital structure?

Dr. Dave Webb:

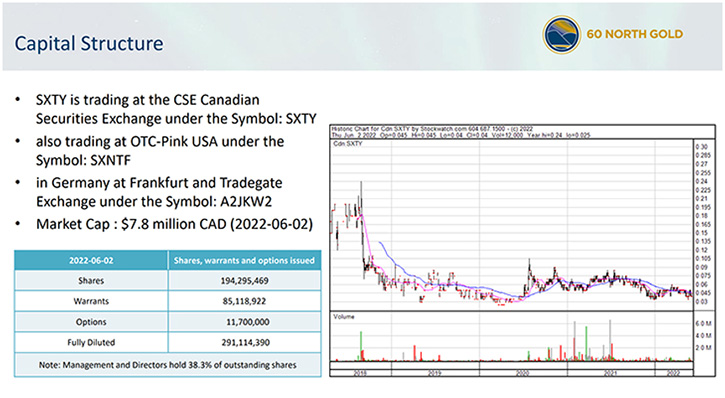

We have just under 200 million shares, issued and outstanding. We have about 85 million warrants outstanding. They're all out of the money right now, as most junior companies are experiencing. So, our warrants are exercisable between 7.5 and 10 cents a share and that would bring just over $7.5 million into the Treasury. It’s a very opportune time, for those warrant holders, because our mining, now that the program that we're going to be instigating, is really just 60 days of operations, to get down and start opening up the vein, in these very high-grade areas. I presume that getting lots of high-grade gold-bearing rock, up on surface, is a good thing and the market should reflect that.

Dr. Allen Alper:

Sounds like this year will be a very exciting time for Sixty North Gold.

Dr. Dave Webb:

Yeah, we really like the project. I think it's important to know that Directors, insiders, Management, own over 38% of the stock. We have a couple other large shareholders, who we've been working with, or at least listening to their input, very seriously, as we move the project forward.

Dr. Allen Alper:

Well, it's great to see that the Management and Board is aligned with Shareholders. That's excellent! Dave, could you tell our readers/investors the primary reasons they should consider investing in Sixty North Gold Mining?

Dr. Dave Webb:

I think the key is investors are of many types, some like gold, some like exploration. We're offering a low-price entry into a brand-new gold producer. We've opted to go after the high-grade deposits, recognizing that gold prices do go up and they do go down. It's very nerve wracking, when you're running a .5 or .6 gram per ton heap leach and gold price drops a couple hundred dollars and you're close to your operating costs. With Sixty North, by keeping our grades in the 30 gram per ton range, we do know that typical mining costs, in these narrow shrinkage stopes, can be anywhere from $100 to $200 a ton, typically.

We know that metal milling costs can range anywhere from $30 to $50 or $60 per ton, in this kind of operation. We know what development costs are. We developed about, 17,000 tons of vein material last year, at a cost of $68 per ton. So, these costs are known and I'm giving you ranges because 43-101 requires certain standards to be met and because we do not have a feasibility study on it, I can't give you exact num¬bers, but I can give ranges that are comparable, that people can look up and confirm, with other miners. I think when you see that, wow, you mean your total cost might be $400 or $500 or $600 a ton or per ounce. It doesn't matter if gold is $1,800 an ounce or $1,700 or $1,600 or $2,000. It just means that we'll be profitable under quite a number of circumstances, should those cost structures hold up.

Dr. Allen Alper:

That sounds excellent. I would say those are very compelling reasons to consider investing in Sixty North Gold Mining. Anything else you'd like to add?

Dr. Dave Webb:

No, I think, for the many decades we have behind us, Allen, you approach this right. You know the questions to ask, you know what the readers want to know. So, well covered! We do have other exploration targets on the property, but they're minor, compared to being able to produce at this Mon gold mine. The A zone is the super high-grade one that will be the moneymaker.

Dr. Allen Alper:

That sounds excellent! We will publish your press releases, as they come out, so our readers/investors can follow your progress.

https://www.sixtynorthgold.com/

David Webb,

President & Chief Executive Officer

604-818-1400

dave@drwgcl.com

|

|