Colin Moorhead, Executive Chairman and MD, Xanadu Mines (ASX: XAM, TSX: XAM), Discusses Their Gold-rich Copper Exploration in Mongolia and Its Potential as One of the Last Great Copper Frontiers

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 10/27/2022

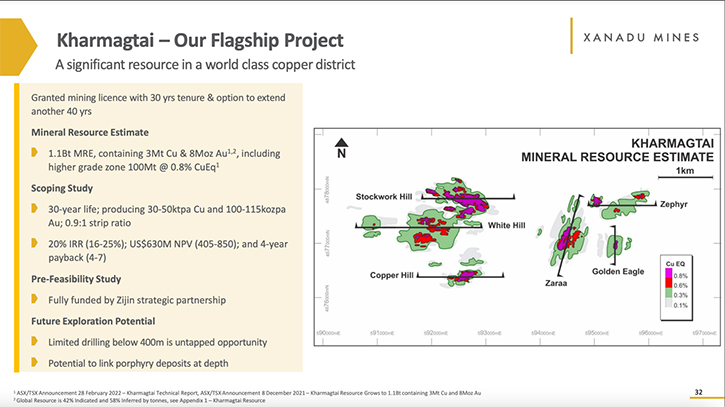

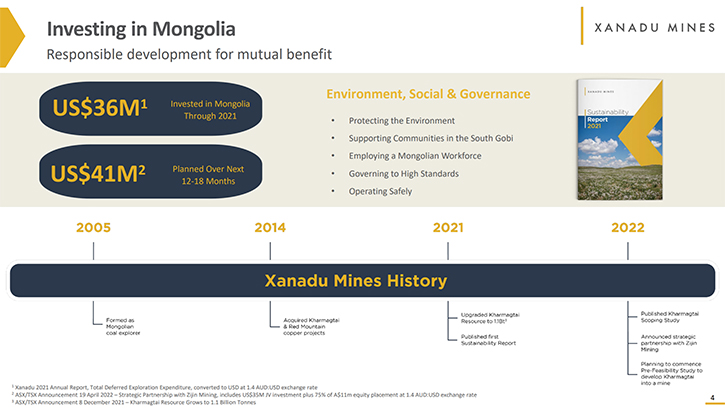

We spoke with Colin Moorhead, who's Executive Chairman and Managing Director of Xanadu Mines (ASX: XAM, TSX: XAM), a company that discovers, defines, and develops globally significant porphyry copper-gold deposits, in Mongolia. The Company owns a multi-stage portfolio of projects, with the flagship Kharmagtai copper-gold project, located in Omnogovi Province, approximately 420km southeast of Ulaanbaatar, within the South Gobi porphyry copper province, which hosts most of the known porphyry deposits, in the South Gobi region of Mongolia. The project has a mineral resource estimate of 1.1Bt, with 3Mt Cu & 8Moz Au, including higher-grade core of 100Mt, grading 0.8% Cu Eq. A recent scoping study shows US$630M NPV (405-850); 20% IRR (16-25%); 4-year payback (4-7). Kharmagtai is fully funded towards a decision to construct, via strategic partnership, with Zijin Mining. Around a month ago, Xanadu kicked off a new exploration program, at their 100% owned Red Mountain project; seeking to expand strike extent of shallow, high-grade epithermal gold & copper-gold-silver skarn mineralisation. For Kharmagtai, near-term plans include a Pre-Feasibility Study (PFS) commencing Q1 CY2023, along with a reinvigorated discovery exploration program, focused on higher-grade targets.

Xanadu Mines

Dr. Allen Alper:

This is Dr. Allen Alper, Editor-in-Chief of Metals News, talking with Colin Moorhead, who's Executive Chairman and Managing Director of Xanadu Mines. Colin, could you give our readers/investors an overview of your Company and what differentiates it from others?

Colin Moorhead: Xanadu Mines is an ASX & TSX listed junior exploration company, focused on exploring and discovering gold-rich copper porphyries and porphyry related deposits, in the southern part of Mongolia. What differentiates us, is the deep connection we have with Mongolia, both technically and socially. I believe we're the proven leading explorers, on either exchange, discovering and defining copper deposits in Mongolia.

Dr. Allen Alper:

Could you tell us about your projects and your resources?

Colin Moorhead:

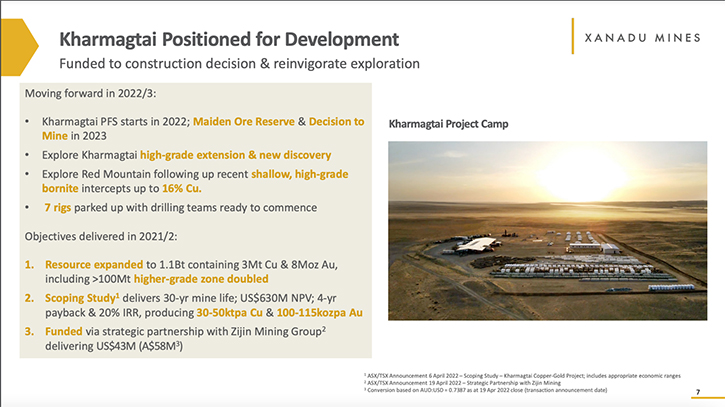

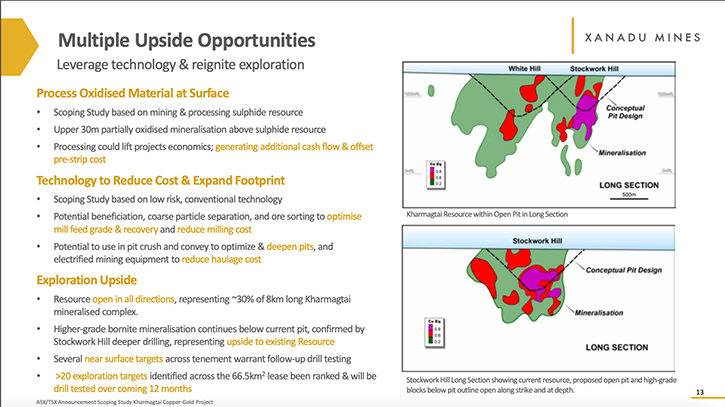

We have two key projects in the South Gobi region of Mongolia. Our flagship project is Kharmagtai, which is at the scoping study or PEA stage. We also have the Red Mountain Advanced Exploration Project, which is currently in the discovery phase, and where we are looking to define a meaningful mineralised orebody. The Kharmagtai Project is a gold rich, copper porphyry, with a total resource of 1.1 billion tons, containing 3 million tons of copper and approximately 8 million ounces of gold, representing only 30% of the mineralised complex. It's very similar geology to the giant Oyu Tolgoi Deposit, down the road. Resource remains open at depth and along strike and is approximately 40% Indicated and 60% Inferred confidence level.

We recently completed a PEA or scoping study that describes what you could do with the project. Outcome was a low risk, conventional truck shovel open pit operation, backed by a 30-year mine life, commencing at 15 million tons per annum. It achieves payback in four years and then we expand throughput to 30 million tons per annum, producing 50,000 tons of copper per annum and 110,000 ounces of gold per annum.

The product is a gold-rich copper concentrate, which is very clean. It has very strong gold byproducts and very few impurities such as arsenic and fluorine. That gold byproduct puts you in a very competitive cost position in the 1st Quartile of the Global Copper All-In Sustaining Cost Curve.

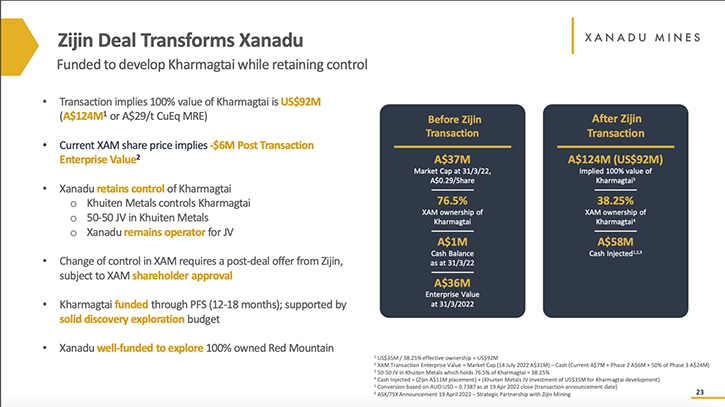

We recently announced a deal, with Chinese copper miner, Zijin for funding to move the project forward. Zijin have invested at the Xanadu company level, with an initial placement of 9.9% at $0.04 per share. This portion of Zijin’s investment was priced at a 38% premium relative to the share price on the day the deal was announced. Recently, Australian Foreign Investment Review Board approved the deal, removing a major hurdle for deal go ahead. Subject to remaining approvals from People’s Republic of China and shareholder approvals, Zijin’s stake at the Xanadu Company level will be an additional 10%, taking them up to 19.9% at $0.04. They are also investing $35 million USD at the asset level, creating a 50-50 JV. That's enough cash to see us both explore, over at Red Mountain and take the Kharmagtai Project to the financial investment decision, plus sufficient funds for targeting high impact discoveries at Kharmagtai too. We have budgeted that achieving final investment decision for Kharmagtai will cost about $20 million and take about 12 to 18 months.

Dr. Allen Alper:

That's fantastic, that's excellent. Could you tell our readers/investors how it is working in Mongolia?

Colin Moorhead:

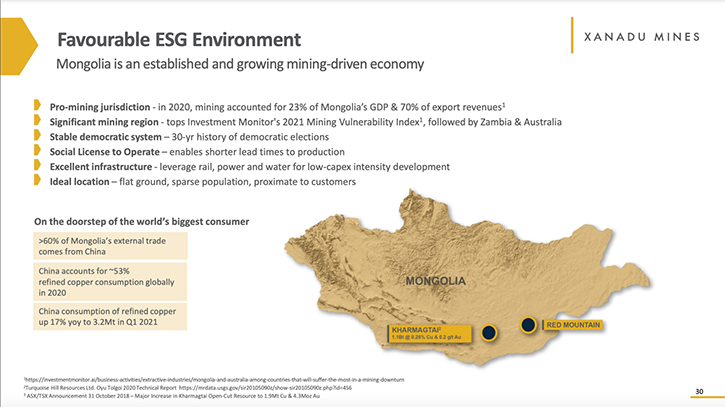

Mongolia is an interesting place and it's a very young democracy. It's about 30 years now since they became a democracy. They continue to evolve in the pursuit of economic growth. Mongolia is a proven & growing mining-driven economy, with mining contributing around 70% of export revenues. But of course, like most, there is still room for improvement; I wouldn’t be surprised if they look to learn from & benchmark against successfully developed mining economies like Australia & Canada. There was quite a famous dispute between Rio Tinto and the Government of Mongolia, over the Oyu Tolgoi Project that has since been resolved. The Government recognized that to improve foreign direct investment conditions and attract more investment into Mongolia, they need a competitive and transparent mining law. At a recent PDAC Mongolia Day event, the ministry announced they would be tabling a new mining law, at the fall session of Parliament this year. From that perspective, we're seeing the country mature, and I believe it will be a solid investment jurisdiction, with potential to become a miner’s destination of choice. The geology of Mongolia is clearly prospective for quality, large scale deposits. In fact, in our area there are several world class copper and coal deposits quite close together. The government has also invested significantly in infrastructure, in what was once a remote location. We now have direct rail links to China, we have roads, rail, port, power, and water, so from an infrastructure point of view, it's extremely well supported.

From an ESG point of view, it's quite low risk. The country is blessed with being flat and sparsely populated, which, when combined with the strong infrastructure, gives you a very competitive time to get into production, underpinned by a very competitive capital intensity. I think the South Gobi region of Mongolia has a lot going for it. You're also sitting right on the doorstep of the world's biggest copper market in China. In terms of cons, it's a landlocked country, so logistics can be seen as challenging but manageable, but infrastructure makes significant inroads to mitigating that problem.

Dr. Allen Alper:

It sounds excellent! Could you tell our readers/investors a little bit about your ESG activities?

Colin Moorhead:

The Australian contingent of Xanadu is me, our CFO, Vice President of Exploration and Chief Geologist. The remainder of the Team is Mongolian based. We have a Team residing in Ulaanbaatar, focused on government relations. On site, we have the geology Team and a very strong community and environment Team. The latter Team deals directly with our neighbors, bottom up. We are one of the few junior exploration companies that’s published a sustainability report and we've recently published our second; both are available on our website.

The short answer is, we seek to create strong, long-term relationships and partnerships with our local communities. We invest and have invested heavily in health, education, and employment for the local population, as small as it is, and are actively engaged in the local government area. Our project principles are to keep our carbon footprint as low as possible and we will be building that into our project development decision making.

Dr. Allen Alper:

Well, that's excellent! Colin, could you tell our readers/investors a little bit about yourself, your Board, and your Management Team?

Colin Moorhead:

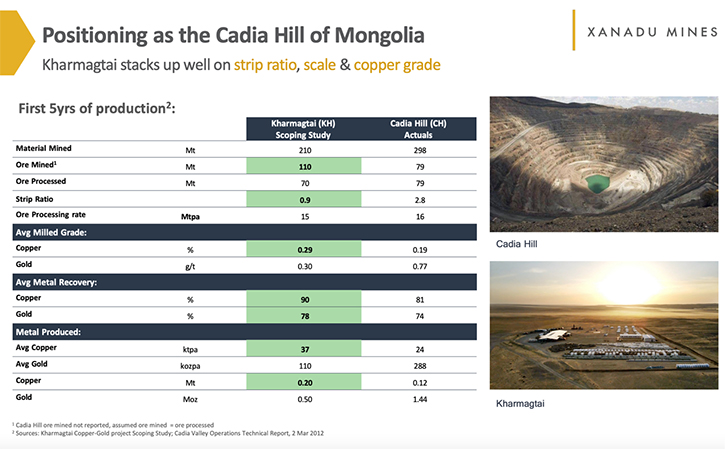

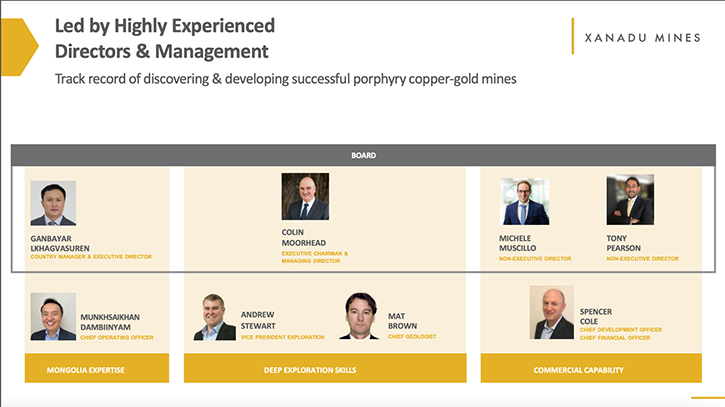

I'm an Australian geologist. I worked three decades at Newcrest Mining, including the last eight years, as Global Executive, responsible for Exploration and Development. I was the former Chief Geologist of the Cadia Valley Operations, which has developed into one of Australia's largest copper and gold operations today. I was involved in the drill out, feasibility and development of those deposits. Interestingly, the first 5 years of production at our flagship project, Kharmagtai stacked up quite well, relative to the starter mine of the Cadia Valley Operations, Cadia Hill. Cadia Valley Operation, also a gold-rich copper porphyry, has evolved quite significantly, on both the exploration and development fronts; we expect similar to play out at Kharmagtai, over time.

Subsequent to that, I was the CEO of Indonesian listed, Merdeka Copper Gold, which has gone on to become a very significant copper and gold producer in Indonesia. Our CFO, Spencer Cole, is an engineer by trade and a financial person. He's also an ex-Newcrest colleague of mine, handling all the financial matters, as well as Chief Development Officer. Our VP Exploration and former CEO, Dr. Andrew Stewart, is our technical guru, with a long history of exploration in Mongolia, including Robert Friedland’s Ivanhoe Mines and Vale. Furthermore, our VP Exploration is ably assisted by our very experienced Chief Geologist, Mat Brown, who’s well versed in Mongolian copper deposits, having also worked, for a significant period of time, in Ivanhoe Mines’ successful exploration discovery Team too.

In country, our Team is led by Ganbayar Lkhagvasuren a co-founder of the Company. He helped us obtain the mining leases from Turquoise Hill (previously Ivanhoe Mines, whose name was changed as an element of the memorandum of agreement, with Rio Tinto, in 2012). He is very well connected, at all levels of government, and oversees. All our activities there are ably assisted by our Mongolian based COO, Munkhsaikhan Dambiinyam . Mongolia's blessed with a very well-educated population. Access, to skills, is very good and we are blessed with an amazing and very switched-on, Mongolian-based Team, which is able to, not only survive, but thrive through the COVID years and achieve all of our objectives, including health, safety, and environment objectives.

Dr. Allen Alper:

Well, you and your Board and your Team have very impressive backgrounds, are very experienced and have a very strong track record of success. I can see the Company is in good hands.

Colin Moorhead:

Thank you. There are also our two Non-Executive Directors. Michele Muscillo, who’s a lawyer, with significant M&A experience and Tony Pearson, who provides commercial advice and was previously Group Executive, at listed Company, South Gobi Resources, responsible for corporate and strategic initiatives. We have a very strong Board, as well.

Dr. Allen Alper:

That’s excellent. Could you tell our readers/investors, a little bit about your share and capital structure?

Colin Moorhead:

We're listed on the ASX and TSX. The majority of our shares are issued on Australian Stock Exchange. Our largest shareholder, currently, is Singapore based, ACA Capital. Once the Zijin Transaction is complete, Zijin will become our largest shareholder. Zijin is a major Chinese copper producer and sixth largest copper producer, in the world, during 1Q’2022, operating in 14 different countries.

Management and Board hold about 6% and we have some very supportive institutional holders, including Nero Resources and Paradise Investment Management. There is also a large proportion of high-net-worth individuals on the register. Currently there are about 1.4 billion shares, on offer, and we're investigating the possibility of consolidating shares on issue, in the near future. The current market capitalization, which is trading at a significant discount, to project value, is sitting at around $40 million AUD.

Dr. Allen Alper:

Well, that is excellent! It's good to see Management has skin in the game. That's great! Could you tell our readers/investors, the primary reasons they should consider investing in Xanadu Mines?

Colin Moorhead:

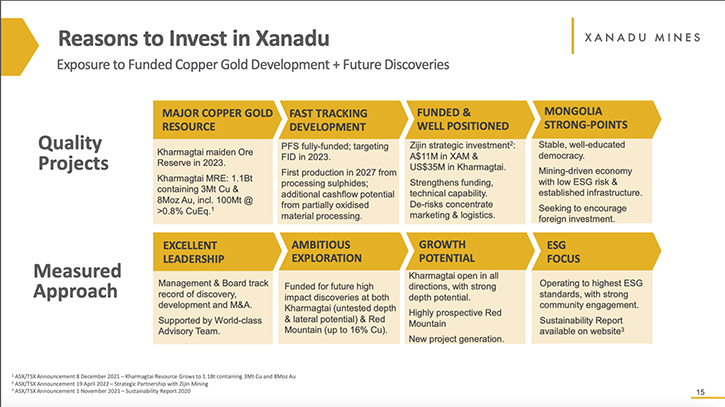

With decarbonization of the global economy, there's a very strong and growing demand for copper to facilitate this transformation. Many commodity forecasters have predicted and modeled a significant shortfall in production. We see that production gap widening, which of course is expected to underpin the copper price, for many years to come. The Kharmagtai Project needs to, and will be developed, to fill that copper gap. Zijin, one of the fastest growing copper companies in the world, has also seen Kharmagtai, as an asset that could be beneficial for supplying into the predicted copper shortfall, in the near term. Zijin is happy with Mongolia as an investment destination and this transaction is their first step into Mongolia. They see that Kharmagtai exhibits all the hallmarks for a deposit that will get developed. It works on low strip, scale and byproduct credits, generating very healthy financials.

Post deal, the enterprise value of the Company is multiples of our current share price. The fundamentals are there for a re-rating, post deal completion. If you benchmark us, on a pounds of copper per ton basis, enterprise value, for the unit of copper, Xanadu Mines is deeply discounted. We expect to see a re-rate when the transaction is complete and a further re-rate as the project progresses towards a decision to mine. It's a very strong case for investment. Post transaction completion, Kharmagtai Pre-Feasibility study is fully funded, and funded for high impact discoveries at both Kharmagtai and 100% owned Red Mountain. The Pre-Feasibility will be aimed at maximizing production economically, including operating cost and capital improvements, via multiple real upside opportunities to minimize waste, reduce emissions and add serious value.

As such, the current XAM share price offers a very well-priced entry. I would say to your investors and readers that XAM should be considered as a solid copper investment exposure, and more importantly, a Company that will be exploring for additional copper growth producing, in the next 5 years, and.

Dr. Allen Alper:

I would say those are very compelling reasons for readers/investors to consider investing in Xanadu Mines. You have a huge resource that is very rich in copper and gold, and you are in a region that supports mining, and right next to a customer. You have great support from the huge copper and gold mining companies nearby. You have an excellent Management Team and local Mongolian Team. You are so experienced and successful, in your leadership, and you also have such great connections, with the Mongolian government. I would say all those are very strong reasons for our readers/investors to consider investing in Xanadu Mines.

Colin Moorhead:

Thank you very much.

Dr. Allen Alper:

Colin, is there anything else you'd like to add?

Colin Moorhead:

I believe our comprehensive discussion highlights all the key aspects of what makes Xanadu Mines such a compelling investment. Thank you for all your great questions.

Dr. Allen Alper:

Thank you for sharing your information and knowledge with us. We’ll publish your press releases as they come out, so our readers/investors can follow your progress.

https://www.xanadumines.com/

Colin Moorhead

Executive Chairman & Managing Director

colin.moorhead@xanadumines.com

+61 2 8280 7497

|

|