Interview with David Williams, Executive Chairman, Thomson Resources (ASX: TMZ, OTCQB: TMZRF): Rapidly Advancing the New England Silver District into Production

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 10/18/2022

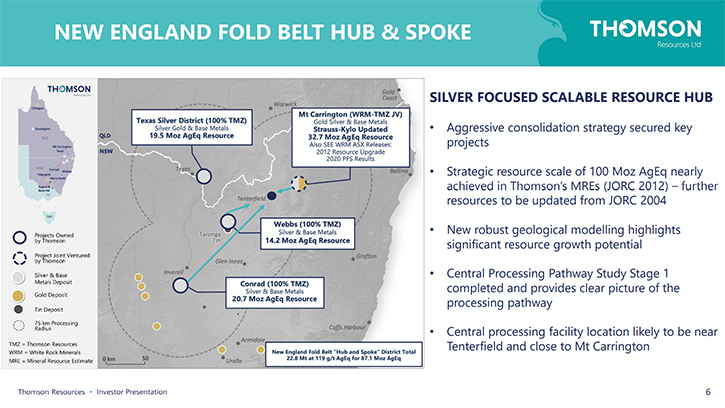

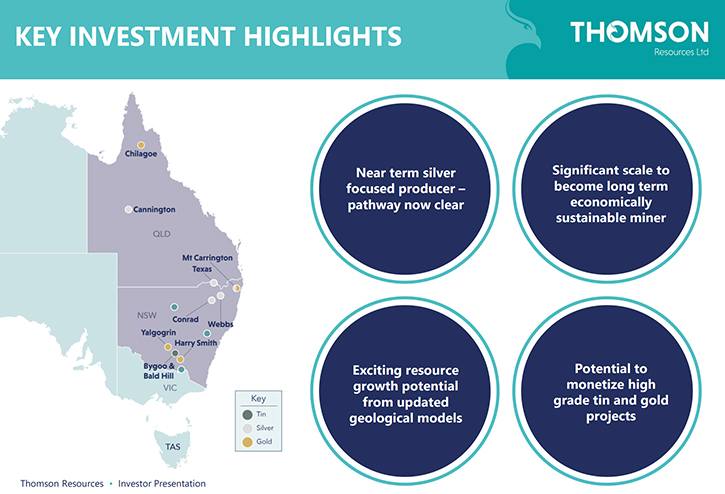

We spoke with David Williams, who's Executive Chairman of Thomson Resources (ASX: TMZ, OTCQB: TMZRF). Thomson Resources has aggressively consolidated a large precious (silver – gold), base and technology metal (zinc, lead, copper, tin) resource hub called “New England Fold Belt Hub and Spoke", that could be developed and potentially centrally processed. The Company's strategy is underpinned by its diverse portfolio of tenements across gold, silver and tin, in New South Wales and Queensland. These projects include the Webbs and Conrad Silver Projects, Texas Silver Project, and Silver Spur Silver Project, as well as the Mt Carrington Gold-Silver earn-in and JV. As part of its New England Fold Belt Hub and Spoke Strategy, Thomson is targeting, in aggregate, inground material available to a central processing facility of 100 million ounces of silver equivalent.

Thomson Resources

Dr. Allen Alper:

This is Dr. Allen Alper, Editor-in-Chief of Metals News, talking with David Williams, Executive Chairman of Thomson Resources. David, could you give our readers/investors an overview of your Company and tell us the interesting things that have happened since our last interview?

David Williams:

Just to refresh your viewers’ recollection of Thomson, the key project, we have been working on, is silver, focused, in northern New South Wales and southern Queensland of Australia. It’s about bringing together, in a hub and spoke strategy, into a central processing facility, the various projects that we have pulled together.

Each of the projects has operated principally as a silver mine in the past. Each had published resources and we have worked through them all thoroughly. We have published our own resource estimates and pretty much done all of them now. We still have to work through the remaining 6 Mt. Carrington ones.

Our target was 100 million silver equivalent ounces that would be available to a central processing facility. Our numbers are up to about 87 million silver equivalent ounces. But we know that what is already out there, in resources published by previous operators, that the 100 million silver equivalent ounces target, we set for ourselves has been well exceeded. We have been quietly working away over that, for approximately the last twelve months or so.

But really, it all comes down to - does it all work together? And if it does work together, how do you bring it all together and will it be economic? The key plank to where we are, going forward, has been what we call the Central Processing Pathway Study. We have just released the results of that.

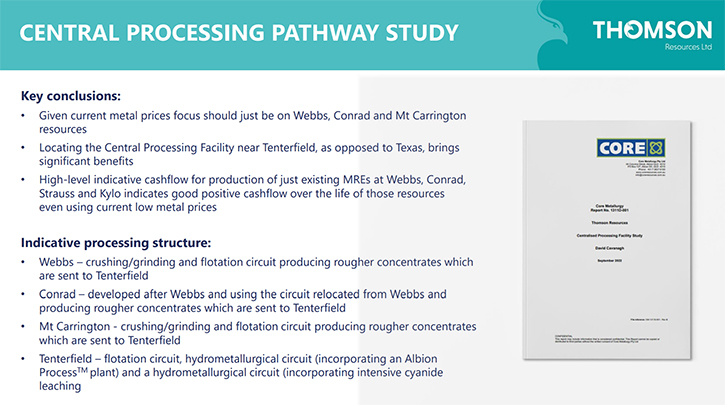

The good news for us is, even at today's silver and other metal prices, we get a very positive indicative result from that techno-economic evaluation. Now it has brought some changes, because of the lower grades and the greater difficulty in processing in Texas. At current prices, it is very hard to proceed forward with the main Texas project deposits of Mt. Gunyan and Twin Hills.

I stress that is at the current metal prices, which are about $28 dollars, Australian, per ounce for silver or around $18 US an ounce. It's simply that you just do not get enough revenue from the minerals at that price, to cover even just the costs of processing them. That is quite a different story in relation to Webbs, Conrad and the two Mt. Carrington deposits. The technical evaluation that we have done and published in the ASX release, is only looking at and dealing with the Webbs and Conrad resources, we have published, and only two of the deposits at Mt. Carrington, the Kylo and Strauss and only using the resource estimates that we have published for them. So, there is plenty of upside, bringing in the other Mt Carrington deposits and expanding all of the resources. Just using those four deposits, so this is sort of a starting point. The indicative cashflow at those low silver and metal prices is over an eight-year project life and indicates a positive cash flow of about $334 million Australian, with about $206 million of that accumulating in the first three years. High level estimates, given the processing structure outlined in the Study, it looks like those first three years would cover the likely CapEx on putting all this together.

So good news, we have the green light. There are some further detailed studies, we will do now, to refine those costs and get more comfortable with the numbers and then we’ll be heading down that feasibility study pathway.

Dr. Allen Alper:

That sounds excellent. I think you’ve made great progress. David, could you tell our readers/investors a little bit more about the processing technology and the central processing facility near Tenterfield?

David Williams:

Originally, we had been looking at Texas as being the obvious choice for the central processing facility. Given the indicative returns, we are seeing in the Study, we were just then looking at it as a site for processing. If we are just looking at Texas as a site for processing, then we are better off choosing something that is a bit closer to the major resources and the major resources are at Mt. Carrington.

We knew that there were limitations on the Mt. Carrington site, in itself. But there is a major country town, Tenterfield, which is about half an hour’s drive down the road. A very supportive community and plenty of suitable land on the outskirts of the town. You have good access to services and human resources and infrastructure, which means that you could likely set up the central processing facility there.

That then leads to some opportunities for us to explore, in relation to Mt. Carrington, on which some of the test work going forward will be focused. Well, can we actually just simply dig the ore up and crush it, sort it and then transport it to Tenterfield, without putting a separate preliminary processing facility on site at Mt. Carrington? We certainly want to explore that.

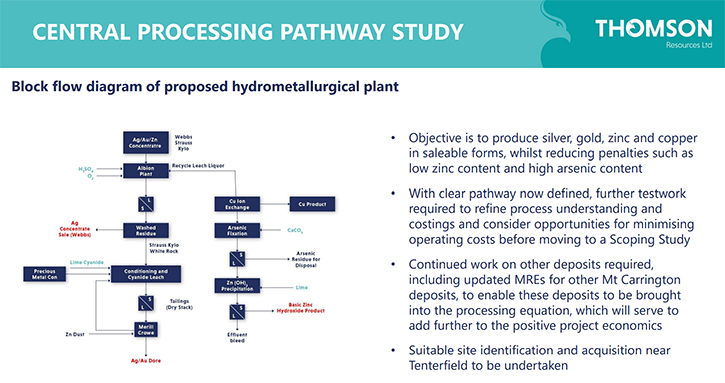

Let us put that potential improvement to one side at the moment. So, what is the level of processing we would need to do at Mt. Carrington, in order to remove a significant impasse, being transportation costs. Essentially that is to put in a grind and float circuit, so you are just producing a rougher concentrate. Then take that concentrate to the central processing facility at Tenterfield and put it through the next stages of processing, along with concentrates from the other sites.

In the case of Webbs and Conrad, the study first looks at just dealing with Webbs, because that's the higher grade, do the mining of Webbs in a campaign, and put in a grind and float circuit there. So again, we are just producing that rougher concentrate, which is then transported to Tenterfield. We would then move that grind and float circuit across to Conrad and go through and do the same process. So, coming into Tenterfield, we have these rougher concentrates, which we then will take through the further processes. The first will be further floatation. to provide a cleaner concentrate. That will then move into a hydromet circuit, which will need to deal with some challenges associated with these ores, if I can put it that way.

Consequently, the hydromet processing circuit will include a process, called the Albion Process. The advantage of the Albion Process is it works very well, in dealing with the higher arsenic content that is there in the Webbs and Conrad mineralization. It is also a very good process in enhancing the zinc recovery, so that we can get a higher-grade zinc, in the concentrate. In the case of some of the Mt. Carrington deposits, that’s necessary, because they are not as high in zinc.

Also, some of the mineralization, in the deposits at Mt. Carrington, is a little bit harder and a bit more refractory. So, this process will also help extraction and therefore produce better recoveries. The hydromet circuit will look to produce gold and silver dore and also to produce a saleable copper product, a silver and a zinc concentrate and a basic zinc hydroxide product. We have always been driven by getting additional value from the associated and sought-after base metals of copper and zinc and in other places some of the other minerals such as tin and lead, if we have them in sufficient quantities. As we go forward, we will continue to look, on the side, at what other minerals might be present and how we might be able to extract them.

Dr. Allen Alper:

That sounds excellent. David, could you tell our readers/investors what your plans are for the remainder of 2022 and the goals for 2023?

David Williams:

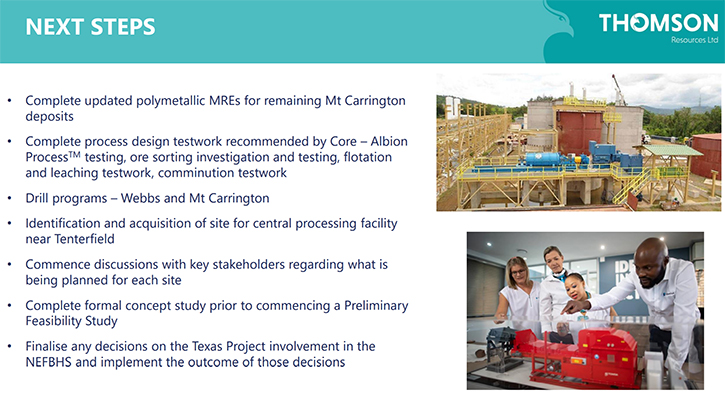

The study is very positive. It has now given us that pathway, we were looking for, so we know where to head. The key work, that we will be focused on now, is doing further test work, particularly on the Albion Process, to see about tweaking it, to get better recoveries, better products coming out and to do some test work and studies on ore beneficiation. Through use of ore sorting, we can simply, at Mt. Carrington, dig it up, crush it, sort it, and therefore not have to do any processing at Mt. Carrington. And similar, in relation to Webbs and Conrad, because that is just again, going to improve the economics of not duplicating a plant.

Once we have done that and some other test work around it, that test work will involve getting samples, which will enable us to do that, as part of drilling programs. We have always planned, once we get through the current wet weather and the wet season, to go to Webbs and do some drilling, both confirmatory drilling, in relation to the resources, so as to increase the grade and the confidence, and also to do some extensional/expansional drilling, to test the new geological model, we developed, and to look to expand that resource.

We will also do some drilling, as part of this, at Conrad, which again will assist us in confirming what we have there. And similarly, at Mt. Carrington, we will do some further drilling, and I might just come back to you, in a minute, regarding the geotechnical drilling we did last year, at Mt. Carrington. This drilling would also include some drilling at Guy Bell, and in between the pits, to start testing how much they all coalesce.

We will probably also start looking at some pretty interesting copper targets, at Mt. Carrington, if the opportunity presents itself next year, and we will publish some more about that in the next few weeks. It's very much about refining our understanding of these processes now, let's see if we can improve them and tweak them - that will necessarily improve the economics. Let's complete updating the mineral resource estimates for the balance of the Mt. Carrington deposits, so we can bring them into this equation as well and complete the test work.

Having completed the test work, we will then be able to start working and refining the engineering of the project. Out of that we will then be ready to launch down that preliminary feasibility study stage. So, there will be a lot going on next year, but it's all in a positive environment, which is just great, I've been looking forward to this day.

Dr. Allen Alper:

Well, that sounds excellent! It sounds like you're in a great position to move the Company forward and next year will be a very significant period for the shareholders and the stakeholders.

David Williams:

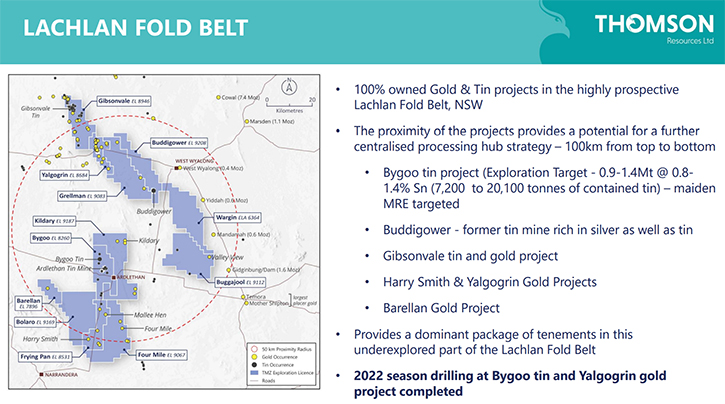

Yes, I think that's right. It will be in that environment, where we know it works. What will be interesting is, now that we have that comfort and that understanding, we will start looking at the other projects in our portfolio, that we have – Lachlan Fold Belt and Chillagoe - and see if they still fit in? Do they still work with where we are going, or can we get better value for shareholders by spinning them out, demerging?

There was a recent analyst report, done on Thomson by Hallgarten – you can access a copy from our website - looking at our tin assets, down in the Lachlan Fold Belt. Essentially, they were concluding that there is a lot of shareholder value, locked into those assets, that simply is not reflected in the Thomson market valuation, because the market values for Thomson are for the Silver Project. They were making the observation, that there's upwards of $20 million Australian worth of value there. If we did a demerger, then we would be able to distribute that to our shareholders.

That is value that they would get and would get directly, which they do not have at the moment. We will work through that now, in relation to the Lachlan Fold Belt gold and tin projects, and we will also look at that, in relation to the Chillagoe early-stage exploration of gold, copper and silver, up there in far north Queensland. That is something else to watch for, which for people looking to invest in Thomson will present a great opportunity.

Dr. Allen Alper:

That sounds like an excellent business approach and opportunity for your shareholders.

David Williams:

Yes. Yes, I absolutely agree. Thanks for that.

Dr. Allen Alper:

David, could you tell our readers/investors a little bit about yourself and your key members of your Team?

David Williams:

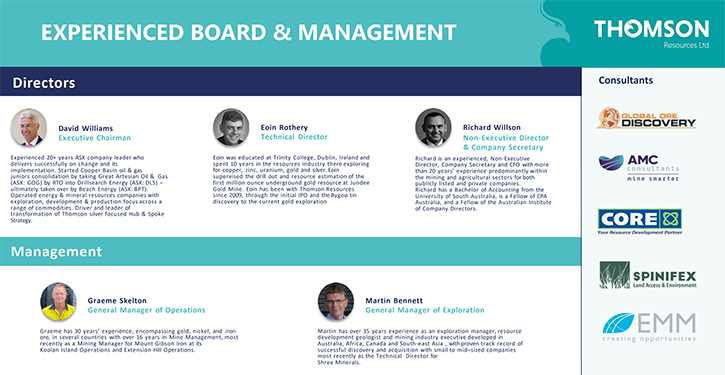

I have been leading ASX listed companies, in the energy and resources space and also in some technology and pharmaceutical R&D, for over 25 years. So, I tend to come in to review and change the strategic direction, to look at restructuring businesses and really just taking a fresh look at them. In addition, from my early days as a lawyer in Australia, I come, with a very strong corporate governance focus. That’s what I’ve been doing driving Thomson, over the last two or three years.

Along with that, we have been building up our own Team. When we started down this pathway, we were very reliant on consultants, and we made sure we had the best of breed consultants to work with us. But that can be an expensive exercise. We now have two very experienced senior managers in Graeme Skelton, our GM Operations, and Martin Bennett, or GM Exploration.

Graeme is all about the development of the New England hub and spoke strategy. Martin is looking at where the resources and opportunities are. We have two key people driving our program forward and then we have smaller Teams, under them, that are dedicated to working for Thomson.

On the Board, we have Eoin Rothery, who’s been with this Company, since its inception. He’s a very experienced exploration geologist. He really provides very good technical oversight. The third Director and Company Secretary is Richard Willson, who comes very much from the finance and corporate governance perspective. We have a good balance.

I think though, as we go forward, we will look at what the appropriate skill set for the Board of Thomson is and that clearly, we need to start bringing in the skills associated with mining, engineering and metallurgy and things like that. We will work through that to make sure that we have all the right skill sets on the Board going forward.

Dr. Allen Alper:

Well, looks like you'll have a very strong, experienced, core, Team and Board. So that's excellent! As you go forward, it sounds like you have good plans to add mining engineers, etc., to strengthen your Board. So that sounds very good. David, could you tell our readers/investors a little bit about your share and capital structure?

David Williams:

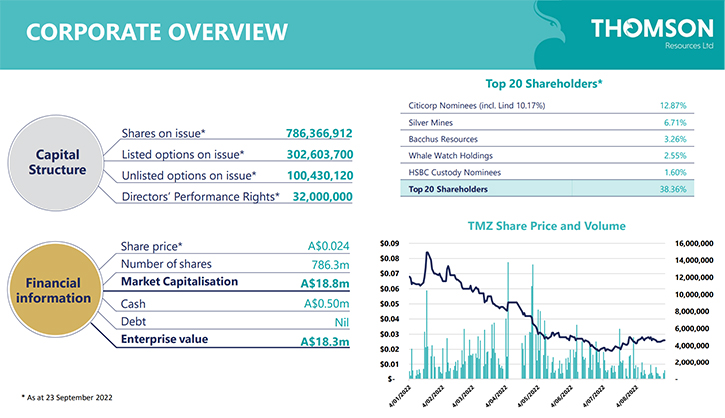

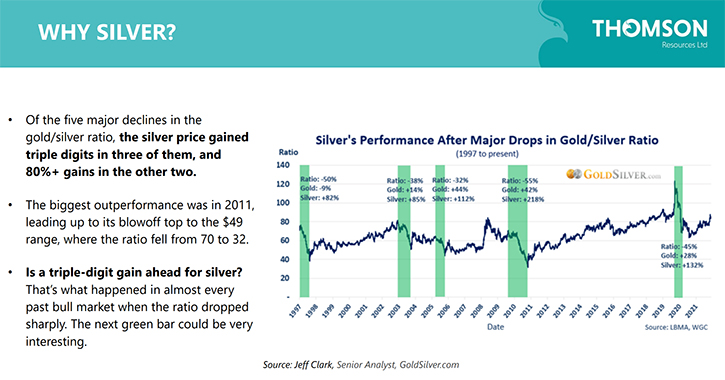

We have been working through raising bits of money, so that we're not raising too much and building up the story, sometimes it has worked for us, sometimes it has not. It has been a funny world, over the last year or two, both in the markets and also with silver. Although it is great to see that the silver price is moving back up and back into the 20s, and it seems to be fairly stable going forward.

I think, as that goes on, that will give the market more confidence. I think we are expecting that gold and silver are going to move higher in due course. Silver has that interesting aspect to it of not just being a precious metal, therefore it has also been driven by the battery metals or technology metals that are required. We really want to get to this point in time and then get the market to get that confidence back in Thomson and where it is going and get the share price up and then start looking at raising larger sums of money.

Where we sit at the moment, we have a bit over 780 million shares on issue and about 400 million options on issue. Those options range from a $0.10 exercise price, through to $0.25 cents, so they are well ahead of where the share price is at the moment. A large chunk of those are listed options, which are at 11.5 cents, and which have been quite actively traded since they were issued.

That gives us a market capitalization, at the moment, of around about $19 million Australian. Like any company, I will say we are undervalued, but I really do think we are in this case. But that's all right. We had to earn our stripes. We have had to demonstrate to the market that we are real. We believe that this study will demonstrate that. We do not have any debt, which is important at this stage.

The top 20 shareholders are about 38% and a key new cornerstone shareholder is the Lind Group, who have come in and are continuing to provide support to the Company, going forward. They are looking for a long-term relationship. We have seen them operate, with other ASX listed companies, and they have been really supportive, particularly at these times, as Companies are going through transition. We can only see it getting better and better from here.

Dr. Allen Alper:

That sounds very good. Sounds like your Company is poised to have its share price increase, based on the use of silver and gold. Silver is very attractive for both the technological use element and Tyson, with the green technology that's occurring. Also, it's a noble metal and it's great for its value as a precious metal.

David Williams:

Yes, it’s all those reasons why we took Thomson in and down the silver pathway, 75% or thereabouts of the world’s silver production is as a byproduct and hence is not sensitive to the supply and demand of silver. It is very underrepresented in Australia and that was where we could see the opportunity. You have to be looking forward, but if you could see that, which we could, then the opportunities present themselves.

We can see that the industrial technology demand for silver is really what is going to drive the price of silver going forward. But it will still be the reason and will still have a very strong precious metal component, which will also drive its price and valuation.

Dr. Allen Alper:

That sounds excellent. David, I wonder if you could summarize the primary reasons our readers/investors should consider investing in Thomson Resources?

David Williams:

We’re not just starting the journey, we're not just exploring, we have resources. We have known resources that can be mined, and we are now on the pathway forward to development. We are well advanced. We are not going to be in production tomorrow, but with where the silver price is, at the moment, you would not want to be. We are very clearly on that pathway in a visible and concrete sense.

We have pulled together scale. Scale is important. We don't believe Each of these individual projects, would work in their own right, because they are not large enough. But, by bringing them together, you have scale, which means you can go to more sophisticated processing, you have mine-life, and you have expansion capability. So, the scale is there to become a long-term, economically sustainable operation.

We are in a good jurisdiction, being Australia, politically stable, with good regulatory environments. We might feel as if we are a long way away from everyone, but in this day and age, we are not. So, it is a good low political risk environment, as far as mining is concerned, and that is particularly the case where we are located. We are also farther inland, so we are away from the more sensitive areas.

The final point, which I touched on earlier, is that ability for us to provide additional shareholder value, to unlock untapped shareholder value, by looking to spin out the gold and tin assets, in the Lachlan Fold Belt, and the exploration copper-gold-silver assets, in Chillagoe, and provide additional value to shareholders and investors, that is not there at the moment, because we're simply valued, on the silver projects. Going forward, presents a great opportunity to return further value to shareholders.

Dr. Allen Alper:

Those sound like very compelling reasons for our readers/investors to consider investing in Thomson Resources. Just the spin out, is approximately equivalent to what your market cap is right now. So that gives you a great opportunity. Plus, you have a great silver resource, and it sounds like you're well on your way to developing a production process, for the gold and silver dore, and recovering zinc concentrate. That all sounds very promising.

David Williams:

Yes. I think there's a lot to look forward to, for investors in Thomson Resources, going forward now.

Dr. Allen Alper:

Well, that sounds excellent! Is there anything else you'd like to add, David?

David Williams:

No, I think that those are the key points. This Study has been a very important step in our very short journey, so far, and it is a positive step. We know it now, it all comes together, it all works and now we can get on with delivering value and additional value to the shareholders. I am looking forward to the further part of the journey going forward.

Dr. Allen Alper:

That sounds excellent. And it sounds like our readers/investors should stay tuned, very closely, to what you're doing and pay attention to the news releases. It sounds like 2022 and 2023 will be a very exciting time for your shareholders and the stakeholders.

David Williams:

Yes. And we are looking forward to bringing our shareholders and investors along for the journey.

Dr. Allen Alper:

Well, that sounds wonderful! We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.thomsonresources.com.au/

David Williams

Executive Chairman

Phone: +61 419 779 250

Email: david@thomsonresources.com.au

|

|