Ron Thiessen, President & CEO, Northern Dynasty Minerals Ltd. (TSX: NDM; NYSE American: NAK) Discusses the Need for their Pebble Project to Supply Copper for Electrification and Green Energy

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 10/16/2022

We spoke with Ron Thiessen, President, and CEO of Northern Dynasty Minerals Ltd. (TSX: NDM; NYSE American: NAK), a Canadian mineral exploration and development company. Northern Dynasty is focused on their principal asset, the world class copper/gold/silver/moly/rhenium Pebble Project, owned through its wholly owned Alaska-based U.S. subsidiary, Pebble Limited Partnership. The project is located in southwest Alaska about 200 miles from Anchorage and 125 miles from Bristol Bay. The Pebble Project's 2021 PEA is financially robust and combines globally significant production and excellent optionality. The ability of Pebble to produce copper at a low cash cost and generate many millions in annual taxes and other government revenues in Alaska, while setting aside appropriate closure funding, could propel this region of Alaska into prosperity and opportunity. In 2020, the project permit was denied, and in early 2021, Pebble lodged an Administrative Appeal against the decision, which continues today.

Northern Dynasty Minerals Ltd.

Dr. Allen Alper:

This is Dr. Allen Alper, Editor-in-Chief of Metals News, talking with Ron Thiessen, President and CEO of Northern Dynasty Minerals. Ron, I wonder if you could give our readers/investors an overview of the importance of the Pebble Project to copper supplies and new energy. Then later tell our readers/investors everything that Northern Dynasty is doing and planning to protect the environment.

Ron Thiessen:

Sure. Let me start by saying a gentleman, Dr. Daniel Yergin and I, got together about a year ago to discuss copper. He had authored a book, called The New Map, which talked about the energy transition from fossil fuels to electricity. I know Dr. Yergin and his firm reasonably well; they have done Economic Impact Studies for the Pebble Project. His firm, S&P Global (formerly IHS Markit) was doing the economic impact assessment for Pebble at the time, so we had a lot of contact with each other.

Dr. Yergin is well known and highly regarded. He wrote a book, for which I believe he received a Pulitzer Prize, called The Prize, about the oil and gas industry and the US's ability to recover, and to become one of the largest producers of oil and gas in the world, in a short period of time, mainly as a consequence of fracking. He then wrote a book called The New Map, which talked about the transition from fossil fuels to electricity. And I said to him that I believed his book was a great read and very educational, but he was missing the “bridges and the asphalt” for the roads.

Fundamentally, he was missing the infrastructure, because otherwise, where was electricity going to come from, and how were you going to use it? Copper is used to produce energy in a magnetic field. You need copper to aggregate electrical currents. You know, high transmission wires are generally aluminum, due to their light weight characteristic. But when you step down to a transformer, distribute electricity to houses, commercial buildings, to EV charging stations, that's all electricity requiring copper wire.

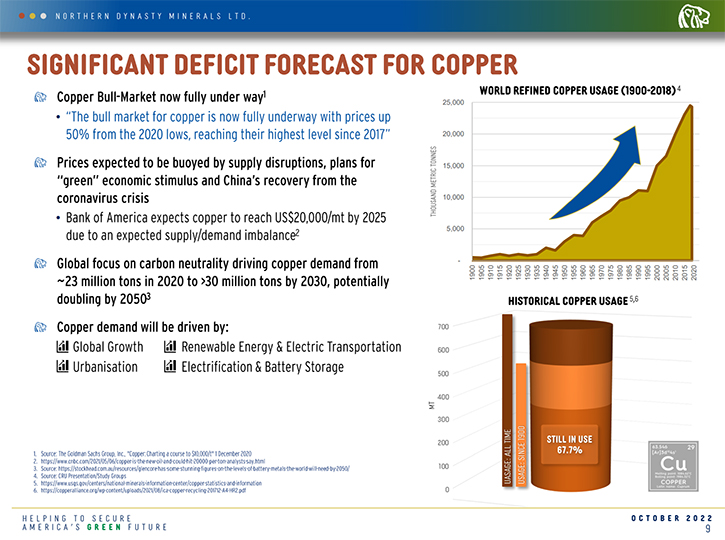

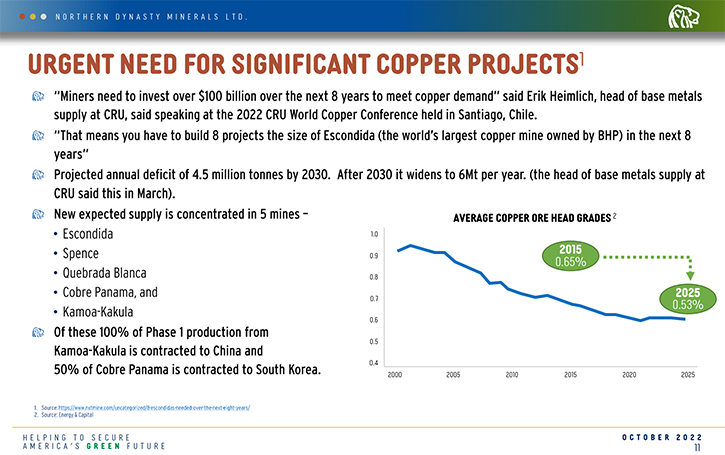

Then again, when you go to use electricity, especially for motion or any kinetic energy or light, you need copper, once again, to convert the electricity back into kinetic energy, light or heat. My discussion with Dr. Yergin continued, and I showed him that the production of copper in the world was declining at the same time as the use of copper was going up. A group of industry participants, consisting of almost all the largest mining companies in the world; BHP, Rio, Freeport, Sumitomo, Trafigura, Glencore, Teck, Antofagasta, and others was assembled to fund a study to look with greater detail into the role of copper in energy transition.

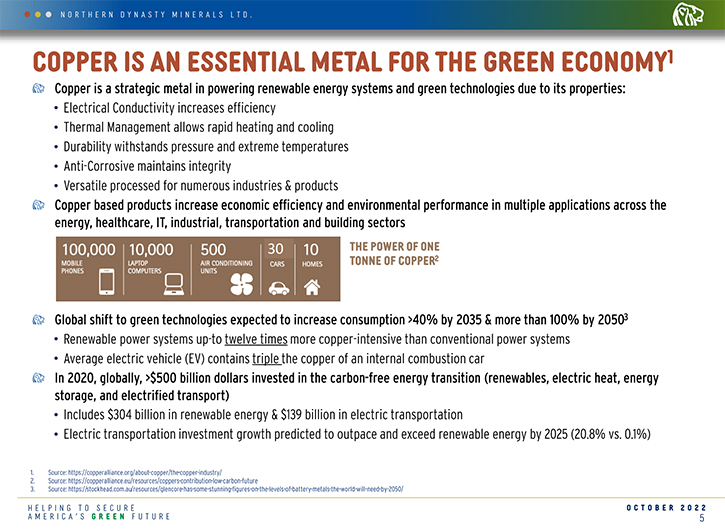

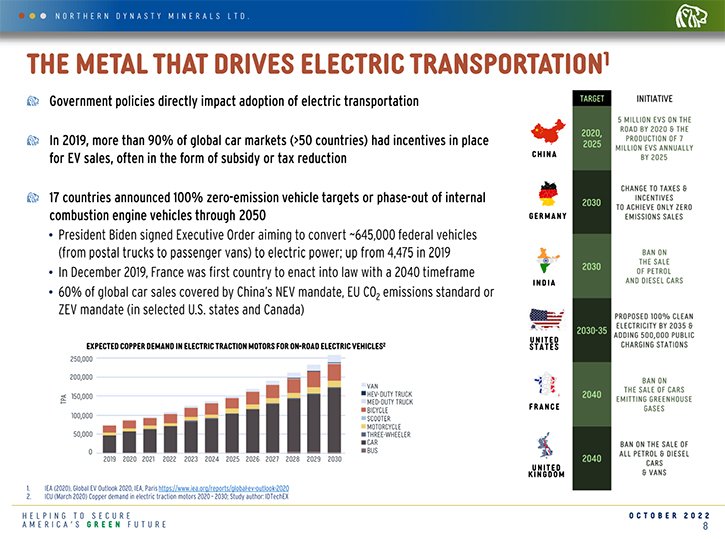

S&P Global published that document in June of this year to great acclaim. Fundamentally, the report showed that EV’s alone will require global production of copper to increase by 50%, by 2030 and 100% by 2050. We're currently producing about 20 to 24 million tons of copper a year around the world, and we're going to have to increase that by 50% or 12 to 13 million tons per year. Meanwhile, existing copper production is going down due to declining head grades of existing mines and shuttering of depleted mines. If we left it alone, we'd probably be below 20 million pounds of copper a year production by 2030. But between now and 2035, we need to increase that by 50% and between now and 2050 we have to increase copper supply by 100%.

It is truly staggering and almost unbelievable to think about how much copper we will need in order to create the amount of electricity that's needed to replace the hundreds of millions of barrels of oil we burn a year. You can do the calculations for yourself, 100 million barrels of oil at 1,500-kilowatt electrical equivalent per barrel. It's a massive amount of electricity and it's a massive amount of copper production. The S&P report is really eye-opening. Then Dr. Yergin and I were talking about individual countries and probably one of the most important ones, in this paper, was America.

Even today, America imports 44% of its copper metal, it's not self-sufficient. Most of that copper metal comes from Asian countries which have focused on building smelters over the past decades, while in America it's been going down basically every decade since the 1990s, when America was self-sufficient. By 2030, America will have to buy roughly 70% of its copper needs offshore. And who is the most prolific copper metal producer in the world? China. They have basically gone from next to nothing to controlling and operating 45% of all the copper smelting and refining capacity in the world.

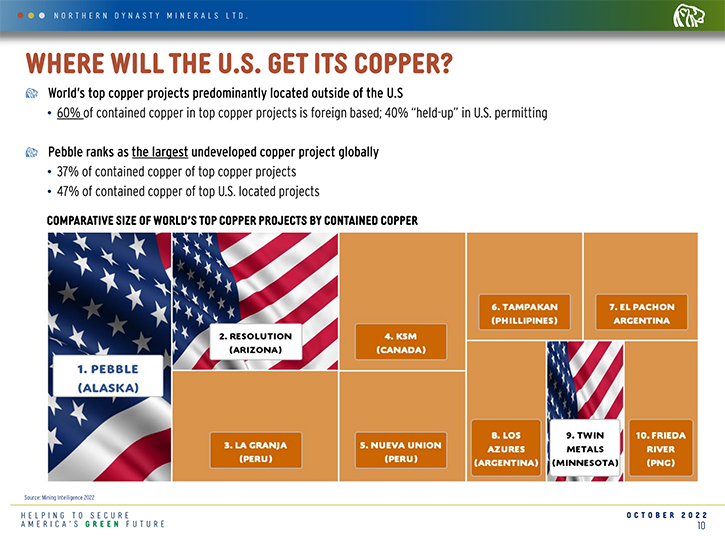

And they have gone out of their way, over the last two or three decades, to lock up the supply of copper concentrates, from Latin America, Central Africa, Zambia and the DRC, Indonesia, and other locales. The fact is that we simply cannot be self-sufficient in copper production unless we seriously look at developing new resources in North America. Mining.com has great graphics. It shows the 10 largest copper deposits in the world, three of which are in America: Pebble, Resolution and Twin Metals. Two other very large ones in the United States are Rosemont and Polymet. All five of those American-located copper mines are stuck in permitting limbo and government litigation which is trying to prevent them from being developed.

Dr. Allen Alper:

That is really truly shocking.

Ron Thiessen:

It’s not like we just need one or two of them, we need all of them, as soon as possible. It really is shocking. You think of how important copper is and we're not going to have any copper mines? Really? Biden's recently announced $51 billion bill, in support of critical metals, has a couple shocking components to it. Number one is copper is not considered a critical medal for this administration. Number two, that $51 billion cannot be used to create, support or enhance any mines. So how do you support critical metals without a mine? There’s just no logic to this.

Dr. Allen Alper:

No. I think there's a total misunderstanding, by many people, that you need to mine these critical metals to support electrification of the world.

Ron Thiessen:

Electrification of the world has been literally growing exponentially. People never think about it but here is a simple example. We used to have cameras that used film. And you got these rolls of film in 12, 24, 36 pictures, and you were judicious, carefully taking pictures, developing them, and storing the picture in albums etc. I would say that probably less than 10% of the population were active, enthusiastic photographers, and maybe 20% of the rest of us just took pictures but watched how many as it was expensive. Well, now with iPhones, everybody takes pictures, and they take thousands of pictures. The old physical pictures didn't use any electricity. But the new pictures that we take do. Think of how many pictures you have at your fingertips that are stored someplace, most likely cloud storage. Taking, recording, and moving that picture to and retrieving it from the cloud all requires electricity, now multiply that by everyone on the planet with a smartphone. And that is just one application, think of all of the others, crypto, email, Facebook.

Ever since the advent of the Internet, our electrical consumption has grown exponentially. Now we're going to take on EVs, motion and transportation and we're going to electrify it. People often say, “Ron, why do you put up with all the frustration of this? Why? Because copper is the way of the future. A Pebble-type project is discovered at most once a decade and there are tens of thousands of geologists out there looking and we already have one. So that's where I sit, in terms of my view of the future of copper, and the need for mines, like Pebble.

If we don’t start producing our own copper, we will lose all of our manufacturing to China, because they will control the supply of the metals. We talk about the weaponization of various commodities, which is the latest buzzword, but really it's just getting control of it. The US used to have control of all the global cobalt production, but no longer because the main cobalt producers are in Central Africa and are now controlled by companies that are effectively controlled by the Chinese. We used to be self-sufficient in North America for copper, but no longer. We used to have 10 smelters in North America, we now have three, and we are heading towards zero.

Dr. Allen Alper:

It's tragic what has happened to our ability to supply critical elements like copper, as electrification of the world is ramping up.

Ron Thiessen:

One of the biggest lithium deposits, in the world, is in the United States, Thacker Pass, it's going down the same path as the big copper projects. I've talked to the senior executives at NRDC, an environmental advocacy group and I asked them, “How would you see a mine operating? Where is the mine that you believe is operating in accordance with what you'd be able to support?” They tell me there should be no mines in America. There's no need for any mines? It's not their business to find out what's a good mine and a bad mine, the simple solution for them is no mines. And they are paid by donations to fight against all new mines.

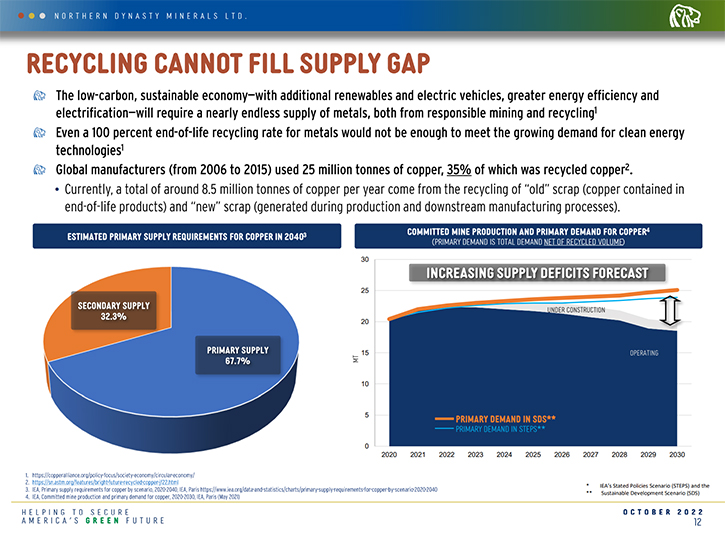

And I go, “Well, how are you going to get your metal?’ And they say, “Well, we believe that if you recycle efficiently, there are no more mines needed.” And I said, “But we're growing our consumption of all of these metals. There's not enough that's been produced. Even if you recycle it all, you still need more, because there's more electricity being used. Just think of all the transportation systems. NRDC is not a science and fact-based organization; their website says they are an advocacy group. Which means that they pick a theme, and they raise money off that theme, by expressing opinions they don't have to be held accountable for, regardless of how short-sighted or harmful it will be for the US in the longer term.

Dr. Allen Alper:

Well, it's a pity that there's a lack of appreciation and understanding by people who are interested in green energy and replacement of fossil fuels. They do not understand the need for critical elements and metals to support this.

Ron Thiessen:

I agree entirely. Now I've given you the doom and gloom. Let me say, because of this, there exists huge opportunities. We need people like Elon Musk, who can become prophetic about it and convince the retail masses that this is what we have to do, he is so good at it.

Dr. Allen Alper:

You were talking about Elon Musk, and I thought that was a great introduction. So please start from there again.

Ron Thiessen:

Well, my view was that Pebble and copper represent this huge opportunity, not just an economic opportunity, but an environmental opportunity. We just need to educate everybody about these opportunities. Instead of negativism, it becomes positive, just like Elon Musk did, with the EVs. I think Robert Friedland, in our industry, is probably the best at promoting that kind of outlook and aspect. He does have a very good video on the Ivanhoe website that talks about the S&P Global White Paper, on the role of copper in the energy transition.

I think he really puts it into context for your readers. I know I shouldn't be promoting somebody else's materials, but listen, it's a small industry. We all have to pull in the same direction and I'm happy to let people know how good Robert is at doing that. When we were designing Pebble, we spent significant time and energy minimizing its environmental footprint, in order to protect the environment and protect the fish and enhance their habitat.

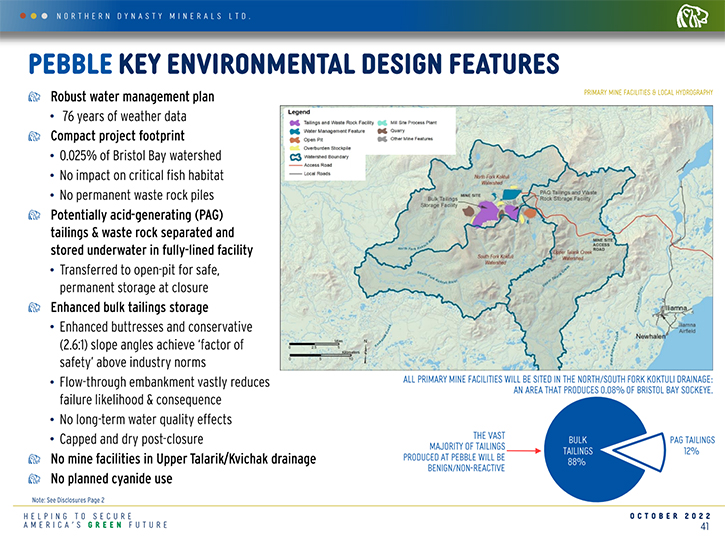

One of the things that we did was to look back at the tailings disasters around the world. We look back 20 years, but specifically over the last four or five years; there have been a few that have really caught people's attention. While there's a multitude of contributing factors that create these catastrophes, they all tend to have one common factor that either triggers or exacerbates these catastrophes and causes the catastrophic event and that's water. Excess storage of water, in a tailings storage facility that's meant to store sand, is not a good idea.

When you liquefy that sand and you break down the embankments, it's all of that moving water, with all of that sand it carries with it, that creates the damage. If you could eliminate the water, then these things (tailings storage facilities) should not move. If they can't be liquefied, they can't move. We absolutely need a little bit of water in our tailings facility because that is used for mineral processing, but the trick is to minimize the amount of water, because in all of these catastrophes that we've looked at the amount of water in the tailings storage facility is several times more than what is needed for the processing.

In fact, if only the process water had been in there, there would have been little to no damage. What we did at Pebble is design a tailings storage system where water would be eliminated from the tailings storage facility in an expedited manner. We'd use the flow characteristics of the water to move out of the tailings storage facility rapidly, and then we capture it in what are called settling or storage ponds. We would then have water treatment facilities designed to treat that water so that it could be discharged into the environment. It would be treated to the highest standard required by the state.

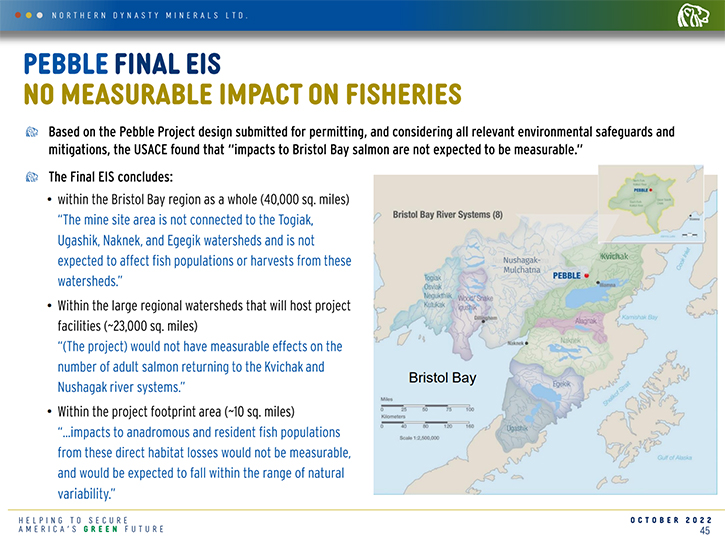

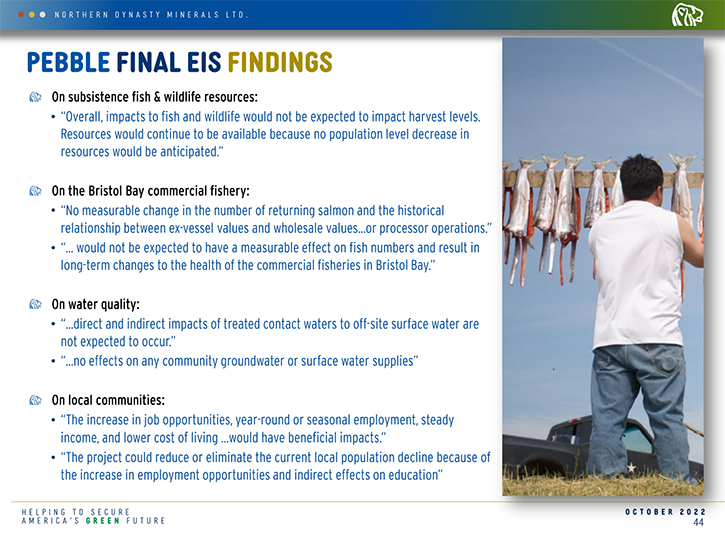

By managing the water in this manner, you can't have liquefaction of the storage facility. At the end of the day, the Army Corps of Engineers, their independent engineering company AECOM, and the other participants in the FEIS came to the conclusion that they could not conceive of an event or a series of events, including human error, which would lead to a catastrophic tailings failure that would seriously materially damage the environment or the fishery. Because of the unique design of this facility and the water treatment capacity, we remove the water out of the TSF, so there'd be no liquefaction and we would treat it rapidly through very high-volume water treatment facilities before releasing it to the environment.

That's probably one of the reasons that others in the industry don't have these water facilities, because they are expensive. But our design included two water treatment plants in excess of half a billion dollars to be able to treat whatever amounts of water that was needed to ensure that that TSF didn't accumulate excess water in it. The positive outcome of that is under our plan we will now be able to discharge more water into the environment than normally exists at critical times of the year. So, we're actually creating more habitat for fish, because there's more water at their key spawning cycles or time.

While it may sound trite, but “if you build it, they will come”. That is a strategy that the US Government and Trout Unlimited use to create a greater abundance of fish: they improve their habitat by increasing the amount of water in various habitat areas. We can see that not only are we preventing any kind of environmental damage, because of the design and how we handle water, but we're benefitting the environment by increasing the amount of habitat for fish to propagate in. Propagating more fish should enhance the fishery overall. From an environmental standpoint, that's what that we're doing. We're also trying to minimize our footprint by not using as much waste rock, by focusing on areas with very low waste to ore ratios.

Dr. Allen Alper:

That’s an outstanding engineering job. It shows how Northern Dynasty Minerals believes in stewardship of the environment.

Ron Thiessen:

We just published a news release recently that lays that out. We want to be a responsible, sustainable producer of metal, but we also want to enhance, to the extent we can, other industries in the area, whether that be fisheries or forestry, etc. Producing more habitat for fish is good and so is bringing lower cost energy into the region. It’s good for the commercial fisheries because currently they're paying $0.80 to $1.00 per kilowatt hour for energy, and they need a lot of electricity to run their plants for canned salmon. Generally, people pay a lot for energy out there, because it all has to be flown in and they use diesel generators which aren’t very efficient.

Which leads me to the next question, which is what are we doing for the people in the region? Aside from providing a job, which I think is a great thing, because providing somebody with a job when there are no jobs is really giving them a hand up, not a handout. The idea is there will be about 6,000 jobs at the mine site, transport infrastructure and balance of the State. We'll give priority to Alaskan people that are prepared to be trained and work on the project. We've also created something called a Pebble Dividend Fund, and it's really a trust that we put a percentage of annual net profits interest into.

A portion of the profits of the mining operations every year will go into that, and it'll be distributed to the beneficiaries of the trust. How do you get to be a beneficiary? You simply have to be an adult person that lives in western Alaska and sign up for it. There are about 7,500 people who live in this region, probably 40% to 45% of them are adults. That's not a lot of people, so we anticipate that this annual dividend per person will be something in the order of $2,500.

But if you think about it, if the price of copper moves to $5.00 a pound instead of $3.50 a pound, that dividend would probably double at that point per person. For an area where the employment levels and the amount of cash people have is extremely low. Only about 35% of the people that live in western Alaska have jobs, and few are full-time jobs. There’s no other industry to work in. Then, combine that with low-cost electricity, bringing infrastructure that reduces the cost of living.

Instead of $10.00 for a gallon of gas, you go down to probably $3.50, $4.00. Instead of having to rely on diesel gensets, we'll have natural gas-powered electricity production. Instead of a half-gallon of milk costing $20.00, it'll be $3.00 like it is normally. We're trying to implement a lot of broad-based initiatives, both for the environment and the people of western Alaska.

Dr. Allen Alper:

That sounds excellent. That's really great. It would really help the environment.

Ron Thiessen:

The region.

Dr. Allen Alper:

Provide jobs, yes.

Ron Thiessen:

The taxing district, out there, is called the Lake and Penn Borough and it occupies about 90% of the landmass in western Alaska, but it only has about a third of the population, 1,800 people, living in 22 villages. Their challenge is these are small villages, and if a village has fewer than ten children in the school, the school is forced to shut down, because the state cuts off funding and the borough can't afford to pay. This puts the survival of these small villages into question. The borough's current budget is in the $5-6 million range. If the Pebble mine were operating, they would collect from this mine $24 million a year in property taxes at its lowest level of output. That's a five times multiple of the amount of money that they will have available to run these villages and provide schooling, which I think is another huge upside.

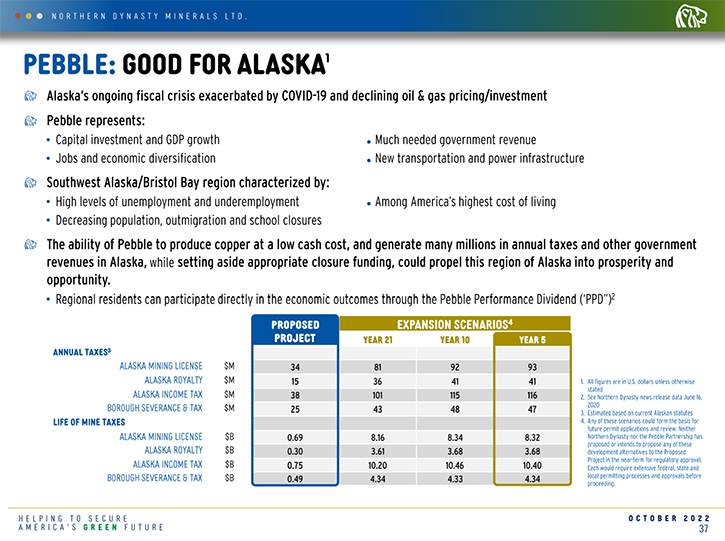

The State of Alaska is obviously going to collect a variety of revenue streams that result from our mine. There will be royalties, there will be income taxes and there'll be mineral levies. All of that will total probably something in the order of $75 to $100 million a year to a state that has a population of about 650,000 people. So, it's very material to the state while their share of oil and gas revenues are declining because the world is moving away from fossil fuels.

Dr. Allen Alper:

That sounds excellent. Ron, in summary, could you just highlight the key points you made on your ability to supply copper to the world, it's importance and the efforts you're making to help the region and the environment and the fishery?

Ron Thiessen:

Sure. Pebble, in the form that we've taken into permitting, will produce about 350 million pounds of copper a year. Which is, I think, is a material amount of additional copper 100% produced in the United States, in a responsible, reasonable manner with concern for the people, in the area, and the environment. And all the capital, estimated to be about $6 billion, is functionally spent in North America, and particularly in Alaska. That's dollar for dollar to the GDP of the state of Alaska.

We're even looking at how to go from producing concentrates that have to be processed elsewhere, to making a concentrate that can be converted at the mine site or nearby into metal. We also have talked with some of the smelter groups, in Asia, Korea and Japan, mainly about a plan where we don't transfer the ownership of the metal and concentrate to them, rather they just toll process, in their smelters and deliver the metal back to us. So that functionally is metal produced in America.

But there's also new technology today, called hydrometallurgy, which I think is the next wave of converting copper concentrates, or other metal concentrates, into actual metal. That's something we're exploring. And I would say, during the first 20 years of production, we probably should consider bringing in a hydrometallurgical processing facility, which would benefit not just Pebble, but other facilities in Alaska as well.

This is an exciting possibility, but for now we are concentrating on getting through the permitting process. We've achieved a great milestone, we finished our final environmental impact study, with the Army Corps of Engineers, costing well in excess of $50 million.

That becomes the decision-making document for Pebble. Unfortunately, we had a negative final decision on the ROD, which is the federal permit, as a result of getting caught up in a political maelstrom at the time. And you never want decisions to be made, during a politically active period, because who knows what the outcome is? But we think that we can overcome that and we're working through an Administrative Appeal of the negative ROD. We think that the FEIS does not support the denial of the ROD and therefore that that denial will be overturned, and we will be successful, because the FEIS is so positive.

The FEIS described in great detail the desperate need for a project like Pebble, in this area of Alaska. I think we can be successful here in the future and we can prove that we can do this environmentally responsibly and we can produce copper, one of the most important metals for the transition to the green economy going forward. Again, talking not just about my Company, and our production. There are five big copper projects in America. Pebble is the biggest then Resolution, Twin Metals, Rosemont and PolyMet

Every one of them is behind some kind of either ENGO litigation or government litigation, trying to prevent them from going into production. The United States does not need just one of those projects, they need them all so that they can get back to producing at least 75%, if not close to 100% of copper metal in country. It's environmentally responsible and it's sustainable. That’s all I have to say for today.

Dr. Allen Alper:

Well, I think you have done a fantastic job presenting the need for copper and making the United States independent, at least for the bulk of their needs and how critical it is, in the green energy movement, to be self-sufficient and producing copper in the United States.

Ron Thiessen:

I agree entirely.

Dr. Allen Alper:

Ron, is there anything else you’d like to add?

Ron Thiessen:

I was going to say, I agree entirely with everything that you've said. At the base, that’s really what we’re trying to do. I think that we can do that, and we can provide tremendous financial opportunities while we're at it. We just need to get over the unwarranted reluctance to have mining. It's one of the greatest economic uses of land, and it uses such a small amount of land. Western Alaska is 50,000 square miles and Pebble will use, at the end of the day, at the most, twenty-five square miles. Our initial project is only about six square miles of footprint. But over the life of the resource, if it's all harvested, it is going to be about twenty-five square miles. In comparison to 50,000 square miles, I think that's pretty minuscule compared to the amount of wealth that this project would generate for everybody.

And very importantly this isn’t about Pebble or the Fishery; it is an opportunity to have both and allow the mine to add so much more economically and environmentally to the region.

Dr. Allen Alper:

That’s excellent. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://northerndynastyminerals.com/

Ronald W. Thiessen

President & CEO

info@northerndynasty.com

|

|