Interview with Garrett Ainsworth, President and CEO, District Metals Corp. (TSX-V: DMX, FRA: DFPP): Exploring for Rich Polymetallic Deposits in a World Class Mining District: Bergslagen, Sweden

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 10/14/2022

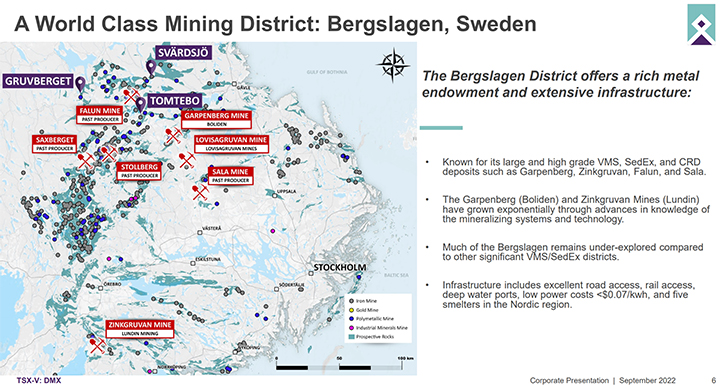

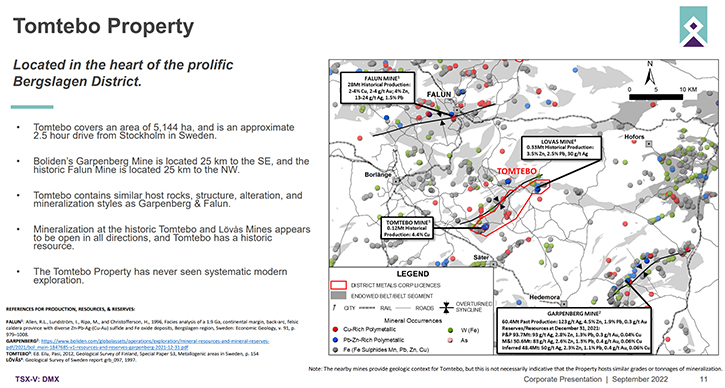

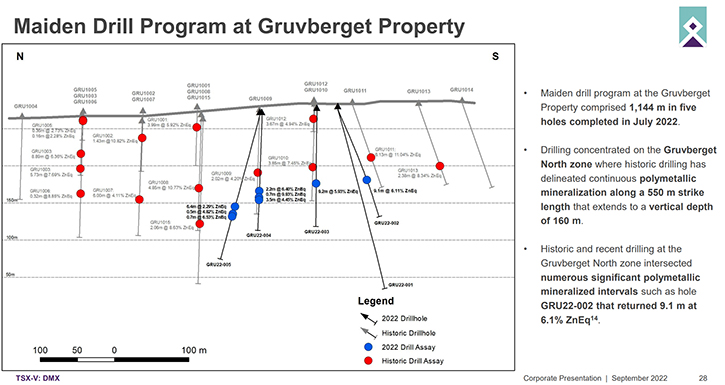

We spoke with Garrett Ainsworth, who is President and CEO of District Metals Corp. (TSX-V: DMX, FRA: DFPP), a geoscience-based, systematic, and valuation-oriented exploration and development Company, focused on the world class mining district, of Bergslagen, Sweden. The Company's flagship is the advanced exploration stage, polymetallic Tomtebo Property that comprises 5,144 ha and is situated between two significant historic polymetallic mines, with numerous polymetallic mines and showings, along an approximate 17 km trend that exhibits similar geology, structure, alteration and VMS/SedEx style mineralization, as other significant mines within the district. The maiden drill program, at the polymetallic Gruvberget Property, completed in July 2022, has been a great success, and returned significant polymetallic assays, over appreciable widths, with continuity that remains open, from a shallow vertical depth of approximately 160 m. District Metals plans to conduct their next drilling programs in 2023.

District Metals Corp.

Dr. Allen Alper: We are very excited about what you're doing in Sweden and the great results you're getting. So, I'll start the formal part of the interview. This is Dr. Allen Alper, Editor in Chief of Metal News, talking with Garrett Ainsworth, President, and CEO of District Metal Corporation. Garrett, could you give our readers and investors an overview of your Company and also discuss the recent, very successful bill data that we’ve received?

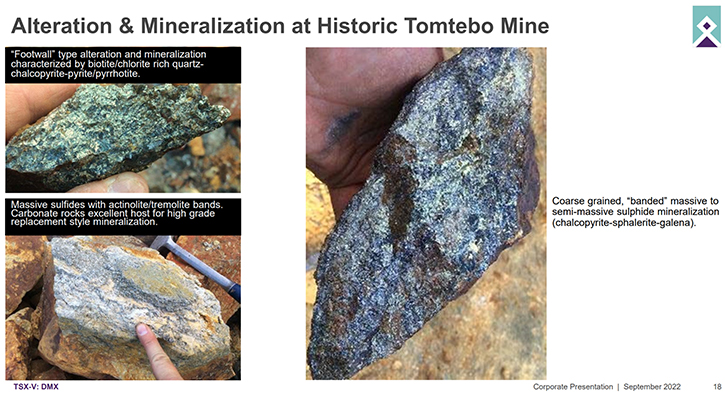

Garrett Ainsworth: Yes, absolutely! At District Metals, we're a Team, with a track record of success, ranging from discovery through to production. We have a lot of experience raising capital as well. We're exploring for polymetallic deposits, within the prolific Bergslagen district, which is in South Central Sweden. It's a region where Boliden operates their world class Garpenberg mine, and Lundin Mining operates their world class Zinkgruvan mine. We got going, in the Bergslagen, in the middle of 2020, with our flagship property, the Tomtebo property. It's an advanced stage exploration project, with numerous historical polymetallic mines and showings. Much of our drilling in 2021 and 2022 has occurred at and along trend from the historic Tomtebo mine. We've had three drill programs at Tomtebo, where we have completed around 12,000 meters. A lot of our success has actually been at the Steffenburgs zone, which is the northwest quadrant of the historic Tomtebo mine, where we recently reported 25.5 meters at 8.2% zinc equivalent.

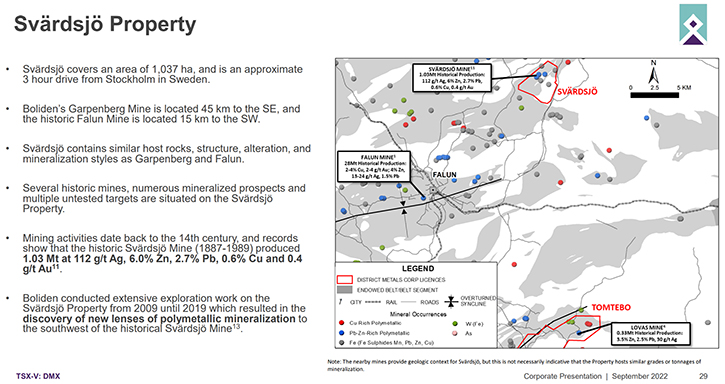

High grade polymetallic mineralization at the Steffeburgs zone is open at depth and partially along strike. We like the Bergslagen District so much that we also acquired two additional advanced stage exploration properties that are within 40 kilometers of Tomtebo. These are the Gruvberget Property and the Svärdsjö property. We recently drilled Gruvberget this past summer, where we hit polymetallic mineralization, in four out of five holes, resulting in the best drill intercept of 9.1 meters at 6.1% zinc equivalent. Mineralization remains open at depth and partially along strike there. So, we're excited to get back to it next year. And then, on Svärdsjö, our last project in Sweden, we've just been given a whole swath of historical drill information and historical and exploration data. So, we're just going through that. We should have news out, on a compilation, from work done at Svärdsjö later this year.

Dr. Allen Alper: Oh, that's excellent! That's great news! It's an exciting time for you and your Team and also your shareholders and stakeholders. Could you tell our readers and investors a little bit more about your projects and also your plans going forward?

Garrett Ainsworth: We've completed drill programs at Tomtebo and Gruvberget, which has mineralization open in many directions. Those are ready to come back, with subsequent drill programs, and grow and expand from the known mineralization there. Once we're done all the compilation work at Svärdsjö, we'll be in a position to start drilling. The advantage of having these advanced stage projects is that there are areas within them that are very much drill ready. But we're also developing additional drill targets. At our Gruvberget Property, much of the property there is covered by thin veneer of glacial till or overburden, ranging from two to 20 meters thick as much of it as woodlands. We've recently completed an orientation survey for soil sampling, where we've employed ionic leach analysis, which is a very effective method in detecting blind mineralization in bedrock. We should have news out on that pretty soon.

The results from our orientation survey are likely going to lead us to do a much larger soil sampling program, at Gruvberget, where we're going to be focused on areas identified as a priority from our recent SkyTEM geophysical survey that identified conductive and magnetic anomalies. In some cases, our geophysical targets are associated with historical mineral occurrences, as well. So, the extra layer of geochemical data from soil sampling will really help us to prioritize the drill targets on Gruvberget, outside of the main area that we've been drilling, which is the Gruvberget North zone.

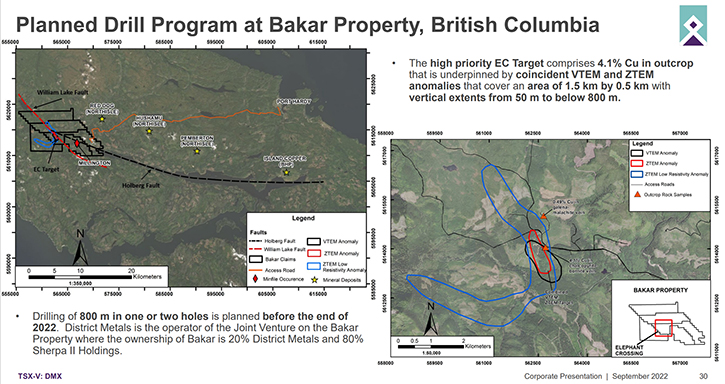

I should also bring up another project that's not in Sweden that we will be drilling. We are aiming to drill our Bakar property in British Columbia starting in the month of October. Bakar is a multi-parameter anomaly that’s targeting copper mineralization at our EC Target. Bakar is adjacent southwest from NorthIsle Copper and Gold where a number of copper porphyry deposits are located. So, it is most likely that we are dealing with a copper porphyry target at the EC Target, which has 4.1% copper outcropping, at surface, associated with very large coincident VTEM and ZTEM anomalies that span, 1.5 kilometers by 0.5 kilometers in area, with the depth, starting at 50 meters and going below 800 meters. It's never been drilled and we're really excited. It's one of the best grassroots targets that I've come across in my career because it is anchored by geophysical and geochemical anomalies within the right structural setting. So, we're excited to see what the drill rig comes up with.

Dr. Allen Alper: That's fantastic. It's great to be exploring in a great area. Sweden is known for polymetallics and gold and other minerals. Also, to be exploring in British Columbia and also looking for copper, which is a very important element for electrification of the world.

Garrett Ainsworth: Yes, definitely.

Dr. Allen Alper: What are your plans, with this project, for the remainder of this year and next year?

Garrett Ainsworth: At the EC Target on the Bakar Property, we are going to drill 800 meters, in one or two holes, in the month of October, so coming up, within the next two, three weeks probably. And then, what we do really depends on the drill results that we come up with, from these one or two drill holes. If it turns into a discovery, then the drilling budget will be increased, and we'll be off to the races. Obviously, if we don't hit anything of significance, then that would basically write off that target and we would turn our full focus back to our projects in Sweden.

Dr. Allen Alper: Well, I would think that if you do get some interesting copper results, you'll get quite a bit of financial support to investigate further. So, this will be a very critical time when you get the results of the drilling in October.

Garrett Ainsworth: Absolutely. Yeah, I agree with you.

Dr. Allen Alper: Garrett, I know you have an accomplished and experienced Team that is knowledgeable and diversified. Could you tell our readers and investors about yourself and your Management Team, Board and also, your technical and strategic Advisory Group?

Garrett Ainsworth: Yeah, definitely. So, with the Team at District, myself, I'm a geologist by training. A lot of my experience and success has been in the Athabasca Basin. Looking for and discovering uranium deposits. I was VP Exploration for Alpha Minerals where I led the discovery of the Triple R Uranium deposit, which Fission Uranium bought Alpha Minerals’ 50% ownership of that project and subsequent deposit in 2013 for 189 million dollars.

Then in 2014 I went on to work with NexGen Energy, as a VP of Exploration and Development. We had a lot of success with the Arrow Uranium Deposit discovery and other discoveries, along the Patterson Corridor. In 2018, I left NexGen and found a shell company, with some very supportive shareholders, and went on a search globally, for something that wasn't uranium, to be excited about exploring. And that's where we landed our Tomtebo Property. It has all the hallmarks of having high potential to contain something of significance.

And then, along that path, we formulated the Team to help fit the strategy in Sweden. Our Country Manager, Hein Raat, worked for Boliden Group for over 10 years. He has a heap of experience, focused in Bergslagen, looking for polymetallic deposits. He's executed our drill programs amazingly well and continues to do so. And then we also brought on Rodney Allen, who's our technical advisor. He was with the Boliden Group for almost 20 years. His claim to fame is that he led the Team at Boliden Group that made some significant discoveries at Boliden’s Garpenberg Mine, which is about 25 kilometers southeast of our Tomtebo project.

It really took Garpenberg from near closure, to now being a tier one asset for Boliden, Our Board is anchored by Joanna Cameron, with whom I worked at NexGen. She's a lawyer by trade. It is always great bouncing ideas off her and making sure things are being followed legally to T. Doug Ramshaw is a very well-known executive, with Alamos Mineras. His most recent win was as a Director of Great Bear Resources. He has a good technical background and strategic know-how in the industry. And then Jonathan Challis is a mine engineer, by training. He also worked for financial brokerages. So, he knows capital markets fairly well, just like Doug. The Team has been really, really well thought out and well-rounded that we've put together at District Metals.

Dr. Allen Alper: Well, it's really a very impressive, experienced, accomplished, and diversified Team. That's excellent! Could you tell our investors a little bit about your share structure?

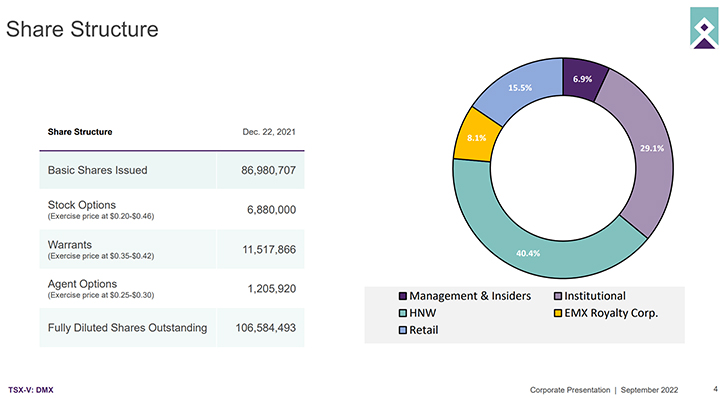

Garrett Ainsworth: Yes, absolutely. Right now, we have just about 87 million shares outstanding, about 6.9 million stock options. There are about 11.5 warrants and those are priced at 35 to 42 cents. I should mention the stock options are priced at 20 to 46 cents. So, fully diluted. There are also 1.2 million agent options fully diluted. There are about 106.6 million shares outstanding, in terms of the share structure that we have, or on the share registry. Myself, I have about 2.7 million shares that I've bought at anywhere between 12 and 40 cents.

Doug Ramshaw has just under a million. There are also other holdings by insiders as well, that bring us to about 7% of the shares outstanding. And one of the key things about Districts share registry is that we've made a lot of effort to bring in the right groups and funds, high-net-worth. We have funds such as KJ Harrison, Cambrian Capital, Extract Capital and APAC Capital, Commodity Discovery Fund, and Commodity Capital. The list goes on. So, for the size of the Company, we have some very impressive funds, on our share registry, and they're being very supportive on our path forward and they see our objectives in Sweden.

Dr. Allen Alper: That's great to be so well supported by very strong well-known funds. So that's excellent! Garrett, could you tell our readers and investors the primary reasons that our readers and investors, should consider investing in District Metals?

District Metals Corp.

Garrett Ainsworth: Yes, absolutely. First and foremost, it starts with the Team. We're very technically focused, but we also have a lot of experience raising capital. Those are two key characteristics of Management that are really, really important. We're very diligent with cash burn. Given the volatile markets that really started getting volatile earlier this year, around April, we made moves to adjust our burn, our G and A. So, we're down to about $30,000 per month for our G and A. So, we're in pretty good shape to withstand what's going on in the markets right now, with about 1.2 million in cash. And then of course, when you get the right Management, you get the right projects and that's what we've done.

We very carefully selected the best projects, we could find, in Sweden and we're looking to advance them ourselves. But because we have three now, we're also talking to some major mining companies, to see if there's anything that works on that front as well. That would mean funding would not create dilution for shareholders at least on one or two of our projects. But yeah, we're definitely looking at other ways to go. And then just the people, investors and the share registry that encompasses some very high-end funds. So, you're in good company, as a shareholder of District Metals.

Dr. Allen Alper: Well, those are very compelling reasons to consider investing in District Metals. You have great projects and great locations, known for discovery and mining, and you have a great Team, and you are well supported, with a balance of institutional and retail investments. So, I think that's all excellent! And you now have a new project that you're investigating that could be a big windfall for copper. Is there anything else you'd like to add, Garrett?

Garrett Ainsworth: Nope. I think we're well covered, on all fronts.

Dr. Allen Alper: Great! We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://districtmetals.com/

Garrett Ainsworth

President and Chief Executive Officer

Phone: (604) 288-4430

info@districtmetals.com

|

|