Peter Schloo, President, CEO and Director, Heritage Mining, Ltd. (CSE: HML) Discuses Exploring High Grade, Gold and Copper, District-Scale, Drayton-Black Lake Flagship Project in Ontario

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 9/29/2022

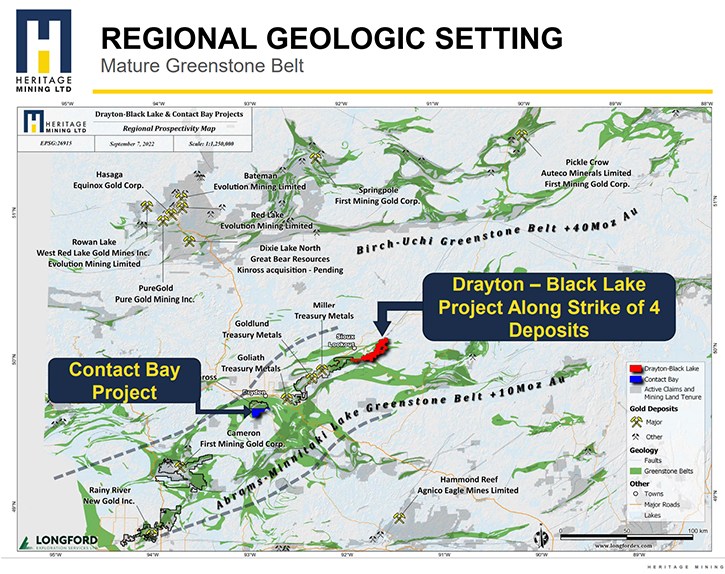

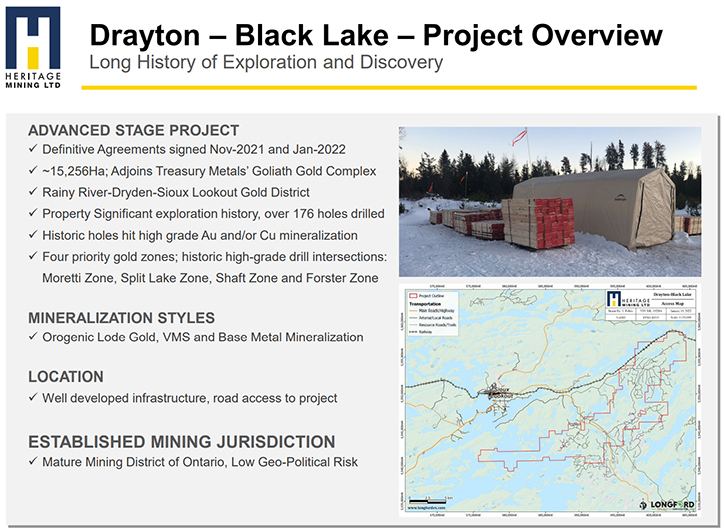

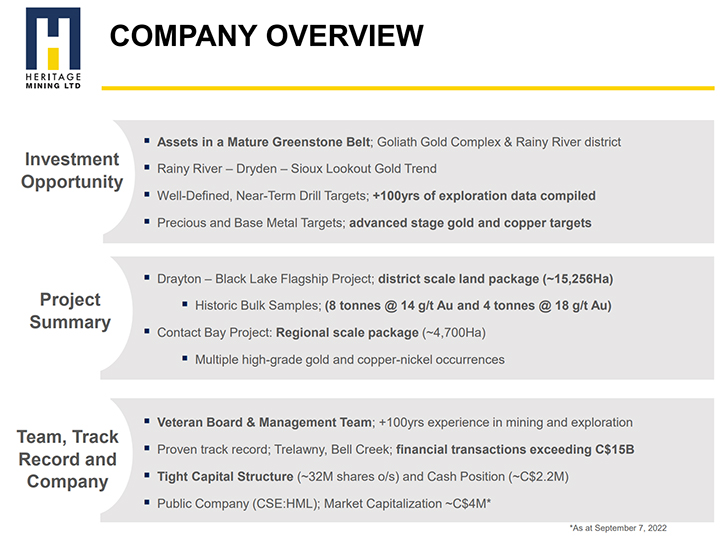

We spoke with Peter Schloo, President, CEO and Director of Heritage Mining, Ltd. (CSE: HML), a new junior mineral exploration Company that went public on August 26, 2022. The Company's, district-scale, Drayton-Black Lake flagship project totals ~15,256Ha, in northwestern Ontario, Canada. The project is on trend, with Treasury Metals’ (Goliath Complex), with multiple, high-grade, gold and copper occurrences. There are several, well-defined, near-term drill targets, over four zones, close proximity to infrastructure, combined with over 100 years of exploration data (176 historic DDH totaling ~20km) never compiled until 2022. Heritage Mining is well capitalized, with a tight Capital structure, with approximately 31.9M common shares outstanding. The Company’s Veteran Board and Management Team has over 100 years of experience in the mining and exploration industry, with a proven track record.

Heritage Mining, Ltd. CEO, Peter Schloo, on-site at the Drayton Black Lake project.

Dr. Allen Alper:

This is Dr. Allen Alper, Editor-in-Chief of Metals News, talking with Peter Schloo, President, CEO and Director, of Heritage Mining, Ltd. Peter, could you give our readers/investors an overview of your Company, and what differentiates it from others?

Peter Schloo:

We have a district scale package, in northwestern Ontario, adjacent to Treasury Metals. We obtained the property from Group Ten, now Stillwater. What sets us apart from the rest is, there're about 100 years’ worth of data that has never been looked at from a low grade, high tonnage perspective. That's why we were attracted to the project initially. We have fantastic access to the property. There are all-weather, maintained, logging roads, throughout the property. to get to about 90% of our targets.

The total package now has expanded, from approximately 14,000 hectares, since last week, to 15,256 hectares. We have a veteran Board and Management Team, which totals over 100 years’ experience, in the mining and exploration space. We have a proven track record, with similar geology to Trelawny, Bell Creek and the Joubie Gold Mine. Inclusive of our Consultants, Management and Directors, our financial transaction experience exceeds C$15 billion.

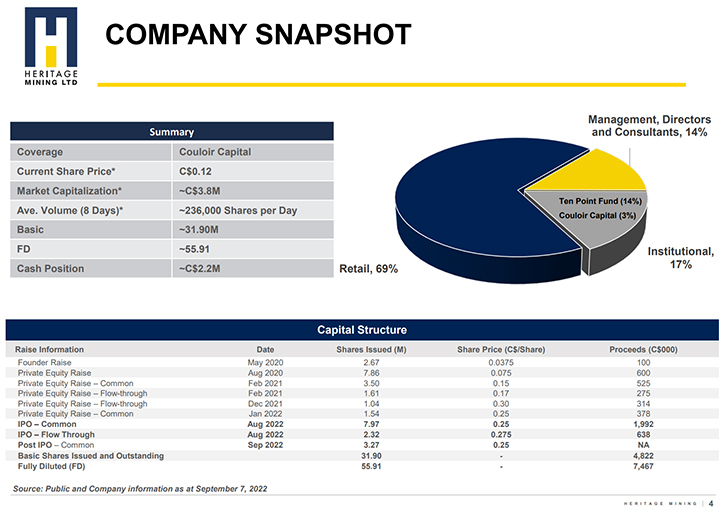

From a capital structure standpoint, which definitely sets us apart, we're about 32 million shares outstanding, right now, that's post IPO. We had to issue shares, included in that number, about 3 million, as part of our option agreements, with various groups. We have a strong cash position, at $2.2 million. Our market capitalization is approximately $4 million. I compare us to 40 other gold exploration companies in Ontario specifically, that have a gold or gold copper exploration package and are doing similar things to what we're doing. And that's all that really drives the comparable.

Then we benchmark ourselves on market cap, shares outstanding, cash balance, and property size. Right now, we sit in the top quartile across the board. Another item that differentiates us from most of the companies is that we've taken a serious interest in our marketing side, specifically, our social media platforms. We're in the top quartile across our comparables, LinkedIn, Instagram, Facebook, and Twitter, as well. We even have a Reddit account.

We listen to these different avenues. If you were a Twitter follower, two weeks ago, you would have gotten a message from me, saying we're on the road to going public. Do you want more information? So, we’re very active, in these areas, where I think a lot of groups might say they are, but we’re in the trenches, actually engaging, with our audience, on various different platforms, which is very exciting.

Dr. Allen Alper:

That's excellent! We do the same.

Peter Schloo:

Just to give a summary, from a Company snapshot, we have started coverage, through Couloir Capital. So, I definitely refer everyone to there. We got a buy rating for $0.31 at Couloir Capital, out of Vancouver, with Rob Stitt. Our current share price is about $0.12. I think, as of yesterday's close, it's 3.8 million market capitalization. Another item, that puts us out in front of our competitors is our average volume traded. Right now, we've been on the market for eight total days and the average shares traded is about 236,000. The average in our comps is about 100,000 shares per day, so we're over two times the number of shares.

We just completed our IPO, and are the hot story on the street. Not a lot of IPOs, in our space, were done in the summer. So, there's definitely going to be more attention. But we're doing what we said we would and we're trying to stick to the top quartile. Unfortunately, for the audience, we're obviously down about half from our IPO, so one would think that we're a bit undervalued at this point.

Management, Directors and Consultants, post IPO, hold about 14%, so we all cut checks every single round. That comes, with the Director, Officer, or Consultant position. If you want to continue being a Consultant, it's expected that you participate in the various raises, just to show continued support for our Company.

We also have two institutions that are involved and have been involved, since the founder and seed round, both long-term holders. For myself, follow me through my career and that's that ten-point fund, out of Spartan Asset Management and Couloir Capital. Then we have a retail following of 69% to make up the rest. We have a really good high-net-worth retail base.

We're down half because, and this is just my opinion, there's a certain group that wants to exit. I think after about 2.5 million, in selling volume, in total that'll be cleared up and we're approaching that quickly, especially with our volume traded per day. So, we'll be getting that cleared up and then looking forward to the future.

I can also point out, we did file our capital structure, detailed by round, online on SEDAR, so if anybody's interested in the detailed capital structure, from a rate standpoint, the date, how many shares were issued, the share price and the amount of proceeds that came out of that raise, that's all filed publicly, forever, on SEDAR.

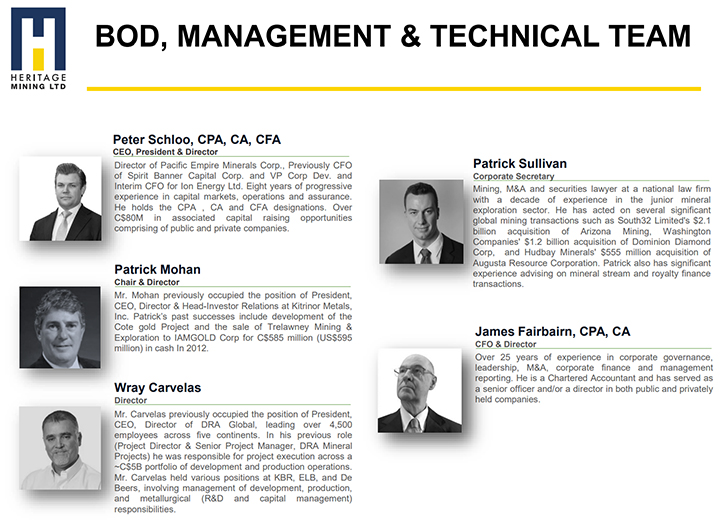

In terms of our Management Team, I'm a Chartered Accountant and Chartered Financial Analyst by background. What's not online right now, is I'm also a licensed prospector in the province of Ontario. I've been up there, multiple times, with our Team, on the due diligence site visits and getting familiarized with the property.

We have our Chairman, CFO and Director. They were both Directors in the Trelawney sale to IAMGOLD, from the early days. Wray Carvelas, who's also a Director of Heritage Mining, was Founding Director, CEO of DRA Global, which is a global mining and consulting firm. He took it from 30 or 40 people all the way to 4,500.

I met Wray, from the days when I was working with Steppe Gold, which was a development gold play in Mongolia, which is now a producer and onto their second phase. So, they're doing a fantastic job and it was great to assist them, from the capital market side, into going into production. DRA Global actually did the mine building consulting, that’s how we developed our relationship.

We also have Patrick Sullivan as our Corporate Secretary and also Legal Counsel. He served and acted on several significant mining transactions. Examples South32, $21 billion acquisition of Arizona Mining. Washington companies a $1.2 billion acquisition of Dominion Diamond Corp. HudBay a $55 million acquisition. The list goes on. We have a significant Board and Management Team that has been there and taken companies all the way through to production, which is great.

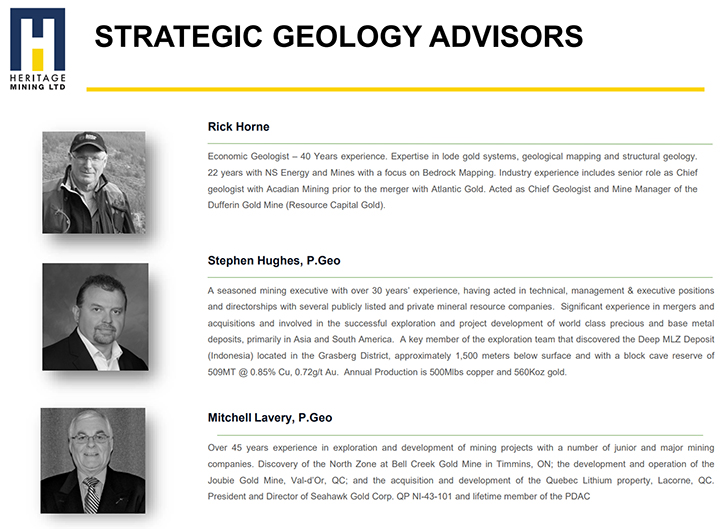

From a geological standpoint, we have Rick Horne and Stephen Hughes on our Team. Rick Horne has 40 years’ experience. We've actually used him on a previous project, in Nova Scotia. Once the rubber hits the road with Rick and his Team, we signed a definitive agreement and had drills turning into weeks and they're up there right now, so we've added Torque Mining to the Team post-IPO.

Stephen Hughes is helping out, on a part-time basis. His notable experience was as Head of an underground exploration, in the Grasberg Mine, in Indonesia. He’s very good in 3-D modeling. He’s discovered and taken to production millions of tons, from a copper standpoint. It’s great to have him in the trenches along with us.

Then we have Mitch Lavery, who has been out to site, multiple times. He's taken two mines through to production, Bell Creek and the Joubie Gold Mine, in Ontario and Quebec, with similar geology to both of our projects that we have now. It's great to have him as an advisor.

I've mentioned that we’re in close proximity to infrastructure. So just to build on that more, we have a highway going through the property. We have a railway touching on the top. There's a power line going through, which was what drove us to do airborne EM and MAG. So, we're definitely waving the flag of systematic exploration and we're doing exactly what we said we would do.

Right now, the Team is up there, accurately putting in GPS tags on dated information. We're up there mapping the orientation of the veins that are at surface and some more chip samples, to confirm and get accurate mapping.

Dr. Allen Alper:

That sounds excellent! Could you tell our readers/investors a little bit about the Drayton-Black Lake Project area and a little bit about the history and your plans?

Peter Schloo:

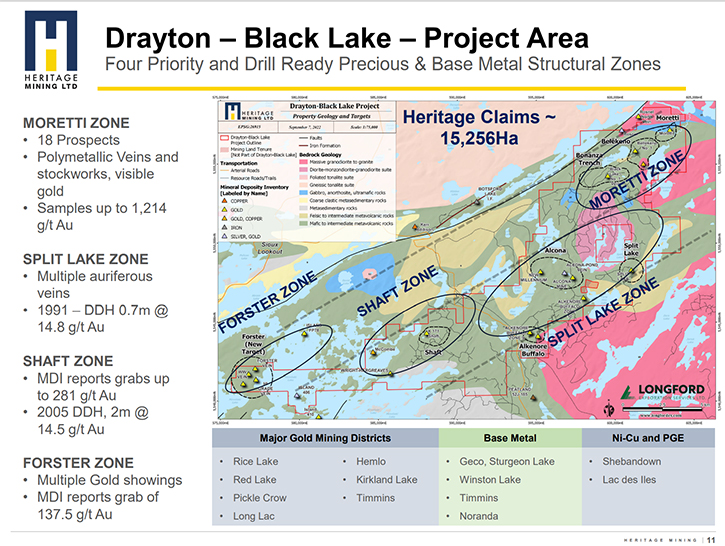

The Drayton-Black Lake Project, initially, when it was held by Group Ten, there were about 13,000 hectares. Then we entered into an agreement with Paul Reeves, who has the Alcoa mine three compartmental 100m shaft plus the Split Lake extension acquisition. That's put us just north of 15,000 hectares. It’s in the Rainy River Dryden Sioux Lookout District. The property has a significant exploration history of over a hundred years. But to dive in a little deeper, there are 176 holes drilled over 20,000 meters. We have some historic hits of high-grade gold and copper mineralization.

We've stripped it out to four priority target areas, the Moretti, Split Lake, Shaft and Forester Zone. The mineralization style of the Drayton-Black Lake Project is orogenic lode gold, VMS, and base metal mineralization. For the exploration history, I would definitely draw readers to the website. We do have a detailed exploration history slide. Notable groups that have been on there are Rio Tinto, Teck, Placer Dome, Cameco and recently, Stillwater has been advancing the project, keeping the claims in good standing, so we’re very happy that they passed on the torch.

From a geological perspective, what we're actually seeing is similar to the Goldlund Deposit, an exciting area. But again, it's underexplored and the thesis of the entire property is that we have all of this data, that first and foremost has never been digitized. When we were performing preliminary due diligence, just from in the cloud and what we can get from just researching the property, accessing the data room, and cross-referencing it, with the public records.

It's very clear, early on, that there was not a complete, consolidated database, so that was step one. We've been looking at it until the wee hours of the morning, myself included, just looking at the old historic data. The consistent theme is that there are narrow high-grade gold intercepts and sometimes copper throughout the property, isolated to selective sampling with quartz veins. What you'll have is a set of veins and back in the day, they would just go and take the small quartz veins samples and send that to the lab, but they wouldn't do anything in between. Well, it's very similar to what Treasury Metals has, at their Goldlund. They had the data to do the same thing, but they did the whole assay, the entire thing, from a low-grade, high tonnage perspective, to see if they could get a broad zone of mineralization. So, that's our plan.

Our priority areas are the Moretti and the Split Lake Zone. We have the Split Lake area, which we just added to our claim package, we grabbed some claims along the Greenstone Belt. There's a 100-meter shaft, a lot of good historical information there, so, we're excited to further that area along. We also have the Alcona Mine and New Millennium. There are some great drill intercepts that are perpendicular to what we think the orientation of the veins are, at the Alcona Mine, and that stretches almost a kilometer.

The New Millennium is three or four kilometers away. If those things connect, and it looks like a reasonable thesis that they may, your one and done there. And then the New Millennium, there are reports of trenching, two kilometers to the southwest as well. So, a very interesting area that we look forward to. We also have the geophysical data back. We had it flown previously and now we have the data post-IPO. So now we're going through that, and you can look forward to a nice corporate update, as soon as possible.

The Moretti Zone is basically 10 to 30 meters wide, and that's in the northeastern part of the property. That is a 10- to 30-meter-wide structural zone, with approximately 6 km that we think is a strike length. You'll see high-grade quartz veining, throughout the 6 kilometers, so our thesis is to go out there and test to see the continuance of that. We're also seeing some copper mineralization, which is keeping us very interested, because not a lot of groups have talked about copper up there. Those are in two priority target areas, and I'll probably leave it at that.

Dr. Allen Alper:

Well, that's very good. Could you please tell us the primary reasons readers/investors should consider investing in Heritage Mining?

Peter Schloo:

We have a very tight capital structure, with a Board and Management Team and consulting group that has been there and done it before. You have individuals, who have been in the business for over 30 or 40 years, and they're applying their knowledge to a Company that's new, which is very interesting. We can take all those learning curves that have been experiencing all the scars and apply that to a project that has a fresh, new look. There's 100 years’ worth of information that's never been digitized, 176 holes that have never been put in and looked at in 3D. It’s never been systematically advanced, from an exploration perspective, with low grade, high tonnage in mind.

From an exploration standpoint, given that you have a project, with significant upside, from a multi-million-ounce, multi-zone standpoint because we think there are four areas, with multi-million-ounce potential, in and of themselves. You have a Team that's been there and done that before, which is normally a good check mark. Fortunately, for everybody reading the story now, I think we were basically undervalued, by about 30%, on our IPO, 30 to 35%. This is just looking at public comparables, as I was talking about before. Now we're trading at $0.12. Nothing bad has happened. We look forward to releasing our corporate update and adding value to the property.

We have a history, since inception, of doing what we said we would do. We advance projects to a decision point. And this one, we think it has a significant amount of advancement and value that we can add. We haven't even started and we're already trading at half. I understand that it's a tough market, but I would say that this is a fantastic opportunity to jump in. We're half our market cap. We have $2.2 million in cash, the market cap is about C$4M and we haven't even started. I think there's a ton of value for us to add, so I definitely encourage everybody to take a look.

Dr. Allen Alper:

Well, I think those are very strong reasons for readers/investors to consider investing in Heritage. You have a fantastic Team, you’re in an excellent region, and you have great infrastructure, great perspective properties, with a great history of development. So, I think it's worth getting to know your Company, as a young Company, getting started, and you have great capital structure. So, it all sounds excellent!

Peter Schloo:

Thank you very much. We think we've done our best and continue to do so.

Dr. Allen Alper:

Well, that's great. I'm very impressed, with the Team you put together, and the properties you have and how rapidly you've moved the Company along. Is there anything else you'd like to add, Peter?

Peter Schloo:

I think we've touched on all the key points. We're trading at a discount. I think once we get to the net sold, what from a volume perspective, around two, two and a half million, we'll see where we really are. I think there's a little bit of an overhang that we have to deal with. It's definitely something that one should take into consideration because we're trading at a fantastic price right now.

Dr. Allen Alper:

That sounds excellent. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://heritagemining.ca/

Peter Schloo, CPA, CA, CFA

President, CEO and Director

Heritage Mining Ltd.

Cell: 905-505-0918

Email: peter@heritagemining.ca

|

|