Interview with Canadian Mining Hall of Fame Recipient Dr. Robert Quartermain, Co-Chairman and Jonathan Awde, President & CEO, Dakota Gold (NYSE American: DC): New Gold Discoveries, Covering over 40 Thousand Acres, Surrounding the Historic Homestake Mine, South Dakota

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 9/26/2022

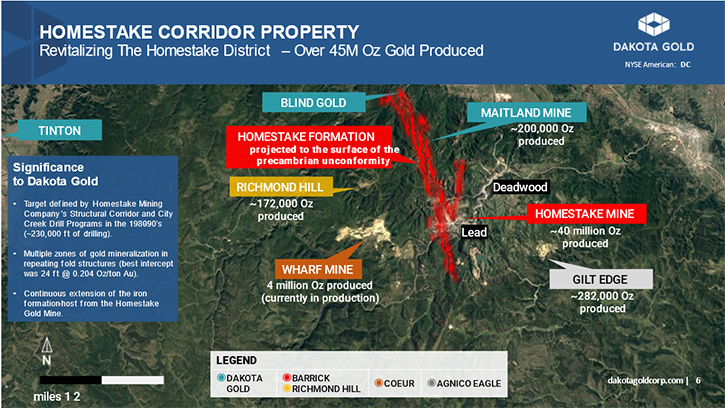

We spoke with, Dr. Robert Quartermain, who is Co-Chairman, and Jonathan Awde, who is President and CEO of Dakota Gold (NYSE American: DC). Dakota Gold is a South Dakota-based, responsible gold exploration and development company, with a specific focus on revitalizing the Homestake District in Lead, South Dakota. Dakota Gold is focused on new gold discoveries, and has high-caliber gold mineral properties, covering over 40 thousand acres, surrounding the historic Homestake Mine. In 2020, Dakota Gold made an agreement with Barrick Gold Corporation, which includes Maitland Gold Project purchase, the three-year surface Barrick option agreement, and the three-year Richmond Hill option agreement. Today the Company is aggressively exploring and working on community integration.

Dakota Gold

Dr. Allen Alper:

This is Dr. Allen Alper, Editor-in-Chief of Metals News, talking with two leaders of the mining industry, Robert Quartermain, Co-Chair and Jonathan Awde, President and CEO of Dakota Gold Corp. Robert, you’ve just been inducted into the Canadian Mining Hall of Fame, in August 2022. Tell me about your incredible 40 plus years, working in the resource industry and what has kept you interested in it.

Dr. Robert Quartermain:

Well, thank you, Allen. It's great to be speaking with you again this morning. What has kept me interested in this industry, during my time, has been discovery. I've been involved with many discoveries, over my 46-year career. I started working in the Northwest Territories back in 1976, while I was still getting my undergrad degree at UNB, and my focus then was on uranium and gold. And I've been working in the gold space since that time.

After I received my Master's Degree from Queens, I was hired by Teck and then in quick succession, I was sent to the Lamaque Gold Mine, where I was Assistant Mine Geologist. And then in quick succession after that, I was sent to the Hemlo Gold Mines, particularly the David Bell Gold Mine. I received underground experience, working at mines, early in my career and later on, in the days that we had Pretium Resources and the Brucejack Mine, that would inform my conviction that there was a high grade mine there, because of that experience that I gained.

In 1985, Teck transferred me to Vancouver to run Silver Standard and some of its associated companies. We did that for a few years, and it wasn't until 1992 that Rick Rule and Jim Blanchard approached me and asked me if we would fund Silver Standard and start to look just for silver and basically create a large silver bank. Our first financing with Rick was 3 million shares at $0.78 and we raised $2 million.

In subsequent financings, over the next number of years, and through success and discovery and acquisition, we grew our resources to over a billion ounces of silver and our market cap exceeded over $2 billion. We were very successful in that plan that we did with Silver Standard. Along the way, we built the Manantial Espejo Project, and we actually built the Pirquitas Mine, in Argentina, which is still working. It set the foundation for Silver Standard, which is now SSR Mining, which has over a $4 billion market cap.

In 2010, I retired from Silver Standard, but they decided to sell the Brucejack Project. Since I was convinced, it was a high-grade gold mine, I went out and raised $263 million, in a financing, to buy the asset for $450 million and we also gave Silver Standard some shares. I put together the Pretium Resources Team initially, which was just Ken McNaughton and Joe Ovsenek, with whom I'd worked, for over 20 years, at Silver Standard.

We eventually grew the Pretium Resources into Canada's fourth largest gold mine and put it in production within seven years from discovery, which was quite an accomplishment. And it's been making profit every day since day one. I think the reason we enjoyed success at Brucejack, is we had a very early and respectful engagement with First Nations and over 30% First Nations currently work at the mine. We built such an excellent mining team and operation that Newcrest came and spent $3.5 billion to buy it just earlier this year.

Throughout my career I have traveled extensively around the world, all continents, looking for opportunities. I've been able to enjoy focusing my philanthropic work, through the ARC Foundation and Panthera, in areas that I like. With Silver Standard and Pretium Resources successes, I felt I had one more opportunity, within me and I'm looking forward to doing that with Dakota Gold.

Dr. Allen Alper:

Well, that's fantastic! What an amazing accomplishment in your career, and it looks like you're about to do it again, so that's fantastic! Jonathan, tell us about your history. You began your career raising capital for junior resource companies and then transitioned to running your own, including Gold Standard Ventures, which was recently acquired by Orla Mining.

Jonathan Awde:

Yeah. I started out my career at Wolverton Securities, as an investment advisor in Vancouver, which has a rich history of financing small cap metals and mining and oil and gas. Wolverton was recently acquired by PI Financial. I started out in Investor Relations and in late 2009, early 2010 and then shortly thereafter, became the Co-Founder, President and CEO of Gold Standard Ventures, where we advanced the Railroad Project in Nevada. Gold Standard was just recently acquired by Orla Mining. It will be Nevada's next open pit heap leach project. That was a great experience, and I came across this opportunity in Dakota Gold. Applied a similar template, of land consolidation and having an excellent Team to work with.

Dr. Allen Alper:

Well, that was an excellent accomplishment. You and Robert make a fantastic team and I know our investors will be very interested in your new Company. Jonathan, what can you tell us about the capital markets today and what you've learned from the past 15 years in the business?

Jonathan Awde:

Well, I think that one of the reasons why so many companies fail in this industry is they're undercapitalized. One of the things that we set out to do was make sure we always had a strong treasury. This is a very cyclical business and sometimes these windows for capital are available. They aren't open for very long and you have to understand that. But, I also think it's important to have relationships with investors that are outside of the mining space.

You must have generalist investors who want to deploy capital. Because if you're just reliant on the precious metals funds, a lot of them being open ended funds, so investors can redeem their capital at any time. When markets turn, they get redemptions, so it just creates this downward spiral of selling. One of my philosophies, is to make sure that your second drill program is funded, before you drill your first hole.

We raised $50 million US, last summer. We actually turned away capital, we had upsized our financing a couple of times. That was the commitment that I made to Robert and Stephen O’Rourke, our other Co-Chair and we're currently sitting on a very strong treasury.

Dr. Allen Alper:

Well, it's fantastic. It's great to have the funds to be able to explore and carry out the exploration, and drilling. It’s an extensive project and it’s great that you’re well-funded and you have a team to move the project forward.

Jonathan Awde:

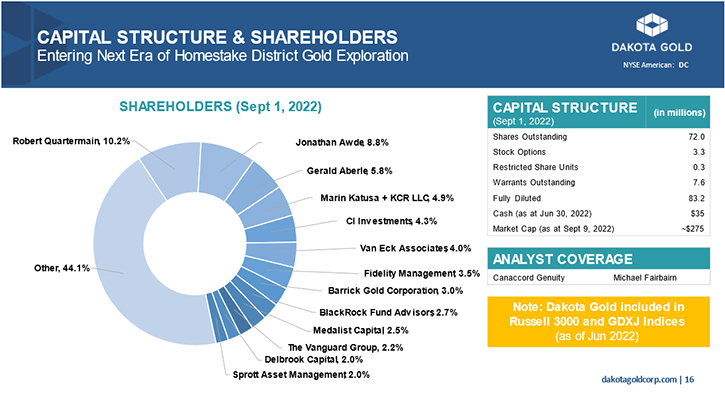

Robert and I are the two largest shareholders of the Company. Being aligned, with our shareholders, and understanding the cost of capital, is something that we live, we breathe, we eat every day. It’s important for us to have that alignment, with our shareholders and understand that we have to fight, in an environment like this, to lower our cost of capital.

Dr. Allen Alper:

Well, that’s fantastic. Very few companies have Management and a Board, with so much investment in the companies they’re running. It’s great to see the two of you are so aligned and invested, with your shareholders and stakeholders. Robert and Jonathan, you’ve now joined forces to start a new Company, Dakota Gold Corp., which was listed on the NYSE America, under the ticker DC, this year. Jonathan, could you tell us about the Company?

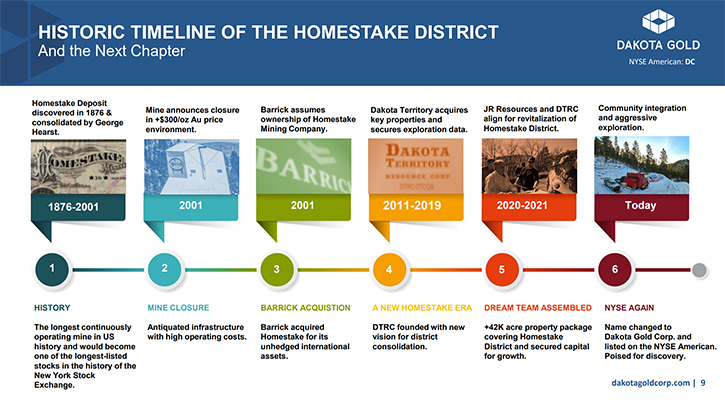

Jonathan Awde: Dakota Gold Corp. is the result of a merger between JR Resources, which was a private company that Robert and I founded years ago, which stands for Jonathan and Robert and Dakota Territory Resource Corp. We completed the merger, we had a meeting, and all four resolutions were passed, completing our uplift, on April 5th, 2022 to the NYSE American.

Really, this opportunity is revitalizing the Homestake District, which produced over 40 million ounces of gold over 125 years. In 2000, Barrick Gold bought Homestake Mining Company. However, Barrick had no interest in South Dakota. Barrick had had interest in the other assets that Homestake had in its portfolio. The Homestake Mine was shut down in 2001 and right away went into Barrick's Closure Group.

We have grown this land package from around 3,000 acres to almost 45,000 acres. We've done three deals with Barrick, over an eighteen-month period. We've done over 35 individual land deals, and we have acquired exclusive access to all of Barrick’s data, not only inside the old mine, but outside of the old mine. That has been invaluable and has really guided this larger, more ambitious land consolidation program.

It's important to note, because we get asked this question a lot, we have three rigs turning on the project, all three of our rigs are on private ground. From a permitting standpoint, from a development standpoint, from being able to repurpose already disturbed ground, it's invaluable to have that ability to operate on private ground. We do have other ground that's on U.S. Forest Service, but right now we are operating exclusively on private ground.

Dr. Allen Alper:

Well, that's excellent. That's great to be in that position. That's very, very rare! Robert, you had just retired from Pretium Resources, after you successfully advanced the Brucejack Project from exploration to being Canada's fourth largest gold mine, in less than a decade. What compelled you to come out of retirement and start up Dakota Gold with Jonathan?

Dr. Robert Quartermain:

I think there were three things. Being a professional geoscientist, the first thing was the geology. I was shown a cross-section of the Homestake District by Jonathan and Jerry Aberle. It piqued my interest in the fact that you had 40 million ounces of gold mined across a couple of miles of strike length, and there were many miles of strike length, which had been tested. But that had been done at a different gold price environment, when gold was $300 an ounce, not $1,600 dollars an ounce.

I know, from my experience, having worked at both the Hemlo, Lamaque and the Brucejack Mines, that you need a certain level of value in the rock to make it economic and as gold prices go up, that cut-off grade changes. So, there was geological opportunity.

Second was the location. You're in an existing mining camp, not only an old gold mining camp, but there's still mining going on there today. You have the Wharf Mine operating near us, where we have our property packages and adjacent to many of them. So, you have this infrastructure, you have a political environment, which is favorable to mining, and we don't find that everywhere in the world, right now, and you have a permitting process and a way you can advance your projects. Second was location, good location.

Third, and probably as important as the other two, were the people. Jerry Aberle, our COO, who previously was the President of Dakota Territories, had worked at the Homestake Mine since the 1970’s. So, he knows it intimately, he's worked underground, he knows the mineralization, what it looks like in the Homestake Mine. That helps us, as we explore areas elsewhere. As Jonathan pointed out, when we went in, there was an opportunity to go and acquire significant amounts of land, going from what started at 3,000 acres to where we're over 40,000 acres now. We could do that because there was no one else focused on it.

We have the people and Jerry's been able to bring together many people, who had worked at the Homestake Mine, with him, years ago. And we have my other Co-Chair, Stephen O'Rourke, who worked with BHP for years and is an international C-Suite individual, who brings a lot of understanding to it. We have this very experienced Team, working in the right location, with the right geology, at the right gold price.

That's what had me come out of retirement to do this, hopefully my third time. And, as Jonathan pointed out, to take a large position. I own about 10% of the Company, so my interests are totally aligned with shareholders, as we continue to evolve this very great opportunity.

Dr. Allen Alper:

Well, that's fantastic. It's great that you have the opportunity for a fantastic accomplishment, for the third time. That's amazing! The Homestake Mine was closed around 2000. In your opinion, what has changed in the past 20 years that makes the project worth revitalizing?

Jonathan Awde:

Well, when the Homestake Mine shut down, the gold price was under $300 an ounce. Really what changed and what created this opportunity was, Robert and I looking at this cross-section and looking at this district, and there was really no one else there. Coeur Mining has been operating the Wharf Mine since 2016. But really it was a change of leadership at Barrick, where after the merger with Randgold, Mark Bristow looked at the Barrick portfolio to optimize and rationalize it and said, “Look, if what we have is not Tier 1 or Tier 2 or we don’t think we can get there, or it’s not strategic, get rid of it!”

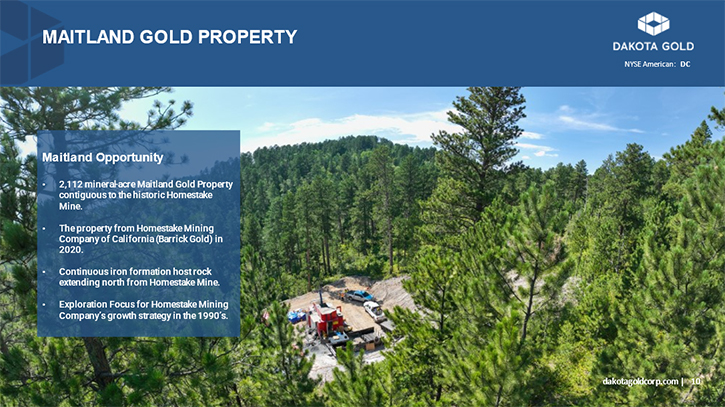

This opportunity was in Barrick's closure group. We had reached out to Barrick in March of 2020 and then acquired the Maitland asset a few months later. As Robert said earlier in the discussion, the Maitland Gold Project, which was the first of three deals we did with Barrick, is actually contiguous with the old Homestake Mine and contains what's called the North Drift Discovery, which was made by Homestake Mining Company in the early 90s.

It's in Homestake Formation, it's quarter ounce to a third of an ounce of gold. Then over three miles to the north, at surface, you have this historical Tertiary resource, shallow oxide. So, we knew we had an opportunity to potentially replicate some of what was going on in the old mine. Timing was great on our part. We had the right local expertise and Jerry Aberle, who just didn't really have access to capital. And we came in with fresh thinking, bigger thinking, leveraged our relationships with Barrick and our access to capital and moved forward.

Dr. Allen Alper:

That's excellent. I'm looking forward, and I know our readers/investors are looking forward to watching the drilling and the exploration move on. It sounds like this will be another great mine development. Dakota Gold has released their first drill results, for the Maitland Gold Project, on June 2nd. Tell me what these results mean for the Company.

Jonathan Awde:

I'll start and then I'll have Robert finish this one. I think it's a proof of concept. We hit gold in two of the primary host units in tertiary and in Homestake Formation, in our first drill hole. These intercepts are allowing us to vector. A lot of the drilling that was done here historically was not done with core, so it really allows us the opportunity to really look and see what's going on. For many people on our technical team, it's proof of concept and game on.

Dr. Robert Quartermain:

I think what was important, as Jonathan pointed out, one of the attractive features of this opportunity was the Homestake Mine, with its 40 million ounces of gold and one of the most concentrated mines, in the world, because of its high-grade nature, ran a quarter of an ounce gold, or basically eight grams per tonne is what they mined. Then you have these three miles of strike length, which were tested back in the 90s when gold price was $300 and you have surface gold three miles away, so we were able to acquire this project.

We put our first holes in and we actually hit Homestake Formation. Now we expected to hit it, but the fact we hit it with mineralization and potentially economic mineralization was quite unique. In many of the projects I've drilled around the world, it often takes a hole or two or many holes. In Hemlo’s case I think we were well into hole 70 before the David Bell Mine was found. When you look at our own Brucejack Mine, we took close to hole 84, which is the hole that hit mineralization that convinced me there was an underground mine there that needed to be followed up on. To get mineralization in your first two holes, as Jonathan points out, shows proof of concept.

Now we are continuing to drill these areas where we have hits and to see how extensive that mineralization is. When you look at a cross-section of the old mine, the mineralization occurs more in pipes or tubes, where they have a certain width to them, but they're much longer down plunge in the fold noses of the banded iron formation. So, once you cut across it and hit it, you can then follow it up to surface or down at depth.

That's what these initial holes allow us to start looking around and finding one of these ledges as they were called. These can be of quite significant size, the main ledge at Homestake Mine was up to 20 million ounces of gold and some of the smaller ledges, of which there are 19 or so, can get down to be two and a half to 1 million ounces of gold. Once you get on a ledge, you follow and drill it off and there's the opportunity. That's what this first hole said, in these three miles of strike length we've had. There are likely other ledges, and we just have to get in to continue to drill.

Dr. Allen Alper:

Well, that's excellent! It's going to be a very exciting time this year and next year for your stakeholders and shareholders. That's excellent! What other catalysts should we expect to see?

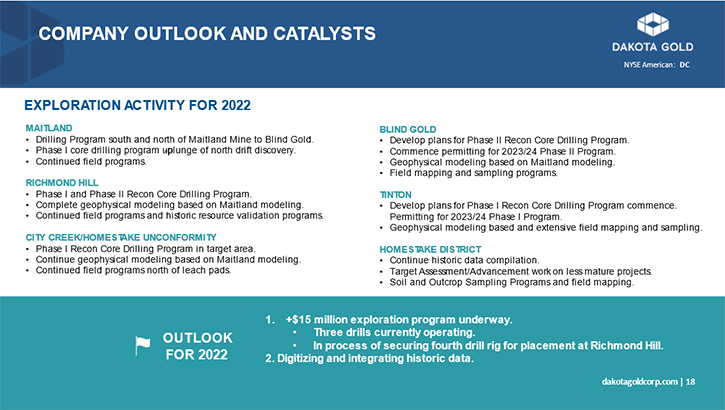

Jonathan Awde:

We currently have three rigs drilling on the project. We are in the process of adding a fourth rig to the overall property package. We have additional drilling results, not just from Maitland, but also from Richmond Hill and our City Creek project. We're still in the pursuit of additional land cleanup and consolidation. While not as large, in terms of going from 3,000 acres to 45,000 acres, some smaller but strategic pieces, and really just integrating all this Barrick data. Again, I cannot emphasize the size and scale this data set, but how valuable it has been for us. This is exclusive access to all of Homestake’s data, not only inside the mine, but outside the mine. So, we're looking forward to finishing that process.

Dr. Allen Alper:

That’s really excellent. It's really great to have all that historical data and to have a great Team looking at analyzing the data and planning and carrying out your exploration. Could you give our readers/investors a little bit more detail, on your share and capital structure?

Jonathan Awde:

We have just over 72 million shares outstanding, fully diluted we’re just over 80 million shares. As of our last financials, we were over $35 million US. As we outlined, earlier in the discussion, Management owns just under 30%. Earlier this year in June, Dakota Gold was included in the GDXJ and also the Russell 3000, which was great. That was just over 12% ownership in the Company, included in the GDXJ and the Russell 3000. And we have a number of Tier 1 institutions that are now shareholders of Dakota Gold.

Dr. Allen Alper:

Well, I'm truly amazed at how rapidly you've put this Company together and obtained the financial sponsorship, the Team together and the property. It’s an exciting time for everyone! It's really great! I wonder if you could summarize the primary reasons our readers/investors should consider investing in Dakota Gold Corp.?

Jonathan Awde:

I think there are several key reasons for investors to look at Dakota Gold Corp. It's a great jurisdiction that's been underexplored. You have the largest banded iron formation-hosted gold deposit in the world, where over 40 million ounces of gold was taken out of a small, compact area. Any time Homestake Mine would drill outside of the old mine, if they weren't finding at least what they were mining, they would stop drilling. We have several pierce points, which point to quarter ounce, 0.15 ounces per ton gold intercepts that are in Homestake Formation that are totally isolated.

We are very encouraged by what we're seeing, we're extremely encouraged by the data. Geologically you're in a very fertile area that's been dramatically underexplored. Number two is, as Robert mentioned very early on, the combination of people that we've assembled, not just on our Board of Directors. We just brought on Alice Schroeder, who wrote a book called Snowball, which is a biography on Warren Buffett. To Stephen O'Rourke, who is C-Suite at BHP and Rio and was President of Global Exploration for BHP and a School of Mines graduate.

Obviously, Robert's career is well known, and it's been an absolute pleasure and honor to work alongside him. But really, Jerry Aberle and James Berry are two key figures, in moving this along. James worked at Homestake Mine, was underground, worked at Wharf Mine. So very familiar with both kinds of gold mineralization here being in Homestake Formation, experience in the old Homestake Mine, but also at Wharf Mine, where they're mining in the Tertiary unit, at surface.

Jerry Aberle is just a walking encyclopedia of knowledge about the history of this district. It’s with people who understand capital markets and are very strategic, very business oriented, extremely disciplined, and are 100% aligned with shareholders. Just one more thing, Robert doesn't receive any compensation. He is not only the largest shareholder, but he donates what he would receive as a salary, as Co-Chair and as a Board Director, toward supporting some of our ESG initiatives. So just to summarize, fantastic geological location, well-endowed, unexplored, the right people with a well-financed Company, with principals, who are aligned with their shareholders.

Dr. Allen Alper:

Those are compelling and outstanding reasons for our readers/investors to consider investing in Dakota Gold Corp., Robert, is there anything else you would like to add?

Dr. Robert Quartermain:

I think Jonathan has covered it all. The key thing that will come out of his conversation, is we're focused, we're focused on gold, we're focused in the Homestake District. We have a focused, experienced Team, well capitalized, with excellent management. That's important for me. This is the only public company that I am involved with currently. You get this incredible focus of experience from a wide group of individuals, who are here strictly working for shareholders and well capitalized to achieve success. I'm very excited about what's ahead of us over the next two years.

Dr. Allen Alper:

Well, that's fantastic. I enjoyed talking to both of you again. Previously, with great successes in your previous companies, and now I'm looking forward to seeing another great success, coming out of your Team and the region you're in and your backing. So, I think it'll be a great opportunity for readers/investors. Would you like to add anything?

Jonathan Awde:

No, I think we've covered everything. Always a pleasure to be on here. Dakota Gold will be at both the Precious Metals Summit in Beaver Creek and the Gold Forum Americas Conference in Colorado Springs, over the next few weeks. So, looking forward to re-engaging, with some of our shareholders and some new investors that we're going to be meeting, as it's been a 2-to-3-year hiatus of not attending these shows in person.

Dr. Allen Alper:

Well, that's excellent!

https://dakotagoldcorp.com/

Jonathan Awde

President and Chief Executive Officer

Tel: +1 604-761-5251

Email: JAwde@dakotagoldcorp.com

|

|