Interview with Caleb Stroup, President and CEO, Headwater Gold, Inc. (CSE: HWG, OTCQB: HWAUF): Technical and Discovery-Oriented Team, Exploring and Discovering High-Grade Precious Metal in Western USA

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 9/23/2022

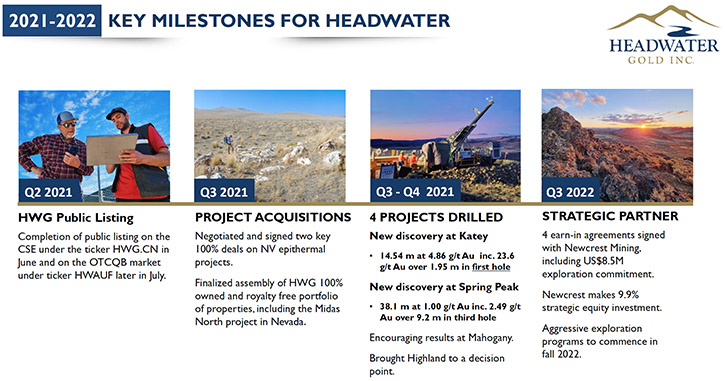

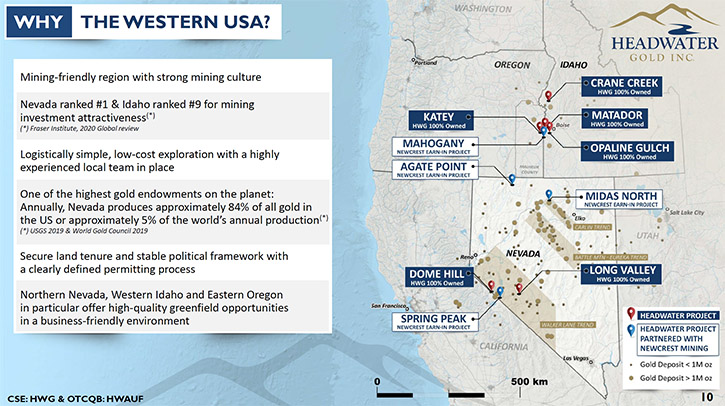

We spoke with Caleb Stroup, President and CEO of Headwater Gold, Inc. (CSE: HWG, OTCQB: HWAUF), a technically driven, discovery-oriented, mineral exploration Company, focused on the exploration and discovery of high-grade precious metal deposits, in the Western USA. Headwater has a large portfolio, of epithermal vein exploration projects, and a technical Team, comprised of experienced geologists, with diverse capital markets, junior company, and major mining company experience. The Company is systematically drill testing several projects, in Nevada, Idaho, and Oregon. Headwater raised $4 million and listed, in June, this year. Headwater drilled four projects, right in sequence and had two new discoveries, one at their Katey Project, along the Oregon-Idaho border, and one at their Spring Peak Project, in Nevada. The Company attracted Newcrest Mining Limited and partnered, with them, on the new exploration program, on 2 of the four projects.

Headwater Gold, Inc.

Dr. Allen Alper:

This is Dr. Allen Alper, Editor-in-Chief of Metals News talking with Caleb Stroup, President and CEO of Headwater Gold, Inc. Caleb, could you give our readers/investors an overview of your Company and what differentiates it from others?

Caleb Stroup: Headwater has been around for just about three years now. The first two years or so were spent, as a private company, exploring for high-grade veins, in the western U.S. We listed last June and have been quite busy since then. We raised $4 million, before our listing and immediately began drilling, with that money. We drilled four projects, right in sequence, and had two new discoveries, one at our Katey Project, along the Oregon-Idaho border and one at our Spring Peak Project in Nevada.

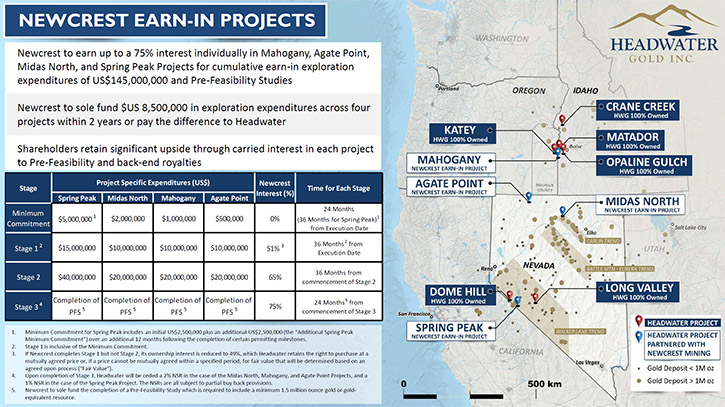

Since we've finished all those drilling programs and announced the results, we've been looking into our options, with the portfolio of projects that we have, we fortunately attracted Newcrest Mining to partner with us. We signed earn-in agreements, with Newcrest, on four of our projects, in our portfolio, as well as equity financing that was just announced, a little over a week ago.

Dr. Allen Alper:

That’s fantastic, they’re a great Company. It’s great to have the support of a Company like that. It shows that you have something that they are willing to invest and partner up with.

Caleb Stroup:

We're very excited. They're a fantastic partner and they're very likeminded when it comes to exploration philosophy and willingness to take exploration risk. And so, I think, it's a very good partnership for us and them as well.

Dr. Allen Alper:

Could you tell us more about your projects?

Caleb Stroup:

We have about 10 projects in the portfolio, right now. All of them are specifically targeting high-grade, epidermal veins. This is something that we did consciously, from the beginning. We're looking for high grade, underground vein targets, things that will have, not only good valuations in a good market, but also still be able to make money, in a softer market, and have longevity. A lot of our peers spend the good times drilling away at half gram, sub economic, deposits. We've chosen to avoid that.

We're looking for things that are going to have lasting value, no matter what the metal prices are. Rather than looking for things that could possibly be economic but need top of the cycle metal prices for a decade or more, which we don't think is very realistic. That really is what drove our decision making, to target the high-grade vein types. Thus far, we've had some pretty good success, with our exploration model, targeting high grade underground mineable veins. And certainly, Newcrest thinks that we're on the right track here.

Dr. Allen Alper:

Well, that sounds excellent! Could you tell us about your initial results and also your plans for the remainder of 2022 going into 2023?

Caleb Stroup:

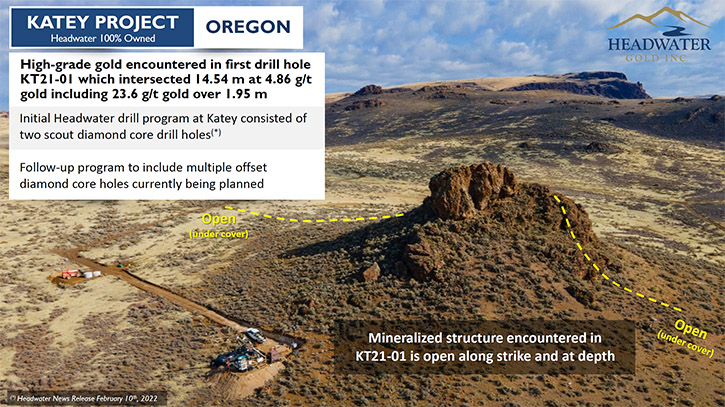

I'll focus on the two main projects, on which we've had a lot of success. Our Katey Project, which is in an emerging belt of epithermal mineralization that is a focus area of ours. Less of a focus behind Nevada, but still an area that we think is very compelling and has a lot of upside. We drilled only two holes, on the Katey Project last year, towards the end of the season. But our model held up and our first hole in the West Zone target hit, approximately 15 meters of 5 grams. And that included a higher-grade core, just under 2 meters of approximately 24 grams.

That's exactly what we're targeting. It's pretty shallow still. Drill depths, right around 100 meters, are all it takes to get down to that zone. That is a fairly straightforward program, to go follow up those results. Katey is one that we kept for ourselves; we did not partner that one with Newcrest. Although they did partner nearby project Mahogany, which is another one we drilled last year and had had some technical successes and hit some gold. I think our best hit was 0.7 meters of just about 10 grams per ton, but still nothing too flashy, especially nothing on par with Katey.

So that one, we were willing to partner off, but Katey we wanted to keep for ourselves. We'll be looking at options to advance that, in the short term here, we've done quite a lot of follow-up work with the geology. Since we drilled those holes, we learned a bunch, with the first hole in that zone. We learned a lot with that limited drilling. We've now applied that throughout the property, with a big mapping, sampling soil program, including hyperspectral and XRF analyses. We threw the kitchen sink at it, for low-cost exploration methods. We've added a lot of detail to the follow up targets, around that good hit. We're looking to offset that, potentially, this year.

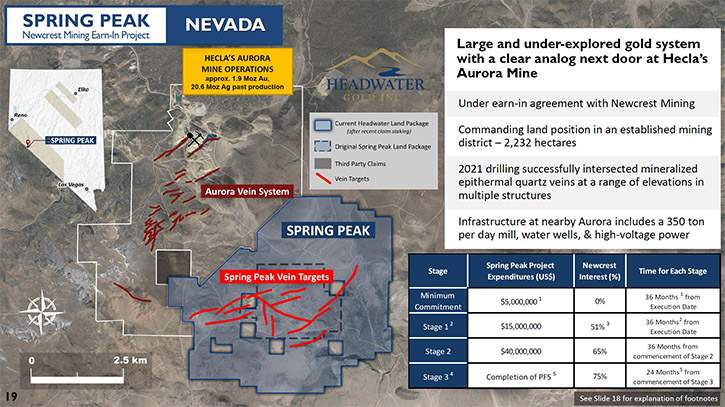

But the first project that we probably will end up sending rigs to, will be Spring Peak, I think, which is one that was partnered with Newcrest. It would appear that Newcrest wanted Spring Peak pretty badly. You can see by the numbers in the earning agreements that commanded a large portion of their minimum commitments, that they were willing to make. They're willing to make firm guaranteed commitments of $5 million spent at Spring Peak, in the ground, in the next few years.

They are fairly serious about this. And to spend that money for them, we need to get going right away. We're looking to kick that off, sometime pretty soon, here this fall. Hopefully I'll be able to announce more details on exactly the timelines and scale and budgets and all that, within the next couple of weeks. But everything's still waiting, as budgets are being completed and all that. But it's all on track to be an active year down there.

The focus of that program will be following up on five drill holes that we drilled last summer, which were the first holes on the project, in 30 some years. We drilled to a depth that nobody else had ever drilled there. Following our model, we predicted that below about 150 meters, is where the gold bearing horizon should be, and no previous drilling, at all, had penetrated at those depths. We drilled five holes and four of the five encountered significant gold values, at that 150 meter and deeper depth horizon.

The best hole that we drilled, was 38 meters of a gram, one gram per ton of gold. In Nevada, that's something you have to pay attention to. 38 meters of a gram, in a blind discovery, does not happen every day. So that is a high priority, for us to get started, following up on those holes. And I think we will command a lot of attention, early on, with our exploration campaigns this fall.

Dr. Allen Alper:

This fall will be a very exciting time for your shareholders and stakeholders.

Caleb Stroup:

That's right. We'll have a lot going on. I'm currently standing in a new warehouse, we just leased, and we're converting it into a core logging facility, to accommodate all of the drill core we're going to be doing.

Dr. Allen Alper:

That’s fantastic. It'll be a lot of fun for you and your Team.

Caleb Stroup:

Oh, for sure.

Dr. Allen Alper:

Caleb, could you tell our readers/investors, a little bit about yourself, your Team and Board?

Caleb Stroup:

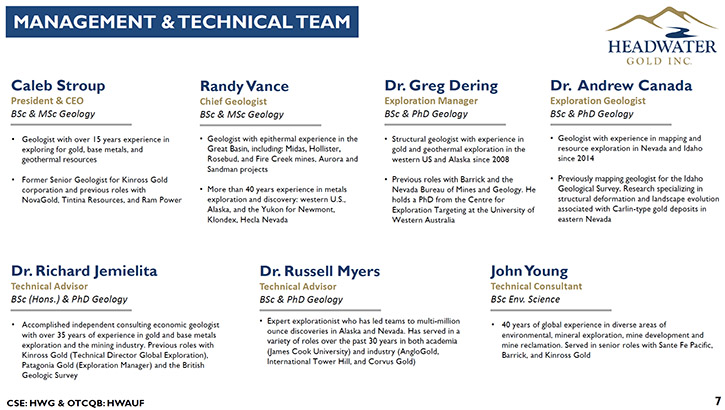

I have a background, both in the junior mining world and in the major mining world. I worked for Kinross Gold, for seven or eight years, immediately before leaving to start Headwater. That was in late 2018. That time was mostly spent in early-stage exploration, although I didn't have a lot of exposure, to mine site exploration, when I was with Kinross. That is also where I met our Chairman, Alistair Waddell, who at the time was in charge of global Greenfields exploration, for Kinross.

We stayed in touch, after he left, and eventually, one thing led to another, and we decided to start this endeavor, focused on high-grade veins. Headwater was conceived, out of a technical first principles concept, for looking for a specific thing (high-grade veins) in a specific place (the Western US), with people who know what they're doing.

On top of Alister and myself, we've added a really strong Board of Directors, with a couple of well-known Vancouver capital markets names, Wendell Zerb and Graeme Currie. We have a great list of technical advisors and technical people, on the ground here, in Nevada as well. A mix of young hotshot type, go-getter field geologists and gray haired, old, grizzled Nevada veterans, who have seen many high-grade vein deposits, both underground and in drill core. We have built this consciously, to have a little bit of everything, on the Team, which allows us to take the Company really wherever we need to.

Dr. Allen Alper:

That's great. Sounds like you have an excellent, well-balanced, experienced, smart, vigorous, young Team. So that's great. I see you have a whole bunch of PhDs, too. That’s excellent!

Caleb Stroup:

Yeah!

Dr. Allen Alper:

Caleb, could you tell our readers/investors a little bit about your share and capital structure?

Caleb Stroup:

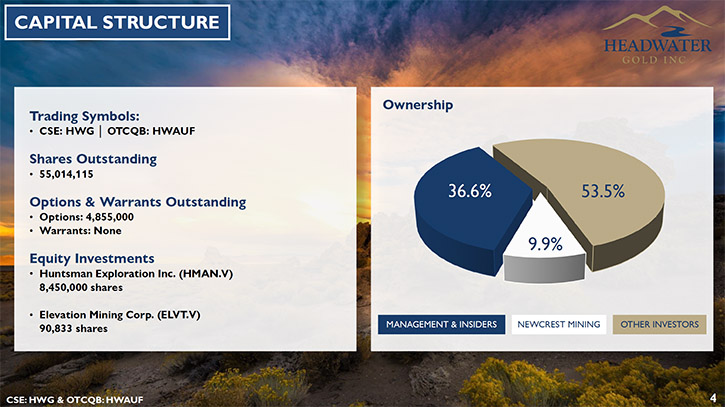

Currently we have 55 million shares outstanding. This is after the recent closing of the Newcrest deal. They took 9.9% of the Company. Still, after that, we also have approximately 37% of the Company held by insiders. Now, this is due to that two-year period that I mentioned, that we stayed private and built up this portfolio of 10 projects. A large majority of that was funded internally by us. We still have a big chunk of the Company, with insiders and are very motivated to make this thing a success and are well aligned with the shareholders.

We don't have any warrants outstanding. We have never issued a warrant, in the history of the Company. We were able to raise $4 million, in advance of our private listing, with no warrants last year. Which in and of itself, I think, was an accomplishment. It's pretty clean, in terms of the share structure, with no overhang, in a lot of closely held paper.

Dr. Allen Alper:

Well, that's fantastic. Could you tell our readers/investors the primary reasons they should consider investing in Headwater Gold?

Caleb Stroup:

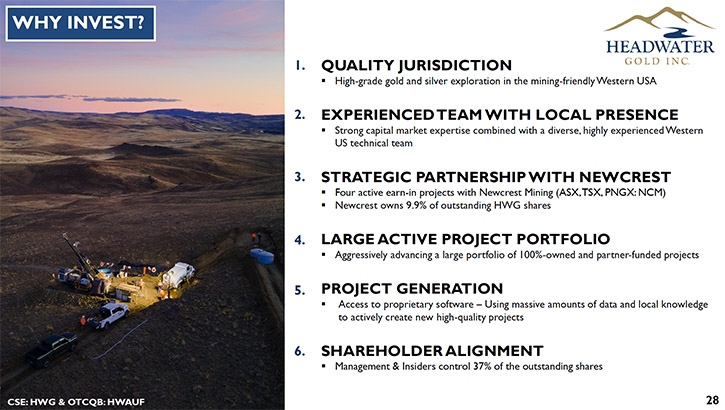

The one thing that immediately stands out, that is not very subtle, is that right now we've been hovering between $10 and $13 million market cap. After the closing of this Newcrest deal, we will have about $2 million Canadian, in cash, and something like $11 million Canadian, in firm commitments from Newcrest. That puts our enterprise value at approximately zero, which I think is fairly hard to justify, considering the transaction that we recently closed here, and the stability that offers for the Company, and our competitive advantage, amongst our peers. Just looking at that alone, I think there's very little downside to the story and really a tremendous upside. We'll have a significant piece of a Newcrest - sized project, if we have any success on any of these four funded earning projects.

Dr. Allen Alper:

Those sounds like compelling reasons for readers/investors to consider investing in your Company. You have an experienced Team, you’re in a great location, in the western United States. You’ve already struck high-grade gold. You have the backing of Newcrest, which is a fantastic company. So, those are all outstanding reasons for our readers/investors to consider investing in Headwater Gold, Inc. In addition, you have more cash and commitment to cash than the market counts for. It’s amazing.

Caleb Stroup:

Yeah. During that time period, we are operating these exploration programs. So not only does my Team get to continue to drive the exploration, which is what Newcrest wanted. They want us to continue doing the sort of work that got us to where we are now. As part of that, we will get a management fee, 10% of the dollars in the ground, we'll collect, as a management fee. On top of this recent equity financing and some cash reimbursements that we got from this deal; we will have no immediate financing overhang on the stock either. Which a lot of companies, out there, are actively wondering how they're going to raise the money to continue to exist. That's not a conversation we have to have right now.

Dr. Allen Alper:

Well, that sounds excellent. Is there anything else you'd like to add, Caleb?

Caleb Stroup:

One thing that we haven't really touched on is that Newcrest took four of our 10 projects, but there is still a large 100% owned portfolio that remains. Some very good exploration opportunities are in there, and we'll be looking to advance many of those ourselves, as 100% owned, self-funded, exploration opportunities. A big part of what got us here, is our ability to generate new projects. Most of our projects were staked through our generative activities and are therefore 100% owned and royalty free. That's the sort of thing that we're going to continue doing. We have our eyes on a few things, for possible future acquisitions, and that's part of the business model, still moving forward.

Dr. Allen Alper:

It sounds like you have a great opportunity to bring on other projects and that might be of interest to Newcrest. So that's excellent! We’ll publish your press releases, as they come out, so our readers/investors can follow your progress.

https://headwatergold.com/

Caleb Stroup

President and CEO

+1 (775) 409-3197

cstroup@headwatergold.com

|

|