Elixir Energy (ASX: EXR): Coal Bed Methane (CBM), Very Large Asset in Mongolia’s South Gobi Region, Excellent Infrastructure, Close to Rapidly Growing Chinese Gas Market; Neil Young, MD Interviewed

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 9/19/2022

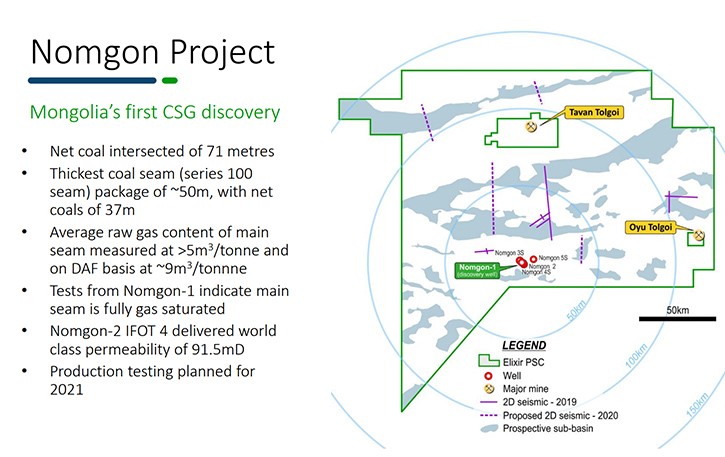

Elixir Energy (ASX: EXR) holds a 100% interest, in the Nomgon IX coal bed methane (CBM) production sharing contract (PSC), a very large asset, located proximate to the Chinese border, in Mongolia’s South Gobi region, near excellent infrastructure, and close to the rapidly growing Chinese gas market. The PSC has a minimum ten-year exploration period and a thirty-year (extendable) production period. We learned from Neil Young, Managing Director of Elixir Energy, that in the course of 2020, they successfully undertook exploration and appraisal work on the PSC, including drilling several holes, seismic acquisition and geological survey work, with results that meet or exceed those of a number of producing CSG fields, around the world.

Elixir Energy

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Neil Young, who is Managing Director of Elixir Energy. Neil, could you give our readers/investors an overview of your Company and what differentiates your Company from others?

Neil Young: Sure, and thanks for the invitation to talk. Elixir Energy is listed on the Australian Stock Exchange, the ASX, and It's focused on gas exploration and appraisal. It has a single focus on one very large asset, a coal bed, methane-specific license, located in the independent Country of Mongolia, just north of the Chinese border. We own 100% of that. In the last two years, since the license was granted, we have been exploring for gas, successfully and appraising our discoveries, to ultimately prove up a large resource, right on the Chinese border, and China is of course the world's largest energy importer.

Dr. Allen Alper: That sounds excellent. Could you tell us a little bit more about your properties, how extensive they are and what you've found?

Neil Young: Sure. I'll do that by telling a story. I used to work for one of Australia's larger oil and gas companies, called Santos. About 15 years ago, I helped it commence stitching together a suite of assets, largely in the Australian state of Queensland, which was Coal Bed Methane focused and which now supplies East Asian Liquified Natural Gas or LNG markets, along with various peers, including the Chinese National Oil Companies, Shell, Conoco, Petronas, Kogas, etc. My view about a decade ago was, if Australian Coal Bed Methane can supply Asia, including China, then what about trying to find sources nearer to the market? Gas is very expensive to move, so I went to Mongolia and, over many years, negotiated a contract, with the government, which we are now executing.

Dr. Allen Alper: Well, that sounds great. Sounds like you and your Team have the right background to do that work. Could you tell our readers/investors what your plans are for the remainder of this year, going into next year?

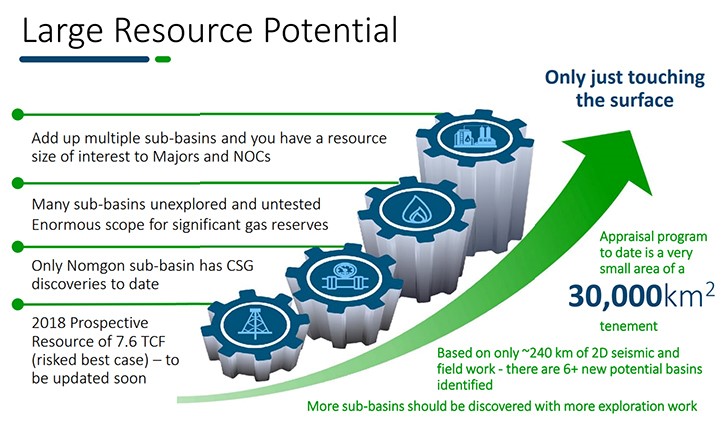

Neil Young: Through the course of 2020, we've drilled quite a number of wells, all of which have been successful. We are nearly wrapping up our program for this calendar year. We have one more well still underway, which is nearly finished. Under the terms of our license, we have an annual process of permitting, which will allow us to recommence our program next year, where we plan to drill even more wells, plus shoot more seismic, and do other exploration work. The plan for next year is to continue appraising our two discovery areas, to conduct a production test, which will decrease the risk of the resources in the area of that discovery, plus continue to undertake more exploration. The license is very large, in any global terms, it's 7 million acres or 30,000 square kilometers, depending upon your Imperial or metric preferences, so there's an awful lot of work to be done there.

Dr. Allen Alper: Oh, that sounds great. Could you tell our readers/investors a little bit about your background and your Team?

Neil Young: My background is commercial and business development orientated. I've been in the energy sector for around 25 years, in various roles, applying that discipline in large companies like Santos and smaller companies like Elixir, which I have effectively founded and which I run just now. That's been a great experience. I've worked in the UK originally, then Australia and then in more recent years in Mongolia particularly, but also other countries, including the good old US of A, Japan, Indonesia, etc. That's been a good background, in a range of companies, large and small companies, and countries developed and developing.

The rest of our Board is comprised of our Chairman, Richard Cottee, who is very successful in the Australian Coal Bed Methane industry. He built a Company called QGC up to more than $5 billion, which is now owned by Shell; and an ex-colleague of mine, from Santos, called Steven Kelemen; and, an Australian/Belarus lady, called Anna Sloboda, who comes from the other end of the ex-Soviet Empire from Mongolia, and who's worked in China and in the resources sector. In Mongolia itself, we have a Team, whose core members I've known for nearly a decade, who are working with local sub-contractors to undertake our drilling programs and other work. We've managed to continue that program, notwithstanding COVID and all the travel and other limitations that arose, in the course of this year.

Dr. Allen Alper: Well, it sounds like you and your Team are very strong and very experienced and prepared to carry out your work.

Neil Young: Thanks.

Dr. Allen Alper: Could you tell our readers/investors a bit about your share and capital structure?

Neil Young: We are listed on the ASX. We are typical for an exploration company, solely equity financed. We have an immediate short term feature on the balance sheet, some listed options or warrants, which are in the money and which expire at the end of this calendar year. Accordingly, these are being progressively exercised and converted into ordinary shares, by the holders thereof, that is delivering us the cash that we need to progress our next year's expanded exploration program and still retain 100% of our assets, without having to dilute. So a fairly simple balance sheet, solely equity based, nothing complex or lines of equity credit, or whatever, which can cause a bit of confusion on a balance sheet. It's all fairly straightforward for us.

Dr. Allen Alper: That sounds excellent! Could you tell our readers investors, the primary reasons they should consider investing in Elixir Energy?

Neil Young: We believe we are one of the few companies, available in a Western stock exchange, whereby investors can try and play the view that China, which is currently the world's largest energy importer, is going to increase its imports of gas and is likely to favor imports of gas from immediately proximate, low sovereign risk countries, in whom we have a very large position, which is a 100% owned. If we are successful, that should be the sort of asset that's very attractive to much larger companies, to develop and produce. So investors, who get on board with us, can go through the journey of exploration and appraisal, and then hopefully the ultimate value adding transition of the assets, from that stage to a production stage, which is likely to be undertaken in the hands of someone else, who will pay richly for the privilege.

Dr. Allen Alper: Sounds like very good reasons to consider investing in your Company, Neil. Was there anything else you'd like to add?

Neil Young: The area, in which we're exploring for gas is very rich in renewable energy resources, wind and sun. We believe that gas complements those and that those resources combined, can supply electricity (and ultimately even hydrogen) to Chinese markets, in a way that is far more locationally advantaged than other global projects, which are looking to do the same, but which would require enormously higher costs to deliver to the same vast energy market.

Dr. Allen Alper: It sounds like you are in a great position to move forward. You have such a big, huge area and so close to China as a customer. That sounds great!

Neil Young: Thanks.

Dr. Allen Alper: We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.elixirenergy.com.au/

Neil Young - Managing Director

Elixir Energy Ltd (ABN 51 108 230 995)

Level 10, 50 Pirie Street

Adelaide SA 5000, Australia

|

|