Interview with John Lee, CEO, Flying Nickel Mining Corp. (TSX-V: FLYN; OTCQB: FLYNF): Mining and Supplying Nickel in High-Tech Batteries, Powering Modern Electric Vehicles

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 9/15/2022

We spoke with, John Lee, who is CEO of Flying Nickel Mining Corp. (TSX-V: FLYN; OTCQB: FLYNF), a premier nickel sulphide mining and exploration Company, advancing its 100% owned Minago Nickel project, in the Thompson nickel belt, in Manitoba, Canada. The combined open pit and underground mineral resource estimate, published in 2021, includes a Measured and Indicated mineral resource of 44.23 million tonnes, grading 0.74 % nickel, for 722 million pounds of contained nickel and an Inferred mineral resource of 19.55 million tonnes, grading 0.74% nickel, for 319 million pounds of contained nickel. On August 23, Flying Nickel Mining announced that they have entered into a non-binding letter of agreement, to acquire Nevada Vanadium Mining Corp.

Minago

Highway 6

Minago crossing highway 6

Dr. Allen Alper:

This is Dr. Allen Alper, Editor-in-Chief of Metals News talking with, John Lee, who is CEO of Flying Nickel Mining Corp. John, could you give our readers/investors an overview of your Company and what differentiates it from others? And can you tell them about your excellent vanadium and nickel projects?

John Lee: Flying Nickel Mining is a Canadian listed Company on the TSX Ventures. It’s a new Company. We went off the listing, in March of this year. We are all about mining metals that power the future. Specifically, the flagship project is our Minago Nickel Sulfide Project in Manitoba. We have just announced a merger, with another Company that explores for vanadium in Nevada. Both metals are critical metals, as classified by the U.S. Geological Bureau, and they are in a political jurisdiction, mining funds jurisdiction in North America.

Dr. Allen Alper:

That's great. Could you tell our readers/investors a little bit about the importance of vanadium and the importance of nickel? Also, a little bit more detail about your Nickel Project in Manitoba and your Vanadium Project in Nevada?

John Lee:

I have been in the mining industry for 20 years, as a chartered financial analyst and I was a very successful trader and investor myself, in the mining space and in the first 10 years. Then I transitioned into running a mining Company, started out as a hobby and then turned to a fulltime job in the last 12 years. I've watched the renewable renaissance carefully, in the last six years, and then carefully accumulated the vanadium and nickel asset for the Company.

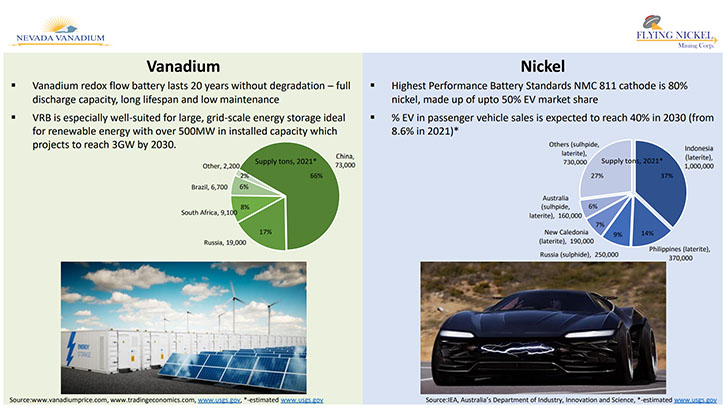

Vanadium is used in redox flow batteries, a very mature technology that was invented by NASA, about a decade ago. These batteries are large in size and last for 20 or more years, without degradation. They can fully charge, and discharge and they have a long attention span and very low maintenance. These batteries are especially suited for large scale utility energy storage that compliments solar and wind very well.

Currently, there's about 500-megawatt full capacity throughout the world, and that number is expected to grow, multiple folds, by 2030. On the other hand, nickel, I think probably a better know metal for your audience is the de facto standard for high performance batteries that goes into the modern electric vehicles

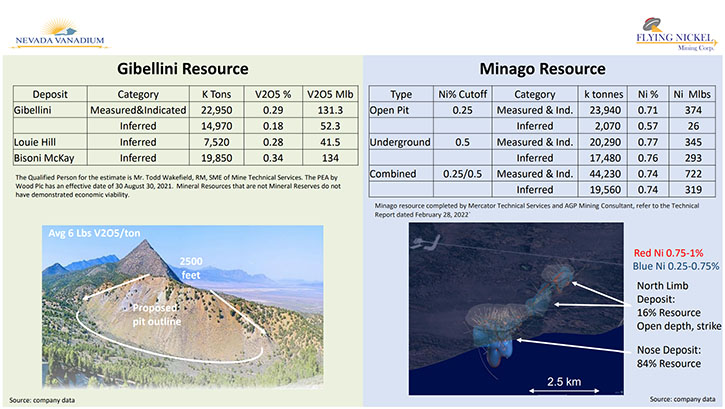

If you look at the lithium batteries, you have anode, which is typically the graphite and the cathode side, which is made from 80% nickel, 10% manganese and 10% cobalt. The nickel project is in Thompson Manitoba and it’s what they call the Thompson Nickel Belt, the second largest nickel cap in Canada, based on historical production.

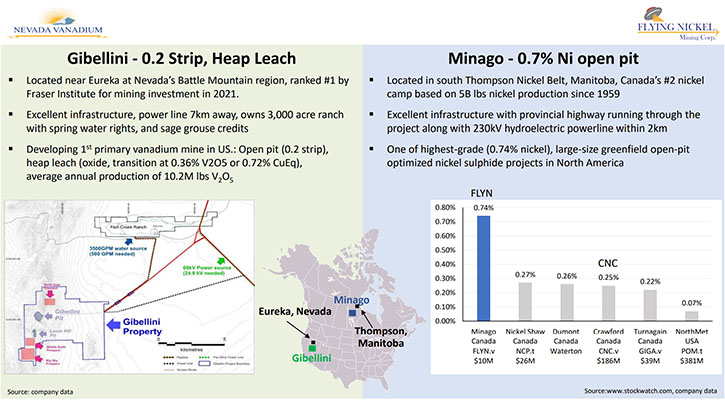

The project has excellent infrastructure and has over a billion pounds of nickel that's been verified in the ground with grading of 0.74%. So, this is probably one of the highest nickel grade, open pit optimized nickel sulfide project in North America. On the vanadium side, the product name is called Gibellini and it's located in the Battle Mountain Region in Nevada, which is the number one jurisdiction destination, for mining investment, by the Fraser Institute.

Similar to Minago, it has excellent infrastructure, with immediate access to power and water. The objective for nickel is to develop Gibellini to be the first primary vanadium mine in the United States.

Dr. Allen Alper:

That's great. Could you tell us some more about your projects?

John Lee:

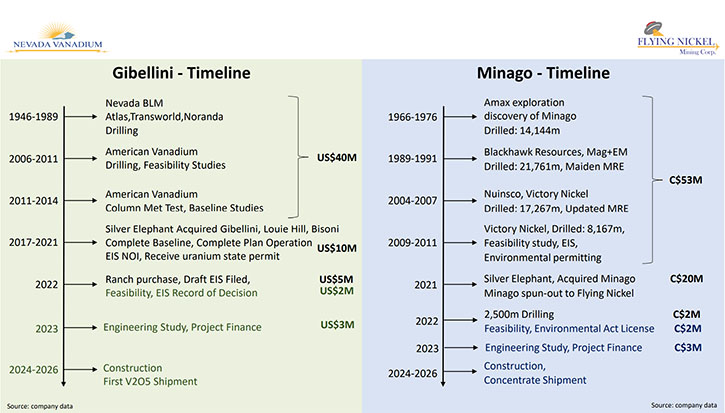

These are not new discoveries, these projects were discovered in the 1970s and 1980s. Billions of dollars have been spent up to 2021 and that included a feasibility study, the majority of environmental permitting, baseline study, a technical study, metallurgical study and extensive drilling. That's what cultivated it into the resource possibility, which is over 350 million pounds. About a third of that is measured and indicated.

On the Minago side, there’s over a billion pounds of nickel and two thirds of that is measured and indicated, and one third is inferred. Both of these projects sat dormant from 2010 to 2020 because that's when the commodity correction began. Flying Nickel and Silver Elephant acquired the Vanadium Project in 2017 and the Minago Nickel Project in 2021.

Silver Elephant spent around $15 million US on Gibellini and then around $25 million in Minago, including the acquisition cost. And now these projects will be blended into Flying Nickel. What Flying Nickel did, especially for the nickel project, is the resumption of the feasibility study. We did a round of drilling in 2022 and we're also optimistic of restoring the permit in 2022.

Flying Nickel, in summary, is in a unique position to have not one but two projects, in multiple jurisdictions, in North America that are, or will become, fully permitted this year, with the fourth last feasibility study.

Dr. Allen Alper:

That’s excellent! Could you tell our readers/investors a little bit about the outlook of the vanadium and nickel markets, the supply and demand?

John Lee:

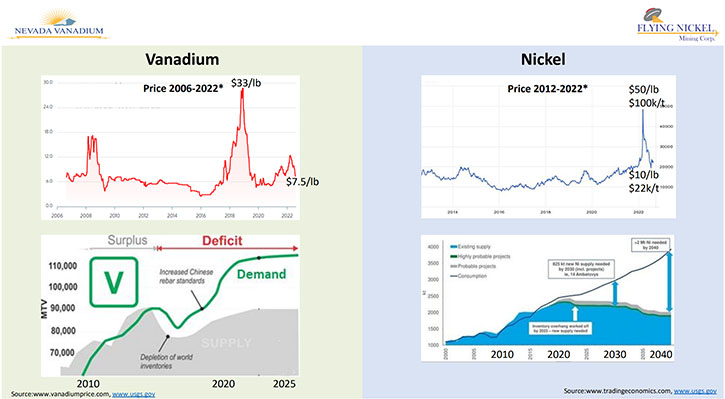

This discussion can go on quite a bit and there's a lot of different research papers. If we're to focus on the price action, usually that would be a telltale sign of what is to come. What we believe is that vanadium and nickel have both gone past the inflection point where, the demand has exceeded supply. Both markets are entering into a structural deficit, and that is witnessed by the vanadium price action in 2017. When the price of vanadium went from around $6 a pound and up to $33 a pound, a fivefold increase in a span of about six months.

Since then, the vanadium price has come down and gone up because of COVID and just due to the market volatility, but still well above the 2016 low of $5, currently trading about $8 a pound. Similarly, nickel has been trading between $5 to $10 for most of the past decade from 2010 to 2020. However, in 2022, just about six months ago, nickel zoomed from $10 a pound to $50 a pound, in a single week.

Because the markets themselves have been nurturing tight markets, it's traditional usage, for both vanadium and nickel, is in an alloy of different applications. But when the energy storage market came in, where about 10% of these metals were used for batteries, that threw a bit of a monkey wrench into the market. All of a sudden you got this new entrant into the mix and that sort of threw the market into a scenario that's never been seen before and that's what happened to the price action.

Even though the price has essentially come down to what it started with, before the disruption, the fundamentals are certainly getting bullish, from here on, with this supply and demand structure deficit. Our belief is that we might not see the price action work in 2017 for vanadium or in 2022 for nickel. But nonetheless, the upside seems stronger than the downside.

Dr. Allen Alper:

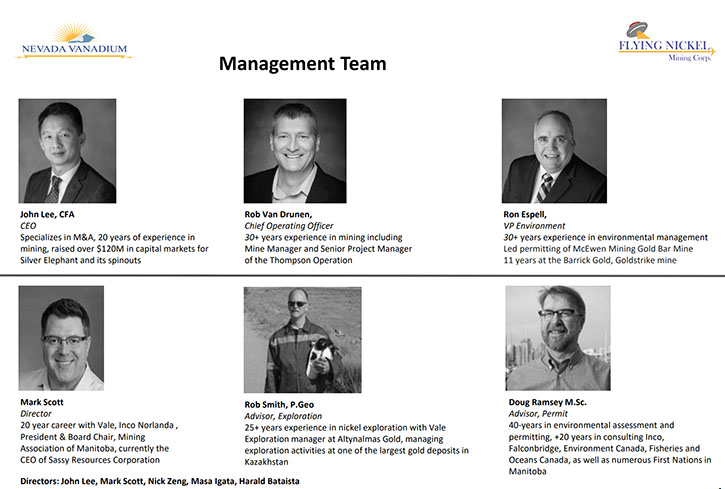

It sounds like a very promising outlook for nickel and vanadium, and they're both critical metals and very important in the electrification of the world. So that's excellent! John, could you tell us a little bit about some of the other key members of your Management Team?

John Lee:

Vanadium was heavily invested in, by a mining legend, called Robert Freeman. He had invested, tens of millions of dollars in vanadium flow battery technology. He called vanadium the miracle metal for the future. On the other side, on nickel, there was a famous quote by Elon Musk to say, “Our batteries are not really lithium batteries, but nickel batteries and the miner should be mining as much nickel as possible” two years ago. He's been the oracle of the nickel market and he continued to source nickel from, all major mining companies and the Indonesian Government.

Moving on to Management. I specialize in M&A and have been on the mining company side since 2009. In the last 13 years I've raised over $150 million in the resource industry, for Silver Elephant and affiliated companies, like Nickel. And recently we recruited Rob Van Drunen, as the COO. He spent 30 years, with Vale, in Thompson. We also have two expert, environmental permitted specialists, and the Team by the name of Ron Espell, who spent over 30 years with Barrick. He is working on the vanadium project, in Nevada. His counterpart is Doug Ramsey, with 40 years environmental assessment and permitting experience, including 20 years in Manitoba.

We have Mark Scott as the Director. He was the Head of the Manitoba Mining Association. He took an early retirement, and we recruited him as Director. Lastly, is Rob Smith, he is exploration guru for us in the Thompson Nickel Belt, he spent over 25 years, in nickel exploration, in the Thompson Valley.

The Company's culture has really shifted from exploration and M&A to where we are, with two projects that could be shovel ready, by the end of the year, with a completed feasibility study. The Company embarked and finally transitioned towards a path of financing and construction, transitioning into a money producer. Therefore, you see the skills of the group transitioning from exploration and M&A into operation permitting.

Dr. Allen Alper:

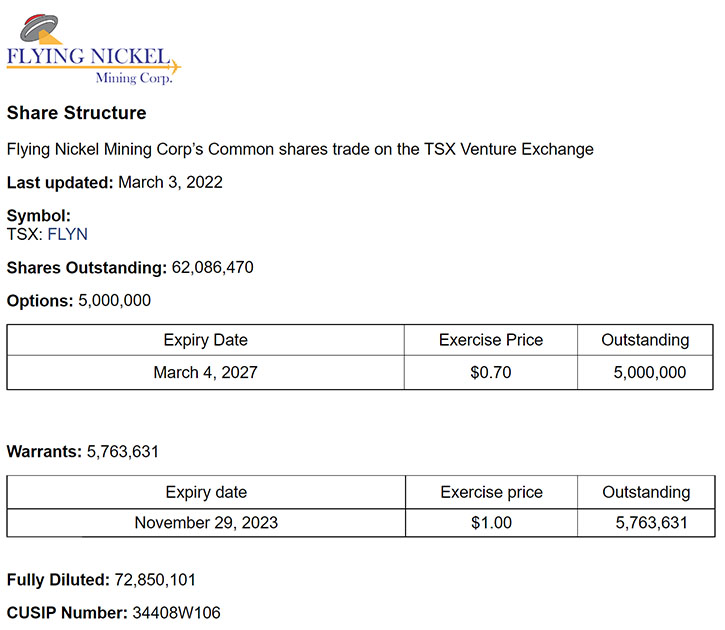

That's excellent. That's amazing how fast you have been moving your Company towards production. John, could you tell our readers/investors a little bit about your share and capital structure?

John Lee:

Right. The company went public in March of this year and the symbol is TSXV: FLYN and OTCQB: FLYNF. Currently there are 62 million shares outstanding, $3 million in the bank. We are fully funded until the first quarter of next year. Of 52 million shares, around 50% are owned by institutions and insiders. We did a run up financing, with $8.76 million in March at $0.70 a share.

The Company went out with a bang in March, because that coincided with the climax of the nickel market. We traded 10 million shares in a month and the stock doubled on the debut to a dollar 40 and was $100 million market cap. But since then, with all the other money companies, it now is trading at $0.15, which is near historic low as a market cap of only $10 million.

I think that's really a low-risk entry point, considering Flying Nickel spent $20 million, acquired the nickel project, another $5 million advancing the project. Then altogether the total investment in the nickel project is in excess of $50 million. The Company is due to release the assays drill results, from its maiden drill program that was executed in the winter of this year, as well as a lease on horizon regarding its permitting efforts and the completion of the feasibility study all in the next three months. We have three major catalysts on the horizon, which we are very eager to share with investors and our shareholders.

Dr. Allen Alper:

Well, it seems like you're very well supported, by very important investors, and it seems like there's a lot of capital community and potential for appreciation of a market value. John, could you tell our readers/investors the primary reasons they should consider investing in Flying Nickel Mining Corp.?

John Lee:

First of all, there are hundreds of thousands of mining companies, and you have to be bullish on the underlying metal. And we are very, very bullish on nickel, along with Elon Musk. I think that metal has a lot of upside. It's a critical metal that's well supported by the North Americans, by Canadians and by the U.S. government. I think we do have a very bullish forecast for nickel prices, going forward.

Secondly, if you look at the Flying Nickel Project, the project arguably had one of the highest nickel open pit grades, in nickel sulfide, in North America. It is in a well-developed infrastructure jurisdiction, in the Thompson Nickel Camp, and it's due to have a completed disability study and environmental permits, so the project will be shovel ready by the end of the year. I think the combination of very high grade, well-established resource, over a billion pounds of nickel, a completed feasibility study, of the economics, will be transparent and the project could be fully permitted and be shovel ready. This really puts the project and the Company in a unique position.

I believe we are head and shoulder above our nickel peers in the nickel junior mining state. Similarly for vanadium, the project will be fully permitted and the feasibility study and well-established resource potentially, with approving the probable reserve, by the end of the year. Both projects could eventually use project financing, with the metal coming out of the ground by 2026. It's not a matter of who has a bigger gun, in terms of resource. A lot of people have tens of millions of ounces or billions of dollars in the ground. It's about a very clear path to production.

The Management has had experience taking assets into production before. The Company has fair liquidity. Unfortunately, one of the industries that requires a lot of patience, at least potentially takes a decade to develop, somehow has to find patient investors. And that's why some investors may be a little overexcited and bought, on high, when it debuted in March. But however, it created a wonderful buying opportunity six months later at a fraction of what it was trading six months ago, despite having very strong fundamentals, both for the metal and for the project. You can look up at flynickle.com. I am very active on Twitter. You can look me up https://twitter.com/johnlee25893955 and that is my handle on Twitter. I have about 2,000 followers and I tweet daily.

Dr. Allen Alper:

That sounds like very compelling reasons for readers/investors to consider investing in Flying Nickel Mining Corp.

https://www.flynickel.com/

John Lee

Chief Executive Officer and Director

Flying Nickel Mining Corp.

info@flynickel.com

|

|