Anthony McClure, Managing Director, Silver Mines Ltd (ASX: SVL) Discusses their Bowdens Silver Project, the Largest Undeveloped Silver Deposit in Australia and One of the Largest Globally

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 9/8/2022

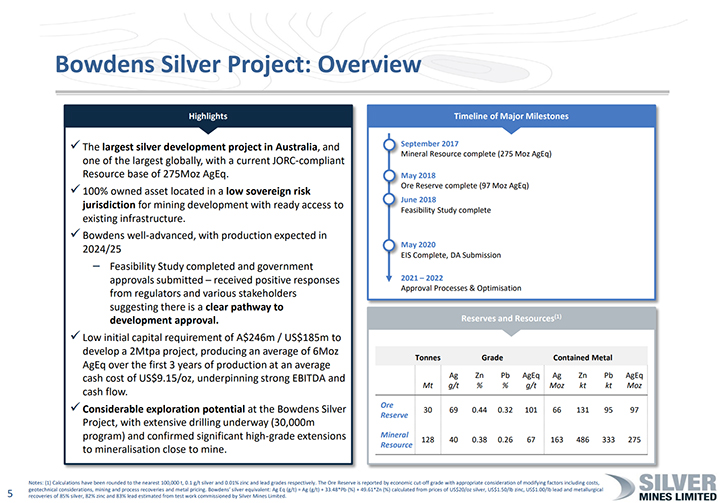

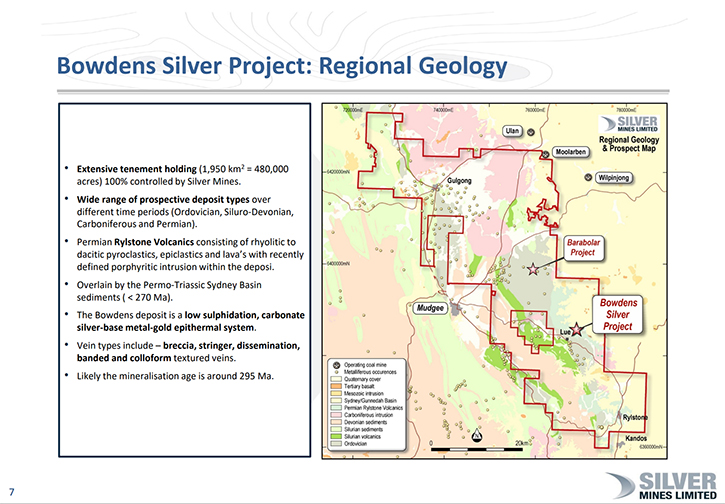

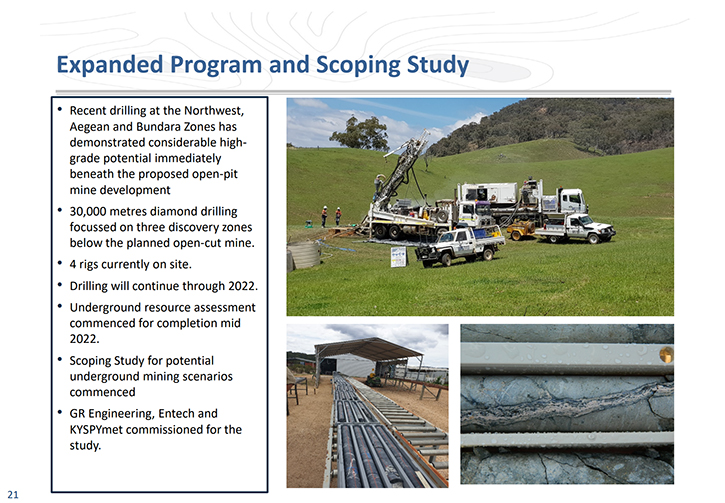

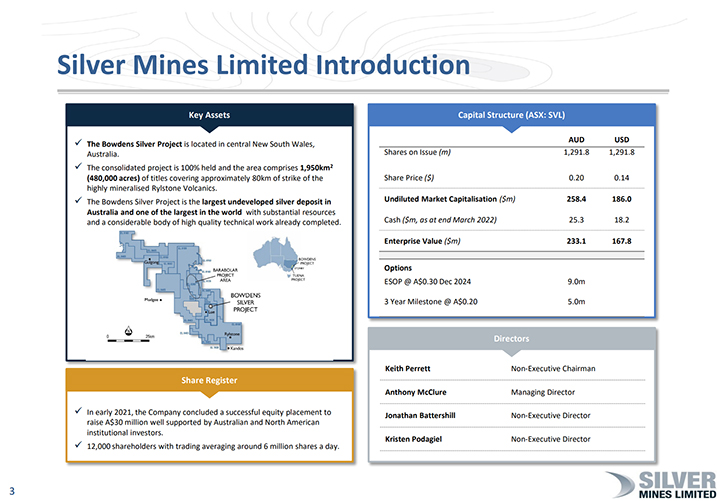

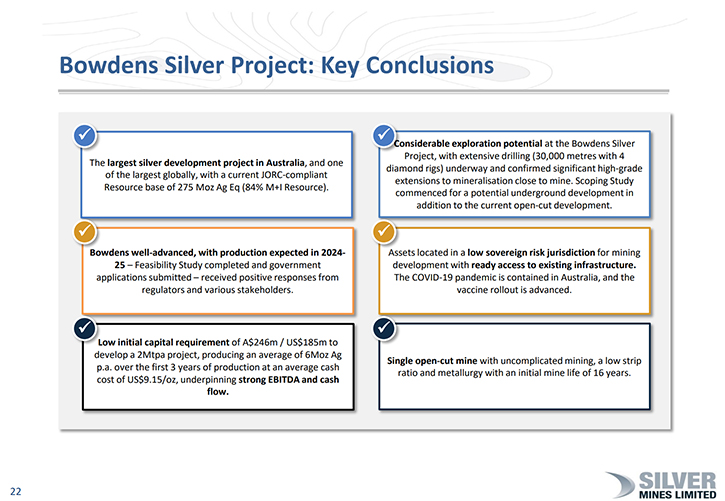

We spoke with Mr. Anthony McClure, who is Managing Director of Silver Mines Limited (ASX:SVL), an Australian mineral exploration and development company that owns the Bowdens Silver Project located near Mudgee, in New South Wales. Previously held by Silver Standard, Bowdens Silver is the largest undeveloped silver deposit in Australia and one of the largest globally. It contains substantial resources, and boasts outstanding logistics, for future mine development. Considerable body of high-quality technical work has already been completed. The project has had continued outstanding high-grade drilling results, and drilling will go on through 2022. Resource assessment and Scoping Study for a potential underground development commenced for completion in 2022.

Silver Mines Limited

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-chief of Metals News. Talking with Mr. Anthony McClure, who is Managing Director of Silver Mines Limited. Anthony, could you give our readers and investors an overview of your Company and what differentiates your Company from others?

Anthony McClure: Certainly. Thanks, Allen. Silver Mine Limited is listed on the Australian Securities Exchange, under code SVL. We took over the company six years ago. The company's been around for a while, but six years ago, we put in a new asset and new management, recapitalized the company and so forth, so it was effectively a new company six years ago. We took over the Bowdens Silver Project, which is located west of Sydney in New South Wales, Australia. That's a project that was previously held by Silver Standard. Bob Quartermain and Rick Rule and those guys owned the Bowdens Silver Project, and that was one of the key initial assets of Silver Standard those years ago. When they were operating that company, they had no intention of getting into development. It was more about driving silver assets and moving them on to others, and that's exactly what they did. They sold it to Kingsgate Consolidated, and we purchased it six years ago.

Anthony McClure: Our first interest, in the project, was completing the drill out, of it, so a lot of drilling had been done. In the first 12 months of our drill out, we added about 100 million ounces of silver equivalent. So, it's mostly silver, a little bit of zinc, and a little bit of lead. So we added about 100 million ounces, and the resource at that point stood at about 275 million ounces of silver equivalent. The mineralized system is vast. It's very unusual for Australia. Silver in Australia is a byproduct of lead-zinc mining or gold mining and a few other things, but there's very little silver in its own right. There's the Cannington project in Central Queensland, which is large. It's owned by South32, and that's in its twilight. Then Bowdens Silver is under the development process and that will be the largest silver mine in Australia. So, there are only the two major projects in Australia, a few smaller projects, but probably irrelevant in the whole scheme of things.

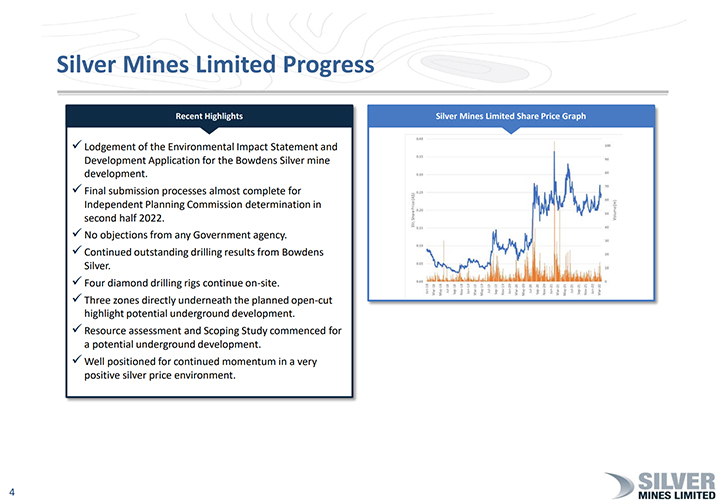

Anthony McClure: So, when we got involved, it was all about de-risking the project, so we completed the drill out. We increased the resource up to 275 million ounces silver equivalent. We completed the feasibility study, for an open-cut development, to produce about 6 million ounces of silver a year, and then we moved into an environmental impact statement. That’s where we are at the moment, we're in our final processes for approvals. So, we are hoping that we'll have approvals complete, by the end of this year, but we see no impediments to that. So, the approval process, in New South Wales, here in Australia, is detailed. The critical items such as water have been solved, and each of the government departments has reported favorably. So we're in the final process of approvals, and as I say, we expect to have it by the completion of this calendar year.

Anthony McClure: Allen, part of our process, in the understanding of Bowdens, has been, yes, very much the assessment of this large, moderate-grade ore body, close to surface, and that's obviously the subject of our initial development. But with our geological background, and just for you and your readers to understand, our silver background is primarily in Mexico. Some know us from the development of the Palmarejo Gold and Silver Project through a Company called Bolnisi Gold, which was listed in Australia. We had a North America listing, called Palmarejo Gold and Silver, and both those companies were taken over by Coeur. The Palmarejo mine is still one of their flagship operations. I was an Executive Director of that Company, so that gave us a silver stripe.

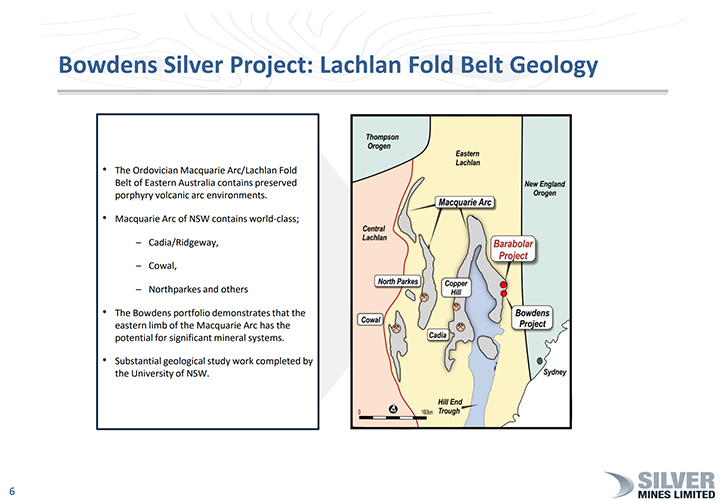

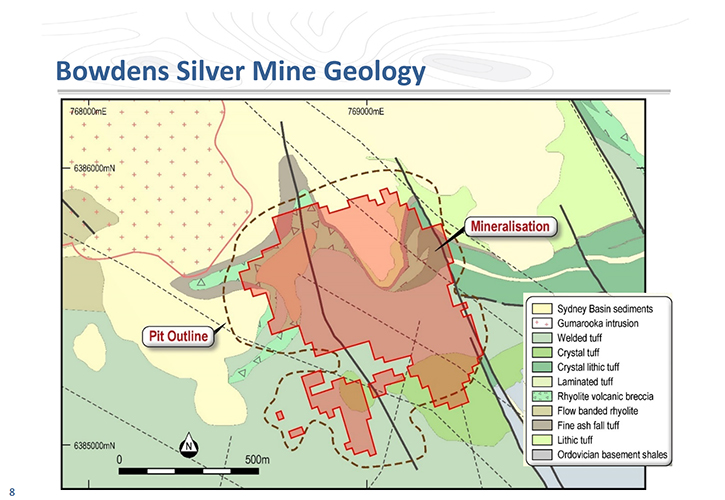

Anthony McClure: So it was great for us to come back home to Australia. We've done a few other things but coming back home to Australia and having a quality asset, three and a half hours from a major city, not in a remote location, so that has its benefits. When we took over, we were primarily interested in understanding why this deposit is where it is. As I mentioned before, very, very unusual for this style of deposit in Australia. And silver is rare here in this sort of style. And a lot of that early worked by silver standard and others was primarily directed at the closest surface minimization, as you can understand. Well, we got involved. Yes, we wanted to de-risk the project and completely drill out and all that, but we wanted to understand why it was there, what was underneath. Are there feeder zones, is there a porphyry system, what has created this massive silver deposit.

Anthony McClure: And low and behold, directly underneath, we made three discoveries. Under the planned open pit we made three discoveries. Over the last year and a half, or so, we've been drilling those out. And early this week, we announced an initial resource assessment for those three areas, which is contributing about 43 million ounces of silver equivalent, high grade ounces, compared to the open cut resource. So actually, because we knew that we were getting outstanding results in there, we actually commenced a Scoping Study on it, prior to the mineral resource, of course. And so we are roughly looking at a further contribution to the open cut development. So, the open cut development is that we will be treating about 2 million tonnes per annum. The underground operation, which we are roughly scoping out, to be coming in online, on year three of the open cut development, could be doing round about half a million tons a year, and that'll be material for us given the much higher grade.

Anthony McClure: And so we view this project, the underground project, as being a very significant material contributor to the open cut development. Now the drilling continues, so we're obviously delighted with that outcome of coming up with an initial underground resource. But everywhere we drill at depth, we're still hitting it. As we get a bit deeper, a bit further to the south and to the east, we get zones, which might have a little bit less silver, but we have much higher zinc, but most interestingly, we see gold coming into the system. So that's where you see that in the underground mineral resource, we have a component of gold in there, be it low grade, 0.3 of a gram. But as we move further south and further east, we're seeing greater return of gold. So we are telescoping out of some minerals and into others.

Anthony McClure: And as we drill a little bit deeper, we start to see copper, coming to the system. So, we view the system as a massive mineralized system. We still don't know the extent of it. The initial development, that's all very good and fine for 16 years open pit, that's expandable. Of course, we have the underground operation. But I'm happy to say, that this operation's going to be still in production in 50 years’ time. It's that sort of ore body. It keeps on giving and we still don't know the full extent. So, we have an aggressive exploration program happening and that's certainly going to be delivering more, as we move forward, over the next little while.

Dr. Allen Alper: Oh, that sounds excellent. It's great to have such a huge silver resource. And as you drill, finding the minerals, gold, zinc, et cetera. Sounds like you and your Team will have a lot of fun exploring and reporting great results as you go on.

Anthony McClure: Yeah, indeed.

Dr. Allen Alper: Probably for generations.

Anthony McClure: Yeah. Some of the interesting work comes from us being a dynamic team and we test theories. We've just recently completed, and we'll show some of this information next week. We'll be at Beaver Creek next week and Denver Gold the week after, we had a bit of information, but we've just been completing some seismic work over the deposit as a test, and then moving further afield, we're on the edge of a collapse caldera, and a big part of the caldera is covered in a thin veneer of sandstone cover. So, we have been endeavoring to look underneath that. And the seismic work has certainly surpassed our expectations and is very clearly defining the structural setting in particular, the actual edge of the caldera structure.

Anthony McClure: In the exploration program, going forward, we still feel, we're just touching the sides. There's a lot more to do. Obviously, it's important to us to get our first mine off the ground, out there, and work on the underground development as well. But the exploration is going to be a particularly interesting part, of how this project moves forward, over the next few years.

Dr. Allen Alper: That sounds excellent, really. It's great to have such a huge project, with such huge resources and such varieties. So, it's developing well, as your Team explores and also to have a project that you could develop into a mine and mine the silver. That sounds excellent.

Anthony McClure: Yeah, indeed. Allen, are you going to be at Beaver Creek or at Denver?

Dr. Allen Alper: Well, I was planning on going, but something came up, so I won't be able to make it. But it's a great conference, so that'll be excellent for you all.

Anthony McClure: I haven't been overseas for a couple of years now, for obvious reasons. It'd be great to get out and see people in the flesh. It's been a long time.

Dr. Allen Alper: Yeah, that's true, because of the space that people have, most meetings have been virtual rather than in the flesh.

Anthony McClure: Indeed.

Dr. Allen Alper: Anthony, could you tell our readers and investors a little bit about your background, your Team, your Board.

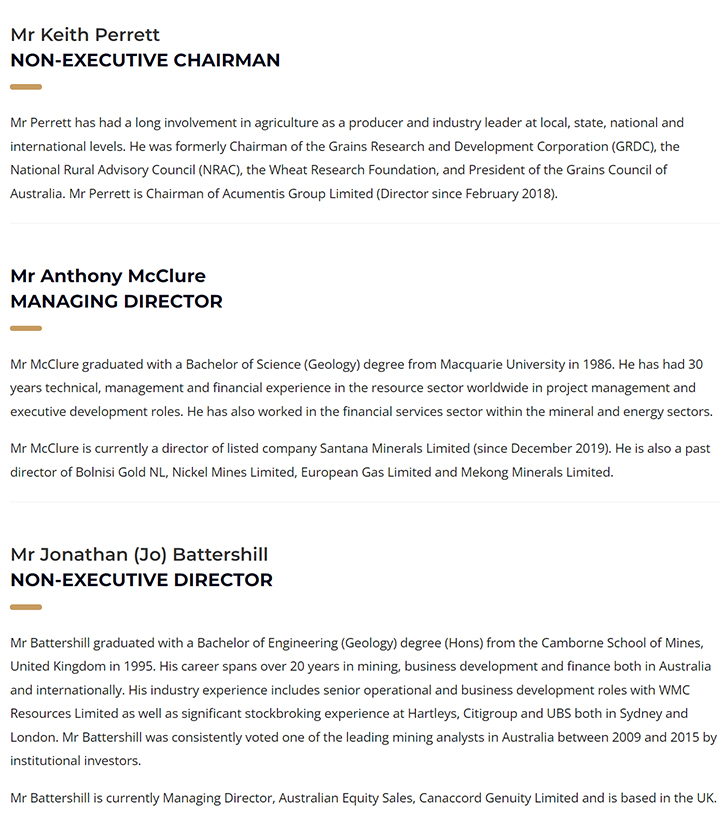

Anthony McClure: I'm a geologist by trade and Executive Director of Bolnisi Gold and its North America subsidiary. Palmarejo Gold and Silver was a successful Company. Bolnisi was initially a startup. We developed a small gold mine in Georgia, in Eastern Europe. Cash flow generated from that moderate size mine, was directed back over into Mexico, where we thought we had greater opportunity and exploration. That led, effectively, to the discovery of Palmarejo. So long story short, Bolnisi and Palmarejo were a startup, effectively, with a capitalization of 20 million Australian dollars. And eventually, bought out for 1.3 billion US dollars, by Coeur, so that was successful.

Anthony McClure: We can all say that we had a gifted project, but there were a lot of technicals that went into that. We had a great Team and you can't develop good projects without having a good team. And so we're delighted with that. We've been off on different projects since then. One in particular was, again, I was an Executive Director of Nickel Mine's Limited, when it was private. Now it's a public company. It has a market capitalization, probably 3 to 4 billion Australian dollars now. And that's a mine we developed. Sulawesi in Indonesia, so that's Nickel laterite, and that Company is doing particularly well. I came off that Board about the time we were starting Silver Mines Limited.

Anthony McClure: We've been involved, with different things, over time. The Team we have, on site, is young and of quality. The great thing about our project is that we are in a good jurisdiction. We're not in the center of Australia, where you fly in and fly out and have harsh conditions and all that sort of stuff. We're in a reasonably sophisticated part of the country. We're close to Sydney.

Anthony McClure: We don't have any issues, from an environmental point of view. The location and the quality of the project allows us to attract the right people. People are looking to get out of some of those harsh environments, putting their families into better jurisdictions. And so very few people have left us, who've come to us. And I think that really bodes well for our opportunity to build up our staff, as we move forward into the initial open cut development. We're in between two major mining centers. North of us, we have the Hunter Valley coal operations, which are huge. And then to the South of us, we have the massive Cadia-Ridgeway gold copper complex, owned by Newcrest. So, we're in a jurisdiction where we can source people and that's an intrinsic part of being successful, having the right people on the ground.

Anthony McClure: In terms of our Board, a few of your readers will know Jo Battershill, who is ex UBS. Joe is English, lived in Australia for a long time, but it's well known in the financial markets and generally regarded as one of the best mining analysts globally. Very well-known, out there in financial services. Our Chairman is not from the industry, he's from a very strong agricultural background and he is a quality Chairman. We have a recent addition, Kristen Podagiel, who's joined our Board, just a few months ago. Kristen has a strong legal background, particularly in legals, involved with mining on the eastern side of Australia. So, we have a small, but quality Board. That is likely to change over time, as we get bigger and as we move into production.

I think we're very well placed. We're very careful about how we are not growing too big, too quickly, in terms of pre-development, but we're going through a significant expansion process, now with a looming approval process. And that allows us to get a lot more serious on the project, in its pre-development phase, through next year, which will be the completion of definitive engineering and optimization. A lot of that's been done already. I mentioned some of the drilling that we're doing in and around the pit, so that's going to change some of the mine design. As we look at gold, coming into the system, we'll add a gold circuit on, but there's a significant amount of metallurgical work going on, at the moment, to further define that. So, by the end of next year, we'll be in a position to make our development decision and be looking at the financing.

Anthony McClure: Financing won't be an issue. We have a lot of interest in this project, not only locally, but from further afield and particularly North America. I think we are happy, in a way, not to be building right now. Capital costs, in our industry, are up significantly, steel prices and labor shortages are really crimping our industry back in Australia and elsewhere, of course. But as we move through, later next year, we're obviously hoping that some of those supply chain issues have been somewhat alleviated and we can get back to a more normal part of the market, hopefully.

Dr. Allen Alper: Well, you and your Team have an outstanding background and such a great record of success, so that's really fantastic. Anthony, could you tell our readers and investors a little bit about your share and capital structure?

Anthony McClure: We have almost 1.3 billion shares on issue. That's not unusual in junior companies, in Australia. Market capitalization is around 230 million Australian dollars or about 160 million US dollars. We follow the silver price very closely. Indeed, if you match our share price graph, with the silver price, they pretty much align. I guess you wouldn't have that without the results we have been delivering over the years. The stock is off at the moment, as are all silver and precious metal stocks. But I think, very generally, we trade at a significant discount to our North American peers, that's clear. That's part of the reason we like to go to Denver and Beaver Creek and see our colleagues. We have a growing quality institutional shareholding in North America, Australia, and in Europe, and a little bit out of Asia, but I think some of those shareholders are very knowledgeable in the silver market. The leverage in the silver stocks is arguably a lot stronger than what it might be, in other precious metals and in gold in particular.

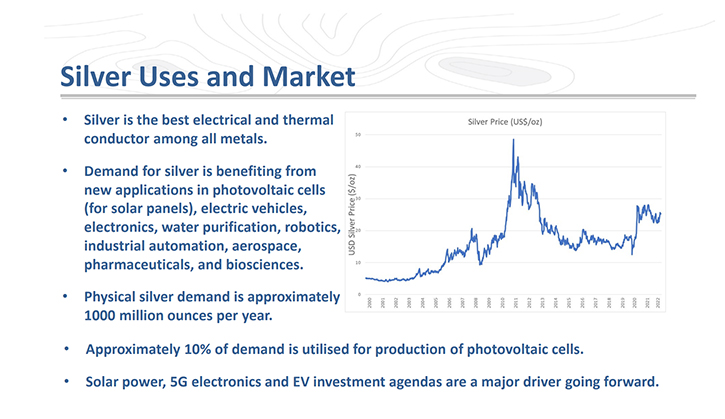

Anthony McClure: The outlook for silver is good. I think decarbonizing, the environment, and silvers use in electric vehicles and solar panels and so forth is a strong driver, I think as we move into next year. Obviously, the mess in the markets, at the moment. is all very confusing across the board. But I think it's good to see some of the higher end analysts out there indicating a very strong environment for precious metals. Silver generally lags behind gold, however, it has much greater leverage in an upswing market. I think we are well positioned in that. Being pre-development and having approvals in place, further color the underground scoping studies, further exploration work and definition on this massive deposit, along with an upswing in market next year, we're in a particularly good position.

Anthony McClure: We're okay for cash at the moment. We have a bit over 20 million Australian dollars, so we're not about to raise money.

Dr. Allen Alper: That sounds excellent, you're in a great position. It's great to have such a strong backing, and being recognized, and being able to have access to cash and having cash on hand, in a very difficult market and having a great commodity that is really not only a precious mass metal, but also electric vehicle metal and solar panel metal. So those are all three reasons to consider investing in Silver Mines to think. Anthony, is there anything else you would like to add on why our readers, investors should consider investing in Silver Mines Inc.?

Anthony McClure: Yeah. I think those are key points. We have the security of a massive resource base, obviously that is a big driver for us. This week, we added the discovered an underground resource, which is effectively double the grade of the open cut. We have a clear path for that being assessed. So, a scoping study will be developed, through and hopefully be complete by the end of this year. We'll have approvals for the open cut development, hopefully later this year. I think, as we move forward, this continued effort in exploration, when we still look at this ore body, it's open in most directions. As we move further to the south and east, we see greater tenure of gold. We are starting to see copper coming into the system as well.

Anthony McClure: The exploration effort will still be aggressive. We have three rigs on site at the moment. We may look to expand on that. And that will be a catalyst for further growth. Next week, going to Beaver Creek, and the following week to Denver Gold, is important to us. Due to COVID, we haven't seen our friends for a long time. We are also meeting new people, which is great. So, it's really important for us to have greater ownership of our Company in North America. Our last capital raising, last year, raised 30 million Australian dollars, a component of that was taken up by North American institutions. We are particularly interested in continuing that expansion of ownership, in North America and Europe as well. We are effectively the only silver stock on the ASX of any substance.

Anthony McClure: We are unusual for a Company of our size. A few years ago, we had an owner shareholder base of around about 3000-3500, mostly retail. We also had a good institutional base. Now we have around 12,000 shareholders and most interesting is that we have a liquid stock, with an average of around 5 million shares a day traded. Sometimes liquidity can be a constraining factor in junior companies, we don't have that issue at all.

Dr. Allen Alper: Well, that's excellent to have that liquidity and a great district. You have a huge resource. And so, I think our North American readers and investors will be very interested in learning about your Company and thinking about investing in it.

Anthony McClure: That's great, Allen. We're delighted to be in your newsletter.

https://www.silvermines.com.au/

Anthony McClure

Managing Director

Silver Mines Limited

+61 2 8316 3997

Email: info@silvermines.com.au

|

|