Rudi Fronk, Chairman and CEO, Seabridge Gold (TSX: SEA, NYSE: SA) Discusses their KSM Project’s Outstanding Update PFS, the World’s Largest Undeveloped Gold/Copper Project

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 9/7/2022

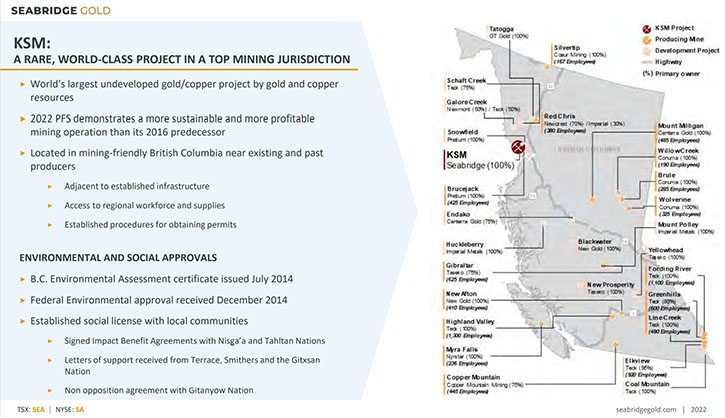

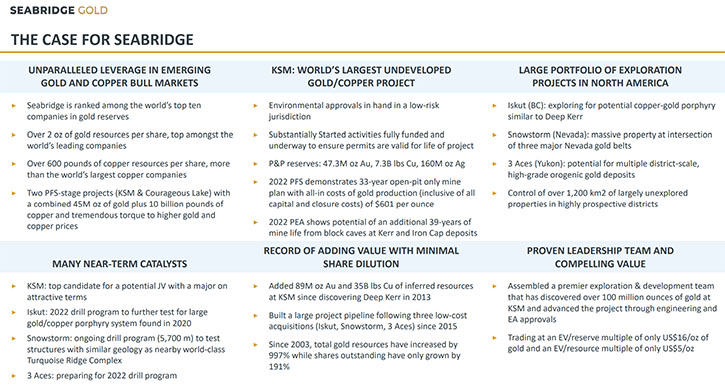

We spoke with Rudi Fronk, Chairman and CEO of Seabridge Gold (TSX: SEA, NYSE: SA), a mineral exploration company, with one of the world's largest resource bases of gold, copper and silver. Seabridge's objective is to grow resource and reserve ownership per share. Seabridge holds a 100% interest in several North American gold projects. Seabridge's assets include the KSM and Iskut projects, located in Northwest British Columbia, Canada's "Golden Triangle", the Courageous Lake project, located in Canada's Northwest Territories, the Snowstorm project, in the Getchell Gold Belt of Northern Nevada and the 3 Aces project, located in the Yukon Territory. The recent highlights, on the Company's flagship KSM project, include the NI-43-101 Technical Report, the 2022 PFS that lifts KSM profitability and sustainability to much higher levels, and the 2022 PEA that shows potential to expand mine life, for an additional 39 years, focusing on copper.

Seabridge Gold

Dr. Allen Alper:

Hi, Rudi. Glad to hear your voice. Looking forward to talking with you and updating our readers/investors on your new KSM Technical Report, which is outstanding.

Rudi Fronk:

It’s great to be back with you. We think it was probably the most important news, in our Company's 23-year history.

Dr. Allen Alper:

Well, it's really fantastic. The data is extremely robust. The economics are so fantastic. Why don't you take us through that report?

Rudi Fronk:

As background, we had completed a pre-feasibility study, for KSM, in 2012 that was used as the basis to apply for our environmental approvals. We received our environmental approvals in 2014. In 2016 we updated the pre-feasibility study, to incorporate changes we had agreed to during the environmental assessment process, as well as changing metal prices and exchange rates. In 2020, we purchased the Snowfield deposit from our next-door neighbor, Pretivm, for US$100 million in cash. In 2021, we did the work on the ground, to allow us to incorporate Snowfield into KSM’s development plans.

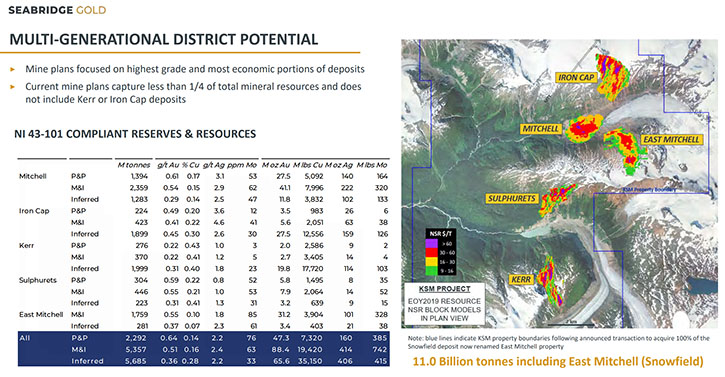

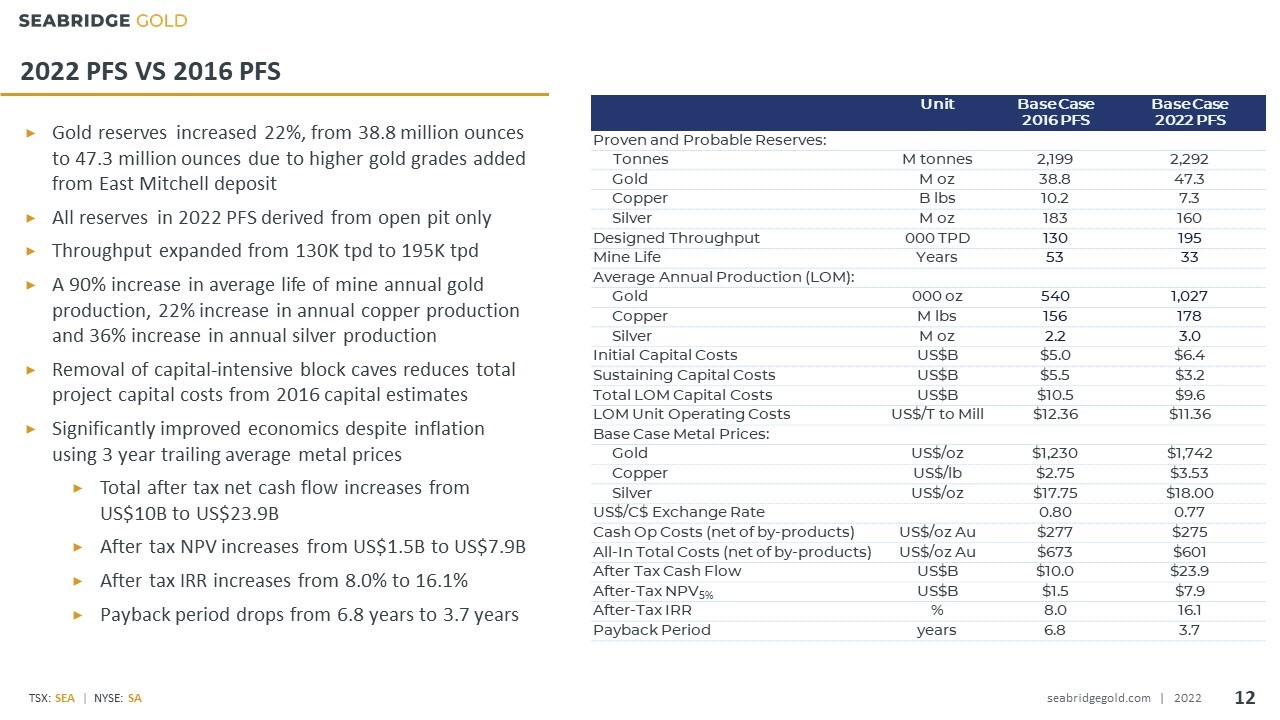

The updated study focused on offsetting the impact of inflation, on the project, as well as reducing its environmental footprint and making the project more energy efficient. The production plan, in the re-cast project, captures three of our five deposits; Mitchell and Snowfield (which we’ve now renamed East Mitchell) and Sulphurets. The previous studies included capital intensive, underground block cave mining, within the mine development scenario.

With the addition of East Mitchell, we were able to remove the block caves from the mine plan, replacing them, with higher grade open-pit gold reserves from East Mitchell. As a result, proven and probable gold reserves at KSM increased from 38.8 million ounces to 47.3 million ounces. Additionally, although initial capital increased, due to inflation, by eliminating the block caves from the mine plans, total capital over the mine life was reduced by about US$900 million.

Another change we were able to make was increasing daily throughput to the mill from 130,000 tonnes per day to 195,000 tonnes per day resulting in a 90% increase in average annual gold production, a 22% increase in annual copper production, a 36% increase in annual silver production, and a 363% increase in annual molybdenum production. KSM now boasts a 33 year mine life, averaging over one million ounces of gold production per year!

The economics also improved dramatically. For example, the after-tax net present value has jumped from US$1.5 billion to US$7.9 billion. The un-leveraged, after-tax internal rate of return, more than doubled to now over 16%. And the payback period, the amount of time estimated to recoup the initial capital, dropped from 6.8 years to 3.7 years. The all-in cost of production, inclusive of all capital, reclamation and closing costs, is now estimated at US$600 per ounce of gold produced, after base metal credits. This is about ½ of the gold industries current projected all-in sustaining cost estimate.

Dr. Allen Alper:

That's excellent. Please continue, Rudi.

Rudi Fronk:

At KSM we have 11 billion tonnes of economic resources, contained in five separate deposits. At this time, our environmental approvals limit is 2.3 billion tonnes of tailings capacity. Accordingly, the updated PFS captures 2.3 billion tonnes, from three of the five deposits as open-pits. The most effective way to mine the remaining two deposits is as underground block caves.

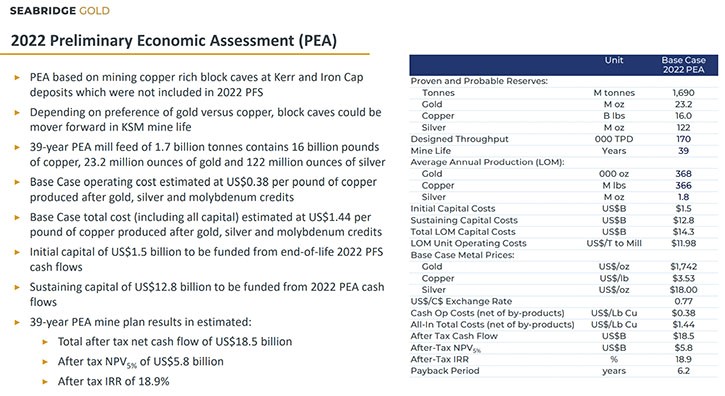

The new technical report includes not only the updated PFS, but a PEA that shows what the project could look like going beyond the 33 years of open pit mine life. The PEA captures another 1.7 billion tons of resources from the Iron Cap and Kerr deposits, above and beyond the 2.3 billion tons in the PFS, potentially adding another 39 years of mine life, capturing an additional 23 million ounces of gold and 16 billion pounds of copper to production. This ore would come after the 33 years of open pits, with an additional US$5.8 billion in projected, after-tax NPV, from the time of commencing the PEA.

When you look into the future, you can easily see KSM’s multi-generational dimensions. This point is extremely important to the indigenous groups, in and around the project area. This is a project that can sustain employment, for the existing population, their children, their grandchildren and their grandchildren's children. I can't think of any project that I'm aware of, in the world, that has that potential longevity.

Dr. Allen Alper:

Those are outstanding numbers, really fantastic. How do you plan to advance the project into production?

Rudi Fronk:

We've made it very clear, for some time now, that this is a project we intend to joint-venture, with a major mining company. Due to its size, we don't have the ability to take on a project of this scale on our own. Over the past several years, we've been talking with all of the large mining companies that we believe possess the technical, financial and social capabilities to build and operate KSM. In fact, we have received proposals from a number of them, none of which satisfied our expectations at the time We only get to do this once and, to be frank, our expectations in a transaction are higher after the FFS

While we continue to engage with potential partners, over the years we have continued to de-risk KSM and make it more attractive to a partner. Clearly, the new PFS makes the project more attractive from an economic perspective. In addition, by removing block caves from the first 30 plus years of production, large companies that have never block-caved can now execute on the project, while exploring the technical requirements of the PEA. When you look at the capabilities of the largest gold and copper mining companies, only two stand out as successful block cavers.

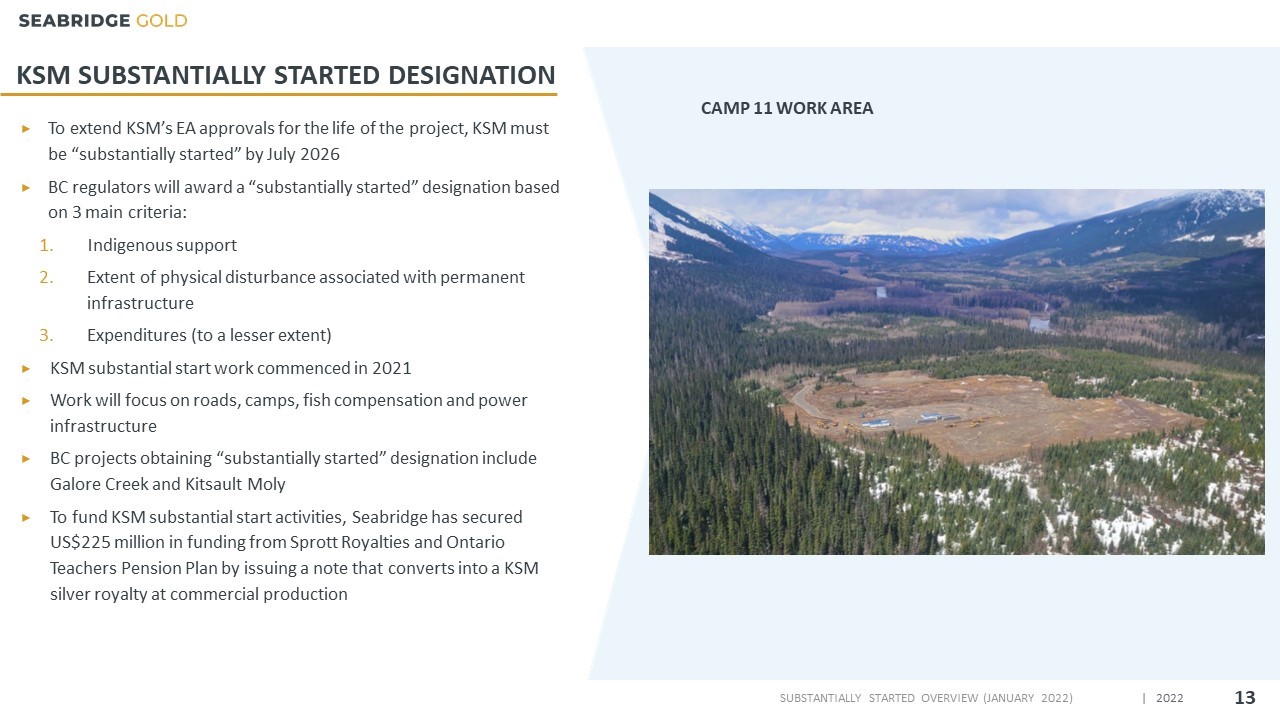

Another risk, we are now in the process of removing, is ensuring that the environmental permits, we have in place, will not expire. In B.C. there is a designation known as “Substantially Started”. If you can achieve this designation, your environmental approvals are valid for the life of the project. To achieve Substantially Started, we have commenced early site construction activities, including roads, bridges, camps and fish compensation areas that are permanent components of the project. Earlier this year we raised US$225 million that is now being used to fund Substantially Started activities. Removing this potential risk from the project, strengthens our hand in joint venture discussions.

Dr. Allen Alper: That's fantastic. It's great for your shareholders and stakeholders and for the community.

Rudi Fronk:

Yeah. Unfortunately, even though this is really important news, probably the most important news we've generated in the 23 years since we started

Seabridge, the market hasn't caught on yet. Our share price has been challenged, performing in line with other gold equities. Although gold has done well, relative to general equities and bonds, over the past year, gold stocks have not performed in line with the gold price. In our view, the improvements we have made at KSM are not reflected in our share price. I believe that will come, in time, independently of a better gold market or a joint venture deal, as sure as these are. The PFS is that good. I also believe that these improvements to the project strengthen our hand considerably, in terms of our ability to get a favorable joint venture done, with a major mining company.

Dr. Allen Alper:

Well, that's excellent. That's very important. I think this report really moves Seabridge forward and the potential for development and mining has greatly increased.

Rudi Fronk:

One other benefit we have is the power that we will use at KSM is furnished from hydro sources. We've now secured contractual agreements with BC Hydro, the provider of power in British Columbia, the rights to 245 megawatts of power from the +$700 million northwest transmission line that has now been built and energized in close proximity to KSM. By using hydro-power, at KSM, the project will have a very small carbon footprint. BC Hydro is now building the sub-station for KSM and we expect to be in a position to draw line power, from the grid, for KSM, within the next few years.

Another important aspect of KSM is that it will produce substantial amounts of copper that the world will need for green energy initiatives, like electric powered vehicles, wind turbines and solar panels.

Dr. Allen Alper:

That's excellent! Could you tell our readers/investors some of your key plans for the remainder of the year going into 2023?

Rudi Fronk:

We will continue to focus on joint venture discussions, with the world’s large mining companies. Obviously, with KSM’s new technical report now in hand, we believe our negotiating position has been significantly strengthened. I might add here that many of these companies have uniformly praised the quality of our work, as being well beyond what they normally see from ‘junior’ companies. We think this makes us a good partner for the right company.

In addition to KSM we have other activities, going on at the moment, including a drill program at our 100% owned, Iskut property, which is located about 30 kilometers from KSM. We see a lot of similarities at Iskut to what we saw at KSM, when we acquired that project in 2000. We have a number of exploration targets, we're focusing on, at Iskut, any one of which we believe could be a company-maker in its own right: large gold, copper porphyry deposits.

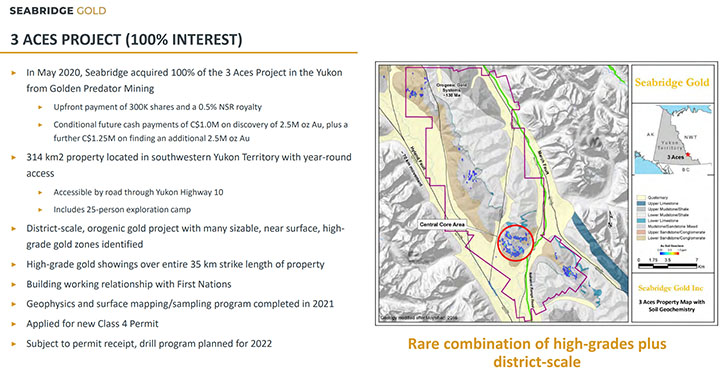

At the other end of the exploration spectrum, we acquired a project, at the height of COVID, called 3 Aces, located in the Yukon. We're now waiting on our permits, from the government, that will allow us to conduct our initial drill program at 3 Aces. Previous operators intersected some very high-grade gold, close to the surface, but couldn’t establish continuity. We think we know why. We're excited to get in there to see what we can make of this project and hopefully we will get our permits in the next couple of weeks, so we can start our activities there in September.

Dr. Allen Alper:

Excellent. You’ve recently made some Management changes, could you tell our readers/investors a little bit about that?

Rudi Fronk:

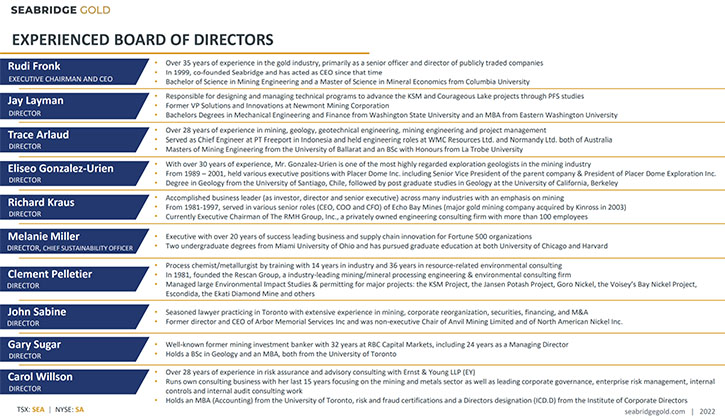

Yes. Jay Layman, our President and COO, who was with us now for 12 years, has retired for personal reasons. Jay is staying on the Board, to help in management transitions with two new appointments. Jay has also agreed to serve as the Chair of our Board’s Sustainability Committee.

Replacing Jay as Chief Operating Officer is Ryan Hoel, who joined us about a year ago. Ryan was the person we brought in, to run the substantially started activities at KSM. Ryan has a lot of big project construction experience, with some of world’s largest mining companies. Because ESG is becoming such an important aspect, in the markets today, we also appointed one of our Directors, Melanie Miller, as Vice President of Sustainability.

One thing that I'm proud of is that when you look at the changes we have made, we were able to make them all internally. We think very hard about succession planning, always making sure that we have that person in-house that can step up and take on someone's role.

Dr. Allen Alper:

That’s excellent. I like to see companies plan and give the opportunity to their employees to grow, that I think, gives their employees a greater commitment to the Company and to the Company's success.

Rudi Fronk:

Yeah, I think so. I think, being able to demonstrate the potential for upward mobility, helps you attract some good talent at lower levels. Then you give them the opportunity to grow and learn and build on their experience and they’re there then, for your future needs.

Dr. Allen Alper:

That's great. Rudi, could you tell our readers/investors a little bit about your share capital structure?

Rudi Fronk:

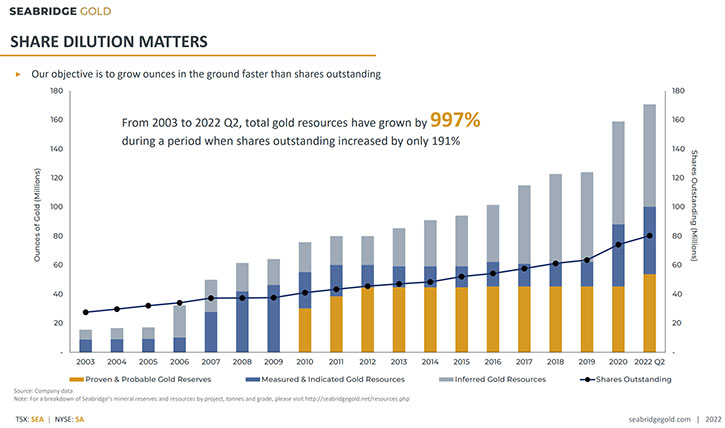

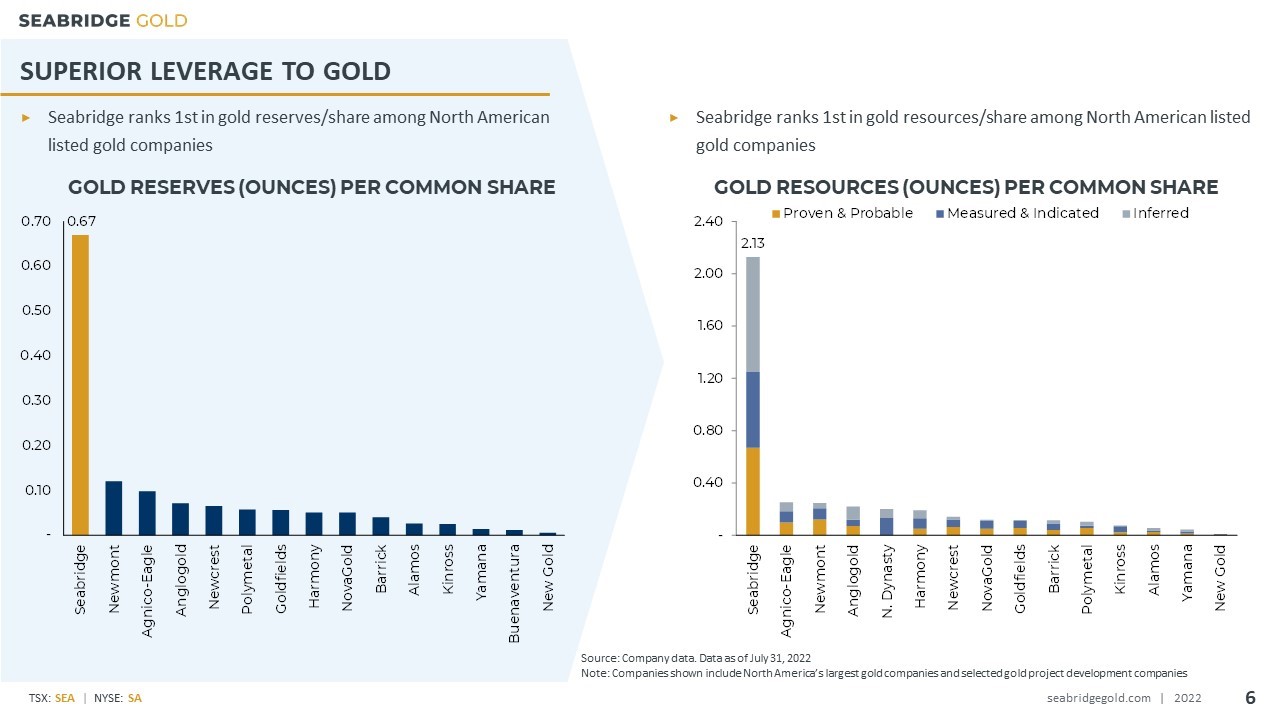

Our ability to offset equity dilution with demonstrative value is what separates Seabridge from most companies in our space. When we formed the Company in 1999, our business plan was based on providing optionality and leverage to the gold price. And we do that through the concept of attempting to grow our ounces in the ground, faster than our shares outstanding. If you look at us today, each one of our shares is backed by over two ounces of gold in the ground, which is 5 to 50 times more gold ownership, per common share, than other leading companies, in our space. I think our consistency on message and business plan, over the past 23 years, has resulted in a very loyal and longstanding shareholder base.

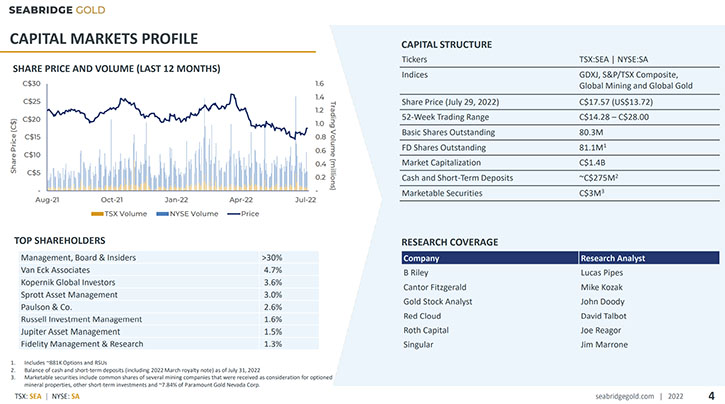

Another unique aspect of our capital structure is that insiders of the Company own over 30% of the stock, and we have other long-term shareholders that have been with us for over 20 years as well. Our shares continue to be tightly held.

Dr. Allen Alper:

That’s excellent and it's great to see that Management has skin in the game and is committed to the success of the Company. It’s great that it's so aligned with shareholders.

Rudi Fronk:

Very much so! I think, if you look at our industry in general, that's not the case. It always amazes me, how few shares most of the senior executives of these big Companies or Members of their Board own in the Company that they are supposed to be managing. When you own shares, you think first and foremost as a shareholder, especially if a large portion of your net-worth is in the common shares of the Company you run, and for me that is the case.

Dr. Allen Alper:

That's excellent! Rudi, could you summarize the primary reasons our readers/investors should consider investing in Seabridge Gold?

Rudi Fronk:

Well, first and foremost, it's the optionality and leverage we have to the gold price. Since we formed the Company 23 years ago, the gold price is up about 500%, our share price is up over 6,000%. Because of that concept of ounces of gold per common share and growing those ounces per share over time we've delivered outsized performance, in a rising gold price environment. The fact is that if the gold price is going to go higher, so will our share price, as it has done over the past 23 years.

The second reason would be owning 100% of the world's largest undeveloped gold and copper project, namely KSM, in a world where the big gold companies are running out of reserves, they need new projects and the big copper companies need new projects to satisfy demand growth that will come from green energy initiatives.

The third reason would be our ability to find gold. We have three earlier stage exploration projects in the portfolio; namely Iskut, 3 Aces and Snowstorm, any one of which we believe can be a company maker. Our Team has found more gold over the past 15 years, than any Company in the gold mining industry, and that includes the majors. And now we have three new projects we're just getting started on.

I think, last, but not least, is our commitment to stay the course. We clearly lay out what our objectives are, each and every year, in our annual report and then in the next year's report, how we did against those objectives, as well as what the new objectives are. I think that consistency of message and staying on track has served us well, in terms of maintaining and keeping a very long standing, loyal shareholder base.

Dr. Allen Alper:

Well, those are very compelling and outstanding reasons for our readers/investors to consider investing in Seabridge Gold. It seems like this is the time when it looks like inflation will be with us for a while and that the US dollar is trading near an all-time high. Gold seems like a safe haven and Seabridge is totally leveraged to gold and also has copper levels you need and demand, for copper is growing very rapidly, as the world becomes electrified.

Rudi Fronk:

Yeah. I would agree with you 100% there.

Dr. Allen Alper:

Rudi, is there anything else that you’d like to add?

Rudi Fronk:

No. I think we covered the main points today and why I believe investing in the shares of Seabridge has never been more compelling than it is today.

Dr. Allen Alper:

I enjoyed talking with you. I enjoy updating our readers/investors and I think you have a fantastic Company.

Rudi Fronk:

Well, I tend to agree, which is why I am comfortable to have over 90% of my net worth invested in Seabridge common shares. So, I believe in it!

Dr. Allen Alper:

Well, that's great!

I also invested in Seabridge, so I'm now a stockholder too.

Rudi Fronk:

That means I work for you, that's good.

Dr. Allen Alper:

All right! That’s great!

Rudi Fronk:

Thanks, Al.

Dr. Allen Alper:

Appreciate it. I'm very impressed with your work.

https://www.seabridgegold.com/

Rudi P. Fronk, Chairman and C.E.O.

Tel: (416) 367-9292 • Fax: (416) 367-2711

Email: info@seabridgegold.com

|

|