Cobalt Blue Holdings, Ltd (ASX: COB): Ethical and Reliable Cobalt for a More Sustainable World, Transforming Global Battery Production; Joel Crane, IR/Commercial Development Manager, Interviewed

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 9/4/2022

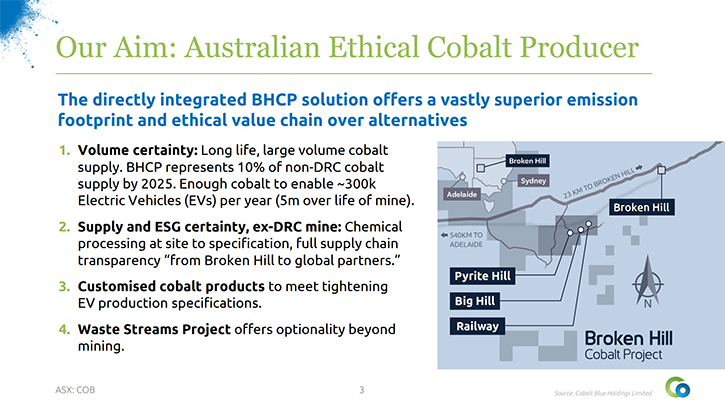

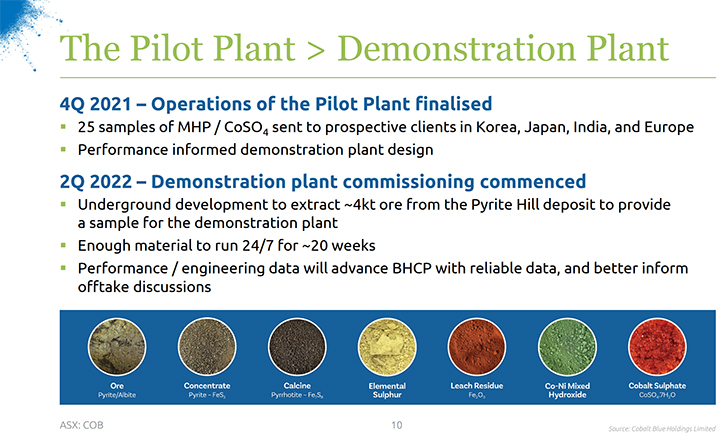

We spoke with Joel Crane, Investor Relations Manager for Cobalt Blue Holdings, Limited (ASX: COB), an exploration and development company, focused on green energy technology solutions and the development of the Broken Hill Cobalt Project, in the far west of New South Wales. Cobalt is a strategic metal, and it is in strong demand for new generation batteries, particularly lithium-ion batteries, now being widely used in clean energy systems. The main targets, for exploration, are well known, and document large-tonnage, cobalt-bearing, pyrite deposits. The project area is under-explored, with the vast majority of historical exploration, directed at or around the outcropping pyritic cobalt deposits, at Pyrite Hill and Big Hill. Cobalt Blue Holdings has designed, built, and is now commissioning and operating a Demonstration Plant in Broken Hill. The plant is aiming to treat a minimum of 3,000 tons of ore (up to 4,000 t) and produce circa 10 tons of cobalt products, (mixed hydroxide and/or cobalt sulphate).

Cobalt Blue Holdings Limited - Mine site – crushed ore stockpiles

Dr. Allen Alper:

This is Dr. Allen Alper, Editor-in-Chief of Metals News, talking with Joel Crane, Investor Relations Manager for Cobalt Blue Holdings. Joel, could you give our readers/investors an overview of your Company and what differentiates it from others?

Joel Crane: Cobalt Blue is a 100% owned, publicly listed Company, on the ASX, and our current main focus is to develop the Broken Hill Cobalt Project. It will be an integrated mine and refinery, where cobalt is the primary mineral, with a byproduct of elemental sulfur. One thing that makes us unique is that we are the only primarily cobalt mine, with the exception of one project in Morocco.

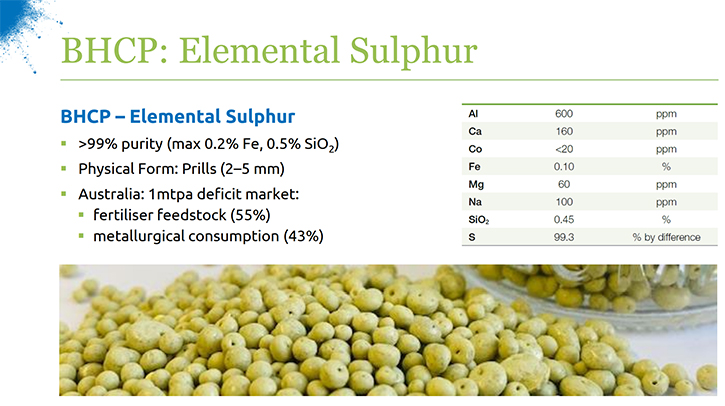

Cobalt is otherwise produced, in association with copper and nickel, as a byproduct. 85% of our revenue will come from cobalt and 15% from elemental sulfur. The other thing that makes us unique is that we are an integrated mine and refinery. We will be mining, and we will also be refining that product, the concentrate, into either an intermediate MHP, or a final product of cobalt sulfate, both of which go into the electric vehicle battery industry.

Dr. Allen Alper:

That's excellent! Could you tell us a little bit more about the project, a bit about the partners you have, and the finance projections?

Joel Crane:

The project itself is located 23km outside of the iconic town of Broken Hill. It's been around, as a known asset, since the 1960s, but is only coming to commercialization now. We developed a pre-feasibility study in 2020, and now we are in the midst of putting together our final definitive feasibility study, which will be ready about a year from now.

We have constructed a demonstration plant that is taking around 4,000 tons of ore that we've accessed, directly from the resource, via an 80-meter decline, and are converting it into a concentrate and then either MHP or sulphate, as I described before. Those samples will then be sent to commercial partners, around the world for qualification purposes. We have about 15 or so of those commercial partners, located in East and North Asia, as well as in Europe and North America. We are in negotiations with a number of parties, but that's all I can really say at this point.

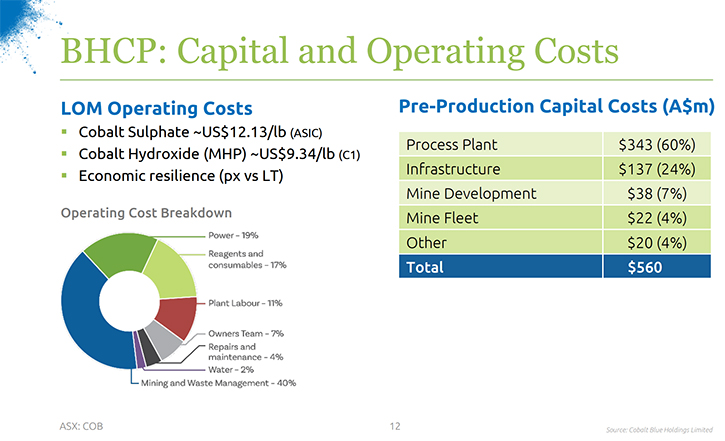

Our project CapEx last guidance was given at the pre-feasibility stage, in 2020 and at that time the guidance was $560 million AUD and that's to build the mine and the refinery. We'll be able to provide updated numbers, once the definitive feasibility statement is ready, about a year from now. We have a market capitalization between $250-300 million Australian. That obviously depends on what's happening in the stock market.

Dr. Allen Alper:

Could you tell our readers/investors the extent of the resource and the reserves?

Joel Crane:

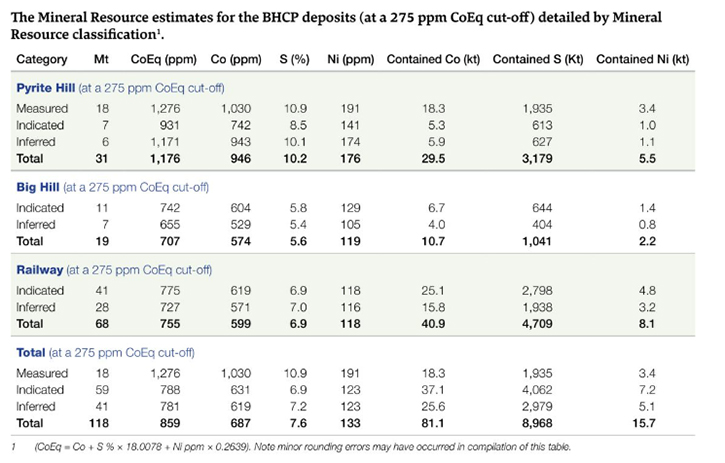

The Broken Hill Cobalt Project hosts a global Mineral Resource estimate, comprising 118 Mt at 859 ppm (parts per million) cobalt equivalent (CoEq) (687 ppm cobalt, 7.6% sulphur & 133 ppm nickel) for 81.1 kt contained cobalt, (at a 275 ppm CoEq cut-off).

The Probable estimated Ore Reserve, for the deposits, comprises 71.8 Mt at 710 ppm cobalt and 7.6% sulphur. The Ore Reserve estimate was based on, and inclusive of the Mineral Resource estimate, released on April 4, 2019, now superseded by the Mineral Resource estimate, released September 16, 2021.

The Broken Hill Cobalt Project mine schedule also considers a production target. comprising 98 Mt at 690 ppm cobalt and 7.4% sulphur for 67 kt of contained cobalt. The production target is inclusive of a small component (approximately 20%) of Inferred Mineral Resources, captured by the final pit designs.

Dr. Allen Alper:

Could you tell us about your primary goals for 2022 going into 2023?

Joel Crane:

The primary goal for the remainder of 2022 is to run this demonstration plant, successfully. The plant itself began full operation in late July, and we're going to run three or four 20-day campaigns, using a 24/7 shift. From those campaigns, we'll have all sorts of data and knowledge, regarding the crushing and concentration circuits, as well as the refinery. These next few months will give us the ability to make adjustments, to this demonstration plant, that will help with final design and specifications, for the final project scoping, in the DFS. So that's the main operational goal for the rest of 2022.

On the commercial side, we are in negotiations with several commercial partners. Those would be either automakers, battery, or pre-Cam producers. Basically, we are looking for someone, who is willing to put down some money, in the form of a prepayment, or a JV, or an equity partner that would be interested in some guaranteed offtake, at an attractive price.

In 2023, after the DFS is complete, the construction phase will begin. On the commercialization side, we’ll be spending a lot of time putting together the ultimate shape of the final funding package

Dr. Allen Alper:

Well, that sounds excellent. Could you tell our readers/investors a bit more about the products you're going to be selling and producing?

Joel Crane:

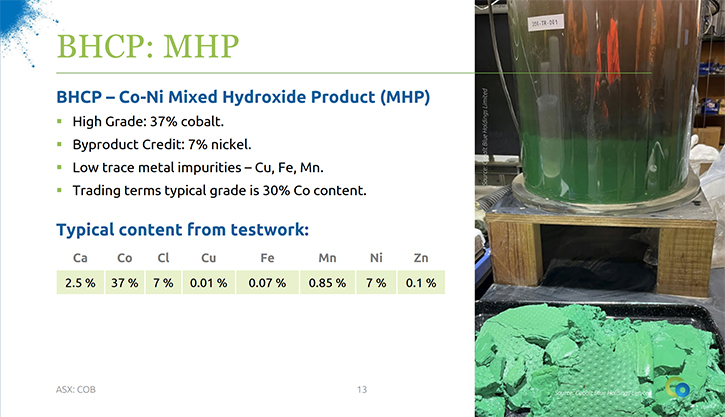

Mixed Hydroxide Precipitate (MHP) is an intermediate product, which comes in the form of a green paste and has, on average, around 30% cobalt and about 7% nickel. It does have some other low traces mineral impurities, such as copper, iron, and manganese, but those will be blended out. The typical trading terms, of this product, are around 30%. We can get that up to between 30% and 35%, depending on the concentration.

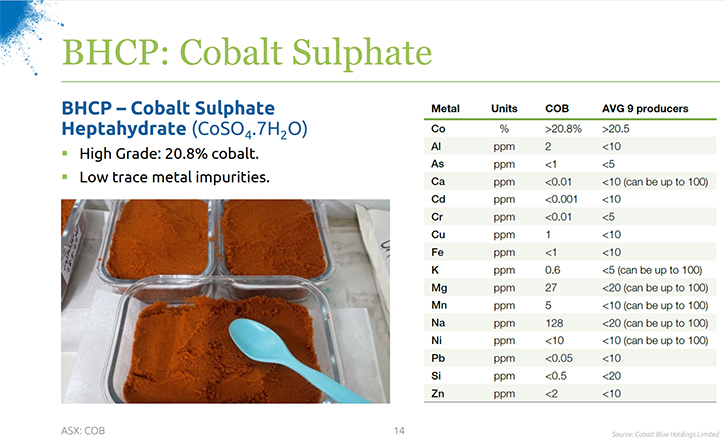

The sulfate itself is a high-grade sulfate, around 20% to 21%, and has quite low trace metal impurities. This red, slat-form chemical can be sent directly to a battery producer, a preCam producer that goes directly into their production process. It's customer specific on whether they want the intermediates or sulphate

Dr. Allen Alper:

That sounds very good. Joel, could you tell us a little bit about your cost, compared to others?

Joel Crane:

In terms of capital intensity, we're pretty competitive. I have to stress that the last number, that we gave, is two years old. Given what we know about inflation, the adjustment will be headed in a fairly obvious direction. But just in terms of capital intensity, we really do stand out, versus the rest of our peers, namely because of the size, which I haven't detailed.

We are going to have about three and a half thousand tons of metal equivalent cobalt. That will make us one of the largest projects, outside of Africa, in terms of capital intensity. We are extremely competitive, because we are a primarily cobalt operation,

Most of our peers are primary nickel producers, with cobalt as a byproduct. Those nickel operations tend to be quite complex and capital intensive. That really makes us stand out, that we don't have to worry about those expensive nickel circuits. We're just producing a standard open cut mine and refining process.

Dr. Allen Alper:

That sounds very good. One big advantage, I would think you would have, is the safety and the security of your project, compared to where many other projects and Cobalt are coming from.

Joel Crane:

Well, that's right. 70% of the world's mined cobalt comes from the Democratic Republic of Congo. Not to say that all operations are unsafe or environmentally unfriendly, but certainly the Country and the region has had its issues in the past. The other major emerging cobalt jurisdiction is Indonesia, because of the association with the emerging nickel industry there. Indonesia unfortunately has far less intense environmental regulations, so much of the production of minerals there, is primarily done, using coal-fires power generation. The carbon intensity is quite high, and their environmental records tend to be quite low.

For us, being a greenfield mine in Australia, one of the most highly scrutinized jurisdictions, in terms of the permitting, we will end up being one of the most carbon competitive and energy efficient operations, on the planet. The other advantage we have is where we are located, just outside an established mining district in Australia. We have very good access to power and transportation. The transcontinental rail line literally goes through our tenement and the highway is just a kilometer away from the asset itself. We already have been allocated access to rural water, more than we require.

Perhaps, most importantly, because of where we're located, we have access to people. 150 years of mining has made mining, in this region, its main industry. So, we're able to access, not only the people, but the rest of the infrastructure quite easily. We have full community support, particularly because we're a new operation that's investing heavily in the community.

Dr. Allen Alper:

That sounds excellent! Could you tell our readers/investors a little bit about your background, your Team and your Board?

Joel Crane:

I'll start with the new CEO, Joe Kaderavek. He has a long history in the mining industry, both in terms of operations and a background in mineral processing, as a consultant for both BHP and Rio Tinto, and that's through projects in Australia, North America, and Europe. He also has a past in the financial markets, as he was equities research lead for Deutsche Bank, and he also worked for a hedge fund, investing primarily in resources.

The Executive Manager, or the technical guru behind our flow sheet, is Dr. Andrew Tong. He's a metallurgist, with over 15 years’ experience in project development, particularly, with this complex process of liberating minerals from pyrite, which is our main mineralization. He's patented a number of innovative minerals processing technology.

I am the Manager of Investor Relations, but I'm also involved in much of the commercial negotiations. I'm a commodities economist, with over 15 years’ experience analyzing bulk base precious metals, for both global investment banks, as well as Rio Tinto, for which I worked for around five years.

The Chairman of the Board is Robert Biancardi. he's had numerous Directorships, of all sorts of private companies and has worked for major institutions, such as IBM, Citibank, and Westpac. The other Director is Hugh Keller, who is a retired lawyer, but has spent a long time looking at the resource industry. The final Independent Director is Rob McDonald. He has 40 years of international mining experience, and also investment banking and private equity investment management.

Dr. Allen Alper:

Well, it sounds like you have a very experienced and diversified Team and Board, so that sounds excellent!

Joel, could you tell us a little bit about your business and cash model?

Joel Crane:

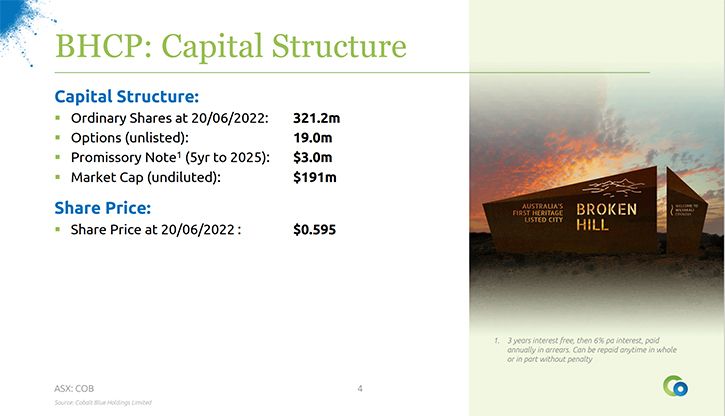

The capital structure is relatively vanilla, we're 100% owned. We have just a small amount of debt, in the form of a promissory note, which is just a leftover, from when we bought out the partnership. Our market cap is around $250 million. We have about $11 million in the bank. We also received the $15 million grant from the Federal Government to derisk our DFS, so we're fully capitalized through the end of our DFS period into next year.

Dr. Allen Alper:

That sounds excellent, you’re in a great position. You have a resource in a great area, with a great demand, in this growing need for cobalt for electric vehicles. Joel, could you tell our readers/investors, what are the primary reasons they should consider investing in Cobalt Blue Holdings?

Joel Crane:

For anyone who is looking for direct exposure in the energy transition, via critical minerals and more specifically electric vehicles, there are very few other places that have the type of direct exposure that we have. Cobalt, 98% of the time, comes as a byproduct from copper and nickel, so there are very few places, in global equity markets, you can actually get direct cobalt exposure. If you're buying into an equity of a company that produces cobalt, you're also buying exposure to the other commodities they produce. There's really no other pure play on earth.

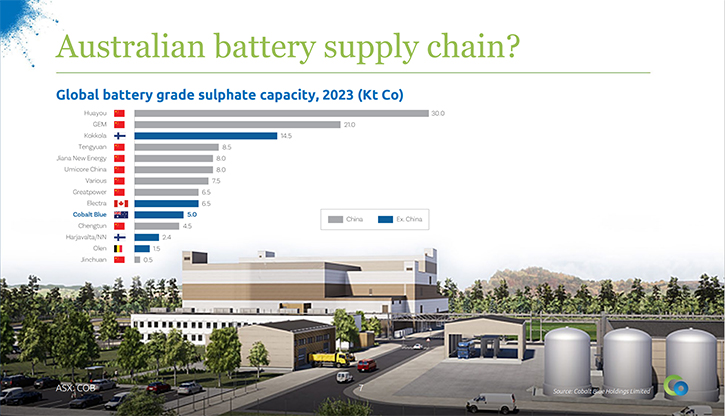

Not only that, but we are also just committed to helping establish Australia, as one of the new critical minerals’ hubs, not only for mining, but also refining. We're very committed to attracting more downstream industry, into Australia, in the form of preCam-com or even battery production. So, if anyone's looking for direct exposure to this industry, and the growing trends, this is the place to be.

Dr. Allen Alper:

Those sound like very compelling reasons, for our readers/investors to consider investing in Cobalt Blue Holdings. You have a great resource in a great area, a huge resource, low costs and a growing demand. Also, it's a critical element in electric vehicles. Joel, is there anything else you'd like to add?

Joel Crane:

I think you have covered it all and asked all the right questions. Thank you for the opportunity to include an article on Cobalt Blue Holdings in Metals News.

https://cobaltblueholdings.com/

Joe Kaderavek

Chief Executive Officer

info@cobaltblueholdings.com

P: (02) 8287 0660

|

|