Dev Randhawa, Chairman & CEO and Raymond Ashley, P.Geo., Fission 3.0 Corp. (TSXV: FUU, OTCQB: FISOF) Discuss Exploring for High-Grade Uranium in the Premier Athabasca District, World Class Team

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 8/30/2022

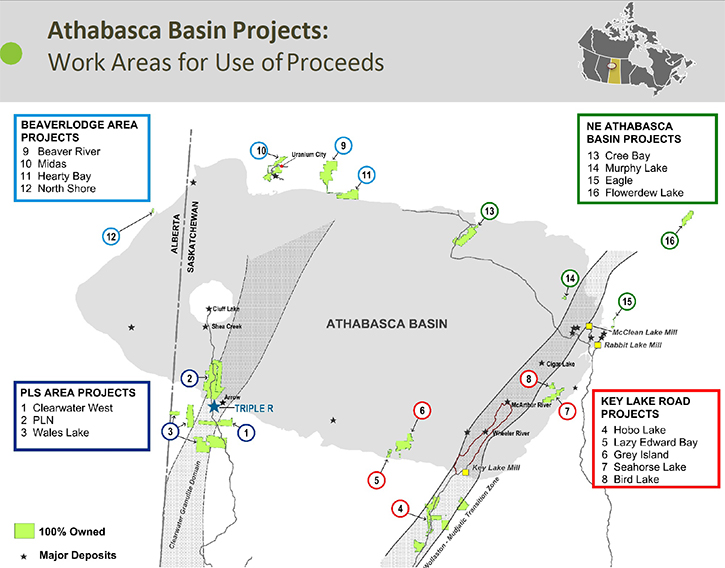

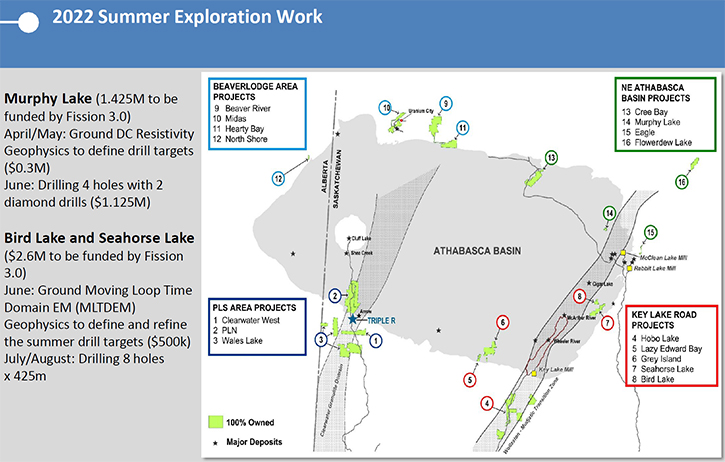

We spoke with Dev Randhawa, Chairman and CEO and Raymond Ashley, Professional Geoscientist of Fission 3.0 Corp. (TSXV: FUU, OTCQB: FISOF), a uranium project generator and exploration company, focusing on projects in the Athabasca Basin, home to some of the world's largest high-grade uranium discoveries. Fission 3 currently has 16 projects in the Athabasca Basin. Several of Fission 3's projects are near large uranium discoveries, including, Arrow, Triple R and Hurricane deposits. The extensive 2022 Summer exploration work program included drilling at Lazy Edward Bay and Murphy Lake. Prospecting, sampling, and ground geophysics are also planned at Hearty Bay to ready the property for follow up drilling next winter. The PLN property is the most advanced, of the Fission 3 portfolio, by virtue of its proximity to the world class uranium deposits, being advanced by Fission Uranium Corp and NexGen. A 3000m drilling program is planned at PLN property in the fall.

Dr. Allen Alper:

This is Dr. Allen Alper, Editor-in-Chief of Metals News, talking with Dev Randhawa, Chairman and CEO and Raymond Ashley, Professional Geoscientist of Fission 3.0 Corp. Maybe I'll start with you, Dev. Could you give us your vision. Tell us a little bit about what differentiates your Company. A little bit about your awesome Team and background. And then a little bit about the uranium market, why it's so critical, why the future looks so bright. Then Ray could get into the exploration activities and review that.

Dev Randhawa:

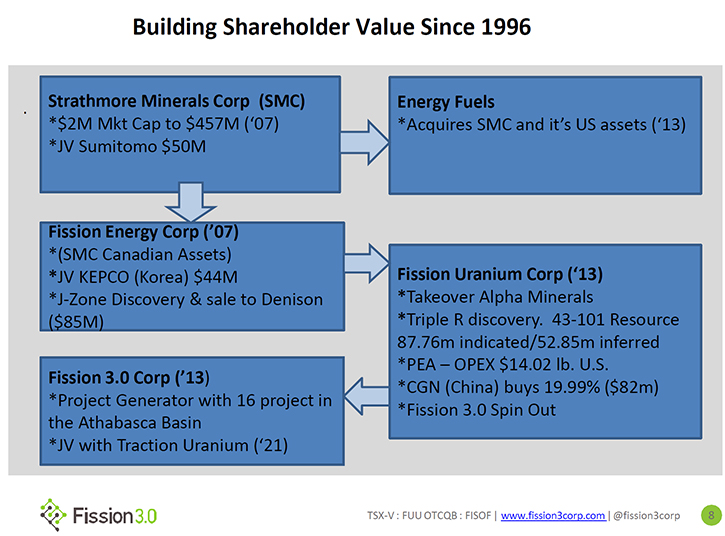

First, what sets us apart from anybody else is our track record, over the last 25 years. We’ve tried to take advantage of the cycles, by acquiring quality assets, in bear markets, and maximizing the value of the assets, in the bull markets. It began with Strathmore in 1996. The Canadian assets were spun out into a new company, called Fission Energy and the remaining U.S. assets, in Strathmore, were sold to Energy Fuels. Meanwhile, our Technical Team, led by Ross McElroy, (CEO of Fission Uranium), and Ray Ashley, Professional Geoscientist, made the Waterbury discovery. This was later sold to the late, Lukas Lundin and his Team at Denison Mines. We then spun out the other exploration projects, on the western side of the Athabasca Basin, into Fission Uranium, (which made the Triple R discovery of over 130M Lbs.). The exploration assets in Fission Uranium then became Fission 3.0 Corp. The key here is these assets were identified, with the same technology and Team as Fission Uranium’s Triple R discovery.

Since January of this year, there has been a complete disconnect between the spot price of Uranium to stock prices. Fission 3.0 was trading at $0.10, when uranium was $30 Lb., We are currently trading back at 11 cents, with uranium at $49 Lb. On paper this makes little sense to the average retail inventory, but fear and greed are hard to explain at times

The recent announcement, from the Japanese government, has certainly lifted U markets. We will spend over $12 million this year and have $5 million left after this summer’s large exploration program.

We're well-funded, well-managed, and we have assets that were hand-picked, over time, during bear markets.

We generate our exploration targets, with the use of ‘vectoring’ in for uranium and we're systematically looking to find that high-grade discovery. Our Technical Team is constantly trying to understand where the uranium is located, in our projects, and they process many different techniques to do this. The process is time consuming, and we look for conductors that are the key to locating high-grade uranium, using geochemistry, airborne surveys and on the ground mapping.

Dr. Allen Alper:

That sounds good to have Ray continue to talk about your exploration activities. That would be great!

Raymond Ashley:

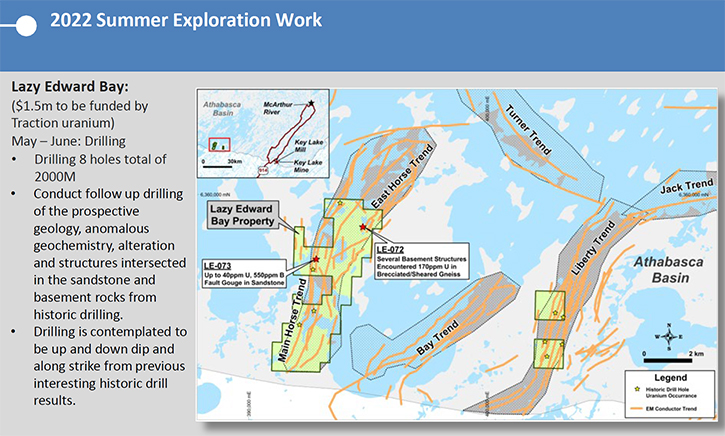

We recently completed a drilling program, at Lazy Edward Bay. That project is subject of an option agreement from Traction Uranium. They funded the $1.5 million drill program. We set out to drill 2,000 meters, with eight holes, and we managed to sort out the logistics, so that we were able to drill 3,000 meters in ten holes. That’s a project that we picked up, when uranium was out of favor and by combing through assessment reports, filed by companies, who've done work historically.

There were some excellent results that needed to be followed up, by work conducted in late 80s by Uranerz and J & R in 2017. So that's what we set out to do. Our drill program confirmed the historic results, all the right signs were there, the hallmarks for high grade uranium, in the Athabasca Basin. There was significant structure on the Horse West conductor, with bleaching and alteration in the lower sandstone. Radioactivity was intersected, in seven of the ten holes, at the unconformity with a hand-held scintillometer. Those are key signatures that accompany high-grade uranium deposits

All that together really confirmed the potential that we saw, by reviewing the historic work, it really has confirmed to us that it's a very prospective structural corridor. The property is located halfway between the Key Lake Mine and the Centennial Deposit, with conductive northeast trending structures, similar to those that are associated with those deposits. It has all the right signs and this first drill program really confirmed what we hoped, and has provided encouraging results to follow up.

We're drilling right now; at a property we call the Murphy Lake Property. It's in the eastern side of the basin, just five kilometers south of ISO`s Hurricane Deposit, and east of Cameco’s La Roque Trend, where there are historic intersections of high-grade uranium. The original plans, for the summer drilling, were to drill five or six holes, targeting conductors, defined by the spring ground geophysical work that aimed to identify, pinpoint the graphitic faults, which really are the reactivated structures that the fluids that bring in uranium travel along. The intersection of significant anomalous radioactivity, in the sixth hole, of up to 2300 counts per second, with a handheld spectrometer, has led us to expand the drill program to try to hone in on high grade uranium.

When things were quiet, combing through historic exploration data, filed with the Saskatchewan Government, allowed Fission 3 to identify and stake 16 prospective properties, in the Athabasca Basin. Of the 16 properties, they've all been staked, we haven't done a deal with anybody to acquire these properties.

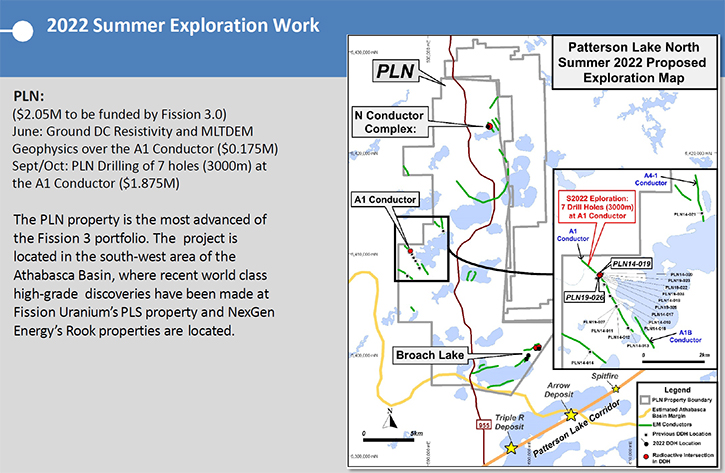

Following that we're heading, in the fall, to our PLN project, which is really Fission 3.0’s Flagship uranium property. It's just due north of the Triple R and NextGen’s Arrow Deposit. There are conductive corridors, parallel to the corridor that hosts those two deposits and previous work drilling by F3 identified a Northwest trending A1 conductor that heads up towards the historic Cluff Lake mine, where Fission 3 intersected uranium mineralization in 2014.

We've confirmed the presence there of a very prospective conductive structure, and drilling was done there in 2014 and 2019. That A1 conductor had sniffs of uranium and pathfinder elements and just had all the right signs, for high grade uranium. The plan there is to continue drilling, along the A1 conductor, to try to vector in on possible high grade. The main target is the untested northern 900 meters, of that conductor. The geochemistry, and the results were getting better towards the North.

The ground geophysics, to guide the drilling, is now completed, It looks to pinpoint the graphitic faults and for alteration and cross structures that the uranium mineralization is associated with. Fission 3.0 is lucky to have so many properties and to have managed to keep this same Technical Team employed. There are 13 members of the Team and most of these geoscientists were there for the discoveries at Waterbury and Triple R.

Fission 3.0 managed to keep working through the downturn, to really do all the work to come up with these uranium properties. We're excited about the programs that are ahead of us. I'm encouraged by what I see and hopeful that we can hone-in on some high-grade.

Dr. Allen Alper:

Well, that sounds excellent!

Dev Randhawa:

Because we have a strong Team, and we compensate everybody, the best we can. The key here is that we stake land, which costs very little, and Saskatchewan is a good place to hold land to do some work. We use past data, we go through those more than anything. We like this area and when properties come up, we grab them. In the States, there are no reports done, and you can't stake online. We can stake online, and we have data. It's a big advantage! The mining system is a bit more advanced, in some ways, in Canada.

If you're really sharp, with your computer, and know what you want, you can get it. We feel that we moved every project along, it took us sixteen holes, just on Triple R. It took how many for NexGen to find theirs? It takes time. It's hard to be patient, but we're very thoughtful, on how we do it. Drilling is quite expensive, but the rest of the stuff isn't, so we try to redo a lot more work and narrow it down. With high-grade uranium, it can be off ten yards, miss it and just get a bit of it.

But we know enough about it. If there's some bleaching, we know the uranium fluids have run through there. The question is, where did they go? We have bleaching and alteration here. You have to have those to have uranium. Those are the different signs for it.

Dr. Allen Alper:

That sounds excellent. Dev, could you tell our readers/investors a little bit more about the significance of the region you’re in and the importance of that region for uranium?

Dev Randhawa:

Sure. Well, you're looking for evidence of where the high grade is, where this fuel part of uranium is. There are two or three key things, and Ray, what would you say the top three things are? Bleaching?

Raymond Ashley:

Yes. Bleaching, clay alteration, pathfinders, boron and the elements that are known to accompany the uranium, those are the signs that we look for. It's clear that the Athabasca Basin, I think that's what you were asking Al, about the Athabasca Basin itself.

Dr. Allen Alper:

Yes. Maybe you could say a few more words about that basin and its significance in the past, and right now, and in the future?

Raymond Ashley:

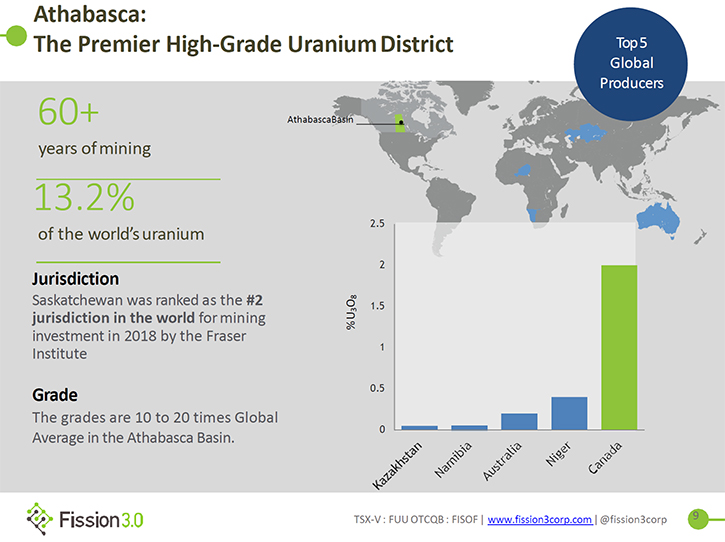

The uranium deposits in the Athabasca Basin are something like 20% higher, than anywhere else in the world. The key is that mining costs are low, competing with Kazakhstan. That's the real significance of the uranium in the Athabasca Basin, and world class deposits are there. It's the place to be for uranium exploration. The trouble is that there's no more land to stake in the Athabasca Basin.

When uranium becomes in favor, the entire basin gets staked. Fission 3.0’s advantage is having been at it and looking for the right properties, in the times of the downturns, when uranium was out of favor. That has been our greatest advantage, having 16 properties, in the basin, that we selected. It's not what ground was left to stake. These were properties that were researched, over many years, and selected for their prospectivity. Using our knowledge, from having been around, and been around for major uranium discoveries. The best address for uranium exploration is the Athabasca Basin and we're lucky to have 16 properties, in the basin.

Dr. Allen Alper:

That sounds fantastic. Dev, could you tell our readers/investors the importance of uranium and the move to green energy?

Dev Randhawa:

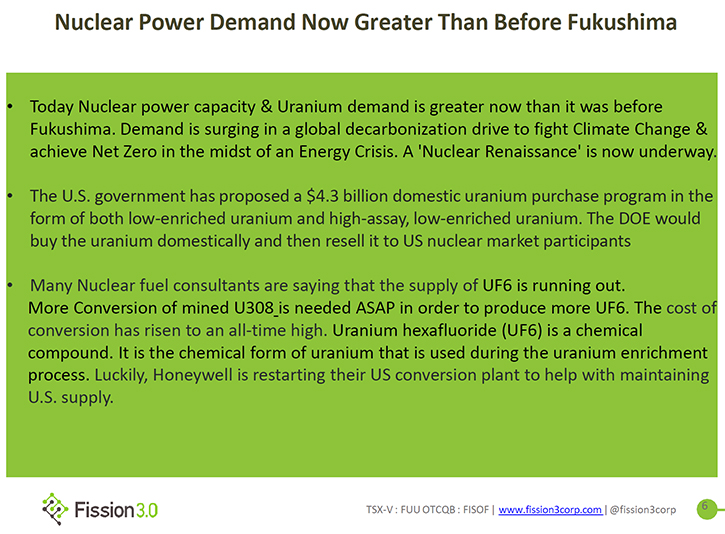

I've been in this business since 1995 and I've never had the winds go in our favor. Number one, having the Democrats on side, we've never had that. The Republicans are always pro nuclear, but Democrats weren't. But they have recognized, along with countries like Germany, the disaster of trying to switch to renewable energy completely, without having a backup. Examples of Germany, which was the poster country for green energy and unfortunately, they were using primarily coal to heat their country, last winter.

When the wind didn't blow, and the sun didn’t shine, like some scientists predicted, they've had to use coal. I think it's been a real wake up for every country. There's been a real massive turnaround, like Korea was saying three years ago, we're going to phase out nuclear and use renewables. Well, as people are seeing, it's a great way to get elected, but a terrible way to stay warm, because intermittent energy is just no base for power. The batteries they have now, you might get 90 minutes, some say nine, if they’re poor batteries, they can't store it. I think the recent announcement, by the Brussels European Common Market, as they now embrace nuclear and natural gas, to be a part of the green energy, they're actually qualifying now, for a lot of large funds, which can invest in that space, with their ESG requirements.

Okay, we can invest in uranium, now that it's part of the green energy. Prior to this, there were a lot of people, including environmentalists, living in dreamland thinking they could. I point to Germany again because they were going to spend $1 trillion to connect all the turbines and the solar panels altogether, 3,900 kilometers were going to be hooked up. Well, they got 39 kilometers, 1% of what they wanted for that budget. That's another example of people wanting to go, but there's no backup. Nuclear is the only energy source, with no carbon footprint, with baseload power, that you can turn on and off, because all of us tend to want to use our energy primarily from 5:00 PM to 8:00 PM. We literally use about half our energy, at that point, because we all go home, turn on our ovens, have dinners, we go to restaurants, and you need to be able to turn it on and off and nuclear does that.

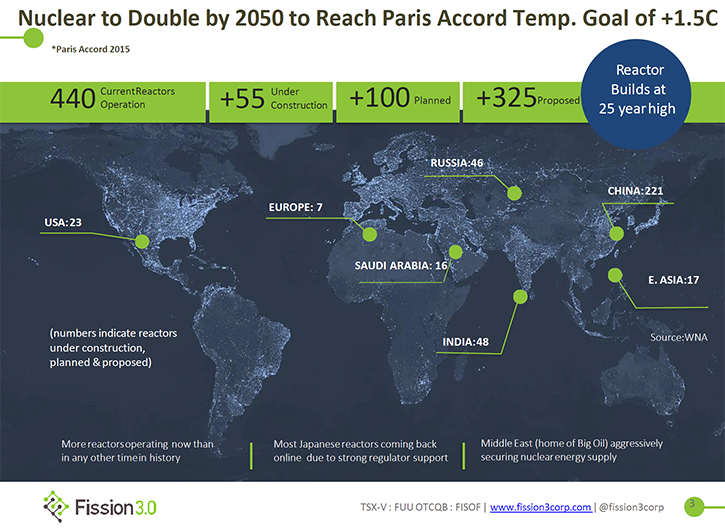

People are realizing, if we're going to reach any of our green energy goals, with the Kyoto Protocol, the Paris Accord, you must have nuclear. China has recognized that. They go from nothing to 30-40 reactors, building 40 more. The States have about 100. Almost every country in the world has switched. Germany was the poster child, Japan is now going back stronger, trying to get all their 30 reactors back on. Almost every country was going to cut back. again.

Unfortunately, reality doesn't care about politics and politics for a long time were saying, well, we can live off the sun and the wind. That’s just not the case, it won’t happen. People are waking up and there’s absolutely no way any country can meet any of its lofty goals, without nuclear. It’s just not going to happen. I've been preaching it for a long time, but this is the first time, in almost 40 years, in my life, that I've been talking about the value of nuclear power. Now it has its downsides, like any other power, but it is baseload and absolutely no carbon footprint, zero.

Dr. Allen Alper:

That shows how critical uranium is, and how important the outlook for uranium. Could you say a little bit about supply and demand of uranium?

Dev Randhawa:

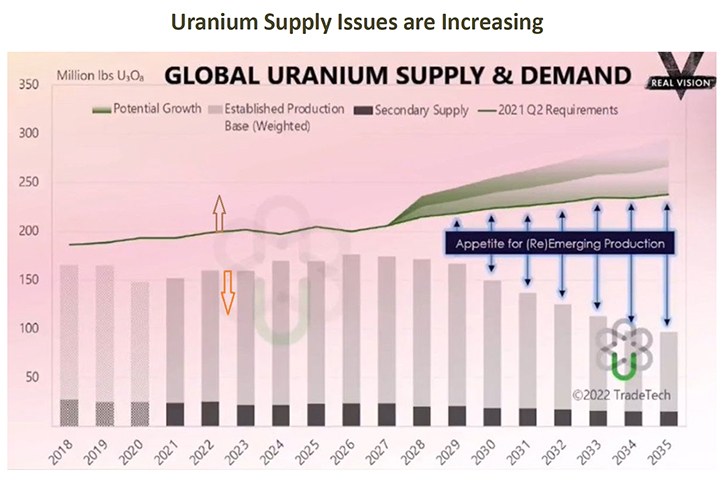

We have traditionally had, over last few decades that I've been in it, a demand that has been higher than supply, always. We typically need almost 200 million pounds, we produce 150, the rest comes from very secondary sources and slowly those are running out. There's always been a deficit. We haven't even talked about the Russian factor. Green energy folks are finally waking up, okay, we need nuclear power, let's go. The second factor is, Putin knew this about five years ago. He, right now, has almost 50% of the uranium processing equipment and facilities. They've got to be careful not to tick off Mr. Putin.

He also, through Kazakhstan, controls about 40% of the world's uranium and every 10th light bulb in the United States is powered by Russian uranium. The other factor, which is going to happen, if the U.S. continues to make sure there's no Russian or even Kazakhstan uranium, and you'll even see another constriction of supply. So that's another factor altogether.

The reality is, though, Kazakhstan has the cheapest uranium. I believe they can make money under 20 bucks because their cash costs are under ten. I believe in Canada we can do under 40 because our cash costs are in the teens. However, the United States does not have high-grade uranium, the best you're going to see 0.2 or maybe 0.5. In Canada goes 2% to 5% uranium and it has all the rules in place to put mines into production.

Because of that, the state needs, in my view, $70 to $80 uranium before they start thinking of turning on their mines. Now we're at 50-60, so we still have a longways to go and more importantly, America has zero uranium production. Despite what you hear from the promoters, on some other companies, there is no production, maybe 100,000. What's sad is one time America used to produce 40 million pounds and had a demand for 4 million if you can believe this. Now it's switched. We need about 50 million pounds and produce zero.

Unfortunately, we let Russia take over that whole process of uranium. Canada is a good place to get it, that's another reason why I think Canadian assets are more valuable for investors. Looking at it backwards, if you believe you want a cleaner world and you want to invest, you have to look at uranium as part of the green energy, what I would call the green energy solution.

Then you want to look for assets that belong in Canada, places that are safe with good jurisdictions. Canada offers that. Then you want to look at management teams. Who's done this before, who's gone out staked land, grabbed land, gone through the process, expensive and tough and found deposits and sold it. So that's what Fission 3.0 really is. That's one thing we've done. We've gone out there and done all this before twice, that's why it's called Fission 3.0.

Dr. Allen Alper:

That's fantastic. I mean, you have an awesome Team. A Team of discovery and success, you're in a great region and you know it, in detail, and understand it. So that's fantastic. Dev, could you summarize the primary reasons our readers/investors should consider investing in Fission 3.0?

Dev Randhawa:

Sure. When we're investing in real estate, they say it's location, location, location. I would argue, that when it comes to investing in exploration companies, it's management, management, management. That's in my view. Because of that, Rick Rule says, some people are what they call serious successful and that's what we've been before. We've gone through cycles before; we know when to raise money and we're well-funded. We have some outstanding projects; F3 owns 100% of every one of our projects because we staked them.

It's about Management’s track record of success, it's about having assets, I think you need to own 100% of them and you need cash in the bank, it's an expensive process. We have all that we are. Especially for us, in the next few months, the market may not be listening, but we're going to continue to drill, drill, drill, hoping to find a deposit. That's what we're about, to find another world class deposit. I don't think this issue of climate change is going away anytime soon. I mean, the Russian Ukraine invasion may end, in the next 6 to 8 months, but this demand for clean energy is not going away.

Finally, you have Bill Gates and Warren Buffett, building a reactor in Wyoming. Why don't you hear that? And everybody's cheering them on. The coal mines are shutting down up there, so they're putting in a plant, which I think is wonderful. Whether we like the push for green energy, I want a cleaner planet for my kids, too, but not at the expense of people not being able to heat their homes. We have to find a balance and I believe uranium is a crucial part of that track, towards a cleaner earth. Yet we need energy to live.

Dr. Allen Alper:

Those are compelling reasons for readers/investors to consider investing in Fission 3.0. You have a proven Team, you’re in a fantastic location, you’ve done it before, you can do it again. The outlook of uranium is crucial, in the move away from fossil fuels, and you’re well financed. Those sound-like excellent reasons to me. Is there anything else you’d like to add, Dev?

Dev Randhawa:

I would encourage people to buy stocks now. The problem is we get into these bear markets. People have become more and more momentum players and not contrarian. Rick Rule says if you're not a contrarian, you're a victim. This is the perfect time to buy companies that are well funded. You can buy our stock for $0.08, $0.10, rather than buying at $0.30 like we were buying before. It takes courage to buy and bottom pick. But I think some of your readers/listeners are smart people, who can buy stocks right now.

I'd encourage your listeners to forget what's on the screen by fundamentals. When everything moves, the easy money will be gone. These stocks will go up 50% quickly, and they won't go up 50% more after that. The easy money is always made, when we first come off the bottom. With uranium, our fuel prices tend to go up in September, so we're only six to eight weeks away.

I think this is a great time for buying stocks. If you have some cash, pick up these cheap stocks, it's the perfect time for it. You're getting the same companies, lots of cash and instead of paying double the price, you can buy them here. I know it's hard to do that in a bear market, but that's the time you make the money.

Dr. Allen Alper:

It sounds excellent and that sounds like great advice for readers/investors. Is there anything else you'd like to say?

Dev Randhawa:

No. Thank you for your time and thank you, Ray. Hopefully it's been educational, and it'll hopefully help your investing audience, to learn a bit about us. But just about the uranium industry. It's not understood well and I'm glad, hopefully, we can move people along that educational journey.

Dr. Allen Alper:

I think you did, Dev. I think you did a fantastic job of telling our people about what’s happening in energy and the role that uranium is playing, in the move away from fossil fuel. I think that’s excellent!

Dev Randhawa:

Thank you.

Raymond Ashley:

Thanks a lot, Allen.

Dr. Allen Alper:

I enjoyed talking with you and Ray. Have a great day. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.fission3corp.com/

Dev Randhawa, CEO

Investor Relations

Ph: 778-484-8030

TF: 844-484-8030

ir@fission3corp.com

|

|