Peter Espig, President, & CEO, Nicola Mining Inc. (TSX.V: NIM, FSE: HLI) Discusses Owning Three Diversified Solid Core Assets in Southern British Columbia; Exploring for Copper, Gold, and Silver, and Generating Cash

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 8/2/2022

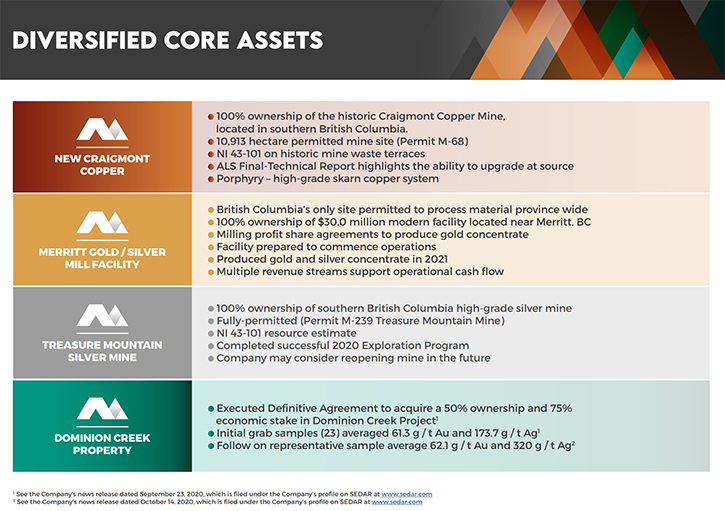

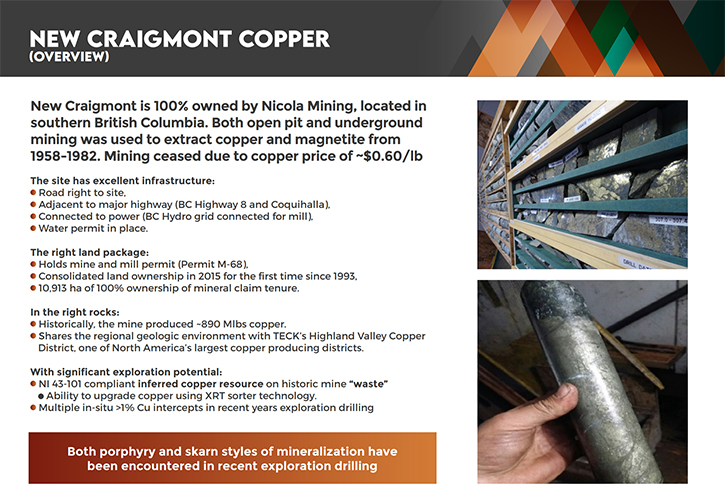

We spoke with Peter Espig, President, and CEO of Nicola Mining Inc. (TSX.V: NIM, FSE: HLI), a junior mining company, with three 100% owned, diversified core assets, all located together, in southern British Columbia. The Company's New Craigmont Copper Project is a high-grade, skarn copper, adjacent to Highland Valley Copper, Canada’s largest copper mine. The property contains the historic Craigmont Copper Mine, a 10,913 hectare, which includes mine permit M-68, and a NI 43-101 resource estimate, on historic mine-waste terraces. The permitted, Treasure Mountain Silver Mine, with a NI 43-101 resource estimate, is Nicola's second asset. The third asset is the Merritt Gold/Silver Mill and tailings facility, British Columbia’s only site that is permitted to process material Province-wide. Nicola Mining has Mining and Milling Profit Share Agreements in place, with high-grade gold projects. The facility recommenced gold and silver production in 2021.

Nicola Mining Inc.

Dr. Allen Alper:

This is Dr. Allen Alper, Editor-in-Chief of Metals News, talking with Peter Espig, President and CEO of Nicola Mining. Peter, could you give our readers/investors an overview of your Company and what differentiates it from others? Tell us about your exploration and other activities, in British Columbia, and talk about your core assets.

Peter Espig:

I think what really distinguishes us is that we are a junior mining company that has three very solid and unique assets. We also have operational cash flow that makes us a cash generator, versus a cash burner. Most junior mining companies focus solely on flow through, to fund exploration, raising some hard capital to support their operations. However, without raising the next round, these companies run into distress. We're in a very stable position, because we do have the three assets that have operation upside. But, at the same time, we have a very solid base that gives the Company operating cash flow, to keep the lights on.

Dr. Allen Alper:

That's excellent! It's a great position to be in, very few juniors are in that position.

Peter Espig:

Correct.

Dr. Allen Alper:

Could you tell me more about your core assets?

Peter Espig:

The Company has three core assets and I'm going to go over each asset separately and explain how they fit into the puzzle. Before I do that, though, I will make a point in that the assets together all have synergies. Several junior mining companies, they'll have a gold asset, and they'll have a silver asset, but they'll be in separate jurisdictions. All our assets are located in the vicinity, close enough to leverage one of our key assets, which is our fully permanent mill.

We're not a company that looks at doing acquisitions or expansion, into South America or into Quebec or Ontario. We're really B.C. focused, because that's where we're based. We understand it, and that's where the assets, that are synergistic to one another, are able to leverage one another.

The first asset I'll talk about is New Craigmont Copper Project. Without getting into too much detail, on the fundamentals of copper, everybody has a viewpoint. Copper is a green metal, it's a metal that is going to be increasingly, in scarce demand, after 2023. We have what's called the new Craigmont Copper Project. When I say project, it has a fully permitted mine. The permit is mine permit M-68.

Having a great exploration project doesn't tell you anything about the net present value of that project, because until you get your permit, you don't have anything like valid extraction calculation ability, because it can take anywhere between 10 to 20 years and some projects never become permanent. Because we have a permit, and globally it takes approximately, right now, 13 or 14 years to get a permit, whether that's British Columbia or South America. This is a copper project that is fully permitted, with a mine, Permit M-68.

We have close to 11,000 hectares. It is the site of the historic Craigmont Mine, which is the highest-grade copper mine, in the history of North America, that's open and closed at an average copper grade of 1.3%. We are adjacent to Highland Valley Copper, which is the largest copper mine in Canada by far. What makes this project unique is that there was very little exploration done historically, because the mine closed in 1982, not because they ran out of copper. It closed because copper was, at that time, $0.60 a pound and it cost them $0.61 a pound to extract, so they were losing about a penny a pound.

Copper prices have increased, at a much greater rate than the cost of mining, because of new technologies and better equipment. Why does this asset exist? Because from 1982, up until 2015 November, there were several stakeholders in the historic Craigmont project. From 1982 to 1993, there was very little work done. From 1993 until 2014 their entire focus was extracting magnetite, from the historic tailings, so there was very little exploration done, because they were focused on the cash flow of the magnetite value and the copper on the historic Craigmont Mine is associated with magnetite, which is a secondary metal that has value.

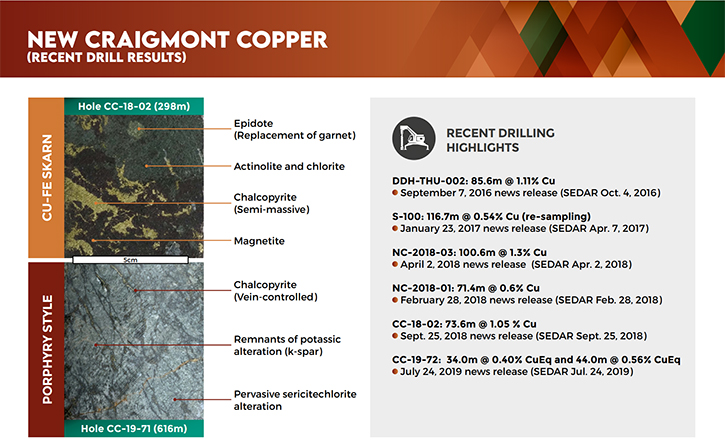

In 2015, we took over a site that had very little exploration done on it. Since we've taken over in 2016, that was really the first copper exploration that was done since the 1970s on the project. Since then, we've had several holes of over 70 meters of 1%. I think our highest-grade hole was 133 meters of one quarter, 1.5% copper. There are very good grades and there's very good upside, as far as exploring the potential of a porphyry on site.

We just completed a ZTEM survey and we're awaiting those results. We've received preliminary results and I can just say they're very intriguing and we're going to base an exploration program, specifically targeting a porphyry system. That porphyry system could be contained, in the Guichon Batholith, which is the location of Highland Valley upper peripheries, or the Nicola unit, which is where the historic mine of Craigmont is. If you think of real estate, we're kind of the corner lot of the Guichon Batholith and the Nicola Batholith. Our location is perfect for exploration. That's where the ongoing focus of the Craigmont property will move forward, from here.

Dr. Allen Alper:

That's excellent. What are your plans for 2022?

Peter Espig:

There are two things that are going to be very instrumental. One is receiving the ZTEM survey and then we're going to do a very systematic exploration plan, based on the ZTEM. We applied for MYAB, which is a multi-year permit, we submitted the application, in March of 2021, and we look forward to receiving a five-year multi-year exploration permit. That's very important, because it gives you carte blanche, over the entire project, because until we did the ZTEM survey, we didn't really know where the main targets are going to be. It's the combination of receiving our five-year permit and the results of the ZTEM survey, which we're going to be announcing very soon, once we receive them, that's going to dictate our exploration on the Craigmont Project.

Dr. Allen Alper:

That great, it sounds like 2022 will be an exciting time for your stakeholders and shareholders.

Peter Espig:

I am often asked, what's your budget? A unique advantage is a budget is based on how much money you raise, but when you have positive operational cash flow, your budget is based on your cash flow. I'm not saying that we're not going to raise any flow through. The point being is that the exploration is not contingent on how much you raise. Our exploration is going to be contingent on our success. We have the cash flow generation, to allow us to continue to expand our budget, based on the success of every hole.

Dr. Allen Alper:

That sounds excellent! Could you tell us a little bit more about your outlook for assets?

Peter Espig:

The next core assets that we have are two mine permits and a newer mill that was constructed in 2012, on land that we own freehold. We are one of the few mines, in the world, that can say, that their entire mill, the tailings facility, the operations all sit on land that they actually own freehold. Our site is an industrial permitted site, rather than your typical mine, where your permit facility sits, on top of crown land, and at some point, you're going to have to make that back, directly. Our obligation is to acclimate it back to industrial usage, which we are right now.

We have a gold and silver milling facility that is fully permitted. We paid $8 million for the land. There's been approximately $30 million invested into the mill and the permitting. We have a fully rubber lined, tailings facility. Because we are so unique, we are a permitted site, we received a permit from the BC Ministry of Mining that allows us to receive gold and silver mill feed from anywhere in the province of British Columbia, without having to apply for additional permitting. Essentially, we're a de facto airport to sites that would be akin to airplanes. We're the only site in British Columbia that is permitted to receive third party gold/silver mill feed Province wide.

The mill provides us cash flow to feed the exploration costs. Not only that, because the land is owned freehold and we're industrial, Management is very creative for the Company, because mining goes in cycles. A year ago, 2021 was a great year for mining companies to raise flowthrough and raise hard cash because the world was very robust, markets were booming. You’re seeing a very different market now. So, all this exploration that we're seeing in 2022 is actually based on cash flow that was raised in 2021. 2023 is going to look very different, for a lot of companies.

As a creative Management, we look at, okay, we have the mill, but how else can we get cash flow from our project? We are a partner for the Trans Mountain Expansion project and utilize the material, for our export reclamation requirements, to mitigate dust.

In November of 2021, B.C. had unprecedented flooding that saw a lot of infrastructure highways washed away in British Columbia. We entered into a partnership with Lower Nicola Site Services, which is an affiliated Company of the Lower Nicola Indian Band. We partnered with them, to help repair highways and infrastructure, to put First Nations back onto the highway grid, to repair Highway 8. We received a permit for riprap, the rock that is used to repair highways and riverbeds. We also have a gravel pit that is operating.

We have multiple revenue streams from our site. Right now, we're in talks, with two gold projects, to become a source of milling. The mill provides a viable business, it provides cash flow and we're very blessed to have that, as a fully permitted site. I cannot emphasize the importance of that. Getting a permit, for a milling facility, is very, very expensive. It takes a long time, over a decade. So, the fact that we have this, is a very important part of our three-asset portfolio.

The last asset that we have is Treasure Mountain, which is a permitted silver mine and exploration project. We refer to it as the Treasure Mountain Silver Project. It has mine permit M-239 and we have 51 minerals, ten years, over 2,850 acres. Some of the samples that we've gotten back, in our soil sampling, had 813 grams silver, half a gram gold, 90%. Zinc, 4.7%. Copper. We had another sample that came back over 7,000 grams, so the grades are .34 grams gold, 2,250 grams silver .43 percent copper, 5% lead and this is chip sampling across a vein. Another sample came back 8.79 grams gold, 7,270 grams silver point .8% copper at chip sampling of an exposed vein at surface.

Now, we don't know what's below it, but it's just very exciting. It's a very exciting exploration project that sits on Treasure Mountain, which is a fully permitted mine. From a blue-sky perspective, looking at these projects and understanding how long it takes to get these, a site permitted in British Columbia and how many years you take away from your CapEx investment, to your NP analysis, of actually being able to extract liquidity out of that, we're a great site and this is a great little Company.

Dr. Allen Alper:

Well, that sounds fantastic. Peter, could you tell our readers/investors a little bit about your background and your Team?

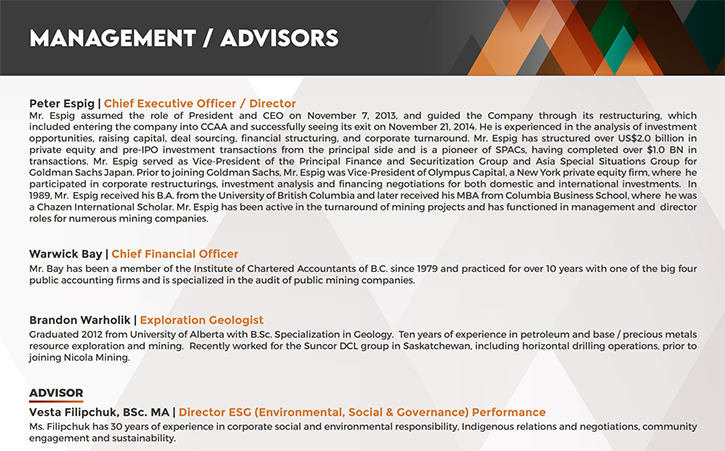

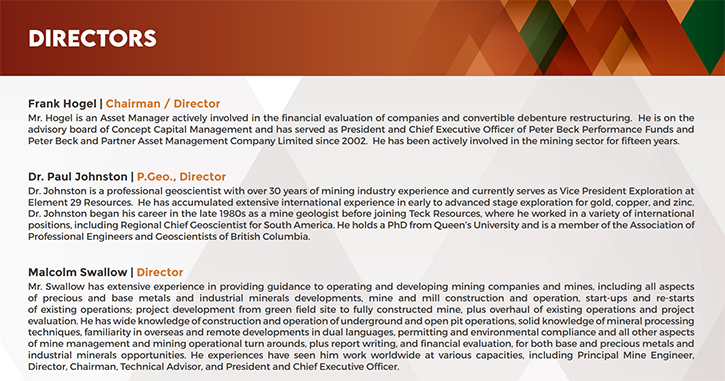

Peter Espig: Nicola Mining, to me, is a full circle of my life. In 1982, when I was a high school student, in Kamloops, British Columbia, I started working on the drilling rig. I was a driller for eight years, all the way through university. The very first day of summer, I was working, up north, 103 days straight as a diamond driller. I know what it's like to pick up wrenches. I know what it's like to get grease under your fingernails and diesel on your jeans. When the opportunity came up to take the helm, the Chairman, Frank Hogel, and I, agreed to work together.

Frank, who's also a mining investment expert, and I decided to move forward together. I was a Wall Street banker; I was a VP at Goldman Sachs. I worked in the Special Situations Group, worked for Olympus Capital Asia, you know, private equity. I was one of the pioneers of SPACs. I did just over $1,000,000,000 in SPAC transactions. I came from a Wall Street background and understood what it's like to fix companies, because that's what we focused on, fixing companies, and building platforms and seizing good opportunities, and Nicola was that opportunity, at the time it was called Huldra Silver.

I didn't expect it to be this difficult. Because when you start out in mining, you don't understand the complexities and how difficult it really is, but we understand that now. And, we have a CFO, who's also hands on. We have a Manager, at the Craigmont site, his name is Garrett Hopkins, he's a hands-on guy. One point that I want to emphasis is our commitment to ESG. Because, as a mining company, you cannot undervalue the importance of your commitment to environmental sustainability and governance.

We have a very solid Team that is led by Vesta Filipchuk, who hails from Teck Resources. She was one of their leaders of community engagement. We also have Vahnessa Espig, who leads our Company, internally on ESG and spends the bulk of her time working closely with First Nations and understanding what their concerns are. Having a good Team is not just focusing on the exploration side and the operations side, it's also focusing on the entire commitment to mining and to environment.

Dr. Allen Alper:

That sounds excellent. I'm glad to hear that you have that focus, it’s essential. So, that's great!

Peter Espig:

People sometimes fail to recognize the value in that. I say this to a lot of exploration companies that you want to show your commitment to the environment early on. Because if you don't commit early, you fail. We've really spent a lot of effort on the ESG side and the importance of our Company.

Dr. Allen Alper:

That's excellent! Peter, could you summarize and highlight for our readers/investors, the primary reasons they should consider investing in Nicola Mining?

Peter Espig:

I would say that if you look at a mining company, as an investment, and when I say mining company, a resource company. Because the majority of companies in the resource sector are not miners, they're exploration companies. You look at the risks versus rewards. As you head into a market that could be confined by capital, and you see capital becoming more and more conservative. The greatest way to mitigate your risk, because you can have a great exploration play that runs out of money and you're going to see the share price decline.

What Nicola does is it gives you the following upside. It gives you the upside of a silver play. It gives you an exceptional copper asset that would be amongst the best in North America. But you're throwing in the fact that they're both permitted and then you're throwing in the fact that we have operational cash flow. And that gives you the ability to feed the exploration, but it's a huge mitigation on the downside, where we're not forced to raise capital, at a depressed stock share price, to keep the lights on. That's very important, because a lot of companies are going to give you the upside, but we not only give you the upside, but we have the ability to protect you on the downside.

Dr. Allen Alper:

That's excellent! That's great! Is there anything else you'd like to add, Peter?

Peter Espig:

Thank you for interviewing us for Metals News. I enjoy following Metals News, and it's always nice talking with you.

Dr. Allen Alper:

Thank you. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://nicolamining.com/

Peter Espig

CEO & Director

Phone: (778) 385-1213

Email: info@nicolamining.com

|

|