Luke Norman, the new Chairman of U.S. Gold Corp. (NASDAQ: USAU) Discusses Gold Exploration and Development, with Near-Term Production Potential, at Their CK Gold Project in Wyoming

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 7/31/2022

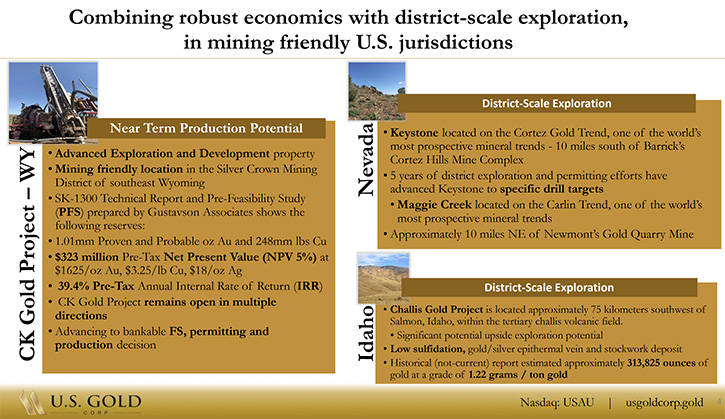

We spoke with Luke Norman, who is the new Chairman of the Board of Directors of U.S. Gold Corp. (NASDAQ: USAU). U.S. Gold Corp. is a U.S. focused, gold exploration and development Company, with near-term production potential, at their CK Gold Project, located in Southeast Wyoming that had a Preliminary Feasibility Study (PFS) completed on it. The Company is advancing CK Gold to bankable Feasibility Study, permitting and production decision. U.S Gold Corp also owns a portfolio of exploration projects, including Keystone and Maggie Creek properties, on the Cortez and Carlin Trends in Nevada, as well as the Challis Gold Project located in Idaho.

CK Gold Project

Dr. Allen Alper: Well, hi, Luke. Glad to hear your voice. I'm looking forward to interviewing you. I know you've been involved with U.S. Gold Corp. for a long time, and I want to congratulate you for being appointed Chairman of the Board.

Luke Norman: Thank you.

Dr. Allen Alper: Luke, I wonder if you could start off and talk a little bit about your association with U.S. Gold, your vision for U.S. Gold, and a little bit about your background and an overview of U.S. Gold.

Luke Norman: Wonderful! Yes. Thanks for taking the time to have this chat today. So, my background, late '90s, early 2000s, I started with a brokerage company in Vancouver, Canada where we specialized in precious minerals, junior mining companies, both exploration and development. And raised a lot of money for a lot of junior companies, during that time period, up until around 2005, when I started to recognize that there were a lot of juniors, listed here in Canada, all searching for different variations of precious metals, all over the world, but the execution was the issue. The Management Teams weren't really following through, with promises that they would make. So, I stepped out of the brokerage side of the business and decided, well, if I'm going to complain about it, I should maybe take the horse by the reins and get involved, in the actual management side, of these smaller companies.

So, I did get involved, as Director of a number of different Companies. Then in around 2007, a business partner and I decided to go after a very significant exploration asset in Nevada. It was called the Railroad Project. We started a Company, called Gold Standard Ventures together. It was a great success and still is. We made a significant discovery there, on the South Carlin Trend, the Carlin hosting some of the biggest gold deposits on the planet. So, I really switched gears, to focus my primary efforts on gold and silver, Nevada originally being my core focus. I've since stepped out of my core focus area. I also have some really interesting exploration assets, in Australia, with another Company, Leviathan Gold Corp. At U.S. Gold Corp, we got together in 2014 and put together the portfolio of assets that are now in US Gold Corp today. That was with co-founder, Ed Karr. Today those assets include our Copper Gold development project in Cheyenne WY. Keystone and Maggie Creek in Nevada, and Chalis in Idaho.

Dr. Allen Alper: And you've been a substantial investor in U.S. Gold.

Luke Norman: I have. Yes.

Dr. Allen Alper: U.S. Gold has a very substantial portfolio, and you have a project in Wyoming, moving along very, very rapidly and with great potential.

Luke Norman: Yeah. There's quite the story behind that, Allen. We had primarily focused on our exploration assets in Nevada, coming out of the gate. We went public on NASDAQ in June of 2017. And our core focus, at the time, was a project that's still in our portfolio, called Keystone, which is near Barrick Gold’s massive Cortez mine complex. That's Barrack’s main engine, these days, for production in Nevada. So, we were focusing on exploration there and Copper King was sitting in the wings, just waiting for us to put in a bit of time and effort and to better understand it. The market had looked at Copper King (or the CK Gold Project, as we now call it) and had incorrectly judged it as being a bit of a difficult asset because they looked at the grade as being not high, and usually high grade is king in the mining space.

They also didn't like the general location of it. It's close to a state park in Wyoming. So, it just sat in the background. I brought in a specialist to review it and take a look at it for us, because we thought maybe we'd even look to sell that asset, at the time, so we could continue to focus on our Nevada exploration assets. That specialist was a gentleman by the name of George Bee. George is now our President CEO, as you're aware of course, but George at the time was independent. He had just left Barrick Gold Corp, for his third tenure. He had built some of the biggest gold mines on the planet, during his time at Barrick.

So, I thought there's no one more qualified than George to take a look at the CK asset, in Wyoming and give us an opinion on whether it should be sold and, if so, to whom. He came back to me quite abruptly, after several weeks of due diligence, and said, "I think you're crazy to sell this asset. This asset should be your core focus. And if you want to turn the focus of the Company towards development stage projects like CK, I will come and join forces with you, and we'll get to work”. So, we were fortunate enough, in 2020, to have George Bee join us at the helm. And yes, as you said, now we have this fast, advancing, development asset in a great mining jurisdiction. And I'll get into some of those initial investor concerns about the project, which have since been quashed by Mr. Bee.

Dr. Allen Alper: Oh, that sounds excellent. Yes. Continue with your discussion of your assets, of your portfolio.

Luke Norman: Certainly. So, as I mentioned, we did adjust our focus. It was very difficult, at the time, to raise capital to just purely explore in Nevada. Barrick and Newmont had joined forces to become Nevada Gold Mines and in doing so, they removed a lot of competitive tension, out of Nevada gold mining. Discoveries were not reaching the heights that they were when there were the two largest gold mining companies on the planet, competing to acquire these discoveries. So, we brought in George Bee, and we started doing a lot more work over at the CK Gold Project. We had, what was called a pre-economic assessment, on that project that we had acquired, when we acquired the project.

It needed a much deeper dive into the geology and the engineering, and we needed to understand what was happening, more intimately, within the local community and whether this project could be advanced. So, George came in. He took the helm in 2020, and we began a pre-feasibility study. That's the very first step, of the final steps, to get to an economic decision on a project. And we completed that in December, of last year. What it showed us was a very robust deposit that sits exposed at surface – there is minimal overburden – which is just moving value-less rock. So, it's a shovel ready project, which is unique, to say the least. Most deposits these days are undercover, which means they're deeper, a hundred plus meters undercover, more often than not. And even then, they're still considered open pit targets.

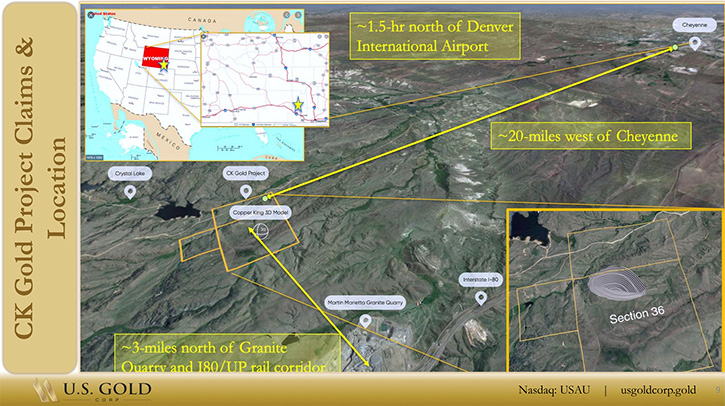

So, we have this at surface, very amenable grade, development asset. But the big question mark had been, can you develop an asset like this, when it sits so close to a state park? Well, this is not just an ordinary state park. The park also hosts two very large man-made lakes called Crystal Lake and Granite Lake, which are the water reservoir network for the township of Cheyenne nearby. And those lakes are also used as recreational areas with campground facilities and beaches etc. So now this sounds like an even more challenging kind of situation to get into.

But, as we did more work with state officials, and working with the local park board, et cetera, what we found out was that the reservoir network is under pressure. They need more capacity, more water storage, and their intention is to actually raise the dam heights at these lakes and flood out the recreational portions of this park. So, lo and behold, we go from being a mining operation that might be too close to a state park recreational area, to a mining operation that's probably going to save the recreational area.

And the reason I say that, and it's a pretty rash statement, is our copper gold deposit is hosted in the very granite that is used in these water storage lakes, that are currently in existence there. So, the open pit, left after mining it, would simply tie into the network and be additional capacity. It would actually supply more additional capacity than what is planned through the increase of dam height and flooding of the park. So now we have this great deposit and potentially a park-saver.

Dr. Allen Alper: Oh, that sounds excellent. That's really traffic.

Luke Norman: It is! We're full steam ahead. We're about to file our mining permits here, in the next six to eight weeks. The wonderful thing about Wyoming, in particular, where we are located (the deposit is located about 20 miles out of Cheyenne Wyoming) Just to give your readers/investors more dimension, on where that location is. If you fly into Denver International Airport and head north, you're about an hour-and-a-half drive on paved highways, and you'll be at the entrance to our deposit, to where we intend to build our mine. So geographically, it's very well located. But the state of Wyoming is unique, in the fact that, for the continuous 48 states, Wyoming is the only state that controls and mandates its own permitting. So, we are on state ground.

So, we do not require any involvement with the Bureau of Land Management, which is federal, the Forestry, which is federal, nor the Army Corps. of Engineers, which is federal and deal with U.S. waterways. So, all of our permit process is going to be carried out, in the township of Cheyenne, 20 miles away. We have a very good relationship, with the local government. Our filing process, in the next six to eight weeks, is mandated to take no longer than 12 months. So compared to what we were potentially going to look at, with a discovery in Nevada, that fast tracks by about five or six years over what happens on federal ground at present. So, it's a very unique location.

Dr. Allen Alper: That's fantastic! That's really a great benefit for the project. That's excellent!

Luke Norman: Yeah. Well, Wyoming, in general, has had a slew of challenges, in terms of business and mining in particular. It was a very big uranium mining area. Obviously, a lot of coal mining. The coal has been all but stopped. You have an abundance of unemployment there right now. So economically, an independent study was just done, by the University of Wyoming, on the economic impact Copper King will have on the local area and the positives are numerous, things that I would never even have thought of.

Dr. Allen Alper: That's excellent! Could you tell us a little bit about the highlights of the CK Gold Project 2021 preliminary feasibility study?

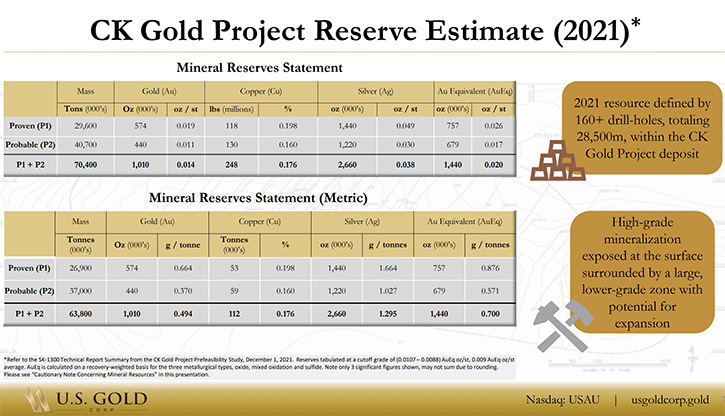

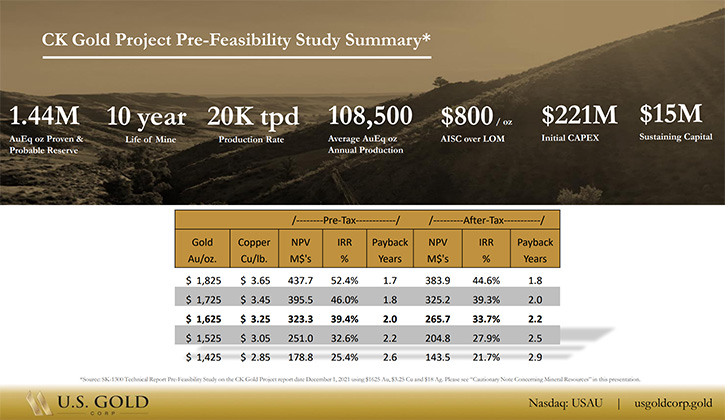

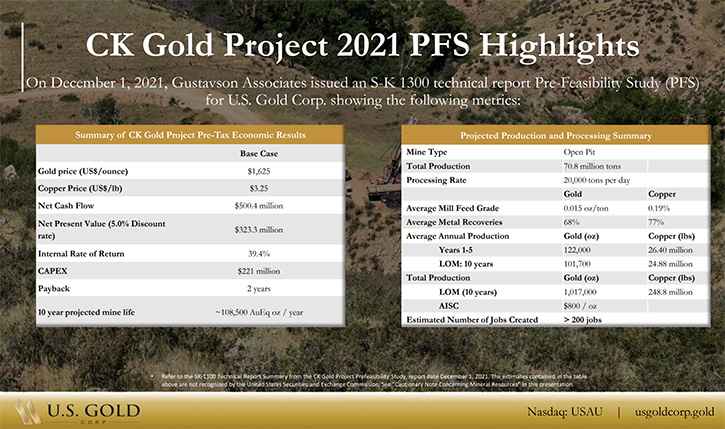

Luke Norman: Yes, certainly! In that feasibility study, we took some of the drilling that we had done previously, plus the drilling that we had inherited, when purchasing the project. And we did a more in-depth and robust resource analysis, on how much gold and copper there is, because it's key that we have copper in this project, I think because copper is obviously shining like gold, right now, from an investment perspective. We did a much deeper analysis, and we came out with, what's called, a reserve. A reserve is a far advanced inventory of the metals that are contained, within the area that we intend to mine. And we came up with about 1.44 million ounces of gold equivalents.

So that's a combination of the breakdown from the economic standpoint of this deposit, which is about 70% of the deposit economics, in gold ounces. So, about a million ounces of gold, 1.1 million ounces of gold. And the balance, 30% approximately is copper, which would work out to be about 280 million pounds of mined copper. That's no small number. We know that it's not just the Biden administration, but other administrations are keenly pursuing the electrification of the auto industry, and other industries, to try and reduce greenhouse gas emissions. So, 280 million pounds of U.S. born and bred copper, being mined by U.S. citizens and being fed directly into the U.S. market, would be a great feat for not just us, but for the local township of Cheyenne.

We're surrounded by these behemoth air turbines, which are generating electricity for that future of electrification. And those alone require so much copper of course. So, it's exciting to have that component of copper, associated with the gold. Some people might see gold as being somewhat frivolous. I certainly don't. I think gold was the true count and measure for value and worth for over 5,000 years, up until about 50 odd years ago, when it was decided that fiat currencies would change all of that. And now we've seen obviously the resulting currency inflations and breakdowns in the monetary system. So having gold, associated with copper, in such a great location, great environment, and having all the positive economic impacts that it's going to have, locally and federally, I think just bodes nothing but great things for the future of this Company.

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors about your plans for your Wyoming projects, this year and going into next year?

Luke Norman: Certainly. The pre-feasibility study of it, didn't entirely answer your question. You asked me, what were its outcomes, but 1.44 million ounces of gold equivalent. That generates over a 108,000 ounces of gold equivalent production, on a per-annum basis. So, we are now in the last stages of turning this pre-feasibility into a bankable feasibility. And all that does is tighten some of the constraints. You get into a little bit more focused footprint for the mining operation and finalizing the economics of the build-out of that operation. And then filing that, with the permitting people in Cheyenne and letting them have their way through that.

But, the beauty of this deposit is the metallurgy, or the way that you recover the metals, from the rock that they're bound in, is a very, very simple and clean process. People hear mines, and especially open pit mines, and they jump to conclusions that you're going to be using extraction agents that are very dangerous to the surrounds and to people. That you're going to have these roasters and such, where you're going to have big stacks pumping out emissions all day. There's nothing like that, with this style of mine. Literally the rock comes to surface, it's crushed down to a certain size like a gritty sand. And it goes through a circuit, known as a flotation circuit, and you separate out a concentrate.

That concentrate is a dry concentrate of enriched gravels, containing high grades of gold and copper. And the balance of that is just stacked dry next to other waste rocks that are byproducts of the mining operation. And those waste rocks don't contain any nefarious byproducts that will leech out over time into the waterways. There's no cyanide leeching or any of that associated with it, arsenic, anything. It is very clean. And in fact, it's so clean that we are exploring, right now, the economic feasibility beyond our copper and gold mining operation, into selling our waste-rock as aggregate. When you mine, the style of mining, which is again an open pit. You have what's called a strip ratio. So, for every ton of ore that we extract from the ground, ore being rock that's containing high grade or mineralized material, there is a ton of rock that is not associated with the gold deposit – thus an ~1:1 strip ratio. That waste rock is the very rock that is being crushed about a mile-and-a-half away from us by a big materials company called Martin Marietta and being sold as aggregate into the Colorado basin at $18 a ton. So, we're going to have about 35 million tons of ore that we crush and extract copper and gold from. Our waste rock that will be sitting on surface is equivalent to free, because we extract it as part of mining operation.

It's also valuable rock and can be used and sold into the Wyoming and Colorado areas as concrete aggregate. So, it's a very unique deposit. And then, of course, you're left with a hole in the ground that would tie in nicely, very nicely, into the water reservoir network that capacity needs to be increased through the township of Cheyenne. So, a lot of positives there, and I think a lot of carbon credits that can be counted up over time and probably added as a net benefit to this project.

Dr. Allen Alper: That sounds excellent. Could you say a few words and give us an overview of your Nevada and Idaho exploration projects?

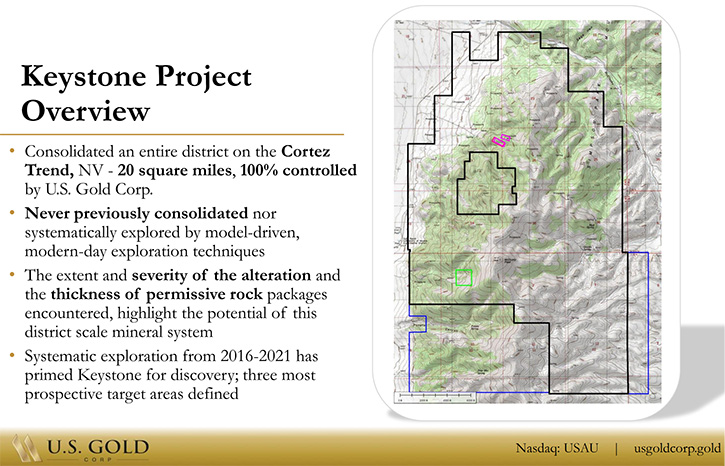

Luke Norman: Certainly. Because, deep in my heart, my true passion is exploration, pure exploration. And I very much like Nevada and Australia. In Nevada, we have two projects. We have Keystone, which is, about 10-mile away from the Cortez complex, which is Barrick's big, big mining operation in central Nevada. We're about 10 miles away from that. We own 20 square miles of a domal area that has a multi-intrusive, like Cortez, and the same rock packages as Cortez. And a lot of the key signatures that Cortez has, that imply that it could have some monster gold deposits within it. Right now, it's a bit more of an impatient market, so investors are not paying up, for exploration right now.

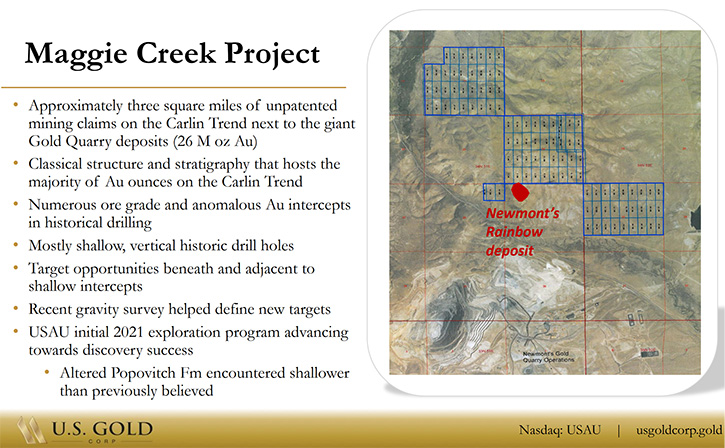

But when that tide turns, and it will turn, Keystone will become a focus for us again to explore because we believe there is opportunity for a multi-deposit, multimillion ounce, exploration discovery scenario there that would dwarf anything that we have in the portfolio right now. So, Keystone is something we keep very, very close to our chest, and it is something we want to work on in the future. Our other Nevada asset, which is again, very unique, is Maggie Creek. Maggie Creek actually sits right in the center of the Carlin trend, which is the originator of Barrett and Newmont's big production and their production styles in Nevada. There are still very big mining operations going on in this north central Carlin trend.

And Maggie Creek is right next to Nevada Gold Mines’ Gold Quarry, which is still being mined, to this day. We did a scout hole there, about a year-and-a-half ago, just to test what kind of rock we had. So, we talk about stratigraphy, you'll drill a straight hole, from surface all the way down to whatever depth you decide is termination depth, just to see what kind of rock packages you have and how much alteration has occurred, so whether those rocks are likely to be infused with gold. And we were shocked to find out that we encountered the key rock package that exists on that North Carlin area called Popovich, we encountered it at a relatively shallow depth around 1,400 feet, and it was heavily altered.

And it looked a lot like some of the rock that George Bee had seen, back when he was running mining operations, in that part of Nevada, for Barrick. So, we do believe that there is high probability of some very enriched high-grade gold mineralization, within Maggie Creek. And when I say a stone's throw from production, I mean, with a good arm you could probably throw a rock from our project, into current producing mines. So, they always say the best place to look for the next gold mine is in the shadow, of a head frame, or the shadow of an existing mine. And that's what Maggie Creek looks like.

So again, that's another project that we are keeping very close to our chest, but something we would love to exploit, at some point, in the near future. So, yeah, that Nevada portfolio, I think, is a world class junior exploration portfolio that would probably have us trading, with a market cap, very close to or similar to what we have presently, with CK in the mix. So, at some point, that value is going to be recognized. And if we go up to Idaho, of course, we have the gold project that we were lucky to inherit, when we took over Northern Panther. It has over 300,000 ounces of gold known presently, but we think there's a lot of upshot to that. There are a lot of other companies, working and exploring around us right now, looking for discoveries.

And we're hoping that we can either team up with one or two of them or just treat it as a standalone. But we have known gold mineralization there, as you know, with the resource that already exists. And we would absolutely like to further that, at some point in time, too. But right now, the real value in U.S. Gold Corp is the CK Gold Project or Copper King, however you want to call it. That's the Copper King Gold project. It's very undervalued from all of our perspective right now, relative to what we have. 1.4 million ounces of gold should be trading at a much higher valuation. So, our job right now is to help translate that asset into value in our stock. So that is by completing this bank feasibility, by getting our permits filed and of course, approved and showing that this mine is moving ahead.

Dr. Allen Alper: Oh, that sounds excellent!

Luke Norman: And that's this year!

Dr. Allen Alper: That's great. This year will be an extremely important year for your shareholders and stakeholders.

Luke Norman: Yes.

Dr. Allen Alper: Luke, could you highlight and summarize the primary reasons our readers/ investors should consider investing in U.S. Gold Corp?

Luke Norman: Yes. We are acutely sensitive to the price of gold and the upside on the price of gold. So, the pre-feasibility study that we did, came out with very positive economics. It has an all-in sustaining cost (this means that the dollar cost for us to produce an ounce of gold from our pre-feasibility) of about $800 an ounce. Gold right now is trading, as you know, up in the $1,800 an ounce range. We did all the economics on this project at around $1,625 gold, and about $3.25 copper. So, with the price of gold up here already, our net present value has increased dramatically. So relative to our net present value, versus our current market capitalization, we're trading at about 0.15 net value.

Our peer group traditionally traded about 0.4 to 0.6 of net value. And at $1,825 gold and $3.65 copper, this project has an almost $400 million net present value. So, at 0.4, that's $160 million. At 0.6, that's $240 million. Where this project should be reflected, in terms of just our market cap right now. Our market capitalization has been under pressure, as the entire space has been, but I think none more dramatically than us. And I think it's just purely because we trade primarily on a tech exchange, on the NASDAQ, but we are trading at all-time lows. We are trading below any cost base and any stop that's out there in existence from an investor standpoint or our private placements.

Our last private placement was done at $8 and higher. And we're down floating in the late fours right now. I think it's an amazing opportunity for investors to want to purchase into our company right now. That gap between our current valuation and where we should be trading, relative to our peers, as that starts to increase and get closer to where it should be, there's a lot of value to be created.

Dr. Allen Alper: Well, those sound like extremely compelling reasons for our readers and investors to consider investing in U.S. Gold Corp, an excellent opportunity for our readers and investors.

Luke Norman: We believe so. I should just touch on the fact that we're also unique. I know I use the word unique a lot, Al, but it is a unique company, again. One that's listed on NASDAQ, which we are going to probably diversify a bit and include a Toronto stock exchange, listing at some point, so that we're dual listed. So, we do have access to the analysts and the specialists out of Canada, who are more familiar with this kind of mining opportunity. But we're also unique because we have such a very tight share structure. We have 8.3 million shares outstanding. And a lot of that stock still sits in holding, at the transfer agent, and about two million of those shares are post multiple rollbacks, from the history of U.S. Gold Corp, which previously was a tech company.

So those shares are in very small blocks, very tight structure and a little bit of positivity in buying and people, who believe in the long-term potential of this Company. It's not going to take a lot of attention and a lot of movement for this Company to really turn around and start to reflect its true value or true potential value. And we have a strong cash position. We sit on about close to nine million in cash, and we only have about a 40 million market cap. So, a $30 million enterprise value. We're very cheap.

Dr. Allen Alper: That does sound like a great opportunity for our investors. And I'm impressed with how you have escaped dilution of your stock.

Luke Norman: That's key to us. We're all shareholders and that's the key. Management, insiders, we're 20% of the Company and we don't want to become 10% of the Company. We want to remain 20%. The only way we do that is maximize the use of our dollars in hand and create as much value as we can.

Dr. Allen Alper: Well, it's great to see that Management and the Board has confidence. That's excellent! We’ll publish your press releases as they

come out, so our readers/investors can follow your progress.

https://www.usgoldcorp.gold/

U.S. Gold Corp.

Investor Relations:

+1 800 557 4550

ir@usgoldcorp.gold

|

|