Gary O’Connor, President & CEO, Moneta Gold Inc. (TSX: ME, OTCQX: MEAUF, XETRA: MOP) Interviewed: Advancing its Timmins Tower Gold Project, 11.8 Moz, One of the Largest Undeveloped Gold Projects, in North America.

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 7/31/2022

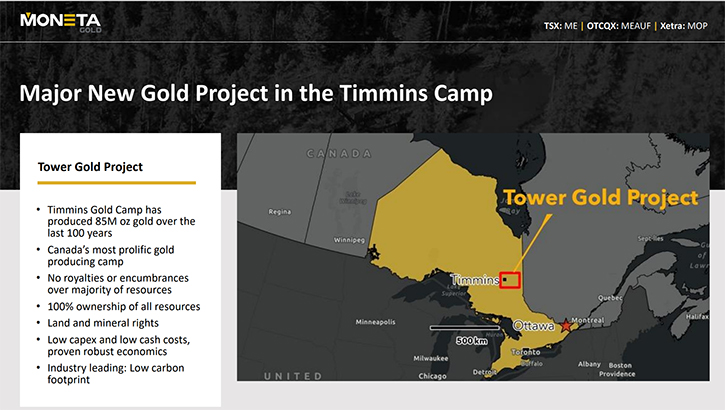

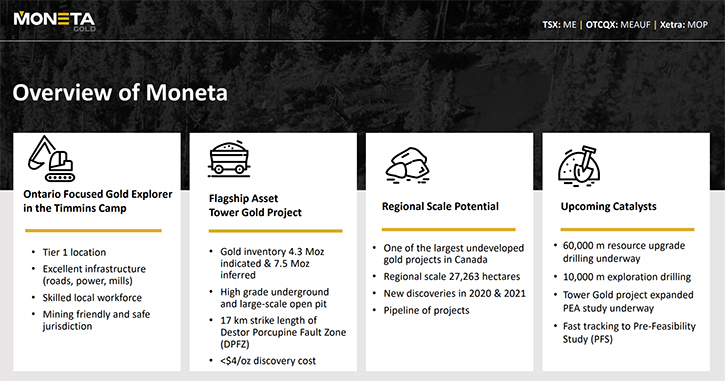

We spoke with, Gary O’Connor, President, and CEO of Moneta Gold Inc. (TSX: ME, OTCQX: MEAUF, XETRA: MOP), a Canadian-based gold exploration company, focused on advancing its 100% wholly owned, Tower Gold project, which currently hosts a gold mineral resource estimate of 4.3 Moz indicated and 7.5 Moz inferred. It is one of the largest undeveloped gold projects, in North America. Moneta Gold's 2022 drill program is primarily designed to infill and upgrade the resource categories, of the mineral resources. An updated PEA study, encompassing the entire Tower Gold project, is planned to be completed in the third quarter of 2022.

Moneta Gold Inc.

Dr. Allen Alper:

This is Dr. Allen Alper, Editor-in-Chief of Metals News, talking with, Gary O’Connor, President and CEO of Moneta Gold. Gary, the last time we talked was in March of 2021. Since that time, your Company has made great advances expanding your resources, and growing the Company. Could you give our readers/investors an overview and update of what’s going on with Moneta Gold?

Gary O’Connor:

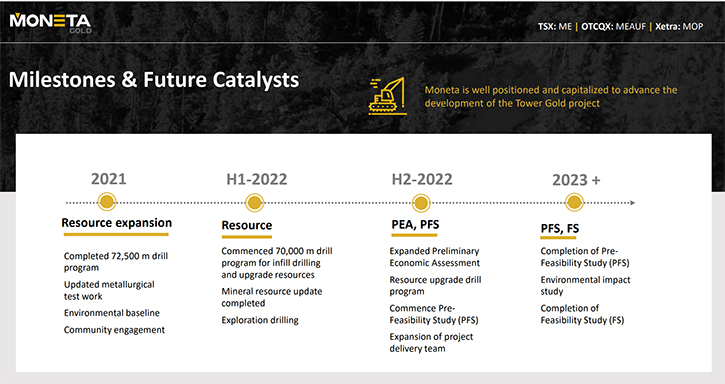

Thank you for the opportunity to speak today and present Moneta Gold again. It's been a very productive and busy year for us. We completed the acquisition of the Garrison project in February of last year and since then, we've conducted a 72,500-metre drill program. Upon completing the drilling last year, we remodeled the resource, and in May of this year, we announced the mineral resource estimate update. The updated resource contains 4.3 Moz indicated and 7.5 Moz inferred, consisting of both large-scale open pit and bulk tonnage underground mining resources. We are now embarking on a Preliminary Economic Assessment study (“PEA”), which will be completed by the end of August/early September. This will provide guidance to the market about the economics of the project and the potential size, scope, and production profile of the combined Tower Gold project.

Dr. Allen Alper:

Well, it's a fantastic project and located in one of the greatest gold mining areas in the world, Timmins, Ontario. So that's excellent! Could you tell us more about the project, more details, and your plans for 2022?

Gary O’Connor:

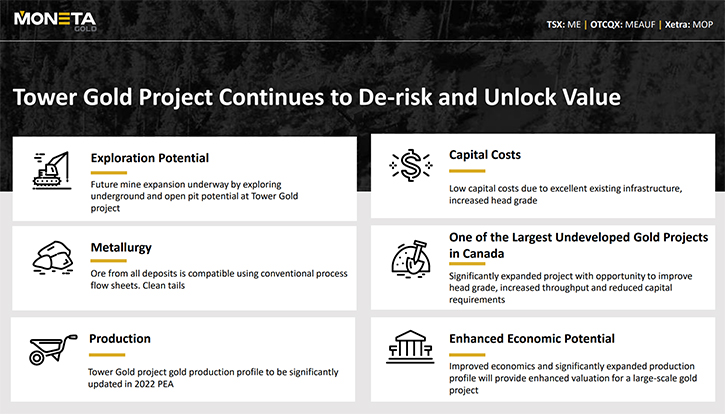

It's located immediately adjacent to Highway 101, in the Timmins Camp, which is Canada's most prolific gold mining camp, where over 85 million ounces have been produced, historically. We're in the process of putting together more than just a gold resource, it’s a new gold camp, on its own. The Tower Gold project is in a great jurisdiction in Ontario, which is very safe and has no known issues with permitting.

We are currently in the process of completing a PEA, on the updated resource. We’ll have that out, in late August, early September. That will provide the production profile, optimum throughput, as well as a valuation of the project. We have already commenced our pre-feasibility study (“PFS”) drilling, which is currently underway as well. We released excellent results last week that showed good continuity, good widths, good grade, from the Westaway deposit, one of our core underground mining centers.

We have results due to be released from our South West deposit, which is the other core underground mining center. Then, over the course of the year, we'll have other infill drilling from other areas within the Tower Gold project. We have some pre-feasibility studies that have already commenced. As soon as we complete the PEA, we'll move into what will be the pre-feasibility study. In September/October we will commence the main studies, however, we have already commenced the drill program.

The current drill program is comprised of 70,000 metres. We have completed 50,000 metres of this program and our plan is to release the results of this drilling, over the coming months. A new mineral resource upgrade will be required for the pre-feasibility study.

Dr. Allen Alper:

That's fantastic. This is a great time for your shareholders and stakeholders.

Gary O’Connor:

The soon to be released PEA is going to be a major step forward for Moneta Gold and will be another major milestone in the Company's history. Once we complete this PEA, we will roll into the pre-feasibility study, as we de-risk the project and upgrade the resources. We have demonstrated excellent potential to do that, with our results today and we will have more results to come. We’ll continue to complete the infill drilling, plus we also announced additional exploration drilling about a month ago. These results clearly demonstrated that we do have a lot of potential to continue to add resources to our large resource base.

Our focus, for this year, will be on completing first the PEA scoping study and then moving into the pre-feasibility. For the second half of next year, we're looking to have that pre-feasibility study conducted with an updated resource to reflect the infill drilling. We have our environmental baseline study ongoing, plus we have our community engagement program ongoing. There's a lot of other work continuing, behind the scenes, for long lead-time items, in regard to moving the project forward.

Dr. Allen Alper:

Well, that sounds excellent! You also strengthened your Management Team, maybe you could say a few words about that.

Gary O’Connor:

Yes, we recently announced the addition of a VP Projects, Gerry Rogers. He has extensive experience, internationally and in North America, developing and operating gold projects. Jason Dankowski joined, as VP Technical Services and Geology. They both have extensive experience in running, operating, conducting mine planning, resource estimation, and reserve estimation.

They have really jumped on board, for the PEA. They're going to be a core part of our Team for de-risking and moving the project forward. We now feel we have a good balanced Team to deliver the project, through the pre-feasibility and we will be looking to add other key people, as we move forward and as we require their skills, for the coming stages. We have our core Team and we're operating as a cohesive and effective unit that is continuing to deliver on our major objectives.

Dr. Allen Alper:

That sounds excellent! Could you update our readers/investors on your outstanding background, and some of the other members of your Team and Board?

Gary O’Connor:

We have a strong diverse Board of Directors with a broad range of skill sets and a lot of experience in bringing mines into production and operation. As mentioned, Gerry Rogers, our VP Projects has extensive experience operating, building, and bringing developing mines into production, both here in Canada, North America, and Australia. He was recently operating the Kinross Gold mines in Ghana.

Jason Dankowski comes to us from Appian, a private equity group. Prior to that, he was doing the mine planning and reserve planning for the Nevada Joint Venture of Barrick and Newmont. He has extensive experience, both in diamond and gold mines internationally and in North America. In addition, I have over 35 years of experience managing large exploration projects internationally, both gold and gold-copper projects, in South East Asia, Eastern Europe, and North America.

Vincent Deschamps is our Director of Sustainability, another key member of our Team, who's delivering the Environmental Impact Studies and the community engagement program. We have Adam Keshishian, who has joined as VP Corporate Development and Stephen McGinn, as our Director of Field Operations, all with good extensive experience, as we look ahead to deliver and de-risk this project.

Dr. Allen Alper:

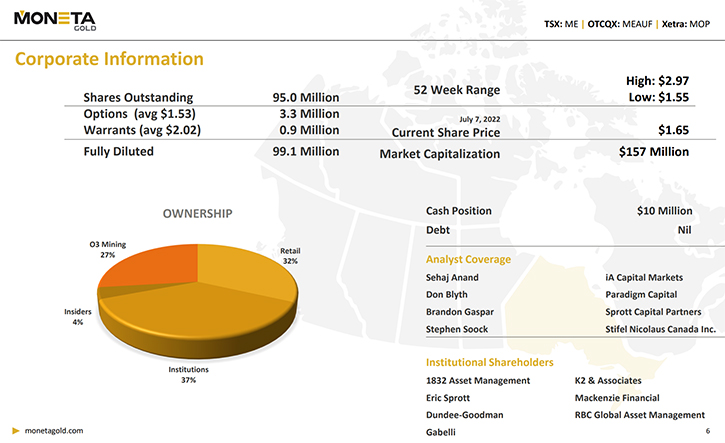

You definitely have an outstanding background, and your Team and Board are outstanding as well. Gary, could you tell us a little bit about your share and capital structure?

Gary O’Connor:

We have 95 million shares outstanding. We're currently trading at about $1.70, so we have a Canadian dollar market capitalization of around $160 million, with over $10 million in cash, as of the end of the first quarter. We've done the majority of our planned drilling already, for this year, but we'll be looking to move into pre-feasibility, as soon as we complete the PEA, over the course of this summer.

Dr. Allen Alper:

That’s excellent! You have some rather strong institutional and retail investors, too.

Gary O’Connor:

Most of the major gold funds, here in North America, are shareholders. We have Royal Bank of Canada, Scotia Bank, Dundee Goodman, K2, Eric Sprott, and Extract Capital. Out of the US, we have Libra Advisors, Gabelli, and US Global. We have some good backers also in regard to our retail investors and they've continued to support us, as we’ve developed the project and we've continued to outperform the gold index, over the last two to three years, and we still have a lot of value to deliver, for our shareholders, moving forward.

Dr. Allen Alper:

Well, you have an outstanding project, an outstanding area, a wonderful Team and you have a great opportunity to even expand further, with each resource that you have.

Gary O’Connor:

Yes, exactly. We did a roll back last year, so we have a good capital structure now. We upgraded to the OTCQX, to enable our US investors to invest in the Company, more readily. We're looking at expanding to a larger trading board, so we’re putting the required pieces in place, to enable a broader range of investors to invest. We’re looking to broaden our investor base and we have solid backing from our current shareholders. Even with the current tough market conditions, most of our investors are up on their investment and have enjoyed good returns. We’re looking to continue to deliver value to our investors.

Dr. Allen Alper:

That sounds excellent! Gary, could you summarize and highlight the primary reasons our readers/investors should consider investing in Moneta Gold?

Gary O’Connor: Moneta Gold has one of the largest undeveloped gold projects, in North America. We have a total resource of 11.8 Moz, comprised of 4.3 Moz indicated and 7.5 Moz inferred, both in a high-grade, underground and bulk tonnage open pit, in a great, safe jurisdiction and an excellent location. We’re currently trading at less than US$10 an ounce, so we see significant upside, at this stage, for a re-rating in valuation for our investors.

We'll be announcing the PEA study soon, to show the value of the project and we expect the study to show that the Company is substantially undervalued, which would point to additional re-rating potential for our investors, as we've been able to prove, from our performance, over the last two to three years. We want to continue our exploration progress as well as other major steps forward such as the completion of the PEA and the PFS, plus the de-risking of the project which contributes to our strong investment thesis. We see now as an excellent time for people to invest in the Company and receive a good return on their investment.

Dr. Allen Alper:

Those are very compelling reasons for our readers/investors to consider investing in Moneta Gold. You have an outstanding project, outstanding area and accomplished Team, with great potential to improve it. Also, you're firming up a PEA and moving on to feasibility. So, it sounds like this would be a great time for our readers/investors to consider investing.

Gary O’Connor:

I think now is a great opportunity to be investing, with this current dip in the valuations. We have very few options and warrants, overhanging the stock, so it's tightly held. We see it as a good investment, with rising gold prices and current gold prices. We’re significantly undervalued.

We are completing our key project deliverables and we continue to move the project and the Company forward. We had good results last week, from the infill drilling, with a great market response and we're looking to continue to deliver, on the infill drilling results, which are pending. So, thank you.

Dr. Allen Alper:

That sounds excellent. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.monetagold.com

Gary V. O'Connor, CEO

416-357-3319

goconnor@monetagold.com

Linda Armstrong, Investor Relations

647-456-9223

larmstrong@monetagold.com

|

|