Brendan Cummins, Executive Director, Black Canyon Ltd (ASX: BCA), Discusses Exploring and Developing manganese, in Northern Western Australia, for Growing Demand in EV Batteries

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 7/29/2022

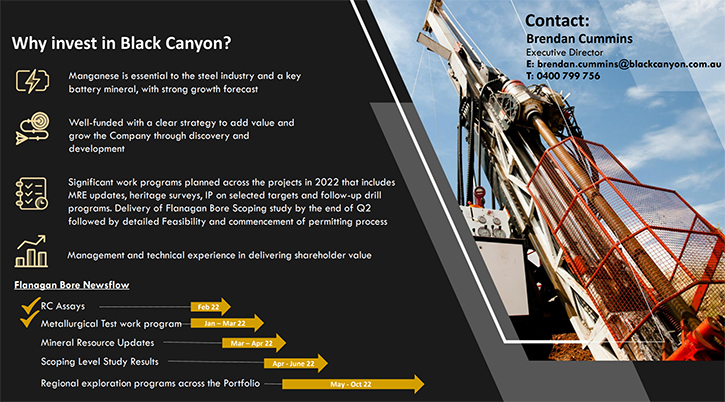

Brendan Cummins, Executive Director, Black Canyon Ltd Limited (ASX: BCA), an Australian manganese-dedicated explorer and potential developer, in Northeast Pilbara, of Western Australia. In the last 12 months, the Company has successfully delineated a very large tonnage manganese-enriched, shale-style-ore body, at their flagship Flanagan Bore project, in joint venture, with Carawine Resources Limited (ASX: CWX), located 2 hours’ drive NE of Newman. The project has potentially a 15-to-20-year mine life, with great resource expansion and additional discovery potential. It has just been announced that a large infill and extensional RC drill program was recently completed. Near-term plans include a scoping study and metallurgical test work. Manganese and copper continue to have attractive fundamentals, with growing utilization in the battery mineral sector, challenging supply conditions.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-In-Chief of Metals News, talking with Brendan Cummins, who is Executive Director of Black Canyon, Ltd. Brendan, could you give us an overview of your Company and what differentiates your Company from others?

Brendan Cummins: Black Canyon is an ASX-listed, manganese-dedicated explorer and potential developer. We listed the Company approximately 12 months ago and have since been very active exploring for manganese up in Northeast Pilbara of Western Australia.

We're a small Company, but we're also quite active. Being a geologist, I was quite keen to get out there and start drilling. We've been quite fortunate that, in one drill program, we've managed to delineate a large resource at Flanagan Bore. Now we're progressing scoping studies, to understand the economic importance of the project as well.

Dr. Allen Alper: Could you tell us a little bit more about the process that you have and give us a little more information?

Brendan Cummins: Certainly. Flanagan Bore is currently our flagship project. BCA have approximately two-and-a-half-thousand square kilometers, under tenure in the Northeast Pilbara. About 800 square kilometers of that is under a joint venture, with another ASX listed Company, called Carawine Resources and Flanagan Bore forms parts of that joint-venture package.

Once we listed BCA, on the ASX last year, Flanagan Bore was the first project I went to, so I could verify the widespread and outcropping manganese and relate these to historic RC drilling and satellite imagery. It was really quite useful to get into the field to locate those targets, because the manganese forms these extensive dark-gray areas of erosional scree.

It was good to see the outcrops and scale of the project at Flanagan Bore and walkover FB3, which is one of the prospects, on the Flanagan Bore project, which was quite exciting, from a resource potential, perspective. I could see there were just hundreds of square meters of manganese outcroppings at the surface, and the grades looked pretty good. So, I was very keen to get out there and drill the FB3 prospect, because it had never been drilled before.

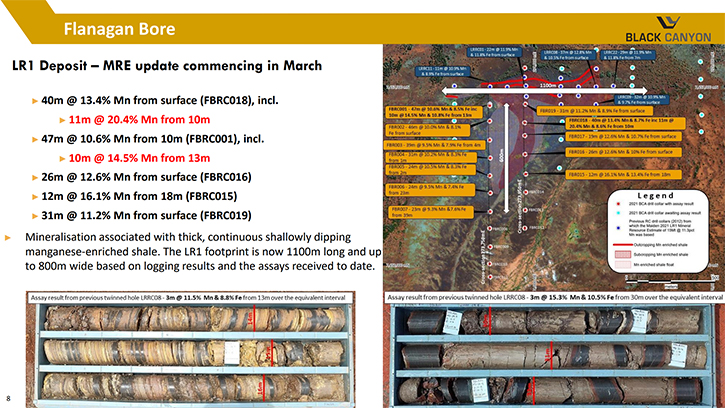

In one RC and diamond core program, completed in December 2021, we've managed to delineate a significant resource at FB3. Also, at the LR1 prospect, which already had some historic drill holes, we have been able to expand the mineralization footprint substantially and add further resources tonnes to the project.

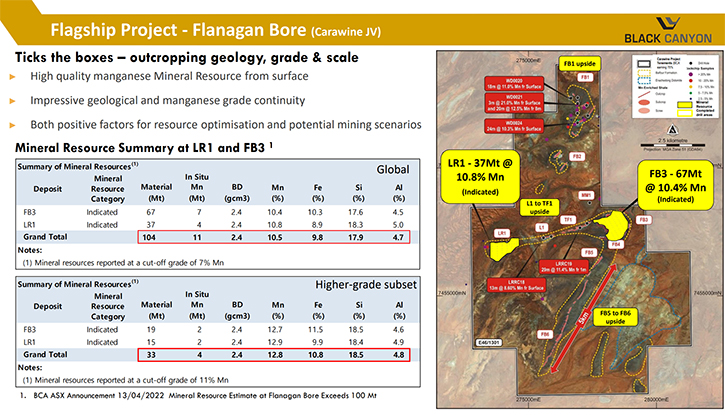

Based on the drilling, completed by the Company, we have defined a JORC total Mineral Resource Estimate of 104 million tons, at 10.5% manganese (Mn). Within that, there are some higher-grade sweet spots, which comprise 33 million tons at 12.8%. Which, through our scoping studies, I suspect will focus on those higher-grade zones, which would hopefully improve manganese recoveries, on the back end of the plant.

Potentially, feeding in some higher grades at the start or processing, gives you a better chance to get a higher-grade manganese product, at the back. On about 30 million tons of higher-grade resource, we are targeting a potential 15-to-20-year mine life, but we are yet to finalize the parameters of that scoping study.

And then, also on the Flanagan Bore project, there are several other targets on the tenement that could incrementally increase the tonnage, on that project, but really, we already have a 100 million tons, which is probably enough to focus on at the moment. The beauty, with exploring for a bulk commodity, like manganese, is that it's relatively cheap and quick to explore and delineate. Flanagan Bore is one of those cases, where we've completed about 6,500 meters and delineated a decent large-sized resource, which has been classified under JORC, as Indicated, which has a moderately high confidence level, associated with it.

We actually have mobilized an RC drill rig out again, which recently completed another 7500m of drilling. The drilling was primarily designed to infill drill the existing resources, to a 100 by 100 meter space, which should, hopefully, be sufficient to upgrade the mineral resources classification, from Indicated to Measured. We won't need to do any more resource definition drilling after that, but we will have completed additional core or bulk sampling programs for metallurgical test work.

Dr. Allen Alper: That sounds excellent! Could you tell our readers and investors a little bit about the market and the use of manganese, and why it's so important?

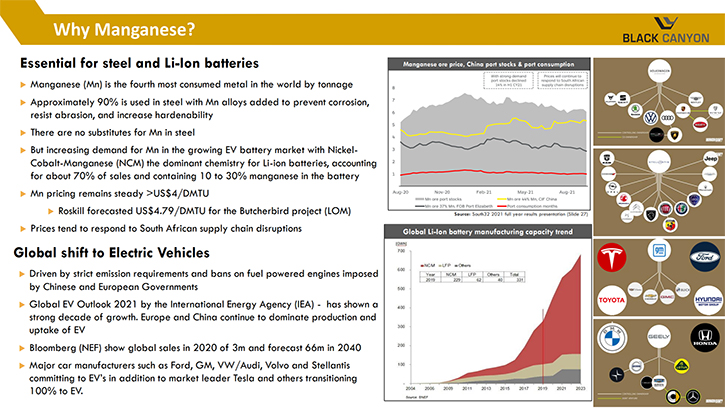

Brendan Cummins: Manganese is a little bit like the forgotten cousin of the battery sector, which is something I'll go into, in a bit more detail. But manganese is primarily used as an additive to the steel industry. The market is probably about 20 million tons, per annum, that's shipped globally. The products come from Australia, South Africa and some come from Europe as well.

Most of that's used in the steel industry because it increases the hardenability of the steel, prevents corrosion. Surprisingly, it's actually the fourth most consumed metal in the world, after iron ore, copper, and aluminum. It's definitely up there in terms of utilization. For every tonne of steel made, there is between 8 and 15kg of Mn,, within the final steel product.

With Li Ion batteries, your standard nickel-cobalt-manganese (NCM) battery is pretty much the technology that's been adopted by the likes of Tesla and Stellantis and a number of other electric-vehicle manufacturers. The nickel-cobalt-manganese cathode chemistry, within Li Ion batteries probably accounts for about 70% of the cathodes, within the EV Li Ion battery market. So this chemistry combination has been widely accepted, by the majority of the battery manufactures that are utilized within electric vehicles.

There are a number of other chemistries that are also entering into that cathode market, but they are for more specific utilizations, such as the lithium-iron-phosphate batteries, which are going to be used more for large-scale energy storage. Whereas the nickel-cobalt-manganese based batteries, have that higher energy density that allows vehicles to travel farther, minimizing charging requirements.

That's probably the trend that we'll see longer-term, as well. Tesla has been constantly reminding the market that they're really interested in the manganese-dominated batteries, purely because manganese is much cheaper than nickel and cobalt. When you look at our nickel-cobalt-manganese cathode, within Li Ion batteries, between 10% and 30% of that battery is manganese, which can equate to 10 to 30 kilos of actual precursor manganese sulfate that is utilized in the cathode of those batteries.

Manganese is the forgotten cousin, particularly in the EV battery sector. Everyone knows about lithium and nickel. and the difficulty in getting conflict free cobalt, but manganese is an equally important component of those batteries. Further research is being conducted to increase the content of manganese in the cathode, purely because it's cheaper and it will bring down the battery costs longer term.

So, in summary, manganese is used predominantly in steel manufacturing, but also growing significantly, as a key component of the NCM cathodes that are used in Li ion batteries. So, with the projects that the Company has in Western Australia, we can potentially produce a manganese concentrate that can feed into the steel market, but we're also looking to position ourselves as a potential supplier of manganese sulphate precursor material, used in NCM cathodes.

So, while it is early days for Black Canyon, we are recognizing that the downstream value-add of manganese requires the Company to look seriously at entering the battery sector as well, so we're working pretty hard on that, at the moment. Our entrance into the manganese sulphate market, might be through doing our own research and development, or we may work in collaboration, with government research departments, who have also completed significant study into that sector. BCA is also looking at collaborating, with other companies, who have already developed flow sheets to develop manganese sulfate, from a manganese ore.

Dr. Allen Alper: That sounds excellent. It sounds like there's a great need for manganese, and I think you've done an excellent job describing it and detailing it. That sounds like your role, your position to fit that market and location in Australia, is also a plus.

Brendan Cummins: Yes, particularly if you look at where most of the manganese sulfate is produced now, 90% of it is coming from China, which obviously makes sense, because they make most of the batteries that supply electric vehicle manufacturing. However, I think being able to provide an alternate and reliable source, to countries outside of China, is also a pretty significant benefit of developing manganese-sulfate projects.

I think it's really an exciting value proposition for Black Canyon. If you look at the bigger picture, we have the deposits at Flanagan Bore, where we can, potentially, start mining and producing manganese concentrate, for the steel market. Then there is an option to carve out a portion of manganese ore to produce manganese sulfate. The Company will then have a complete story, from mining through to processing manganese concentrates and also downstream production into manganese sulfate. That's really the ambition of the Company to position itself to get into both of those markets.

Dr. Allen Alper: That sounds excellent. Brendan, could you tell our readers and investors all about yourself, your Team, and your Board?

Brendan Cummins: Yes. I'm a geologist. I've been looking at rocks globally, probably for the last 25 years. I've been quite fortunate that I've traveled fairly widely, looking at different styles of mineralization around the globe.

Actually, I've done a bit of work up there in the East Coast of the US, as well, which was pretty interesting. Looking at some gold projects over there and also mineral sands, a few years ago. We drove through the Carolinas all the way through to Georgia and across to Tennessee, it was a really good trip – stunning country, actually.

My previous role, before I started with Black Canyon, was with an ASX listed Company, called Strandline Resources. I was with that Company about eight years and was in charge of exploration, primarily for mineral sands, in Tanzania. My Team was very successful, in discovering and drilling several mineral resources along the coast of Tanzania, which had been largely ignored, as having potential for significant deposits.

The Company also owned a significant mineral sands deposit, in Western Australia, the Coburn Mineral Sands Project. I was part of the key Management Team that helped to develop that project to a funding stage that required about AUD$350 million to build. Pleasingly the Coburn project is now well into construction, and they expect first production to start, within the next three to six months, on that project.

So, from my involvement with the Coburn Project, I have a wide understanding of the requirements of getting a project to market, through the feasibility studies, permitting and approvals. Whilst I am a geologist, I was quite heavily involved in the environmental permitting and government approvals, to get everything in line, so works could actually start on site and the project was fully permitted to commence operations.

There are obviously several processes, in order to get a mine permitted and approved, through the various government environmental agencies. So, I've been exposed to that process now and it should help me quite a lot in terms of progressing the Flanagan Bore project.

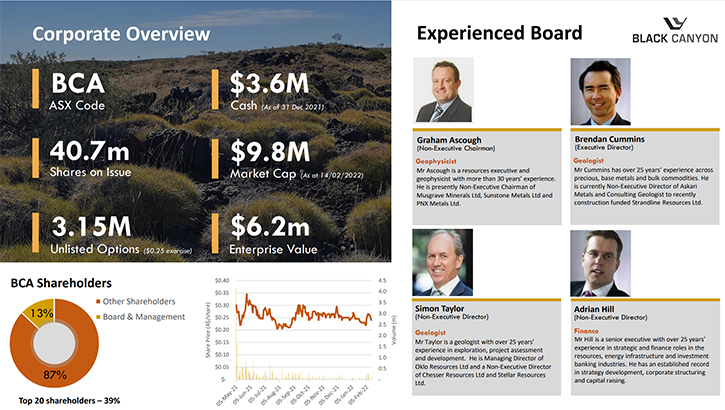

The rest of the Board, we've been working together now, at Black Canyon for the last several years. Our Chairman, Graham Ascough, is a geophysicist, with over 30 years of experience, in running exploration and development companies. Graham started out his career, with some of the majors, but he is also currently involved in a number of other ASX listed Companies, such as Musgrave Minerals, Sunstone Metals and PNX Metals. He is a Non-executive Chairman for Black Canyon, but he is very hands on, and provides significant advice and guidance to the Company.

Simon Taylor is a geologist. He's the Managing Director of Oklo Resources, which is a West African gold explorer. We do have quite a Technical Team, on our Board. Also, myself, as a geologist. That's probably appropriate for the stage of development of the Company. Adrian Hill is also on the Board. He has more of the corporate commercial background, so he provides sound corporate advice.

We are still in the exploration phase. Whilst we've actually been quite fortunate that the Flanagan Bore project has been very successful, it is really quite early days, as we have another two-and-a-half-thousand square kilometers of ground that we want to explore, so quite a bit of work to do.

In terms of Management, we run a pretty lean Team and I'm the Executive Director. I'm a geologist, so that allows me to look after the exploration side of things, as well. But we do have really experienced field crews, who can go and implement the field programs. We do try to do things fairly leanly. Ultimately, as a junior Company, you really have to be quite frugal, with your funds and you just want to make sure that most of it can go into the ground.

Dr. Allen Alper: Yes.

Brendan Cummins: The capital structure for Black Canyon is fairly tight. There are only 51.5 million shares on issue. We recently completed a capital raise, in late April, and raised AUD$3.2 million, which is enough in the bank, to certainly see us continue, with our planned exploration programs and progress the scoping-level feasibility studies and embark on some fairly significant metallurgical test work, later in the year.

Dr. Allen Alper: Wow, that sounds like you are very well positioned for carrying out your scoping survey and your exploration. You have a very experienced, knowledgeable Team, so that all sounds excellent. Brendan, could you tell our readers and investors the primary reasons they should consider investing in Black Canyon?

Brendan Cummins: Well, whenever I look at investment opportunities, I always look at the projects and the Team. In our case, we do have a very strong Technical Board and Management Team. The Board is well experienced, with strong networks, who understand the capital markets, which was why we raised additional funds in April.

It's very important to be able to put that combination together, of the Board's access to capital markets, but then also have the projects to back it up. We've been quite fortunate that we've managed to discover and delineate a large deposit at Flanagan Bore, in a short space of time, which could potentially be a long life mine. So, whilst we are excited about Flanagan Bore, we're not losing sight of the exploration potential, across our significant ground holdings. There is the potential to delineate smaller, but potentially higher-grade sources of manganese, so that is also a high priority for the Company, at the moment.

I think it really comes down to those key aspects. If investors are looking at Black Canyon, we have access to capital, an experienced Team, and highly prospective projects to explore and potentially develop. Black Canyon has a tight capital structure as well, so we're highly leveraged to success.

I think shareholders just want to recognize value creation. Black Canyon is adding value. We're spending money, but we're adding value and that's the whole strategy really, to continue adding value, through development and feasibility studies, which will continue over the next few years.

Dr. Allen Alper: That sounds excellent. You're also exploring a great resource, with a growing market, in a great location, so that's all excellent. Thanks.

Brendan Cummins: The Company has had fairly high-level discussions, with various parties, who are interested in either the manganese concentrate or manganese sulfate. I think they're starting to recognize that manganese has been left behind. It's a key component, of the steel industry, but with growing utilization, within the massive electric-vehicle battery manufacturing sector, as well.

I believe there's going to be a bit of a scramble, looking to consolidate manganese projects. Anything that's outside of China and projects that are located, within mining-friendly jurisdictions, such as Western Australia, which I think is going to rank fairly highly, amongst other global opportunities for manganese, at the moment, with the specter of such recent geopolitical uncertainty, influencing markets.

Dr. Allen Alper: That's excellent! Brendan, is there anything else you'd like to add?

Brendan Cummins: I would just encourage people to look at the manganese sector, for both steel demand and as a substantial and key component of the EV Li ion batteries. Look at which Companies are active in the manganese sector but understand that manganese hasn't been getting as much press, as the lithium sector, which is fairly overheated, at the moment. In the longer-term, EV sales are increasing, and the price of batteries will be influenced by the cost of the materials, used to make the batteries. Manganese is a lower cost input, and many companies are seeking cathode chemistries that use lower cost materials. So, in my view, future demand for manganese looks strong, as we move away from combustion engines to electric vehicles.

Dr. Allen Alper: That sounds excellent. It's important for our readers and investors to learn about manganese and the battery program to make wise investment decisions.

We’ll publish your press releases, as they come out, so our readers/investors can follow your progress.

https://blackcanyon.com.au/

Brendan Cummins

Executive Director

Telephone: +61 8 9426 0666

Email: brendan.cummins@blackcanyon.com.au

|

|