Thomas Ullrich, CEO and Director, Aston Bay Holdings Ltd. (TSXV: BAY, OTCQB: ATBHF) Discusses Exploration of Gold and Base Metals in Virginia

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 7/29/2022

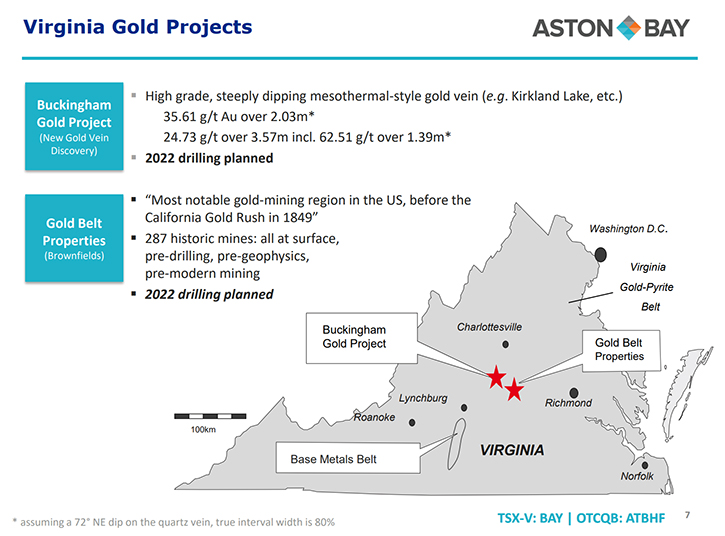

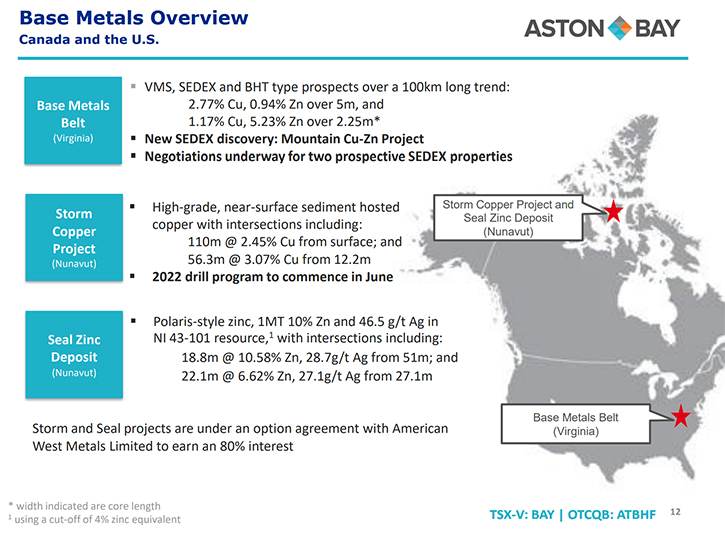

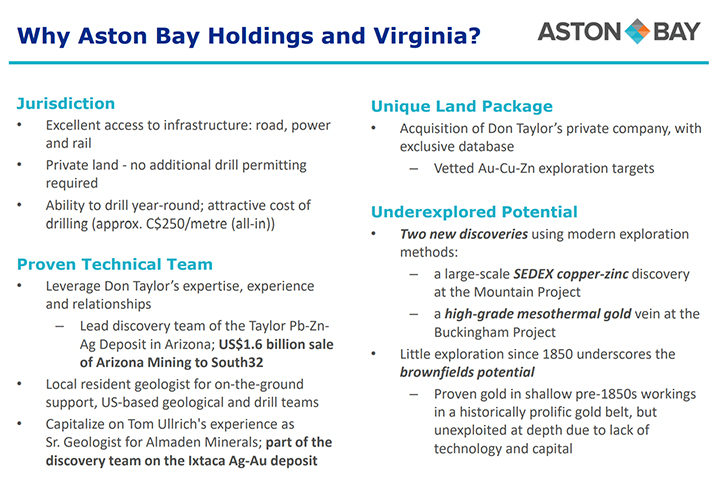

We spoke with Thomas Ullrich, who is CEO and Director of Aston Bay Holdings Ltd. (TSXV: BAY, OTCQB: ATBHF). Aston Bay is a US-focused exploration company, advancing base metals and gold assets in Virginia. These properties are located, within an underexplored gold-copper-zinc mineralized belt, which has historically hosted both gold and base metals deposits. Aston Bay has made two new discoveries, in the belt: SEDEX copper-zinc and mesothermal gold. Drilling is planned for summer 2022 on high-priority targets. The Company also owns a 100% interest in the high-grade Storm Copper Project and the Seal Zinc Deposit in Nunavut, recently optioned to American West Metals (ASX: AW1). American West and Aston Bay recently reported results of ore sorting test work that returned over 53% copper, for a direct shipping product, from the Storm Copper Project. Drilling is planned at Storm this summer.

Aston Bay Reports Over 53% Copper for Direct Shipping Product from Storm Copper Project, Nunavut

Dr. Allen Alper:

This is Dr. Allen Alper, Editor-in-Chief of Metals News, talking with Thomas Ullrich, who is CEO and Director of Aston Bay Holdings. Tom, could you give our readers/investors an overview of your Company and then update them on your different portfolio projects in Virginia?

Thomas Ullrich:

We are a US focused, exploration company, and the thrust of our Company is advancing base metal and gold assets in Virginia. Virginia is a bit of a forgotten area, as far as exploration is concerned, but there is some fantastic potential there. We have an underexplored copper-zinc belt, newly discovered and something we've just been working on. And an important historic gold belt that contributed a significant amount of gold to the US economy. Pre-1850s, it was one of the preeminent gold mining districts in the United States.

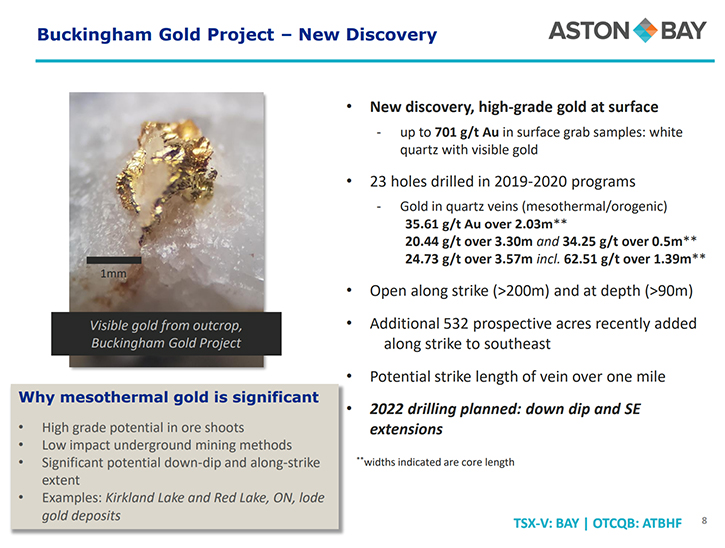

What we've been doing, over the past year or so, is advancing our Virginia projects on two fronts. First on the gold front, at the Buckingham Gold Vein, we have a discovery of an unusual style of gold mineralization for Virginia. Historically, gold has been extracted from what is called the Virginia Gold Pyrite Belt. The style of mineralization that we have just recently found in Virginia, though, is quite different. It is a mesothermal-style gold vein. For people who are unfamiliar with this style of vein, you can think about things such as Archean-style greenstone gold deposits, like at Red Lake or Kirkland Lake, or the lode gold deposits, in the western United States.

The mineralization in the belt typically comes along with a significant amount of pyrite, and that pyrite must be treated carefully, and at additional cost. Of course, pyrite can be dealt with using modern methods, but the mesothermal gold vein, we’ve discovered at Buckingham, contains very little pyrite or other sulfide minerals, so extraction could be cleaner, cheaper, and easier. As well, mesothermal veins have the potential for a significant, along strike and down dip, extension. You can think again of Red Lake and Kirkland Lake, where these veins continue for hundreds of meters to kilometers, and down to significant depths. We've discovered a zone, within the Buckingham Vein, with a very high grade: we are hitting intercepts of an ounce or greater, so there is a significant high-grade potential here, something that we're really looking forward to expanding.

And since we are working in the Pyrite Belt, we do have some gold properties that we would like to explore that are the more traditional style of Pyrite Belt mineralization that, as past-producing mines, already have demonstrated significant grade. We're looking forward to drilling on both styles of mineralization, at a couple of projects in Virginia, later this year.

In addition to gold, we are also actively exploring, on the base metals front. Over the past year, we've been drilling at our Mountain Project, in central Virginia. We're still waiting for the full assays to come back on this one, but we do have results from six of the ten holes we’ve drilled. Although the grades are not as high as we’d like, it is clearly a SEDEX-style of zinc mineralization, in all the drill holes, over a significant 1 by 0.4-mile area. SEDEX style of mineralization has never been recognized in central Virginia before and we think we may be on to a newly discovered base metals belt.

The significance of SEDEX mineralization is that this style of mineralization has the potential of being very large and potentially high-grade. If you're looking for an example, you can think of a Sullivan in B.C. or maybe some of the zinc plays in New Brunswick and, even closer to home on the East Coast of the US, you can think about the Balmat Mine, which is now called the Empire State Mine, in upper New York State.

Don Taylor, who's an advisor for us at Aston Bay and who has been directing our exploration, is the CEO of Titan Mining, the company that is running that mine. He's considers the style of mineralization that we are seeing at Mountain to be very similar to what he sees at the Empire State Mine. That mine has been running since the 1930s so we’re talking about something close to a 100 year mine there. That really gives you an idea of the potential. So those are the two fronts we’ve been working on in Virginia, and we have been fortunate to have two new discoveries already, with mesothermal gold and SEDEX zinc-copper.

In addition to these projects, we have other properties in Virginia that are in advanced stages of negotiation, or on which we have already clinched deals. We are looking forward to drilling on both the base metal and gold front throughout the rest of 2022.

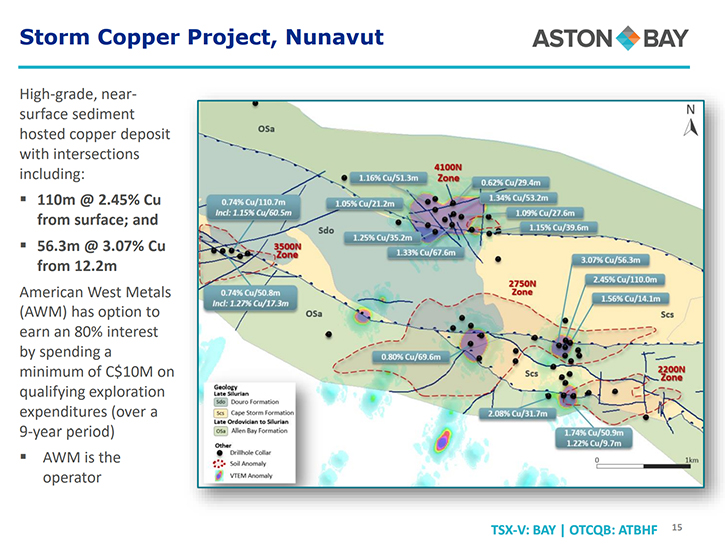

Shifting places here, let’s talk about our original asset, Storm Copper and Seal Zinc, located in Nunavut, far northern Canada. We have a new partner for those projects, American West Metals, and they have been actively advancing that project for us, with no expenditures on Aston Bay’s part.

Last summer, very shortly after signing the agreement with us, they completed an approximately $1 million ground EM program at Storm that delineated some exciting new targets and what we think are potential expansions to the known mineralization. For the readers, who may not know about Storm, we're talking about some very high grade, at surface copper: 110 meters of almost 2.5% copper, right from the surface, and 56 meters or so of over 3% copper, from the very near surface.

This is a very high-grade copper mineralization. In addition to the copper, we also have a high-grade zinc deposit, with Seal Zinc, containing about a million tons of over 10% zinc and almost two ounces of silver per tonne. We expect to be drilling that project this summer as well. That's a quick overview of what we want to do, both down in Virginia and with our partner up in Nunavut.

Dr. Allen Alper:

Well, that sounds excellent! Tom, could you tell us a little bit about yourself, and the industry recognized, technical Team?

Thomas Ullrich:

Sure. I've been in the business since the early 90s, in geoscience. I worked for major mining companies, universities, and junior exploration companies. I was fortunate enough to be on the discovery drill, with the Team at Almaden Minerals, on their Ixtaca silver deposit in Mexico. Prior to joining our Aston Bay, I was the senior geologist for North America for Antofagasta Minerals.

We've been very fortunate to have with us, the Team that originally put together the data and the projects for our Virginia exploration: Don Taylor, Lamont Leatherman, and Elaine Ellingham. The Virginia group of assets was put together by Don Taylor. He's the man who started up Arizona Mining that found the Taylor Zinc Deposit, which was purchased by South32 Mining, a few years ago, for about $1.6 billion. While running Arizona Mining, he also held another privately held Company, looking for copper, zinc, and gold assets on the East Coast and specifically Virginia.

We were lucky enough to come together, with Don Taylor and to bring his Company into Aston Bay, and extremely fortunate to have Don remain, with us, as an advisor to direct the exploration, down in Virginia. In addition to Don, we also have a couple Members of his Team, Lamont Leatherman, a very experienced geologist with well over 30 years of exploration on the East Coast. He’s a native Carolinian and an excellent geologist and someone with several discoveries to his name as well.

Elaine Ellingham, a former Director of Don’s company and a seasoned industry veteran, is a geologist as well, but also someone, with some significant market experience, both with the exchanges and as CEO and Management, in various mining companies.

Dr. Allen Alper:

You have an excellent Team. They have great knowledge, great experience, and a great record of success. Tom, could you tell us a little bit about your share and capital structure?

Thomas Ullrich:

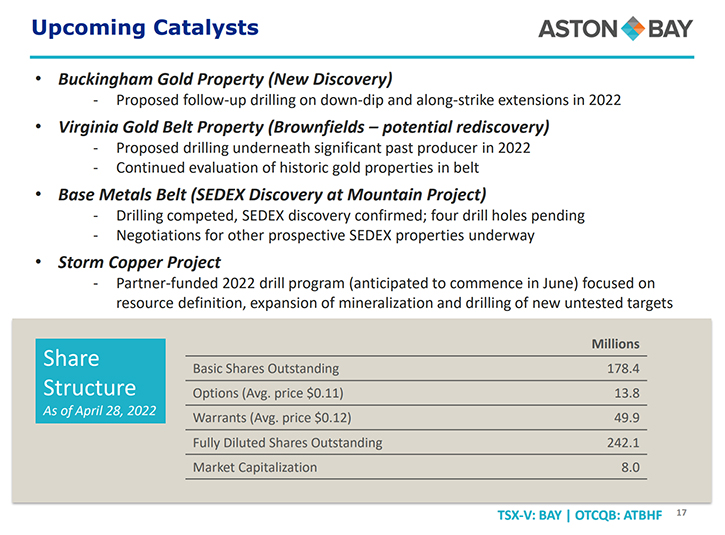

Right now, we have about 178 million shares out. Our share price is attractively priced right now, let's say at about 4 cents Canadian. We are traded; on both the TSX-V: BAY and we’re also on the OTCQB: ATBHF.

Dr. Allen Alper:

Could you tell us a little bit about the primary reasons our readers/investors should consider investing in Aston Bay Holdings?

Thomas Ullrich:

We are a micro-cap company that has a proven exploration Team, and we have a significant portfolio of discovery-level projects here. Our Buckingham Gold property - that's already in new discovery, brand new style and mineralization, not previously recognized in the area. We still have significant potential for down-dip and along-strike extensions there. We plan to further drill Buckingham this coming year.

Also on the gold front, we have our Brownfields properties, in Virginia. Again, Virginia is a proven gold district. There are past producers from the 1850s, so we know the gold is there - this is not just a geochemical anomaly here. Since the gold was mined pre-1850s, we have a good feeling that it is probably fairly high-grade, because the milling techniques and extractive techniques were fairly simple back then.

It is also important to remember that in the 1850s they just didn't have the mining methods that we have today. Deep mining was difficult, due to the rudimentary pumping technology that they had at the time. As a result, many of these past producers have significant untapped down-dip potential strike extent. They typically only extracted the mineralization down to a depth of something like 120 feet, that’s only 30 meters. They stopped mining because the pumps couldn’t keep up and they just couldn't go any deeper. There's a significant upside potential there for us, to just drill below those past producers and see what could still be underneath. So, on the gold front, Aston Bay offers excellent potential, for expanding on our new discovery at Buckingham, as well as potential discovery, down-dip, on some of those past producers, at the Brownfields properties.

On the base metal front, we have discovery potential in Virginia, in this underexplored base metals SEDEX belt. Mountain does not appear to be high grade, but it is large, and it is SEDEX, which bodes well for potential larger and high-grade zinc and copper at other prospects in the belt.

We have excellent base metal potential in Nunavut as well, where our partner is actively advancing our project on two fronts. First, they are expanding on the known mineralization, with the idea of potentially taking them to the mining stage as quickly as possible. Second, with drilling completely new targets for additional discovery.

Our partner conducted some ore sorting tests this past winter, demonstrating that by using simple ore sorting technology the mineralized rock can be upgraded to a potential direct ship product, containing almost 54% copper. For readers, who are not familiar with the typical copper concentrates, pure copper pyrite, which is your typical copper mineral, is about 32% copper. Sulfide concentrates, which is usually what is sold by mines to the smelter, however, contain other non-copper sulfides and so commonly contain 10% to 20% copper. You can see that our potential direct ship product, at almost 54% copper, could be a significant high-value product and something that would be very marketable.

Our partner, who is advancing our Storm Copper project, on the development front, is very exciting and very good news for the shareholders. But they are not just making the known mineralization bigger and demonstrating that we can take it to market - they're also drilling for discovery as well. We have a number of very exciting targets, from last summer’s EM geophysical and our partner is very eager to drill some of those as well.

For the shareholders, we are actively advancing both gold and base metals projects, both in Virginia and in Nunavut, at both the development level and the discovery level. This is a lot of activity and, for a micro-cap stock such as ours, any one of these potential catalysts could be very significant for Aston Bay and for the shareholders.

Dr. Allen Alper:

Sounds like very strong reasons for our readers/investors to consider investing in your Company, Tom. Is there anything else you'd like to add?

Thomas Ullrich:

I’d just like to reiterate that we are a discovery-level microcap Company. We have a significant portfolio of properties that could be on the cusp of discovery and we're very excited to be advancing these projects.

Dr. Allen Alper:

That sounds excellent! We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://astonbayholdings.com/

Thomas Ullrich, Chief Executive Officer

thomas.ullrich@astonbayholdings.com

416-456-3516

Salisha Ilyas, Investor Relations

salisha.ilyas@astonbayholdings.com

647-209-9200

|

|