Dave O'Brien, President and CEO, and Executive Director, Stuhini Exploration Ltd. (TSX-V: STU): Discusses Their World-Class Ruby Creek Molybdenum Resource, in British Colombia, a Critical Green Metal

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 7/14/2022

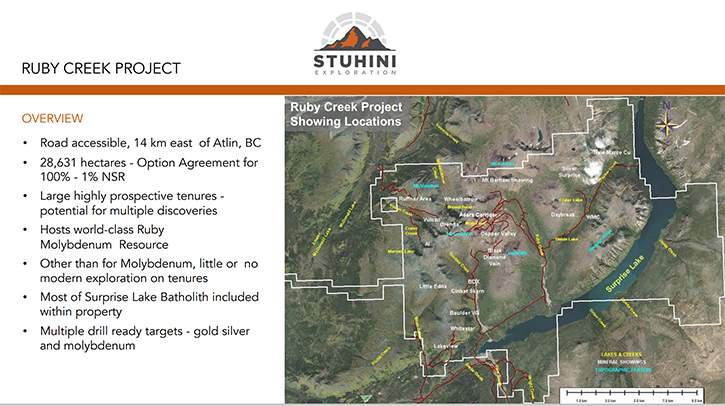

We spoke with Dave O'Brien, President and CEO, and Executive Director of Stuhini Exploration Ltd. (TSX-V: STU), a mineral exploration company, with a portfolio of exploration properties, in western Canada. The Company's flagship asset is Ruby Creek Molybdenum Property, located approximately 20 km East of Atlin, BC. The road accessible project hosts a world-class molybdenum resource, with multiple drill-ready targets, prospective for gold, silver, and molybdenum. Stuhini's pipeline of projects includes the Que Project, located approximately 70 km north of Johnson’s Crossing, in the Yukon, the South Thompson Project, located approximately 35 km northwest of Grand Rapids, Manitoba and the Big Ledge Property, located approximately 57 km south of Revelstoke, BC.

Stuhini Exploration Ltd.

Dr. Allen Alper: This is Dr. Allen Alper, Editor and Chief of Metals News, talking with Dave O'Brien, who's President and CEO, and Executive Director of Stuhini Exploration. Dave, could you give our readers/investors an overview of your Company, and what differentiates your Company from others? I think you have some exciting information about molybdenum, and recently going into nickel. So, could you tell us about your Company?

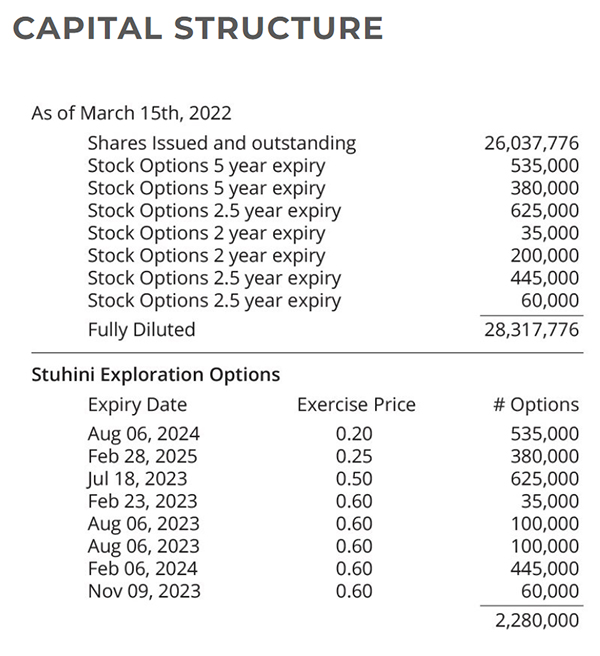

David O'Brien: Certainly. Thanks, Allen. Stuhini was founded in 2019. We did direct listing, on the TSX Venture Exchange. Thus far, after three years, we have 26.1 million shares outstanding, with no warrants. We have a 43% insider position, Company co-founder Barry Hanslit, Eric Sprott and I are the three key insiders. We optioned the Ruby Creek molybdenum deposit, also known as the Adanac molybdenum deposit, in the summer of 2019. We received exchange approval at the end of 2019 and accordingly, we have made three payments to the vendor.

We have two more payments to make before we own 100% of the property. We recently hired Steven Ristorcelli, of MDA in Nevada to conduct a mineral resource estimate, to take the old resource from historical to current. Accordingly, we recently published a pit-constrained resource of 433 million pounds of molybdenum.

Dr. Allen Alper: Well, that's fantastic. That's great. Could you tell our readers/investors a little bit more about your projects and your deposits and also your plans for 2022?

David O'Brien: Obviously our flagship asset is the molybdenum project. When we first optioned the molybdenum project, moly was $7-8 a US pound and we were basically incubating the asset. Right now, it's channeling in the $18-20 range. Moly's had a big move up. So, we've moved this from a call option on molybdenum to the forefront, which is obviously why we chose to do the resource update. Pure play moly deposits are rare as 85% of the world's molybdenum is currently a byproduct. Only 15% is pure play.

We have been in touch with the International Moly Association, in Europe and the CPM group. They're all stating that we need to move to pure play moly deposits. This is probably the top five in the world. I would argue it's one of the best out there. During the last cycle, the former operator, Adanac Molybdenum, had a market cap in excess of $250 million and an $800 million credit facility. The project advanced through bankable feasibility and permitting and into actual mine construction. The road upgrade alone cost $22 million.

Right now, we're just a $13 million Company, with a larger land position in the Atlin area, than the previous operator, in the heart of the Atlin gold camp. We've also added three more projects to our portfolio. We obtain all of our projects, either by staking them ourselves, or taking very inexpensive options. We don’t chase anything as we are value investors – we like to buy quality assets when they are inexpensive and out of favor.

Dr. Allen Alper: Well, that sounds excellent. Could you tell our readers/investors a little bit about yourself and your Team?

David O'Brien: I'm an unusual CEO. I've been investing in the mining sector for over 35 years, so I am an experienced and successful venture capitalist. I'm also a shareholders' rights activist. I run a Michael & Young Fly Shop, a the most successful, fly-fishing business in Canada. The co-founder of Stuhini, Barry Hanslit, runs Zinex Drilling, which is a very reputable drilling Company. He invented the A5 drill rig, which is the most popular, portable diamond rig, in the world.

So our background comes from solid businesses. I like to think that it's refreshing, and investors are starting to realize this. We have successful, seasoned business people running Stuhini and putting top-tier projects, into the Company and building a real Company, as opposed to so much of the promotion that goes on, in the junior mining sector. Everything we built in our lives has been best in class and this will be no different.

My educational background is in mathematics, and I've been running the fly-fishing business the last 30 years. We have assembled a brilliant in-house technical Team at Stuhini, and I believe that's our biggest asset. In business - You're only as good as your people. Ehsan Salmabadi is our VPX. Barry's wife, Janet Miller, is our Project Manager. Her father's Jack Miller, who founded Quadra Mining and developed Sierra Gorda.

We have several QPs on our staff, including Marco Van Wermekerken, Andrew Wilkins and Stew Jackson. We took the pick of the liter at UBC last summer, the best young geologists we could find - I had 16 different students and employees up on site in Atlin last season. We're very, very proud of our team and people don't realize what a talented team we have behind the scenes. They're a very experienced team as well. There you have it.

Dr. Allen Alper: Well, it sounds like you have a very strong, balanced team, an experienced team, so that's excellent. Could you tell our readers and investors a little bit about molybdenum, its uses and also, its growing possibility use for electric vehicles even?

David O'Brien: Well, very good, Allen. Yes, we're very intrigued by molybdenum. As I mentioned before, 85% of molybdenum comes from byproduct, whereby 15% come from pure play deposits, namely from Freeport McMoRan’s Climax and Henderson projects, in Colorado. According to the International Moly Institute and the CPM group, we need to develop these pure plays because the byproduct is waning. Not all copper deposits have byproduct molybdenum.

Traditional demand for molybdenum is in the steel, with 24% of demand coming from stainless steel and 39% from engineering steel. When you want to lighten steel, build bridge trusses and buildings, you have to add molybdenum to lighten it up and keep it strong. Even in Germany right now, they found by adding molybdenum to the steel for cars, they've lightened the weight of the cars by 25%, which is very important, going forward. So, your traditional demand of molybdenum being a steel alloy is also on the increase for a modern world.

What's more exciting that the World Bank actually singled out copper and molybdenum as being required in seven of nine green-energy initiatives, going forward. They singled out those two metals as perhaps the two most important metals for the green future. There's very promising battery technology with molybdenum. Some scientists have stated that by using moly graphene anodes, you might get four times the capacity of a traditional lithium battery.

Also, the windmills, the gearboxes are very high molybdenum concentrations. You want those gearboxes to last for 25 years. If you want to build quality durable steel, steel that is resistant against the elements and stays strong, you need the moly content. So, we're very excited by the new demand forming, in addition to the traditional demand.

Dr. Allen Alper: That sounds excellent! Dave, could you tell our readers and investors a little bit about your share and capital structure?

David O'Brien: Yeah, presently, after three years of listing, we have 26.1 million shares outstanding, with about 2.4 million options and no warrants. So we're pretty well around 28 and a half million fully diluted. All the finances we've conducted in the past have had no warrants attached to them. Presently, our stock is 43% insider held by myself, our Company co-founder, Barry Hanslit and Eric Sprott own about 40% of the Company. We also have about 30% of our shares held by high net worth investors, people who have known me for many, many years and backed me and know that I'm a true businessman, that I respect our shareholders.

I only work for $2,000 per month. My incentive obviously is the two million shares that I own. I've run private businesses in the past. The way to build a business is you put shareholders ahead of yourself and just ensure that you're a large shareholder. So we're very shareholder-friendly and have tremendous respect for our shareholders. We speak to them on a regular basis.

We bill very few meals or entertainment. Our shareholders don't want us doing that. They want the money we raise going into the ground and that's our modus operandi, that the funds we raise go into the ground and help develop the projects.

Dr. Allen Alper: Well, it's great to see that Management has skin in the game and will benefit just like other investors, and you keep your investors in mind, when you are developing and growing your Company. It's great to see that Eric Sprott, who's a very astute investor and knowledgeable in mining, is a key investor of your Company. So that's all excellent. Dave, could you tell our readers and investors the primary reasons they should consider investing in Stuhini Exploration?

David O'Brien: I believe, we are very undervalued, based on the molybdenum resource, we recently put out. We used MDA out of Nevada to do the resource estimate and They're very conservative. The pit-constrained resource has a value today in excess of $11 billion Canadian. Compare that to our market cap of $11-12 million, we're extremely undervalued. I believe we should be trading at 1% of just the pit-constrained resource, which provides tremendous upside. Please keep in mind that this resource is also road-accessible and has a BC Mines act permit still intact. I also believe investors should understand that we have a very large land position in the Atlin Camp. It's actually a gold camp. The Atlin Placer Camp is the most active placer gold camp in Canada. We've also found some spectacular high-grade surface silver showings and we have identified four high priority silver targets, within the tenures. Our Team has uncovered several silver samples over 1%, that’s over 10,000 grams per ton and up to 16,000 grams per ton – we are one of the best greenfield silver stories out there.

We also have a large high impact nickel project in Manitoba, a large Sedex zinc project, in Southern BC, and a project we really like, in the Yukon, that's never been optioned to a public company, called the Que Project. A key member of our Team is also Mark Lindsay, Sean Ryan’s former partner. Mark is brilliant at identifying new opportunities. He’s a prospector and he has been instrumental in helping us identify these other projects and new projects, as we go forward. Again, our whole concept is we are value investors and we acquire assets when they're inexpensive and out of favor and monetize them for our shareholders.

Dr. Allen Alper: Well, that sounds excellent. Is there anything else you'd like to add, Dave?

David O'Brien: Yeah, I'd like to add that pure play moly deposits are extremely rare. There are only three or four big ones, in the world, that we know of, that are of this size and stature Ours is also a climax style deposit, which means it provides very, very clean mining. I also want to remind investors that the project's already been through bankable feasibility. Therefore, when we go back to feasibility, a lot of the heavy lifting's been done. For example, the bulk sample has already been done, the confirmation drilling, the geo technical drilling, as well as the metallurgy – it’s all been done by the past operator. So, it won't be expensive to move this forward, and we can advance this forward fairly quickly.

Again, the molybdenum space was very active in 2003 to 2007, and it hasn't quite caught investors' attention this time around. But investors should dig deep, because from a supply/demand fundamental, it's a very intriguing space. This project of ours is also open in three directions and at depth. One of the holes, AD-417, bottomed out in 45 meters of 0.23% molybdenum, which is very, very high grade, right up there with Freeport's famous deposit. So, our deposit right now, as it sits, is only 200 meters deep. That is very, very shallow, which was why, again, it advanced the way it did during the last cycle.

So, I think that given the open nature of our project, what we have thus far might be just the tip of the iceberg. It's a very large, very impressive, possibly the best project in the world. I think you want to get into the space, before it gets investor attention, because once you read about it in the papers, it's too late. Again, we're very inexpensive, when you look at the quality of our asset.

Dr. Allen Alper: That sounds fantastic. Those are very compelling reasons for our readers and investors to consider investing in Stuhini. You have a great resource, in a fantastic area, and it's a resource, molybdenum, that's growing in demand. It's technically very important, both in electronics and also in strengthening steel and also in corrosion resistant steel. So that's very important. You have a great Team and great support, and I think the timing is, as you pointed out, correct. Anything else you'd like to add, Dave?

David O'Brien: I really appreciate your time, Al. If you need anything from me, let me know. I think we're just starting to get our name out now. We're just finally spending a few dollars on marketing and trying to tell our story. We'll be raising funds soon. I would encourage readers to really look into our Atlin project, because the molybdenum project still has a mine act permit intact, but the permitted portion represents about 2,500 hectares of our 28,500-hectare concession in Atlin.

So, one of our goals, going forward, and there's never any guarantee with this, but we would like to move towards a plan of arrangement and create a pure play moly company, and spin off all of our non-core assets, into a much more exciting sort of greenfields company, because there's quite a divergence between a very, very advanced project, as the moly project and the rest of our assets that are very compelling, but greenfields.

I also want to remind viewers that all of our projects are road accessible, and all have to have a very realistic chance of becoming a mine one day. We're not into promotion. Our website isn't full of reasons why you want to invest in the green energy sectors. Moly's almost as important as nickel, going forward. Also, with all the money being printed in the US, why you want to own gold and silver. Those are givens.

Our website can concentrate on what we actually have as a Company. We want to concentrate on the facts. We are currently trying to attract a senior partner and we're in talks with several parties, in that regard. Again, never any guarantees, but fingers crossed.

Dr. Allen Alper: Well, that's excellent! We’ll publish your press releases as they come out so our readers/investors

can follow your progress.

https://www.stuhini.com/

David O’Brien

President & Chief Executive Officer

Stuhini Exploration Ltd.

Email: dobrien@stuhini.com

Phone: (604) 835-4019

|

|