Alexander Scanlon, Managing Director and CEO, Barton Gold Holdings Ltd. (ASX: BGD) Discusses South Australia’s Emerging Gold Developer

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 7/8/2022

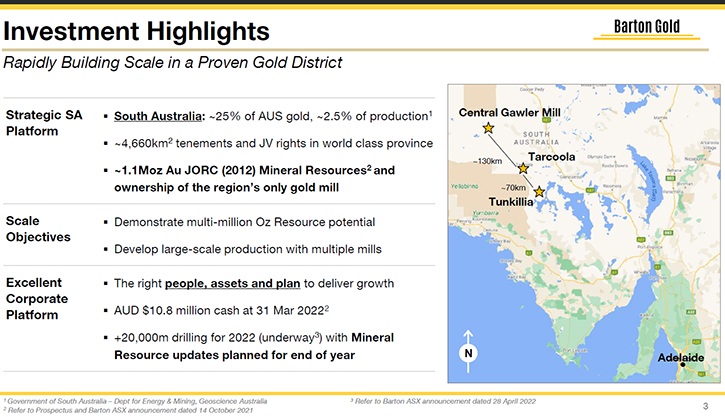

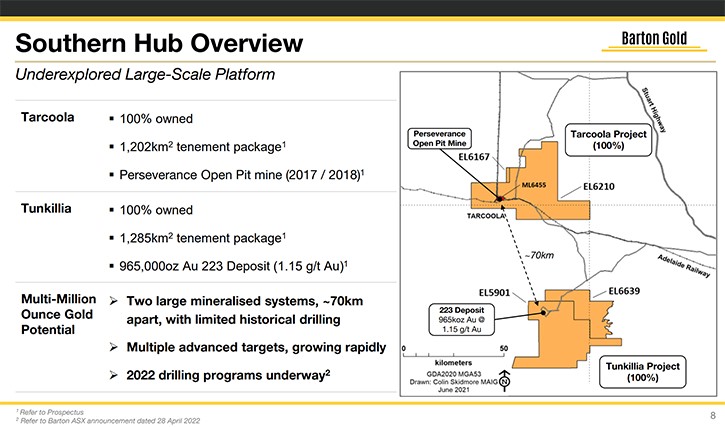

We spoke with Alexander Scanlon, Managing Director and CEO of Barton Gold Holdings Limited (ASX: BGD), an ASX-listed gold exploration company with a total attributable ~1.1Moz Au JORC (2012) Mineral Resources endowment (28.74Mt @ 1.2 g/t Au), a pipeline of advanced exploration projects and brownfield mines, and 100% ownership of the only regional gold mill in the Central Gawler Craton of South Australia. Barton is focused on exploration in two large-scale mineral Resources, at the Tarcoola Project and the Tunkillia Project, where the Company’s latest innovative technical work demonstrates significant opportunities, for major discoveries, with +20,000 metres drilling programs underway and ~6,400m recently completed and assay results pending.

Barton Gold Holdings Limited

Dr. Allen Alper: This is Dr. Allen Alper, Editor-and- Chief of Metals News, talking with Alexander Scanlon, who is Managing Director and CEO of Barton Gold. Alex, could you give our readers and investors an overview of your company, and tell us about the discoveries and exploration for gold that you're doing in South Australia?

Alexander Scanlon: Yes, thank you very much for having us. I'd love to. Barton Gold has been put together as a company to function as a unique, and uniquely focused, pure play gold company in South Australia.

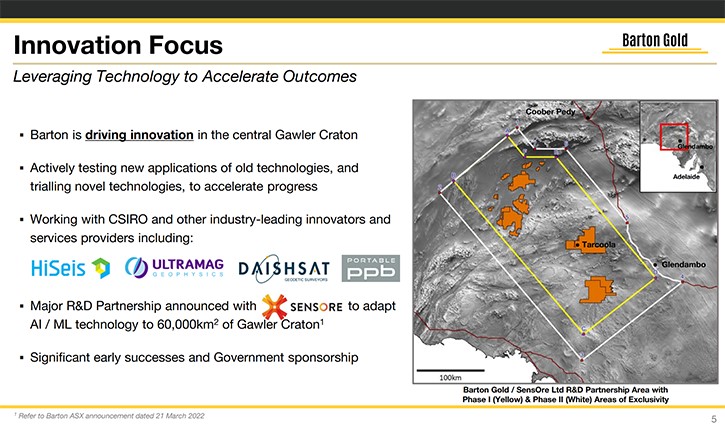

South Australia is very, very well represented for mineralization and structure. It's the home of Olympic Dam, Prominent Hill, Carrapateena, and it actually represents about 25% of Australian gold mineral resources, but it only represents about 2.5% of annual Australian gold production. This is really a consequence of a significant amount of underinvestment, in exploration, during the past 30 years. This has a lot to do with the fact that investors and explorers have gone to other regions of Australia that are slightly easier to explore, like Western Australia, where you don't have to deal with challenges of exploration under cover. But we're bringing a wide range of newer technologies into South Australia, to help defeat the challenge of exploration under cover. And what we've done is to assemble the ownership of, substantially, the majority of all historical gold producing and significant gold exploration ground, in the central Gawler Craton.

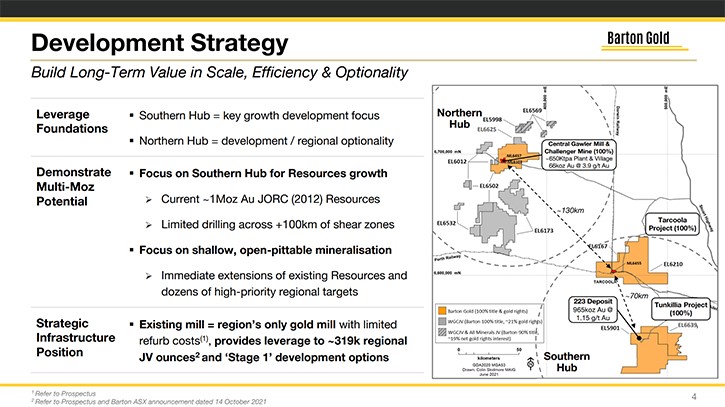

So, across the span of about 200 kilometers, we have about 5,000 square kilometers of tenements and mineral rights. We also own the only gold mill in the region. So, we have a very strong strategic footprint. With that mill, we also have 1.1 million ounces. So that's kind of the starting framework. The region has been under explored for a very long time and now we are bringing in a lot of new technology – both old and new, co-funded by the South Australian Government from whom we get a lot of financial support.

As a result we're rapidly opening up the footprints of our two primary exploration areas. We're really focused on that area, what we call our ‘Southern Hub’.

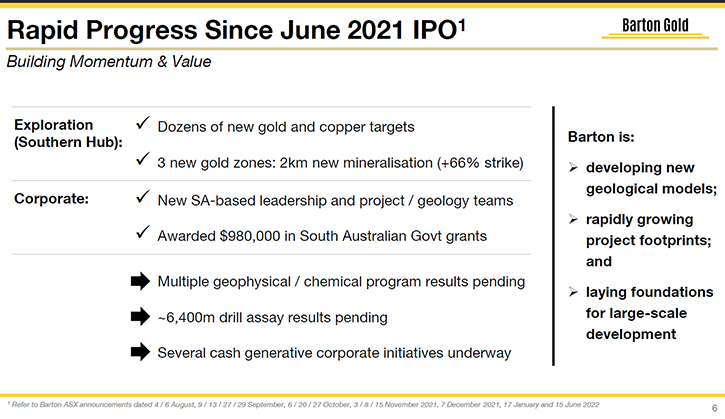

And that is the Tarcoola project and the Tunkillia project. The reason we're focused there is that all of the work we're doing keeps discovering new structures, keeps discovering new mineralization. So, since we IPO'd last year in June of 2021, we have already discovered almost two kilometers of new gold mineralization between these two projects. And we've discovered dozens of new near surface and deeper structures that have previously not been recognized. This year we're really leaning into that success and accelerating the expansion of these two project footprints. We have about 20,000 meters of drilling underway for this year, of which we've just finished the first round of about 6,400 meters. We're targeting new potential gold zones and discoveries across both projects. And our objective for the end of the year is to deliver a significant Mineral Resources update.

Dr. Allen Alper: Well, that's going to be an exciting time for your shareholders and stakeholders and your Team as you make more and more discoveries this year, with extensive drilling. So that's excellent!

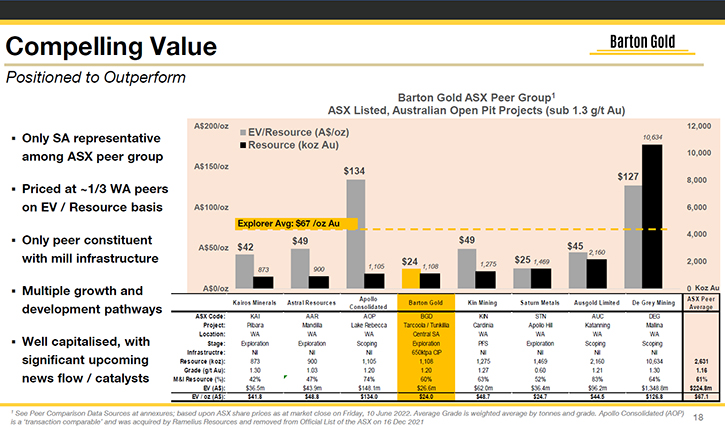

Alexander Scanlon: Yes, we're very excited about it. There are a few things that set us apart in the market, which is always relevant, when we think about comparable companies' analysis of what's out there. And if I like this type of story, for example, if I like large scale, open pit-able mineralization, in a place like Australia, where does Barton Gold fit? If you actually dial down into a very restricted set of search parameters, on the Australian stock exchange, there are only about about eight companies that are Australian domiciled, Australian listed, and focused on large scale continuous, open pit-able mineralization that is sub 1.3 grams (Au) per tonne. Among those eight companies, Barton Gold is the only South Australian player, and it trades at a valuation of about $24 Australian dollars per ounce of gold in the ground.

All of our other peers happen to be based in Western Australia and they trade at a valuation on average of about $70 Australian dollars per ounce. So, what we see in the market is a real and measurable ‘recognition discount’ between these two states, despite the fact that it is very well known that South Australia is richly mineralized. So, we think that positions us very well to outperform in conjunction, of course, with continued significant discovery and growth. It puts us in a very, very good position. And we would also note that, among all of our ‘true ASX peer’ companies in this group, we are the only group that actually owns its own mill.

So, we have a real competitive edge in terms of what I refer to as a "capital drawbridge." We have a much shorter capital drawbridge to cross, into productive operations, than all of our peers. We already have a great deal of very valuable infrastructure, whereas our peers will still need to build that infrastructure. So, we can leverage that into near term operations, but it also gives us an opportunity to leverage that infrastructure and process the mineralization being developed by surrounding explorers, which gives us another very unique angle to extract value in the region. There are presently ~319koz of JV gold mineral resources within 40 kilometres of the mill, and regional explorers advancing high-grade open-pittable mineralisation without any processing options.

Dr. Allen Alper: Well, that sounds excellent. That sounds like a great opportunity for your exploration and also for your investors. I think, once the investors have a better understanding of what you're doing, they will appreciate the opportunity that Barton Gold has for them and for the development of a huge gold resource, and also having processing facilities too. So that's excellent!

Alexander Scanlon: Yes, we're very excited about the opportunities for us in this region. We're confident about the direction we are heading and are focused on doing smart work to get there as soon as possible.

Dr. Allen Alper: Could you tell our readers and investors a little bit about your background, your Team and your Board?

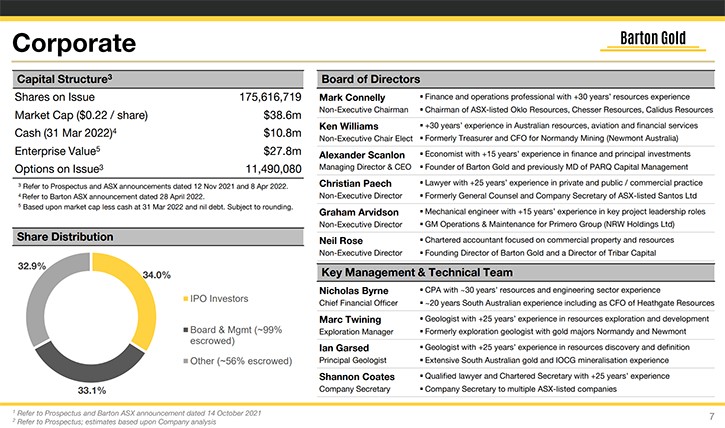

Alexander Scanlon: My background is as an economist and a structured financier. I have worked in private capital management and the principal investments area in the United States, Europe and Australasia. For the past 13 years or so I have been based in Australia, focused exclusively on natural resources and resource-related entities. I have a mixed corporate advisory and principal investments background, and I've had a number of successful principal investments and project developments in the resources sector. Looking back, during the mid-200-teens, my key focus was looking at monetary policy-driven inflation and global geopolitical and credit risks, and this is what led us to look very aggressively at South Australia and gold in particular given its natural advantages in such an environment. This led us to form Barton Gold, within which we have now built very strong exploration and leadership teams. When you look across our Board of Directors, what you will see is that we have a collection of individuals, with a diverse range of skill sets, that extend all the way into and through resource discovery, financing, development, mining operations, treasury management, and large-scale, billion-dollar financial structuring.

We've built a great Board which is really ‘forward focused’, And one of the more significant announcements that we have made recently is that Mr. Kenneth Williams, who was the former Chief Financial Officer of Normandy Mining, has joined us as Chairman. Normandy Mining is a very well-known name in the gold mining industry. In the 1990s they were Australia's largest gold miner, and they were purchased by Newmont as Newmont’s entry into Australian operations.

Many of the significant Australian mining companies that we see today are essentially the children of Normandy, because many of their assets – like the Kalgoorlie Super Pit - have been subsequently acquired by notable miners like Northern Star Resources. These types of companies are now mining the assets that Normandy was mining back in 1990s. So to have Ken join is a real boost to Barton’s leadership team. With the operational project team, we have built our own internal exploration and project management team, led by our Exploration Manager Marc Twining who is also an ex-Normandy name and has about 25 years of exploration experience, with a focus on South Australia. The teams are based in south Australia, which strengthens our ability act, and react, quickly on the ground, but also to sort of ‘COVID proof’ our ground game in this very crazy world where the ability to cross borders isn’t always certain.

So, we have a very strong team all the way around. One of the things that we've always emphasized, as when I have been running private investment, is that quality delivers. You can have an exceptional team, and okay assets, and you're going to have as much success, or more, as with a poor team managing exceptional assets. We have both excellent assets, and an excellent team, so we're really focused on further building that team, empowering that team, and building our South Australian identity around large-scale exploration and development.

Dr. Allen Alper: Sounds like you have a very experienced well balanced Team, and you're really well positioned to explore and develop your properties. That's excellent!

Alexander Scanlon: Yes. We even have someone on our Board who specializes in developing and optimizing mineral processing plans. We're not just a traditional explorer, standing flat footed, if you will. We are poised and ready to sprint into the next stages of development and operations, when we think it is strategically the best time to do so.

Dr. Allen Alper: That's excellent! Very rare position!

Alexander Scanlon: Behind this strategy, we also have a multi-million dollar opportunity that is unique to us amongst our explorer peers. We have the ability to sell assets that we don't need. We have surplus equipment, both surface and underground, and surplus mine camp facilities which are in high demand. We even have some materials we can process, to recover revenue. So, while we are carefully spending our capital on high-value exploration, we can also restock our capital from internal sources without any dilution, as opposed to constantly going back to the market and diluting shareholders.

From our perspective, even if we keep the share price high, if you're constantly raising more capital by issuing shares, a given shareholders’ percentage of ownership of the company will change. We have the ability to look after our shareholder's best interests, in terms of making sure we're maximizing the capital value that we can generate internally, and reduce dilution from external capital raises.

Dr. Allen Alper: Well, that's an excellent position to be in and that's very unusual that a junior would be in that position. So that's excellent. Alex, could you tell our readers and investors a little bit more about your share capital structure?

Alexander Scanlon: We have a very tight capital structure. We have about 176 million shares outstanding, and we have only about 11 million options outstanding, which are all genuine incentive options for Board and Management. These aren't freebies, these aren't ‘sit around and spent time and get stuff for free’ type options. These are options linked to real deliverable outcomes, in terms of outperformance as to exploration success, budget outcomes, and total shareholder return over a multi-year period. So we have a very high degree of alignment between Board and Management and Shareholders. Also, Board and Management actually represent about one third of the Company's shareholders. And that's because Barton Gold was essentially born out of the private equity investment strategy we discussed previously, when I was running a multi-family office specialising in natural resources. So, there is real skin in the game. This very strong alignment is one reason why we're so careful with capital and so creative in how we use it.

In terms of valuation, our current share price sits around 20 Australian cents per share. The result being that we have a market cap of around 35 million Australian dollars, with about 10 million dollars in the bank, which means we have an enterprise value of about 25 million dollars.

As noted, whencompared to our true peers, we we trade at around $25 per resource ounce, compared to an average $75 in Western Australia - but we also have the benefit of a processing plant.

Dr. Allen Alper: Well, that sounds like a great opportunity for investors. Could you highlight and summarize the primary reasons our readers/investors should consider investing in Barton Gold?

Alexander Scanlon: Certainly. I think reason number one is that we have an exceptional foundation. We own the vast majority of historical gold producing and exploration ground, and gold JORC Resources, in our region. And we also have the only processing plant in the region. We therefore have two very strong bases to our foundation. We know what our opportunities are, we've done a lot of work, and we are now rapidly converting those opportunities into new gold mineralization. We're leveraging a lot of technology, which allows us to expedite that process, at a reduced cost. And as we move forward, one of the most essential and important points is that we have excellent people working for us, and excellent relationships with local stakeholders That includes relations with landowners, relations with our regional Traditional Owners, and also with key stakeholders on the government side including the Department for Energy and Mining. So, these are the very essential tools of quality people and quality assets, with ongoing high quality results, that lead to quality outcomes.

When we think about what this represents, it is essentially an opportunity to join a first mover position in a proven strategic gold domain where we already have advanced assets. So, it's an advanced asset entry, in a first mover position, in an entirely new gold district. And why does that matter to shareholders and how does that relate to the gold market? Well, we look around us today and based upon our analysis – and everybody obviously has varied opinions - but we look around the world today and we see a world that looks much like a scarier version of 2008. We have extraordinary amounts of corporate and personal debt outstanding. We have a truly extraordinary amount of monetary policy expansion.

We have now arrived in an inflationary environment, which is rapidly verging on hyper-inflationary in even ‘Western World’ settings. All of these things traditionally point to coming periods of significant instability in paper financial asset markets, and a flight to safety and quality in real assets, predominantly property and gold, tend to be those domains which dramatically outperform at such times. And based upon what we are already seeing today, with the gold price holding steady against very unstable equity markets, we believe that we are on the front end of the next great gold bull market. This is the reason for Barton Gold having quickly and quietly assembled this very strategic position in a very richly mineralized area. We think that gives us a disproportionately strong leverage to the upside in the gold market as we go forward.

Dr. Allen Alper: Well, I would say those are very compelling reasons to look to invest in Barton Gold. You have a great team, great assets, and you are in a great location. You are also undervalued, compared to your peers. So those all seem like outstanding reasons, for our readers and investors, to consider investing in Barton Gold.

Alexander Scanlon: We would tend to agree! Thank you.

Dr. Allen Alper: Alex. Is there anything else you would like to add?

Alexander Scanlon: I think we've covered a good amount of the overview, but one question people always ask is what's coming up, what's happening now? Where can I find more information? Obviously, we have a mailing list that investors can subscribe to on our website. I tend to send out a monthly ‘wrap-up’ summary email. We don't spam bomb our subscribers, with every single piece of news. We sort of wrap it up into a monthly update, unless it is very important information in which case we'll make sure our subscribers know immediately.

In terms of what’s coming up, we have a very significant amount of news flow pending. We have just completed about 6,400 meters of drilling on multiple new discovery targets. We have a number of corporate initiatives underway, as well, and what this will all add up to, for the next six months or so, is a very, very busy period of announcements. We also expect to be capping the year with a significant Mineral Resource Estimate update for the end of 2022. So, it's a good time to familiarize yourself with the story. And it's also a good time to keep an eye on it, because we'll start to see a lot of news flow shortly.

Dr. Allen Alper: Well, it sounds excellent. I'm impressed not only with your geology, but also the business acumen of you and your team. And also, the knowledge of where the market is going. I think you have great insights. We’ll publish your press releases as they come out, so our readers/investors can follow your progress.

Alexander Scanlon: Thank you very much.

https://bartongold.com.au/

Alexander Scanlon

Managing Director

a.scanlon@bartongold.com.au

+61 425 226 649

|

|