Brett Richards, CEO and Director, Goldshore Resources Inc. (TSXV: GSHR, OTCQB: GSHRF, FSE: 8X00) Discusses Their Road to Tier-One Status: The Quest for 10M Oz

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 6/25/2022

We spoke with Brett Richards, CEO and Director of Goldshore Resources Inc. (TSXV: GSHR, OTCQB: GSHRF, FSE: 8X00), an emerging junior gold development company that owns the Moss Lake Gold Project, located approximately 100 km west of the city of Thunder Bay, Ontario. Moss Lake has 3.98 M oz of historical gold resources with untapped exploration upside, and extensive existing infrastructure for building a district scale mining camp. Current activities include data compilation from a very comprehensive VTEM survey, which will guide a one hundred thousand (100,000) meter drill program, aimed at achieving the size, scale and economic viability, to be categorized as a Tier 1 asset. According to Mr. Richards, Goldshore Resources is undervalued, based on the outstanding project economics and the additional ounces they are going to bring to the table, at the end of the year.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, talking with Brett Richards, who is President, CEO and Director of Goldshore Resources. Brett, I wonder if you could tell our readers/investors about your vision for creating the next Tier 1 asset in Ontario, Canada.

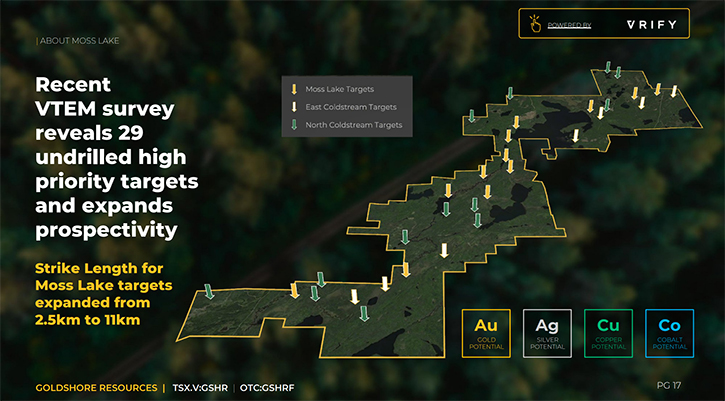

Brett A Richards: Yes, absolutely Al. This project has been around for almost a year. We completed the transaction, to acquire the Moss Lake Project from Wesdome, in 2021, and started trading on the TSX.V, on June 4, 2021. Since that time, we've obviously gone through some very turbulent and volatile capital markets, but we've never really wavered from our original concept and our original thesis, that this has the size and scale and potential to be a Tier 1 asset. Now, we are well established, on our 100,000m drill program, and are drilling brand new targets, identified in the VTEM survey. We have continued ramping up our drill program to seven (7) rigs turning currently, and are drilling targets in Coldstream, North Coldstream and Iris Lake, as well have focusing on Moss Lake. We are as confident as ever of delivering on our target, of getting Moss Lake to a Tier 1 status.

Dr. Allen Alper: That's fantastic! You're in an excellent area that's used to mining, that has, in the past, produced millions of ounces of gold, so that's fantastic! And you have a brilliant and well-renown Management Team, Board of Directors, and strategic advisors. Maybe you could tell us a little bit about them, yourself, your Team, your Board, and strategic advisors. It's very impressive.

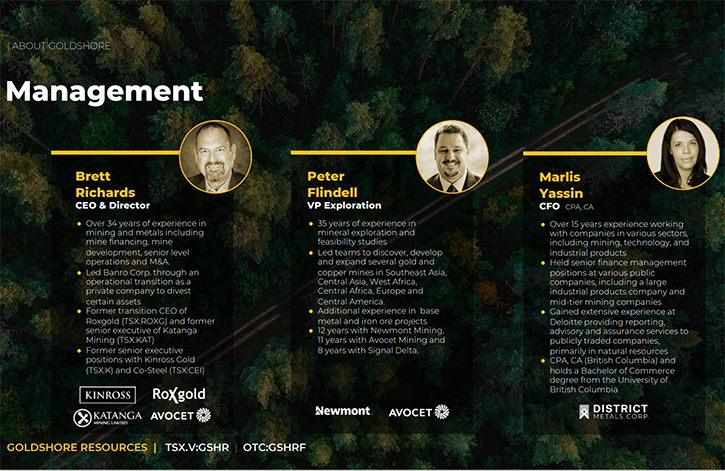

Brett A Richards: Sure, absolutely. Projects like these always start with people. And the success, I think, of great projects, comes with a vision, but it also comes with the collaboration and execution of that vision. I have a great Team that I work with. It's led on the ground, with Pete Flindell, who is our VP of Exploration. He has 35 years of global mineral exploration experience and feasibility studies. He and I have worked together, for almost 15 years now, on a whole series of projects globally, from Southeast Asia to over 14 or 15 countries in Africa. I think Pete has created a great Team on site, and the success of this project will be to their accolades.

Brett A Richards: Just a bit about myself, I've been in this business for around 35 years. I cut my teeth, early on, with majors, metals, and mining companies, and I have worked in gold, copper, base metals, and diamonds, in my career, and was one of the five founders of Katanga Mining. During my career, I’ve run a number of listed companies and large private mining companies, in the gold space and in the copper space, but came back to this project, last year, because I really did see the potential in it.

Brett A Richards: My Board also has equal credibility, led by Galen McNamara, who's our Chairman. But we have a whole handful, of men and women, who are experts in the junior mining space, the mid-tier mining space. And we have an Advisory Board, made up of some really all-star quality people, led by David Garofalo. It includes Craig Parry, Brian Slusarchuk, Leo Hathaway, and Daniel Kunz, tremendous, tremendous visionary mining people! I get the benefit of collaborating, with this group, and also utilizing their network and their ideas, on how to get Goldshore out into the market.

Dr. Allen Alper: Well, there's no doubt that you and your Team, your Board and your strategic advisors are just a first-class group and so knowledgeable, so experienced, and so successful. So, I think it's a credit to you that you could amass a group like that, to be involved in your Company. So that's fantastic!

Brett A Richards: Yes. Thanks, Al.

Dr. Allen Alper: Could you tell me a little bit about your year-round exploration?

Brett A Richards: For sure. We started drilling last year. We tried to continue and ramp up, throughout the fall. We had difficulties, like any new startup. We also faced the forest fires in the West, last year, in Northwestern Ontario, which hampered our ability to get any traction. We also experienced a longer, colder, and heavier snowfall winter, than in past many years, but we did run a number of rigs, through the winter, and we have ramped up, over the past few weeks, to more rigs. We are running seven rigs today and we will balance the speed of development, with the capital markets / cash balance / time of year etc. So, I think, right now, we are running on all cylinders, for lack of a better analogy, and quite frankly, we're going to have quite a bit of news flow come out, over the next six months, between now and the time we complete this program.

Dr. Allen Alper: That's excellent. It'll be an exciting time for your shareholders and stakeholders. That's great that you have the funds to move forward and to do so much extensive drilling and exploration. Brett, could you tell us a little bit about your Moss Lake PEA and also the key project economics?

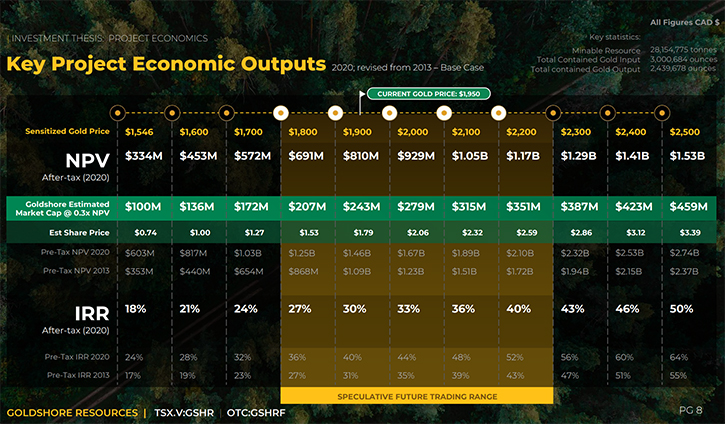

Brett A Richards: Yeah, for sure. This project has been very compelling for me, from the beginning, because of the economics and because this is our starting point. The original PEA, that was done in 2013, on the historic resource, and updated in 2020, by Wesdome, shows some stellar economic outputs. It brings 3 million ounces of gold into the pit shell, let's call it the gold input. And the gold output is around 2.4 million ounces, over 10 years, so around 240,000 ounces a year average, over 10 years, with average cash costs, life of mine, of $922. So very, very compelling economics. And when I talk about a Tier 1 asset or Tier 1 status, those are categories that are starting to tick that box.

Brett A Richards: Our job is to make the resource larger, so that the input is significantly greater than what it is today. But even with 3 million ounces, this project has a $700 million post-tax NPV, at $1,800 gold. And companies like ours should be trading at about 0.3 times NPV. That should indicate that we should be around $200 million market cap today, and we're about a quarter of that. We're about a $50 million market cap today. The macro for the capital markets, and for investments generally, have been very, very volatile, due to a number of situations. But, as a result of that, I think we're quite depressed. from where we should be trading. So, I think it's a great entry point for new investment, because I see tremendous upside, in the next six months to 12 months to 18 months.

Dr. Allen Alper: That sounds excellent. Could you tell us a little bit about your capital structure?

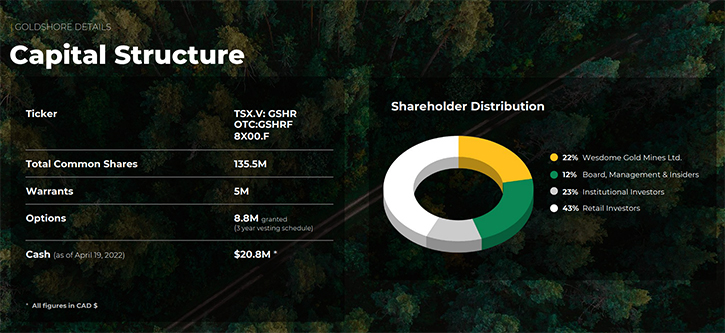

Brett A Richards: Sure. We have about 135 million shares out currently, and we do have some warrants from the last fundraising. We raised $10 million in April, and it was raised at 50 cents, with a half warrant at 75 cents. So, we have about 5 million warrants out. And we have about $18 million in the bank, as of today. So, we have quite a bit of runway, to continue to have an accelerated, but managed program.

Brett A Richards: That accelerated program will be calibrated every couple of months, so we can see where the market is, so we can see where the gold price is and where our share price is and to make sure that we're traveling in a good direction. I'll say we are in a very good position, with respect to the future capital markets and our ability to raise money down the road. So, I think we still have a pretty tight capital structure. And let's not forget, 22% is held by Wesdome and they're not sellers. And 12% is held by the Board, Management, and insiders, and I'm not a seller and neither are our insiders. So, we have about a third of our share structure that doesn't trade, so it's quite tight.

Dr. Allen Alper: Oh, that's excellent! Great position to be in, having the cash and moving forward, with a stable source of investors and capital. So, that's excellent! Could you tell us a little bit about your potential for expansion?

Brett A Richards: Yes! I think what we're going to see, over the next six to 12 months, is more of the same. We're going to see a lot of drill results, between now and the end of the year. But, at the end of the year, we're going to conduct a mineral resource estimation update, and that's the expansion we talk about on the Moss Lake project. There is also great optionality at Coldstream, and Iris Lake, and also down in the Southwest at Hamlin Lake. We're going to be putting drills in there in the very, very near future. So, I'm excited to see what the results are going to be, out of that area. But this is one very big district that has been under-developed, under-drilled and under-appreciated, but in today's gold environment, this is a winner all day long. So, once we get that resource update done, we'll then conduct another economic analysis and that'll happen around Q1 of next year. So, when we're sitting here chatting, this time next year, Al, we'll be talking about the new economics on a much larger Tier 1 size resource.

Dr. Allen Alper: Oh, that's great. Our readers and investors will be keeping track of what you're doing, all through the year, and then seeing the new analysis next year. So that's great! Could you tell us a little bit about your environment, social and governance, the ESG?

Brett A Richards: For sure! Yes, we take ESG as a value-adding proposition. We have formulated great relationships, with our First Nations Indigenous partners and our host communities. We have a lot of collaborative exchange of information, of data and updates, as to what we're doing. We are going to have an exploration agreement, signed fairly soon, with our host community, and I think that's a very large value-creating exercise.

Brett A Richards: There are other things we're doing, within ESG. We are doing an environmental baseline study. We have completed the flora and fauna studies. We've completed the archeological study. We have completed the species-at-risk study. And we have a number of other data collection studies that we'll be doing, over the next three to six months, in addition to the baseline work, so that we're fully prepared and we're fully advanced on an environmental assessment, when it comes time to make that application and look at getting our mining permit started. So, I think we're well positioned in that regard.

Dr. Allen Alper: That sounds excellent. Could you tell our readers and investors a little bit more about the Moss Lake tie-in mine?

Brett A Richards: Yeah. The Moss Lake Mine has a circa 4-million-ounce historic resource. It has a million-and-a-half historical Indicated resource and a two-and-a-half-million-ounce historic Inferred resource. As we have shown, through our data collection and our analysis, so far, through the VTEM survey and through some of the drilling, that this was really under-developed and possibly misunderstood, from the standpoint that we can demonstrate almost a 12- or 13-kilometer strike length of Moss Lake that has the same geophysical signature as Moss Lake. And we also know it's mineralized, to roughly the same extent, because we have historic drilling up in that area. And the reason it’s not in the resource is because the spacing of the drill holes is too far outside of the historic resource, so it never was pulled into the resource.

Brett A Richards: So, we’re excited about not only making those two connections, but also infilling it, so that we can pull it into as large a pit shell as possible, to make the economics as large as possible. And yeah, we’ll probably leave quite a bit of upside on the table as well, simply because we’re not going to be able to drill the entire strike length. But by making it wider, longer (along strike) and deeper, we are going to have an exceptional increase in the historic resource. So that is quite exciting!

Dr. Allen Alper: That sounds excellent. It's great that you have the opportunity to expand the resource and to explore. I think you could explore all year round. Is that correct?

Brett A Richards: We can. There are no restrictions, and we did last winter. We drilled right through the winter. We logged core, all through the winter. And it was a winter of learning, where I think we'll be much better at it this year. But we'll manage our rig total down from wherever we get to this fall, maybe 7, 8, or 9. We'll probably pull it back a little bit because of the difficult conditions and the topography is restricting in the wintertime. So, we'll probably pull it back to two or three rigs, but we can continue to drill all winter long.

Dr. Allen Alper: That sounds excellent. Could you tell our readers and investors, Brett, the primary reasons they should consider investing in Goldshore Resources?

Brett A Richards: I think, if I take my CEO hat off and just look at this from a pure investment standpoint, which I do quite often, there are a lot of compelling features to Goldshore. We are undervalued from our starting point project economics, not to mention the additional ounces we're going to bring to the table, at the end of the year, that we will analyze and produce economic output data. From a peer group valuation perspective, on a per ounce basis, we are trading at $13-$14 an ounce today, which is about a quarter of our peer group average and it's about half of what it actually costs you to find ounces. So, we're trading, in a quite depressed multiple, on a per ounce basis and again, that is our starting point. So, I really believe that we're going to be in a situation, where we're going to add significant value to our share price, over the next six, 12 and 18 months.

Dr. Allen Alper: Well, that's fantastic. It sounds like a great opportunity for our readers and investors. You have a great resource, a great Team, great advisors in an excellent, proven area, and great infrastructure. Also, you have the funds to do extensive exploration this year and the coming year. So that all sounds excellent. Brett, is there anything else you'd like to add?

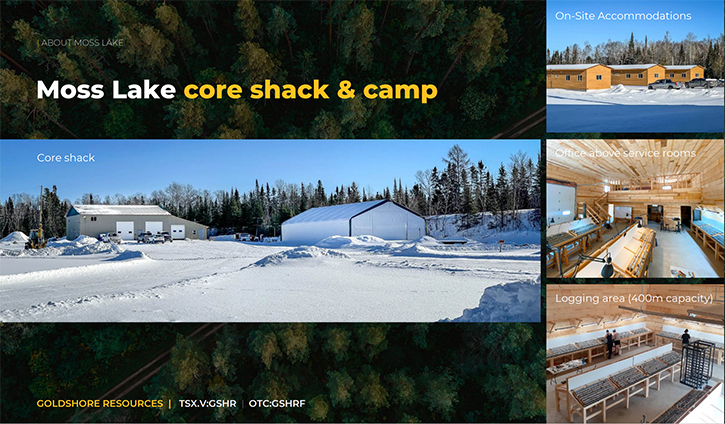

Brett A Richards: Yes, we talk about the investment thesis, and we talk about the size and the potential of all this. And I always go back to it doesn't matter how big it is, doesn't matter what it is. It really does matter where it is. Mine builders/operators are looking for project “do-ability”, and ask themselves questions like, “is this actually going to get built and become a mine one day” or “is it going to be a big resource that needs a sustained $2,500 or $3,000 gold price to get built”? The answer is Moss Lake is going to be built one day. It is extremely economic, at gold prices, in which we are currently trading, and what the major bank analysts predict, as their long-term consensus gold price, for the next 5 years. So yes, Moss Lake is going to be built, and the reason for that is because of our location. Geographically, we are in one of the most desirable areas in Northwestern Ontario. We are on the Trans-Canada Highway, and we have very inexpensive power availability, 10 cent kilowatt hour power, at our disposal, on our site. We also have two international rail lines on our property; we are a hundred kilometers from an international port and an international large city, Thunder Bay, Ontario. So, we have direct access to every piece of possible infrastructure, required to build a district-scale mining camp.

Brett A Richards: So, we can talk about the economics all day and we can talk about the resource potential all day, but it doesn't mean anything, unless it gets pulled out of the ground. And this is a project that is going to go into production one day, because of the location. So, I think from a do-ability standpoint, this is a project that's going to be extremely doable.

Dr. Allen Alper: Oh, there's no doubt about it! That's an outstanding project, Brett. There are not many that are in such a great location, have such a great resource and the opportunity to grow, and such great backing. So those are all outstanding reasons for our readers and investors to consider investing in Goldshore.

Contact Details:

Brett A. Richards

President, Chief Executive Officer and Director

Goldshore Resources Inc.

+1 604 288 4416

+1 905 449 1500

brichards@goldshoreresources.com

https://goldshoreresources.com/

|

|